It can take years for some people to find the right budgeting method that works for them. In fact, the process of finding a system that you can stick to is a lot harder than people think.

I created my first budget in Excel in 2011, and it was a complete failure. Over a period of a year, I tried every budgeting method known to man. I tried the Calendar Method, the Cash Envelope Method, Monthly budgeting, Percentage Budgeting, and the Half Payment Method. Nothing seemed to work.

I would get really excited about starting a new method, use it for about a month, and then get frustrated because I couldn't stick to it. Wasn't I doing everything right? I was writing down my categories, assigning limits to each category, but at the end of the month, I would overspend in each category.

The first year of my budgeting journey was a very frustrating time. There is nothing worse than wanting to improve an area of your life and working hard to get there only to fail every time. I kept asking myself, “Where did I go wrong.”

I would spend hours looking on the internet, finding templates and instructions to follow, and every single time I would wind up being disappointed. I followed every step that I was reading, so why was nothing working?

MY FIRST SUCCESSFUL BUDGET

I'm not going to lie. I gave up on my budgeting efforts for almost a full year. I felt like if I couldn't grasp the concept of budgeting in a year, I was never going to get it. Then something happened that changed my life forever.

I got pregnant. I was going to have a little boy. At that point, gaining control of my finances took on a whole new meaning, and it was now more critical than ever that I learned how to manage my money.

I decided to give budgeting another chance, but this time I was going to do it differently. Why did I have to use one method? During my time of struggle, I found a lot of different things about each of the budgeting methods that I used that I really liked. Was there a way that I could use some aspects from all of them?

It took almost six months, but in the end, I developed a unique budgeting system that changed my life forever.

MAKING IT PERSONAL

After I finally developed a budgeting method I felt like I could stick to, working out the kinks as I went along was my next step. Sure, the process and steps where there, but I was still overspending.

I would spend hours researching what other people were spending on specific categories. I wanted budgeting to work for me so badly, that I depended on other people's budgets to work for me as well. They made it look so easy. They were making progress with finances, surely they were doing something right.

In the beginning, I made the mistake of assuming that if a specific budgeting method worked for someone else, then it would work for me too. As I worked out the kinks of my new budgeting method, I slowly started changing the numbers, so they represented what was happening in my real world.

Small changes, like adjusting my food budget, made such a huge difference. I started analyzing my spending to dig deeper into what was happening with my money, and made adjustments as I went along. The aha moment of using realistic numbers transformed my budget completely. All of a sudden, my budget was actually working!!

THE BUDGETING METHOD THAT CHANGED MY LIFE

In 2016, after failing to find budgeting templates that I could use, I created the first Budget-by-Paycheck Workbook. My budgeting process incorporates three different methods – the Calendar Method, the Paycheck Method, and the Cash Envelope System.

Trust me, no one in the world had printables or worksheets that incorporated all three of these methods into one system or template. So, I decided to design my own.

I am a firm believer that my budgeting method can work for anyone, no matter their income size or schedule. As long as you put in the work to make it personal and realistic to your own life, there is no doubt in my mind that you can be successful.

Today, not only am I going to walk you through every step of my budgeting process, but I am going to give you the steps you need to complete for you to customize the process, so it works for your own life.

Remember, budgeting is a process. It will never work if you try completing each step at the same time. Do the work and perfect each step before moving on to the next. This will give you the highest chance of success in creating a personal budget that actually works!

THE 2019 BUDGET-BY-PAYCHECK WORKBOOK

If you have bought my 2019 Budget-by-Paycheck Workbook, you might be asking yourself, “Where do I even begin?”

The first few pages of the workbook allow you to create financial goals and list out any yearly subscriptions that you need to pay.

For me, yearly subscriptions would end up sabotaging my budget. I would forget about them, and then the auto draft would put my checking account in the negative, leaving me with an overdraft fee. The Membership & Subscription Worksheet reminds you of your yearly subscription costs, so you know when you need to have the money available.

