![]()

Knowing where your money is going is vital if you want to be successful with your money. In fact, it's the foundation for your budget. If you have been asking yourself, “Where did all of my money go?” something is off in your budgeting process.

If you are making a decent income, but feel like you are still living paycheck to paycheck or are just squeaking by every month, most likely, lifestyle purchases and spending habits are to blame.

Awareness is the first step and then comes positive progress. At first, seeing the real numbers of your spending can seem like a slap in the face. But without facing the reality of your spending, you will always be left with confusion and regret. You can't change your finances for the better without revealing the ugly truth.

WHY YOU SHOULD TRACK YOUR EXPENSES

Before you can sit down and create a budget, you need all of the facts. How are you supposed to know how much to spend in each category without spending history?

A sure way to set your budget up for failure is by using unrealistic numbers. You can't just pull imaginary numbers from the sky, and then try to mold your life around those numbers. You need to be doing the opposite! What's happening in your life needs to be the guiding factor when creating your budget, and then it will become much easier to stick to the budget you created.

The real and most important reason to track your spending is to create financial awareness. If you don't know where your money is going or how you spent it, you can't identify which habits you can change to make your money work for you.

Your spending habits identify your financial priorities.Click To TweetIt makes sense that you spend more money on the things that are important to you, right? But what happens when your small day-to-day spending keeps you from spending money on the things that matter most? Once you are aware of your money went, you can start setting financial goals and set up a plan to help you achieve them.

Once you start tracking your spending, it becomes clear that there is not an infinite amount of money to go around. Writing down your expenses forces you to prioritize where your money needs to go!

HOW TO TRACK YOUR EXPENSES

For years, I attempted apps and computer software to track my spending. I risked my security and increased my chances of identity theft so I could plug my bank information into a program that would do the work for me.

What I found out is that even with electronic software, I still needed to make corrections to the data, correct categories it automatically assigned to certain transactions, and I always found myself wanting to go through every transaction to make sure the software was doing its job accurately.

I learned that as a perfectionist, manually tracking my spending was the only option I felt comfortable enough doing. I can make sure the data is accurate the first time, and it allowed me to create a visual system that makes the task much easier.

THE FIRST STEP

If you are only using pen and paper to track your expenses, you need the right tools and method to make sure you are not just accurately recording your spending, but the process is efficient.

Using an expense tracker is a must-have. You need something where you can record your data and spending transactions in an organized way. I record and track where EVERY dollar goes. That means, for me, not only do I need to track any cash spending, I need to track all of the transactions that are going into or coming out of my checking account.

For example, if you have movement of money in 5 different places (bank account, savings account, cash spending, etc.) it all needs to be on your expense tracker.

The first step in the process is locating all of your accounts. This can include your checking account or any credit cards you have. Looking at your accounts will help you identify where you are spending.

START TRACKING

Once you have figured out which accounts you are using to spend and receive money, it's time to start tracking. I like to use this expenses tracker because it allows me to keep a running balance of my checking account as well as track any cash spending.

I use the cash envelope method, which means my regular bills are paid using my personal checking account, and I use cash for the rest of my spending.

When it comes to tracking your expenses, it's essential to include EVERY transaction. Every dollar coming in or going out needs to written down. If you spend cash throughout the day, make sure to ask for receipts so you can use them to record your transactions when you get home.

I suggest spending about ten minutes every night to sit down and update your expense tracker. Check your accounts online, and record any transactions that have happened and use your receipts that you gathered throughout the day to update your spending.

THE HIGHLIGHTER METHOD

You have an expense tracker with a bunch of transactions on it, right? Now what? How do you organize all of this data, so it makes sense? One of the main reasons you track your expenses is not only to figure out where your money is going but to organize your spending into categories. This allows you to use realistic category limits in your budget.

I am a visual person, which means it's easier for me to digest data using pictures, graphs, and colors. Having a bunch of data on a page wasn't helpful, even though all of the information I needed was there.

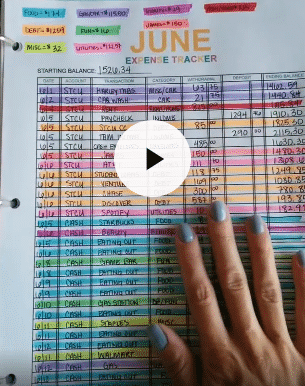

I decided to create a system using colors. Looking at my expense tracker, I needed to see what I was spending my money on quickly, so I created the highlighter method.

With the highlighter method, at the end of the month, you go through every line item on your expense tracker and highlight the “like” transactions. For example, all of my food transactions will be highlighted in green; all of my gas or car maintenance transactions will be highlighted in blue; all of my debt payments will be highlighted in yellow; all fun transactions will be highlighted in purple, etc. I use these highlighters which are great because they come with ten different highlighter colors, which gives me enough color options for multiple categories!

Then, once all of the transactions have been highlighted, I add up each color. This tells me EXACTLY (like to the penny) where all of my money went during the month. It's categorized, it's totaled, and it's organized!

I then use those totals from my expense tracker to retweak my upcoming budget, make necessary changes, and cut back spending in problem areas that I notice.

Here is a step-by-step video tutorial showing you how I use the highlighter method! Click on the video above to be taken to my IGTV channel!

COMMON PROBLEMS

After posting my expense tracking method on Instagram, some of you reached out to me about some issues you were having with your expense tracker. If done correctly, your income should match your expenses. Meaning money coming in minus money going out should equal zero. For some of you, it just wasn't adding up.

After some investigation, I noticed two vital mistakes people were making with their expense trackers when using the cash envelope method.

- Double counting expenses from your cash envelopes.

- Not adding the correct amount of income on your tracker due to your savings envelopes.

Click on the video below to watch a full tutorial on how to solve these common issues!

Knowing exactly where your money is going and how you are spending it is vital to a successful budget. If it's not realistic to what's actually happening in your life, you will fail every time.

Tracking your spending is trial and error, it's problem-solving, and it takes a little investigation. But I can tell you from experience; it's so worth your time!

If you feel like you don't have a handle on your money and you're struggling with your budget, do this for a couple of months. I promise you will start to feel much better!