The TBM Mission

The Budget Mom exists to empower women to build a life they love on a budget they understand and can afford.

Just like you, I am continually trying to learn how to be better at things that matter, like living on less, appreciating what I have, and being the best dang mom that I can be.

I want you to feel hope, inspiration, and confidence as you explore all that TBM® has to offer.

Do you feel overwhelmed with your finances?

If you're like most of my readers, you're a woman who is goal-driven, wanting to tackle your financial life so you can provide a better life for your family. An easier life.

But something keeps getting in the way: There just seems to be too many steps, too much confusing information, so much to do and too little time.

Are you tired of being sick and tired of trying to keep up, but always feeling like you're getting even further behind?

I know how you feel.

I know what it feels like trying to make ends meet when you're paycheck just isn't enough.

To want to make a change for the better, but have no clue on where to start.

I hope to make the process easier by showing you where you can find the most helpful resources on TBM®.

The Content

I provide simple, easy-to-follow solutions to money management. By giving you the action steps you need to take, I know you will be able to see positive, life-impacting progress.

You can find all of TBM's information broken down into five main categories

- Budgeting

- Save More

- Frugal Living

- Debt & Credit

- Finance 101

SAVE MORE

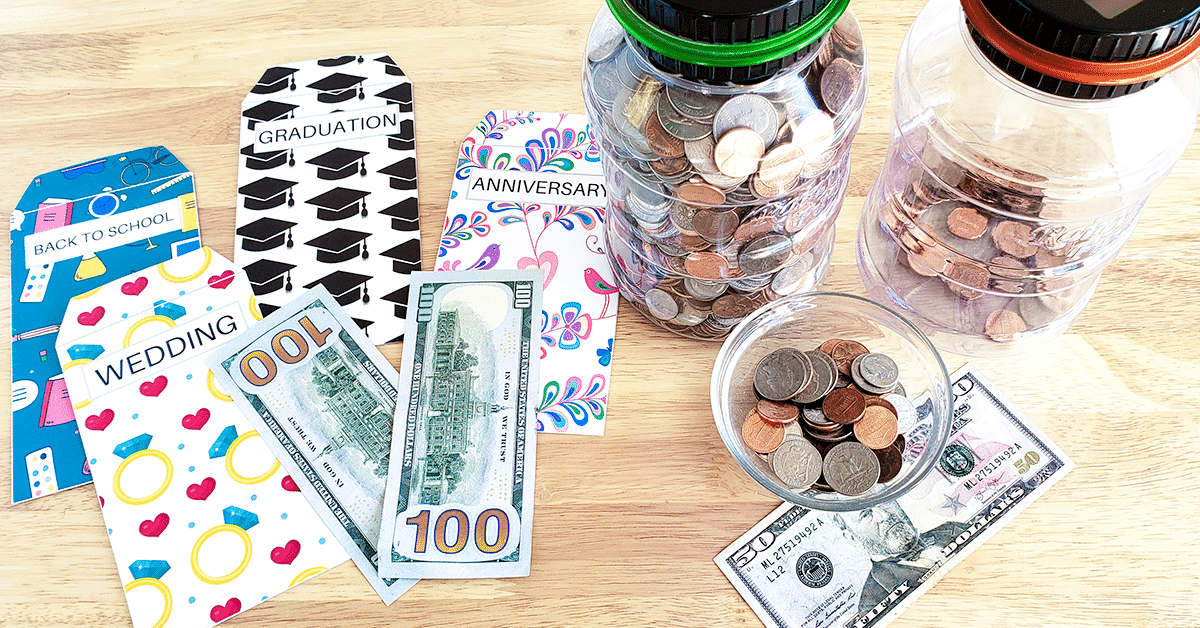

Having a savings plan in place is critical to your financial goals. Find tips on how to save for your next vacation, how to create an emergency savings account, saving for retirement, and how to make saving easier by putting it on autopilot.

