A few years ago, I shared how I was able to pay off $30,000 in credit card debt using the cash envelope system.

Well, quite a bit has changed since then. From a global pandemic to tap-to-pay, the rise of cryptocurrency to higher interest rates, it’s a completely different financial landscape. Oh, and did I mention that more and more stores are accepting card or tap only?

With all of that being said, the cash envelope system may seem antiquated, but it’s still as impactful as ever.

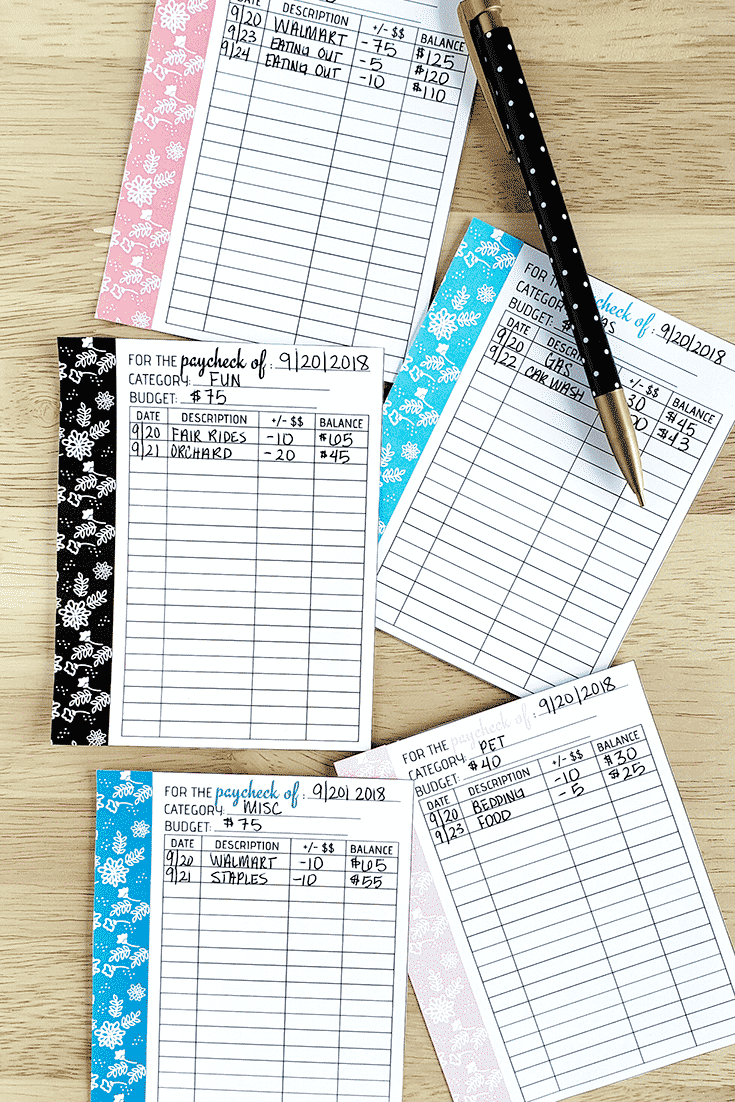

For those unfamiliar, the cash envelope method involves dividing your cash into envelopes, each labeled for a different spending category. It’s a tactile and visual approach to budgeting, where once the cash in an envelope is gone, your spending in that category is paused until the next budgeting period.

It’s simplicity at its best, fostering discipline and mindfulness in spending.

However, as our wallets grow thinner with cards and smartphones replace our cash clips, a digital adaptation is not just convenient; it's necessary.

Enter the cashless envelope system—a modern twist on a classic method. It embraces the evolution of digital banking and transactions, allowing for the same disciplined budgeting without the need for physical cash.

Now, let’s turn the page to today's financial realities. Again, the cash(less) envelope system is as impactful as it’s ever been.

To make the most of it, we have to integrate it into our digital lives.

The strategies revealed below are about embracing the digital age without losing the essence of what made the cash envelope system so effective. Ready to revolutionize your budgeting approach? Let’s get started.

1. Automate Your Budget Categories with Financial Apps

Thanks to smartphones and digital banking, the idea of dividing cash into physical envelopes might seem a bit old-school.

Yet, the principles behind the cash envelope system are timeless in teaching us discipline and mindfulness in spending.

So, how do we marry this age-old wisdom with the convenience of today's technology? One possibility lies in automating your budget categories with financial apps.

The beauty of the cashless envelope system in a digital format is its ability to integrate seamlessly into our daily lives. By leveraging budgeting apps, we can automate the process, ensuring that our spending aligns with our budget without the need for physical cash or manual tracking.

These apps not only categorize your spending in real-time but also sync with your bank accounts and credit cards, offering a comprehensive view of your finances at your fingertips.