TRACKING YOUR SPENDING

![]()

Before you start writing numbers down, before you even think about creating a budget, you need to know where your money is going. This is the most critical step in my budgeting process. Tracking your spending not only allows you to make your budget realistic but also gives you the numbers you need to use within your budget.

If you have never tracked your spending before, this is the first step in my process. I will say this until I am blue in the face…

Without facing the reality of your spending, you will always be left with confusion and regret.

Trust me, revealing the ugly truth about your spending can be scary, and you might not even want to know the truth. But if you don't face it head on, you will never make any progress with your finances. First come awareness, and then comes progress.

You can accomplish this step in two different ways. The 2019 Budget-by-Paycheck Workbook comes with an Expense Tracker Worksheet. Use this worksheet for an entire month to track where every dollar goes.

You need to track any money coming in or going out. This might include transactions from your checking account, cash spending, savings accounts, or your credit card. Wherever there is a movement of money, you need to be tracking it.

If you don't want to wait a month to start using the workbook or process, you can use past bank statements. Print out the last three months of bank statements and start categorizing your spending. This will allow you to figure out where your money is going without waiting a full month to gather the data.

I have a TON of resources on how to complete this first step. Here are my most helpful tools:

- How to Create a Visual Method for Tracking Your Spending

- How I Track My Expenses – IGTV (Instagram) Video

- Two Common Mistakes People Make With the Expense Trackers – IGTV (Instagram) Video

IDENTIFYING YOUR PRIORITY BILLS

Once you have tracked your spending and have a good idea of where your money is going, it's time to identify your regular bills.

These are bills that you pay like clockwork and are usually around the same amount every month. Regular bills are known as fixed expenses. With these types of costs, you don’t have a lot of control over how much you pay.

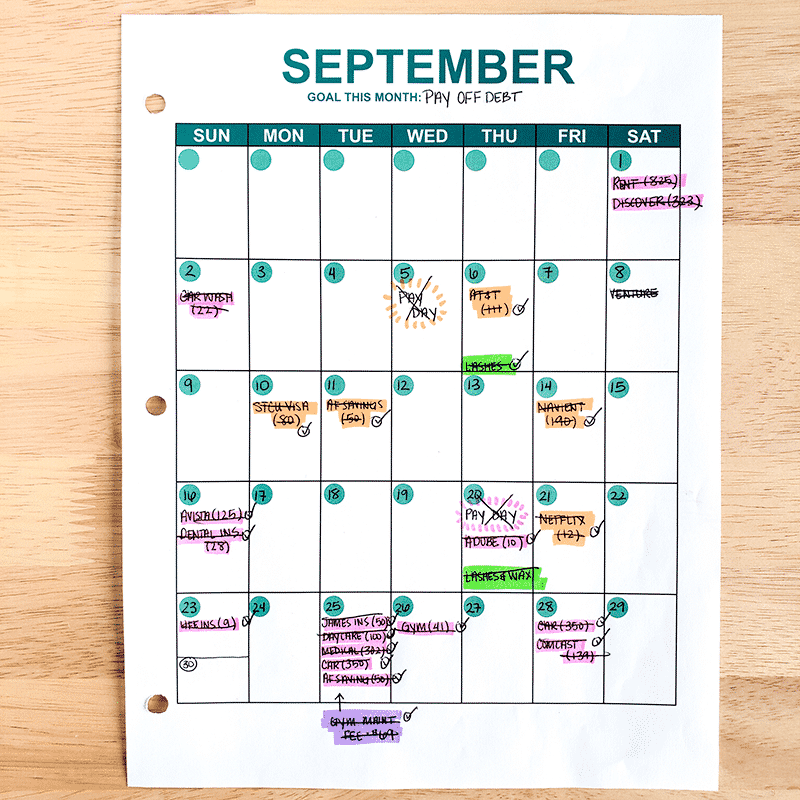

I am a paycheck budgeter, and my entire budget is organized by the paychecks that I receive during the month. The one thing that has helped me with my budget and paying bills is using a calendar to list out my expenses and the amount due. I also write on my calendar which days I get paid and the budgeted amount I am using for my income on those days.

