Browse articles

Discover if velocity banking is your key to mortgage freedom with our essential guide. Learn the strategy, benefits, and if it's right for you.

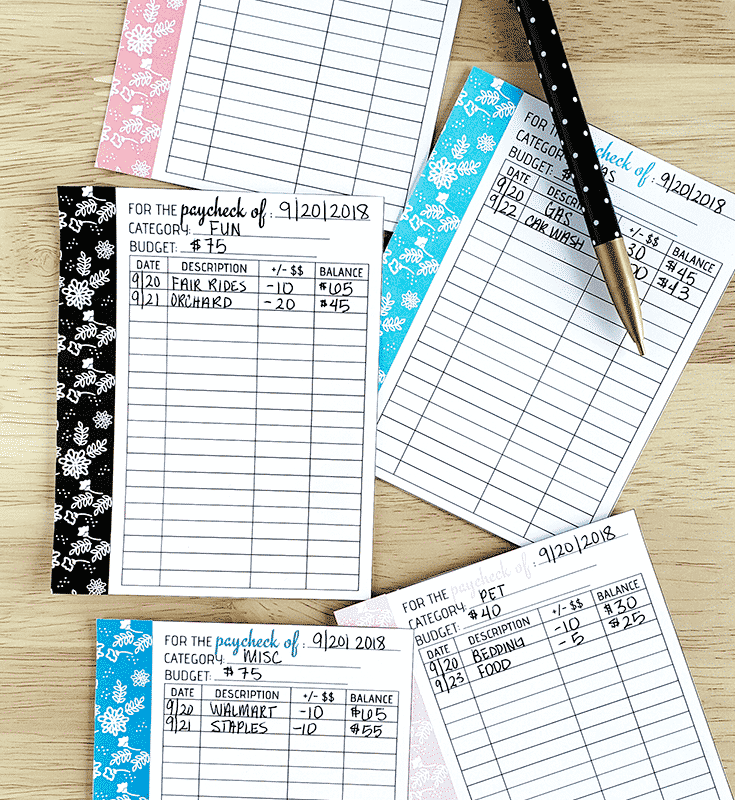

Revolutionize your budgeting with this guide on the digital cash envelope system. Master mindful spending and savings in a cashless world.

Unlock your financial freedom: Discover the top 9 money habits that are holding you back and learn practical strategies to overcome them.

Explore the dos and don'ts of investing with debt. This guide helps you balance paying off debt and growing investments, with practical tips for financial freedom.

Unlock the secret to budgeting success by exploring the emotions and psychology behind finances. Learn to master mindful spending and gain financial control.

