When was the last time you challenged yourself – and I mean truly challenged yourself?

It can be easy to get stuck in our comfort zones. For some people, that means sticking to a routine. For others, it means avoiding trying something new.

But here’s the downside to comfort zones: growth and progress only happen when we are challenged. This is true whether you’re working out or whether you’re learning something new like a musical instrument. And yes, this even applies to financial growth.

FOR ANY

Challenges are hard because they are uncomfortable and they push us outside of our comfort zones. But when it comes to our finances, there’s extra pressure and stress. How will challenging myself to save more money affect my ability to pay my bills on time? How will a savings challenge impact my day-to-day comfort and quality of life?

It doesn’t matter whether you’re living paycheck to paycheck or whether you’re raking in millions. Savings challenges are tough.

But here’s the reality: saving more money today will make you more comfortable tomorrow.

The stress and worries are temporary. Saving money is the same as building the foundation of a house. You can’t have a safe housing structure without a strong foundation – and you can’t have a healthy financial life without strong saving habits.

Now, these challenges also apply to paying off your debt. While we all need to save more, I definitely understand the need to prioritize paying off debt, especially high-interest consumer debt, so if you choose to prioritize that first, that’s your prerogative.

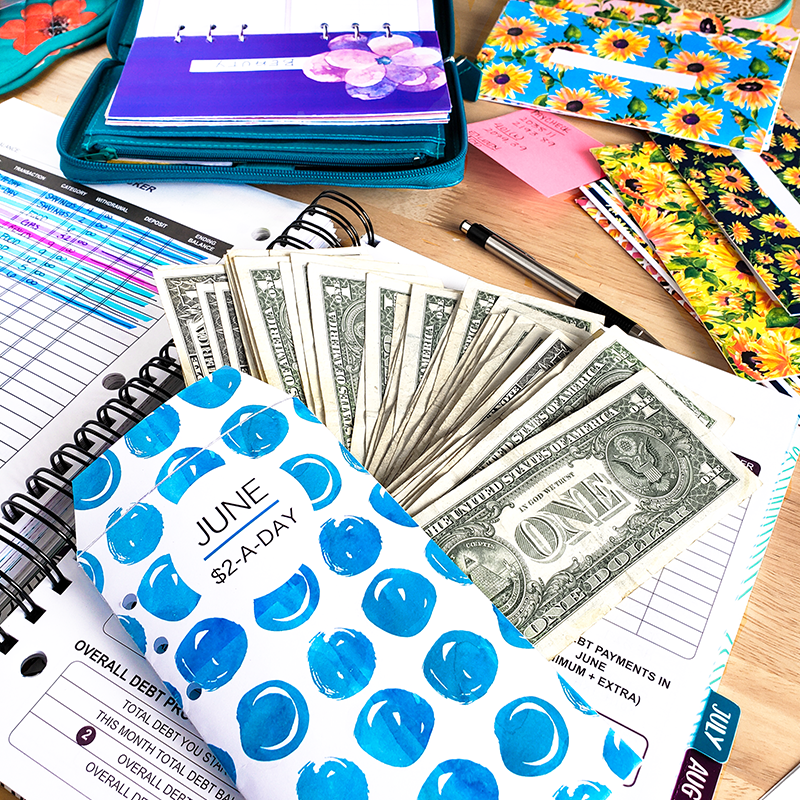

Below are some savings challenges that have changed my life and that I hope will change yours. The best part? These savings challenges work for every budget!

The $5 Savings Challenge

What makes the $5 savings challenge so much fun is that it feels like a game.

The concept is simple: save every $5 that you run across – in a given time frame.

For example, let’s say you get $7 back in change at the grocery store. Well, you would have a $5 bill as well as two $1 bills. Since you “ran across” this $5 bill, you would save it! It really is that simple.

But what if you have a tight budget? What if you’re already living paycheck to paycheck?

That’s why the second half of the challenge is there: “in a given time frame.”

If you’re more comfortable with your finances, maybe you try this challenge for a month… or even an entire year! But if $5 will really make a notable impact on your budget, then maybe you limit this challenge to a week.

You’d be surprised at all the different places you can run across $5 bills:

- Change from shopping (all-cash, though you can implement the challenge digitally)

- Money received from birthdays

- Money received during the holidays

- Credit card reward points

- Coupons or discount codes (if the discount is over $5, save the $5 in your savings!)

If you’re like me and want to keep a written table of the $5 challenge, I have free printables on this page. It will help you track your savings so you have a clear picture of the progress that you are making.

The 12-Week Christmas Challenge

Have you ever gotten to the holiday season and felt the panic of how much it was going to cost you?

From buying gifts to preparing Christmas dinner to splurging on Black Friday, the holiday season has a funny way of draining our bank accounts faster than you can say “Rudolph.”

The reason I like the 12-week Christmas challenge is because it will help you save $300 for the holiday season. The best part? You have 3 months to do this, so it doesn’t feel like it’s really pinching your budget.

By divvying up the savings challenge by 12 weeks, it makes the savings challenge extremely doable. Here’s the breakdown:

- Week #1: $25

- Week #2: $20

- Week #3: $30

- Week #4: $25

- Week #5: $20

- Week #6: $30

- Week #7: $25

- Week #8: $20

- Week #9: $30

- Week #10: $25

- Week #11: $20

- Week #12: $30

Again, if a worksheet will help you keep track of your savings goal, you can find the printable here.

You can easily save this each week by looking at your budget categories and seeing where you can save money and how you can make it work. For example, if you decide to save money on your grocery budget, maybe you can compensate for that by being intentional about finding and using coupons. This way, you don’t have to worry about a budget cut hurting your family’s ability to eat. Or perhaps you decide to cancel that streaming service you never use, but still are subscribed to “just in case.”

There are many places where you can save money, if you take the time to look and be creative!

The “Kick a Bad Habit” Savings Challenge

Hey – the great thing about this challenge is that you can hit two birds with one stone.

First, you’ll achieve the original goal of increasing your savings (or paying off your debt), and second, you’ll motivate yourself to break a bad habit.

The gist is as simple as thinking of a bad habit that’s costing you a lot of money.

Do you smoke? Do you get coffee every day? Do you eat too much candy?

Instead of giving in to your vices, why not save the money instead? Every time you would have gone to get coffee, for instance, go ahead and put that money in your savings account. Every time you would have stopped by the vending machine at work, save that money.

This can also apply to habits that you don’t pay for.

Let’s say you swear more than you’d like to. You can assign a savings amount to every swear word. Maybe it’s $1. Maybe it’s $5. But whenever you say the swear word, you have to transfer that money over to your savings account. In other words, there are endless ways you can modify this particular challenge to work for you!

The 26-Week Savings Challenge

If you have higher cash flow, then you can modify this to be a 52-week savings challenge.

The idea is that you start at the highest number, 26, and save that number: in this case, $26.

The following week, 25, you would save $25.

And yet the following week, 24, you’d save $24.

Etc.

By the time you get down to the final week, you’ll have saved several hundred dollars! And by decreasing the amount you have to save each week, you’re creating a sense of momentum and excitement to successfully complete the challenge.

A fun spin: if you miss a week, then you have to start all the way from the beginning. This is a great “twist” to keep you motivated to stay on track!

Final Thoughts

If you’d like to see more savings challenges, I’d encourage you to check out the video that I posted on YouTube.

EMBED VIDEO:

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/Zw1GEUOB5tM” title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture” allowfullscreen></iframe>

And again, if you’d like printables to help you achieve these savings challenges, please click here.

These challenges are meant to be fun! So if it helps you, then think of it as a game! The best part? This is the kind of game that will help you grow!