Here’s how budgeting apps can revolutionize your cashless envelope system:

- Real-time Tracking: Forget about receipts piling up in your wallet. These apps record your transactions the moment they happen, categorizing each expense into its respective digital envelope.

- Seamless Sync: Connect your banking and credit card accounts to have every transaction automatically categorized. No more manual entries – your budget updates itself.

- Visual Budgeting: With intuitive dashboards and spending graphs, you can see where your money goes at a glance, making it easier to adjust habits and stay on track.

The integration of these apps with the cashless envelope system ensures we stay true to our budgeting goals. It's about making the most out of the tools at our fingertips while honoring the principle of mindful spending—proving that even in a world where cash is no longer king, the principles of the cash envelope system remain as relevant and impactful as ever.

2. Stick within Your Budget and Safely Earn Credit Card Rewards

The cashless approach means we don’t just enjoy the convenience, but also acknowledge the responsibility it entails—especially when we talk about integrating credit card rewards into our budgeting strategy. It’s crucial to underline the role of discipline in this situation.

Credit cards with reward programs offer an enticing opportunity. However, this path requires unwavering discipline.

Let's be clear—while the rewards can be lucrative, carrying debt or failing to pay off the full balance can quickly erode those benefits, leaving you with more costs than gains due to interest charges.

Fortunately, that’s what the envelope system is all about: Creating and sticking to budget categories no matter what. Here's how you can responsibly harness credit card rewards within your cashless envelope system to amplify your savings or travel the world:

- Selective Card Choice: Zero in on credit cards that mirror your budgeting categories. If your spending patterns are predominantly towards groceries and fuel, opt for cards that offer higher rewards on these expenditures.

- Master the Rewards Game: Dive deep into understanding how to accrue and redeem your rewards. Whether it's for cash back, points, or miles, knowledge is power in maximizing your benefits.

- Strategic Budget Integration: Treat rewards as a budgetary component rather than a bonus. Apply cash back directly to monthly expenses or allocate travel points to planned vacations, effectively reducing out-of-pocket costs.

- Discipline is Key: The allure of rewards should never tempt you into overspending. Stay loyal to the budgeted limits set within your cashless envelopes. The objective is to capitalize on routine expenses, not to inflate them.

- Commit to Full Payments: The cornerstone of utilizing credit cards effectively within this system is to eliminate the balance monthly. This practice is critical to sidestep interest and truly benefit from the rewards earned.

Incorporating credit card rewards into your cashless envelope system, when done with discipline, can be a game-changer. It allows you to stretch each dollar further, leveraging the everyday to inch closer to your goals.

3. Turn On Spending Alerts for Real-Time Accountability

Imagine this: You're about to make a purchase that seems innocuous, but your phone vibrates with an alert telling you this purchase will max out your grocery budget for the month.

It's this kind of immediate accountability that can pivot decisions in the moment, encouraging you to reconsider or delay purchases until the next budgeting cycle.

Here’s how you can integrate this into your cashless envelope system:

- Set Up Alerts: Dive into your banking or budgeting app settings and customize alerts for each category. Decide on thresholds that make sense for your budget, allowing for flexibility while still keeping you accountable.

- Practice Mindful Spending: Use these alerts not as a constraint but as a mindfulness tool. They're there to ensure every dollar you spend aligns with your larger financial goals, fostering a habit of intentional spending.

4. Utilize a Cashless Sinking Fund for Irregular Expenses

One of the smartest moves in budgeting is planning for the unexpected or the irregularly timed expenses. This is where the idea of a sinking fund comes into play within our cashless envelope system.

A sinking fund is essentially a proactive saving strategy, earmarked for future expenses such as holiday gifts, annual subscriptions, or car maintenance. By setting aside (“sinking”) a little each month into designated digital envelopes, you can smooth out the financial impact of these larger expenses, ensuring they don't catch your budget off guard.

Here’s how to seamlessly integrate a sinking fund into your strategy:

- Forecast and Plan: Identify potential irregular expenses throughout the year. This could include everything from insurance premiums to holiday spending.

- Allocate Monthly Amounts: Determine how much you need to save each month for each expense, and then allocate these amounts into specific digital envelopes within your budgeting app.

- Enjoy Financial Stability: As you contribute to these funds monthly, you'll build a buffer that allows you to cover these expenses without disrupting your regular budget.

By adopting a cashless sinking fund, we refine our approach to budget planning within the cashless envelope system, ensuring we stay aligned with our financial goals.

These strategies exemplify how the principles of the traditional cash envelope system—discipline, intentionality, and preparedness—can be effectively translated into our digital financial lives.

In doing so, we're not just adapting to the conveniences of modern technology; we're leveraging these tools to build a more secure and mindful financial future.

Interested in connecting with other mindful budgeters? Join the official TBM Family Facebook Group today!