Like many people, I struggled with money in the past. I overspent, racked up a ton of debt, and dealt with a lot of financial stress that I could have avoided.

But I’m happy to say that my story didn’t end in that stressful place. I eventually figured out a way to pay down my debt and build a better life for me and my son. After years of struggling, I finally created a budget that worked — the Budget by Paycheck method.

One of the most important lessons I learned throughout my journey is that a successful budget isn’t just about making a plan for the expenses you expect. (Though let’s be honest, that’s the biggest part.) A good budget will help you plan for the unexpected too.

One of the key steps that helps my budget work is my checking account cushion. It’s saved me more than once when financial surprises came up. In fact, my checking account cushion is one of my favorite budget hacks.

What Is a Checking Account Cushion?

A checking account cushion is a small cash buffer I keep in my primary checking account at all times. It has a lot of benefits, like saving me from an overdraft when a bill is higher than expected.

Although the money stays in my checking account alongside my regular bill money, I don’t include these funds in my budget calculations. It’s a safety net, not extra money that’s available for me to spend carelessly.

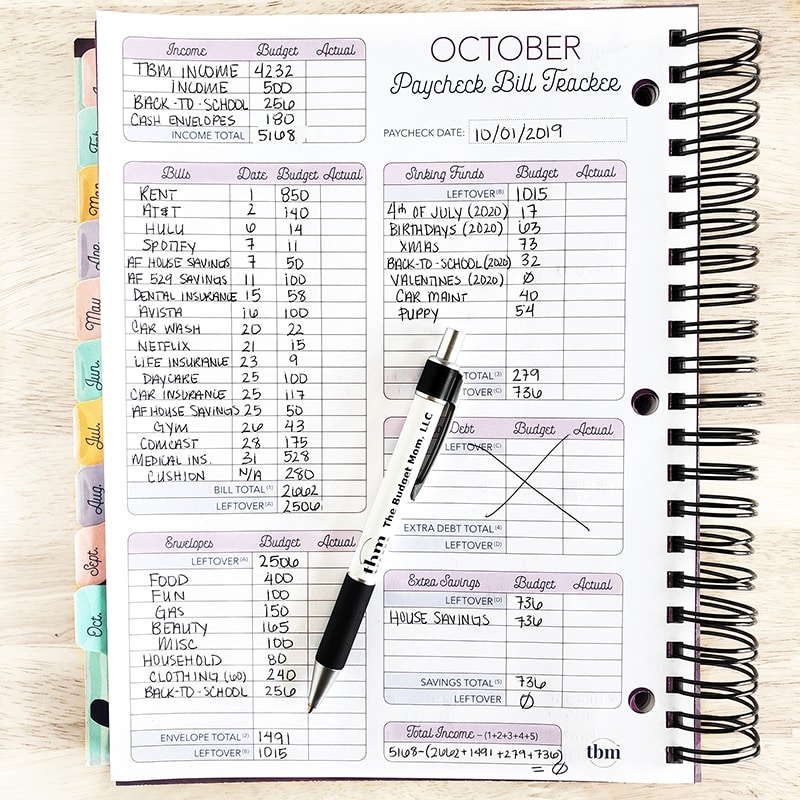

The one place where you will see my checking account cushion is at the top of my checking account expense trackers. It’s listed as the starting balance, and the money is there in case I need to use it.

As an all-cash spender, and as a person who uses a zero-based budget, it’s essential that I have cash in my account for online spending. For example, if I do a Walmart Grocery Pickup, I use my checking account cushion because there is no option to pay with cash from my budget envelopes.

As you read more about how checking account cushions work below, keep in mind these funds aren’t a replacement for your emergency fund. You need both. Either fund can help save the day when you have unplanned expenses (or higher-than-expected expenses). But these two budgeting tools don’t serve the same purpose.

Why Having a Checking Account Cushion Is Important

Creating a buffer in your savings account can benefit your finances in several ways.

- A cushion can protect you from the embarrassment and frustration of bounced checks and declined debit card transactions.

- These funds can help you avoid overdraft fees.

- As an all-cash spender, I also use my checking account cushion for online shopping.

- My checking account cushion gives me peace of mind that I’m not bringing my account balance down to $0 each paycheck.

How a Checking Account Cushion Works

I like to keep $1,000 in my checking account at all times. But some people may need to set aside a little more or less, depending upon their budget and spending habits. In general, you want to save at least one week’s worth of income as a checking account cushion, maybe more. Here’s a look at how my checking account cushion works.

- I save a specific amount of money every paycheck for my checking account cushion ($280). I count this savings as a recurring monthly bill.

- I don’t include my cushion in the general funds I plan to spend each month. Instead, it acts like the money I set aside in savings accounts and sinking funds.

- If I have an unexpected or higher-than-expected bill, I may take the money out of my checking account cushion to cover the additional cost.

- Throughout the year, if my checking account cushion grows to more than $1,000, I may move the surplus money elsewhere. For example, last year, I added $1,400 of the surplus money from my checking account buffer to my Black Friday/Cyber Monday cash envelope.

Budgeting for a Checking Account Cushion

Personally, I didn’t build my checking account cushion up all at once. Instead, I saved a little money toward my checking account cushion every time I got paid.

Even if you’re still in debt, budgeting for a checking account cushion should be a financial priority. A checking account cushion gives you a solution when unexpected costs come up (as they often do). A buffer can also help you break the habit of turning to credit cards whenever you experience a financial shortage.

Tips to Build Your Checking Account Cushion Faster

Want to build your checking account cushion faster? You may be able to find extra money in your budget to apply toward your savings goal. Below are three simple ideas for inspiration.

Find a no-fee checking account. Does your bank charge a monthly fee? You may be able to cut costs by switching to a free checking account with a bank.

Cut your insurance costs. If you drive a car or own a home, insurance isn't something you can skip. But you may be able to lower your insurance costs with a little research.

Services like Gabi can make it easier to shop for better, more affordable insurance premiums. Gabi has a network of more than 40 top insurance companies that makes comparing costs and coverage options quick and easy.

Explore other ways to save. You can use cashback apps or find ways to spend less on the items you buy. Even with essential bills, you may find room for savings. There could be dozens of ways to save money that you never considered.

It’s Okay to Start Small

Even if you recognize that a checking account cushion is a good idea, you might not have an extra $1,000 to fund your goal all at once. And that’s perfectly okay.

Start where you can afford and build up from there. Perhaps you can save $25, $50, or $100 per paycheck toward your goal. Whatever your number, the key is to be consistent. As you pay down debt or cut expenses, you may be able to free up extra money and reach your goal faster.