The Calendar Method lets me figure out which regular bills I want to pay with each paycheck. This is the step that I struggled with the most. It will take time for you perfect a pay schedule that works best with your income.

Here is a list of resources that will help you complete this step:

- How to Use the Cash Envelope Method When Your Income Varies

- Using the Calendar Method to Pay Bills – IGTV (Instagram) Video

- How to Use the Calendar Method When You Are Paid Weekly – IGTV (Instagram) Video

CALCULATING YOUR VARIABLE SPENDING

Once all of your necessary bills are accounted for on your calendar, you need to figure out how much you spend on variable expenses. Remember, a budget isn't created just for your bills. In fact, your budget has the most impact on the spending that changes from month-to-month.

My budgeting method also incorporates the Cash Envelope Method, which means all of my variable spending is done with cash. I hardly ever swipe my debit card, and this is just another way that prevents me from using my credit cards.

The cash envelope system is meant for variable expenses that fluctuate from month-to-month.

Variable costs are not set “in stone.” For example, one month you might spend $30 on clothes, the next month you might spend $400. You have complete control over how much you spend on these items. Examples of variable expenses include:

- Clothes

- Food

- Entertainment

- Household Items

- Gas

Once, you have determined which categories in your budget are variable expenses, you need to establish limits for each of those categories. In short, you need to decide which categories in your budget you want to spend in cash.

The spending categories I use for my cash envelopes are “Car” (gas and maintenance), “Food” (eating out and groceries, “Pet” (for my Guinea Pig, Penny), “Fun” (for activities that I do with my son or date night spending with my boyfriend, Chris), “Misc.” (for one-off purchases or unexpected expenses), and “Health & Beauty” (for my waxing and eyelash extensions).

After you have figured out the categories, set a limit for each one based on what you learned from tracking your spending. Look at past spending trends and determine a value for your cash envelopes based on that. Remember, you will probably tweak these limits as you go, and you should be updating or looking at these limits every time you update your budget.

Here is a resource that will help you create this step:

A CUSTOM SAVINGS TECHNIQUE

Everything that I do in my budgeting process is to deter me from any temptation to use my credit cards. I am currently paying off debt, and the last thing I want to do is dig myself into an even deeper hole. To do that, you have to be prepared with cash.

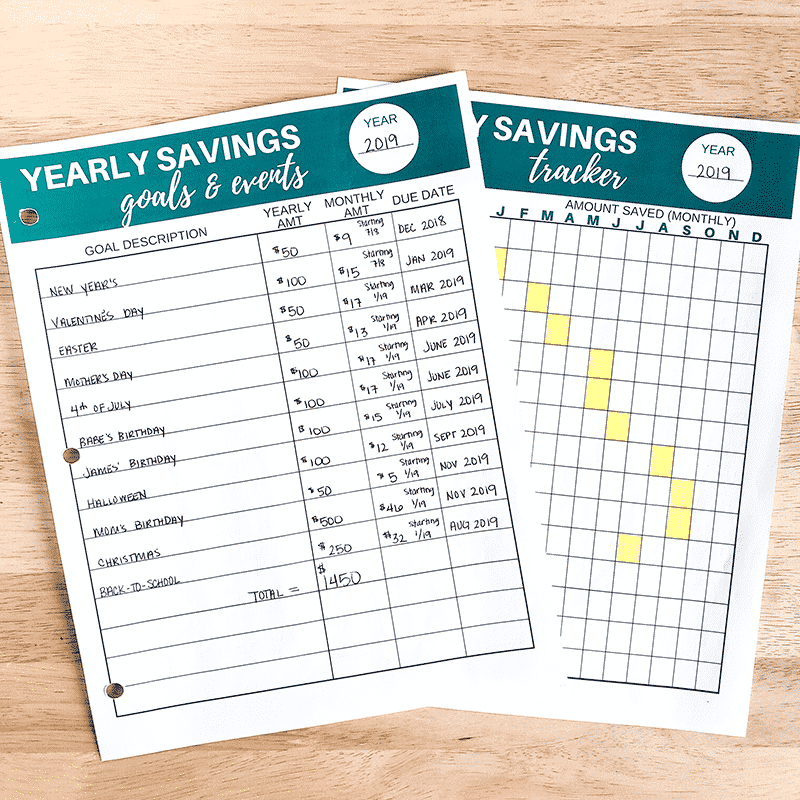

Just this year, I added a new savings technique to my budgeting process. I started my savings method in an attempt to prepare my finances for holiday and event expenses.