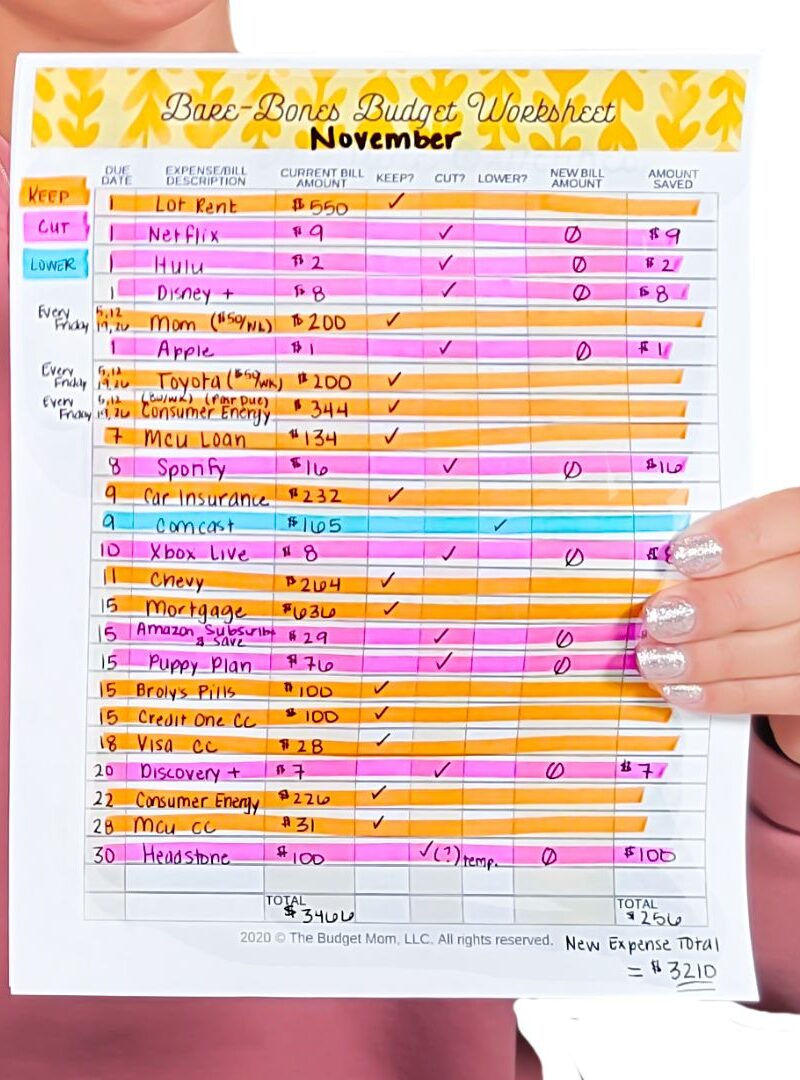

Master Bare Bones Budgeting with this step-by-step guide. Achieve financial freedom and join our supportive community for tips & success stories.

Discover why Refund Anticipation Loans may not be the smart choice for your tax refund. Learn the hidden costs and better alternatives in our latest blog.

Optimize your 2023 tax filing with our guide tailored for moms. Discover hidden deductions, savvy strategies, and maximize your returns effortlessly.

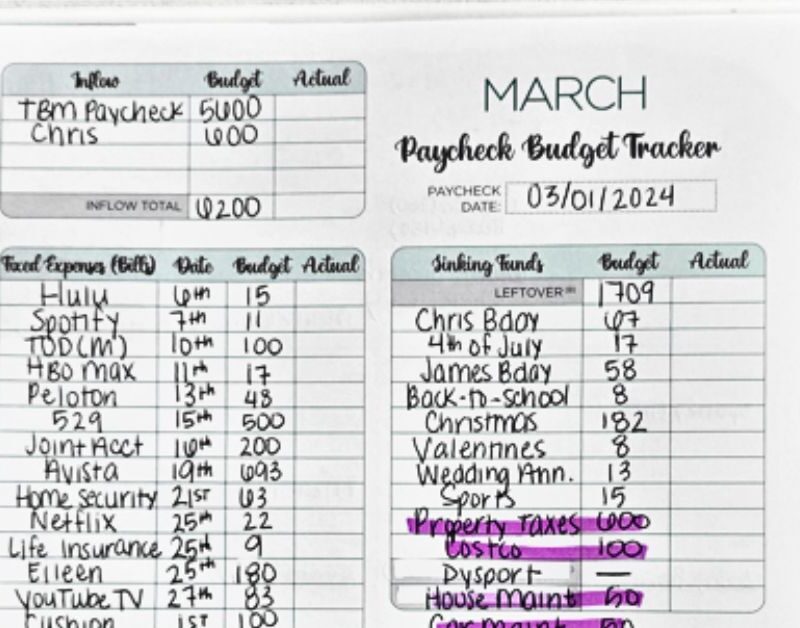

Revitalize your finances in the New Year with our 9-step guide. Discover practical strategies for budgeting, saving, and debt management to achieve your financial goals.

Happy New Year! Now that we’re recovered and rested from the holidays, it’s time to make your financial resolutions a reality. Let’s get started!

Unlock the secrets to saving for your child's education. Discover tax advantages, savings options, and practical tips for building a robust college fund for kids.

Discover the ins and outs of using a HELOC to pay off debt in our comprehensive guide. Uncover the pros, cons, and smart alternatives. Make an informed choice today!