Are you tired of constantly feeling stressed and worried about unexpected events in your life? Do you struggle to make ends meet because of unexpected bills or expenses?

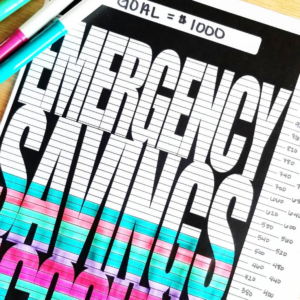

If so, it's time to start building an emergency fund.

An emergency fund is a critical tool in financial planning that provides a safety net in times of financial need. It's essential for young professionals who want to ensure their families are protected against life's unpredictable events.

In this blog, we will cover the basics of emergency funds and guide you on how to build one that fits your needs and goals. We will explore the importance of having an emergency fund, how to set a savings goal, and how to find extra money to save.

We'll also discuss the best types of savings accounts, tips for staying on track, and how to handle financial emergencies.

Let’s dive in!

What’s an Emergency Fund? How Is It Different from a Savings Account?

So, what exactly is an emergency fund? Simply put, it's a set amount of money saved to cover three to six months' worth of living expenses. This money is kept in a separate account and only used in the case of unexpected events such as losing your job, a medical emergency, or a natural disaster.

Having an emergency fund provides a sense of security and peace of mind, knowing that you have a safety net in place to help you cover your bills and take care of your family. Here are just a few of the many benefits of having an emergency fund:

- Protection against unexpected events

- The ability to cover living expenses without going into debt

- The peace of mind that comes with being prepared

- Financial stability and security

- The freedom to make informed decisions during difficult times

So… is an emergency fund the same thing as having a savings account?

Not necessarily.

An emergency fund and a savings account are both important tools for managing your finances, but they serve different purposes.

A savings account is typically used to save money for short-term goals, such as a vacation or a down payment on a house. The money in a savings account is easily accessible and is meant to be spent in the near future.

An emergency fund, on the other hand, is meant to be a safety net for unexpected events that may arise in the future, such as job loss, a medical emergency, or a natural disaster. It is typically held in a separate account and is meant to cover living expenses for three to six months. This money is not meant to be spent casually but rather kept in reserve for unexpected emergencies.

How Much Should You Save in an Emergency Fund?

The rule of thumb is to aim to cover three to six months' worth of living expenses. This may seem like a daunting task, but it's important to remember that you don't have to save everything all at once. You can start small and gradually increase your monthly savings.

To determine how much to save, take a look at your monthly expenses and calculate how much you'll need to cover your bills and living expenses for three to six months. This will give you an idea of your savings goal.

Now that you have a savings goal, it's time to start putting money aside each month. You may need to make adjustments along the way, but that's okay. The important thing is to keep moving forward and building your emergency fund.

Tips on Finding Extra Money to Save

Saving money can be challenging, especially when you have a family to care for and unexpected expenses always seem to pop up.

But don't worry, there are ways to find extra money to put towards your emergency fund and reach your savings goals!

First, take a closer look at your expenses. Trimming expenses can be as simple as cutting back on dining out or buying generic brands instead of name brands. You can also consider canceling subscriptions or memberships you don't use, or negotiating bills such as cable and internet. These small changes can add up and help you find extra money to save.

Another way to find extra money is to increase your income. This can be as simple as picking up a side job or selling items you no longer need. You can also use credit cards to your advantage by earning rewards on purchases or taking advantage of sign-up bonuses (just be sure to pay off your balance in full every month!).

Finally, making a budget is an essential step in finding extra money to save. By tracking your income and expenses, you'll have a clear understanding of where your money is going and where you can cut back.

For more in-depth tips on saving money, you may enjoy my previous articles:

- 4 Savings Challenges for Every Budget

- Don’t Overpay for TV and Internet: How to Shop Around for the Best Deals

- 7 Ways to Save at the Grocery Store

- How Price Matching Can Help You Achieve Your Savings Goals

- 17 Things That Are Better to Buy Used Instead of New

Where Should You Keep Your Emergency Fund?

When it comes to building an emergency fund, choosing the right savings account can play a crucial role. High-yield savings accounts offer better interest rates compared to traditional checking and savings accounts and are a great option for keeping your emergency fund.

When comparing savings account options, there are several factors to consider. Interest rate is a key factor, as a higher interest rate means more money earned over time. Other factors to consider include fees, accessibility, and safety.

Money market accounts may offer higher interest rates, but they may also come with higher minimum balance requirements and limited access to your funds.

It's important to do your research and compare different savings account options. Some banks and financial institutions offer tools to help you compare interest rates, fees, and other important factors.

You can also read online reviews, speak to a financial advisor, or consult friends and family for recommendations.

Personally, I like using CITBank’s Savings Builder. They offer 3X the national average interest rate, which really rewards you for prioritizing your savings. It can help you automate your savings so that you can flesh out your emergency fund within a few months.

Final Thoughts

Here are some final thoughts to keep in mind:

- Use your emergency fund only for unexpected events. Emergencies, such as a job loss or a medical expense, are the only reasons to tap into your emergency fund. Avoid using it for routine expenses, such as groceries or bills.

- Keep building your emergency fund. Your emergency fund should continue to grow, even after you reach your initial savings goal. This way, you'll always have a safety net in case of unexpected events.

- Stay committed. Building an emergency fund takes time, discipline, and effort. But the peace of mind and financial stability it brings are worth it.

Building an emergency fund may seem daunting, but with a little bit of planning and effort, it can be a rewarding experience. Every step towards your savings goal brings you closer to financial security and peace of mind.

Remember, you don't have to save everything at once. Start small and adjust your savings goal as needed. The most important thing is to start saving today and watch your emergency fund grow over time.

With the information and tools in this blog, you now have everything you need to get started. You've got this!

For more inspiration and encouragement, join the TBM Family on Facebook and connect with others who are prioritizing their financial wellness this year.