The Savings Worksheet and Tracker is a system that you can use to organize your savings goals into an actionable plan.

If I were to ask you how much you need to save to cover all of your expenses for the new year, would you be able to tell me?

Do you know how much you spend on birthdays? How about Christmas? Do you spend money on back-to-school shopping? Do you cover any of these expenses with a credit card?

Once you have tracked your spending, and have a good idea of where your money is going, it's time to prepare yourself for the future and any upcoming expenses.

Here are some resources that will help you use these two worksheets so you can create a custom savings plan:

- How to Save Money for Upcoming Holidays and Events

- The Savings Strategy That’s Preparing Me for the Future

- A New Savings Technique – IGTV (Instagram) Video

- My 2019 Savings Plan is Finalized – IGTV (Instagram) Video

- Custom Savings Technique That's Preparing Me for the Future – IGTV (Instagram) Video

USING THE PAYCHECK BILL TRACKER

![]()

The Paycheck Bill Tracker is my budget. When I say, “I create my budget,” I'm talking about filling out my Bill Tracker.

The Bill Tracker is a one-of-a-kind printable that allows you to incorporate the Paycheck Method and the Cash Envelope Method into one worksheet. Since I am a paycheck budgeter, I use one Bill Tracker for each paycheck. Remember, I create a budget every time that I get paid. List out the paycheck date at the top with your expected income from that paycheck.

Always use the worse case scenario for your budgeted income or the income you expect to receive.

The Bill Tracker has a lot of working parts, which means you have to perfect the first three steps above to start using it. On the top of the worksheet, there is an area for you to list out your regular bills with the amount due.

Here are the steps you need to complete to fill out and use the Bill Tracker:

- STEP #1: Write down all of the bills you want to pay for that specific paycheck that you wrote down on the top of the form.

- STEP #2: Subtract your regular bills from your expected income.

- STEP #3: Use any leftover income after paying your regular bills (labeled with letter “A” on the worksheet) for your cash envelopes.

- STEP #4: List out all of your cash envelopes and the cash that you want to spend for each spending envelope.

- STEP #5: Subtract your cash envelope amounts from the income that you had left over after paying your regular bills.

- STEP #6: Use any leftover income after paying your regular bills and cash envelopes (labeled with letter “B” on the worksheet) for your savings plan.

- STEP #7: List all of the things that you are saving for. Use the amounts from your Savings Worksheet and Tracker.

- STEP #8: Use any leftover income after paying for your savings plan to make an extra debt payment. If your priority is not paying down debt, then use any leftover income (labeled “C” on the worksheet) to make an extra savings contribution.

The Bill Tracker was designed to create a zero-based budget. A zero-based budget simply means income minus expenses equals zero. Every dollar of income has a plan and is being somewhere in your budget.

Here are some resources to help you complete this step:

- September Paycheck Budget Overview – IGTV (Instagram) Video

- October Paycheck Budget Overview – IGTV (Instagram) Video

- What is Your Budget Variance – IGTV (Instagram) Video

THE CASH ENVELOPE BREAKDOWN

The Cash Envelope Breakdown Worksheet is a great way to figure out what bill denominations you want to pull out for your cash envelopes. For me, I always start with high bills first. Then I work my way down the lower bills to fill the remaining amounts for my envelopes.

The way I see it, it's harder to spend a $100 bill than it is a $10 bill. That's why I pull out the largest bills first for each envelope.

To use this worksheet, just list all of the cash envelopes you are using for your specific paycheck, and then write down how many bills you want for each denomination. Total the bills down at the bottom of the worksheet with the number of bills and their value for each denomination. Fill out the small table on the right and cut it out to hand to the teller when you go to the bank.