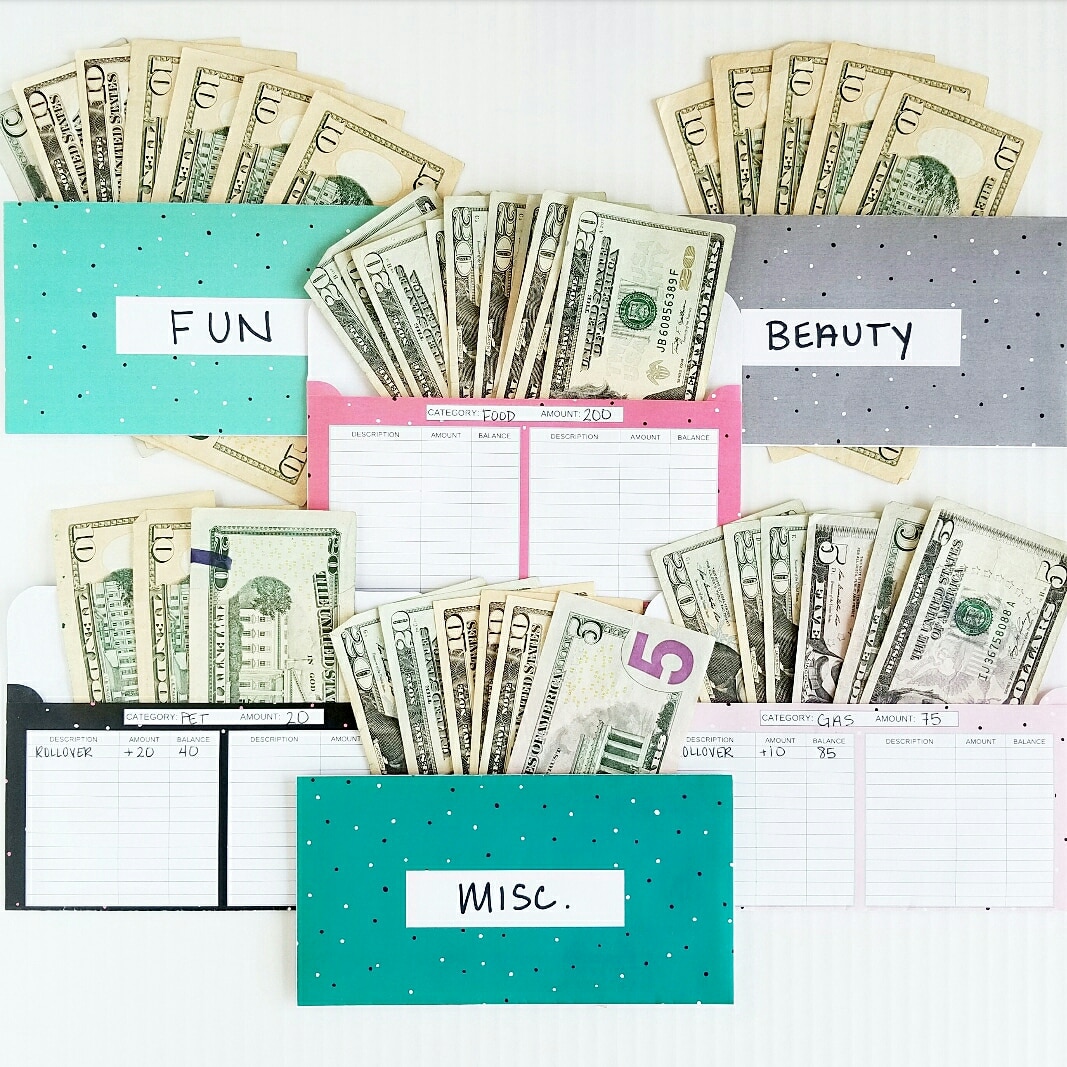

BUDGETING

Nothing is more important than setting up a budget. Find tips on how to create a realistic budget, how-to posts that cover different methods, guides on how to stick to your budget, and tips on how to make budgeting easier.

FRUGAL LIVING

I get it. Life can get busy. It's all about finding balance. Find tips and resources that cover all aspects of your life. From recipes to parenting and DIY, plus thoughts on happiness, photography, travel...and everything in between.

DEBT & CREDIT

Carrying debt is like walking around with a massive weight on your shoulders. Find tips on how to pay off your debt once and for all! From how-to posts, debt worksheets, guides, credit report and score tips, and inspiration.

FINANCE 101

Saving for retirement, investing, and financial planning are all important pieces to your overall financial picture. Read about retirement tips, such as saving and strategies. Find helpful information about investing and tips to make sure you have the brightest financial future possible.

Start With The Free Resources

A course that will teach you how to set up a successful budget using the cash envelope method.

The course includes over 20 different unique cash envelop designs that you can make at home, and you will also get access to over 15 helpful worksheets.

If you are wondering how to start using the budgeting method that has changed my life, this is the first step you need to take!

Do you want lifetime access to TBM's free cash envelopes, and 20 other helpful printables?

Whether you are wanting to track your savings goals or pay for your next vacation with cash, my free resources and tools will help you get there!

Don't miss out! I add free resrouces all the time!

The resource library is password protected. Enter your email ONCE and I will send you the password!

My Financial Philosophy

In a world that is constantly telling you who you should be, it can be difficult to stay true to who are and forge your own path.

Throughout my financial journey, I grew older, developed my own ideas, learned hard lessons from failures, and discovered more about myself than I ever thought I would. Completing the steps to financial freedom is easy – the path to self-awareness isn’t.

It’s up to you to do the hard work, to listen to your heart, and know in your gut you are making the right decision for you and your family.