Ah, tax season. It’s that time of year when we stay up just a little later, heads buried in forms and receipts, hoping to find whatever deductions we can. It’s not exactly the season most View Post

How to Set Financial Resolutions And Achieve Them in 2024

As the new year approaches, many people take the opportunity to reflect on their financial habits and make resolutions to improve them in the coming year. These resolutions can be a great way to set View Post

HELOC to Pay Off Debt: Is it a Lifeline or a Trap?

Imagine the weight of the world on your shoulders, each coin of debt adding to the load. It's daunting, isn't it? The stress, the worry, the sleepless nights—debt can make you feel as though you're View Post

Budgeting When You’re Behind on Bills: A Survival Guide

Are you feeling overwhelmed by mounting bills and a tight budget? You're not alone. According to a recent survey, 63% of Americans are living paycheck to paycheck and struggle to make ends View Post

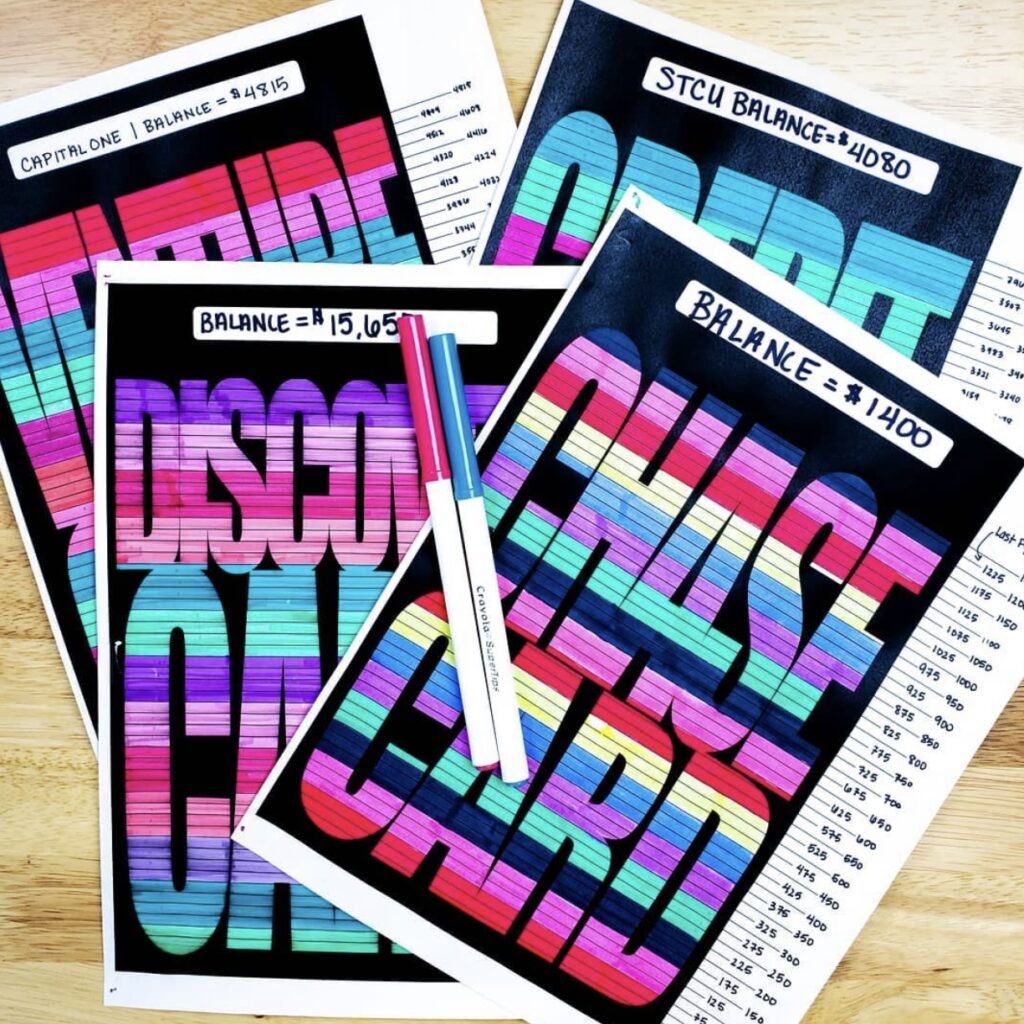

Should I Take Out a Personal Loan to Pay off Credit Card Debt?

The average credit card interest rate just hit 16.98 percent, with new offers coming in higher at 18.89 percent. Coupled with inflation and soaring gas prices, these interest rates are beginning to View Post

What to Do When Your Credit Card Company Sues You

If you’ve ever missed a credit card payment, you’re not alone. In fact, according to a recent study by WalletHub, an estimated 42 million Americans are expected to miss a credit card payment in 2022 View Post