DEBT PAYMENT PLAN WORKSHEET

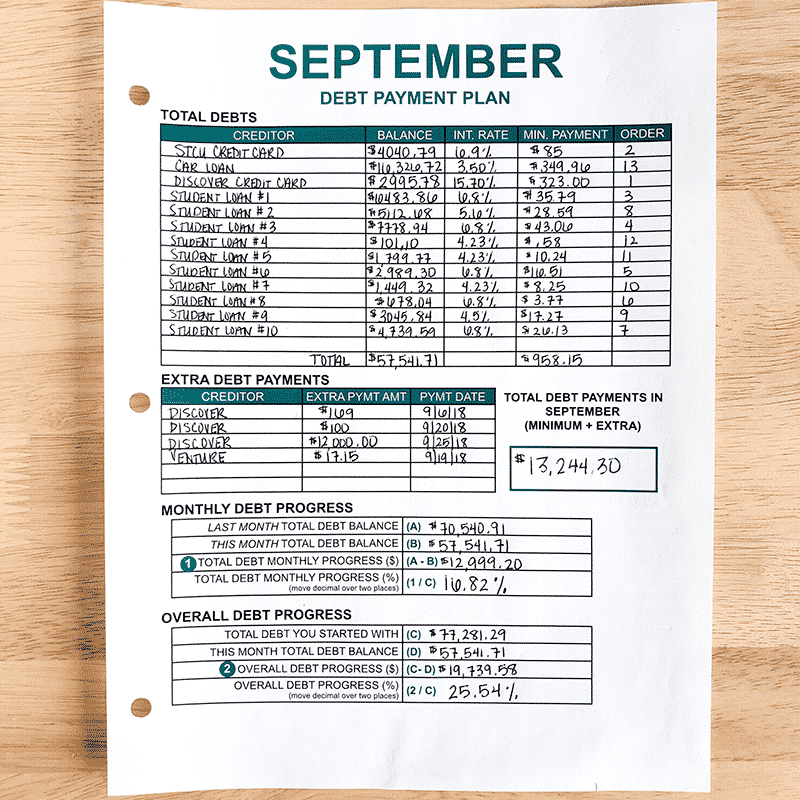

Currently, I am on a huge debt payoff journey. I like to know all of the details about my debt journey, and that includes the progress that I am making. Here are the steps you need to complete to use the Debt Payment Plan Worksheet:

- STEP #1: List out all of your current debts with their balance, interest rate, and minimum payment.

- STEP #2: Figure out which debts you want to pay off first. For me, I am using the Avalanche Method, which means I am paying off my debt with the highest interest rate first. I currently use this worksheet to figure out my debt priorities.

- STEP #3: List out any extra debt payments that you make OVER the minimum payment.

- STEP #4: Fill out the progress information at the bottom of the worksheet.

When filling out the bottom of the worksheet, if this is your first month developing and using a debt plan, it's OK to leave this area blank until next month. At that time, you will have all of the information.

Here are some resources to help you complete this step:

