As you tuck your little one into bed, have you ever found yourself gazing into their sleeping face, caught between marveling at their potential and worrying about the future that awaits them? In View Post

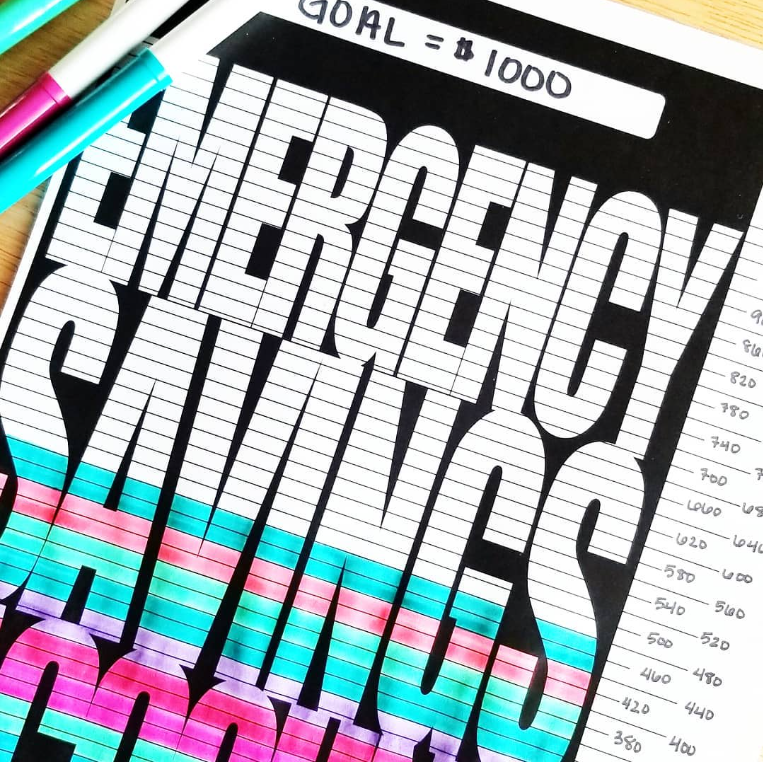

Saving for the Unexpected: How to Protect Your Family with an Emergency Fund

Are you tired of constantly feeling stressed and worried about unexpected events in your life? Do you struggle to make ends meet because of unexpected bills or expenses? If so, it's time to start View Post

4 Simple Tricks to Stick to Your Grocery Budget

Are you tired of overspending at the grocery store and watching your hard-earned money go to waste? With the rising cost of groceries, it's becoming increasingly difficult to stick to a budget. In View Post

Self Employed? How to Plan Your Own Retirement

There are many incredible benefits of being self-employed. For some folks, it’s the convenience of being able to work whenever, wherever they want. For others, it’s the ability to focus on work that View Post

4 Smart Ways to Use Your Tax Refund

This article first appeared on February, 21 2016 and was updated February 19, 2020. Tis the season! Depending on your situation, you probably either love tax time or you dread it like that horrible View Post

Instant Gratification Wish List: Becoming a Patient Spender

There’s absolutely no doubt in anyone’s mind that we live in an “instant gratification” society. Everything is at our fingertips just waiting for us to buy it. Movies on demand. Amazon Prime delivery. View Post