- Pay off Debt With the Debt Snowball Method

- How to Pay Down Debt Using the Avalanche Method

- How to Create a Plan to Pay Off Debt

- Quick Video Tutorial for Debt Payoff Spreadsheet – IGTV (Instagram) Video

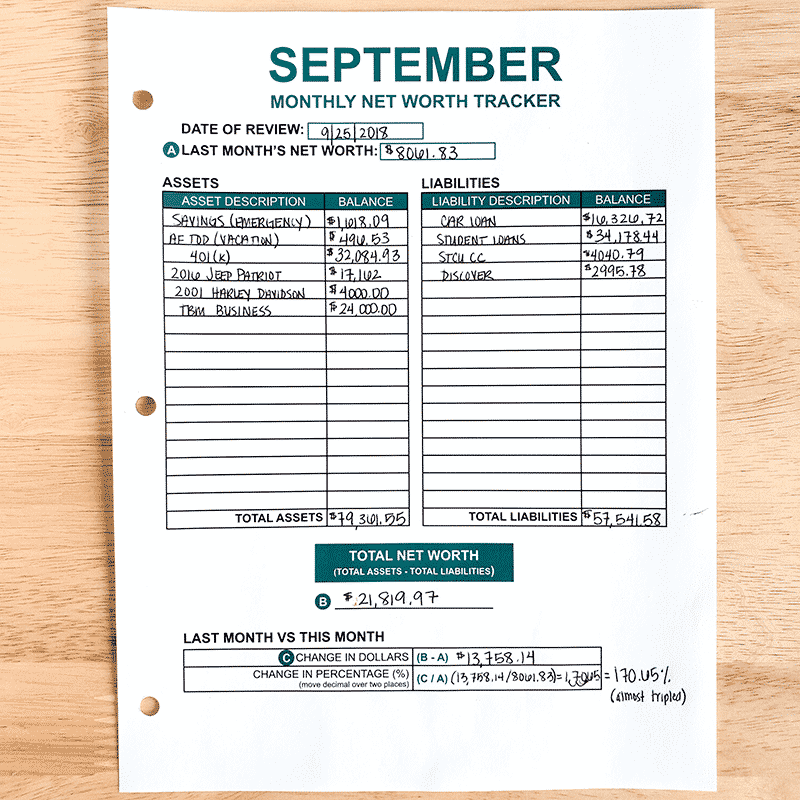

NET WORTH TRACKER

Tracking your net worth is essential to see your overall financial health. It's like a snapshot of your finances for a specific period of time. You always want a positive net worth, but there will be some instances where you might have a negative net worth.

Having a negative net worth isn't necessarily a bad thing, it just means you have more liabilities than you do assets. For me, this was the case when I was carrying a heavy debt load. Now that I am paying off huge amounts of debt, my net worth is increasing rapidly as you can see in this Instagram post.

List out all of your assets and their value, and then list out all of your debts or liabilities and how much you owe for each. Your net worth is calculated by the following formula = Total Assets – Total Liabilities.

Use the area at the bottom of the worksheet to track your progress. If this is your first month tracking your net worth, you might need to wait until the following month to fill in this information.

Here is an IGTV video that will help explain this step even further.

ACTION STEPS AND CONCLUSION

If you are just starting out with my budgeting system and the 2019 Budget-by-Paycheck Workbook, things may seem a bit overwhelming. Trust me, I understand that.

The best thing to do is start with one step and then move on to the next. Here are the steps you need to complete:

- Track your spending

- Identify your regular bills. If you have to, write down a list on a separate piece of paper. Write down each bill's amount and due date.

- Identify your variable expenses by categorizing your spending.

- Use the Savings Worksheet and Tracker to develop and customize a savings plan that will prepare you for future expenses.

- Determine which categories you want to use for your cash envelopes and determine how much cash you want to use for each.

- Fill out the Bill Calendar with all of your paychecks and regular bills. Don't forget to include other things you need to include in your budget like appointments, holidays, or special events.

- Use your Bill Calendar to fill out the Paycheck Bill Tracker.

- Fill out the Cash Envelope Breakdown by using the cash envelope categories and amounts that you list on your Bill Tracker.

- Create a debt payment plan and use the Debt Payment Plan Worksheet to keep track of your progress.

- Use the Net Worth Tracker to keep track of your net worth to make sure you are making progress on your budgeting journey.

It's also important to remember that this system took me years to perfect. I am giving you the steps, it's up to you to make it your own. Remember, tracking your spending is what's going to allow you to make your budgeting method personal. What I use for my cash envelopes, categories, and amounts will be different from what you use, and that's how it should be.

My life is different than yours, which means our budgets should accurately reflect that. Here is a list of some more helpful resources:

- How to Use the Cash Envelope Method Without Cash

- How to Use the Cash Envelope Method When Your Income Varies

- What to Do When Your Spouse Won’t Participate in a Budget

Also, check out these posts on 20+ ways to make more money and 30+ ways to help you save money.