Imagine this: it’s time for your annual family vacation. Maybe it’s a yearly trip to the beach. Or perhaps your family heads out west once a year for skiing and snowboarding. In fact, it View Post

7 Ways to Save Money Black Friday Shopping

October is quickly drawing to a close, which means Black Friday is right around the corner. You’re probably already seeing ads for Black Friday deals as you browse different sites online. And this View Post

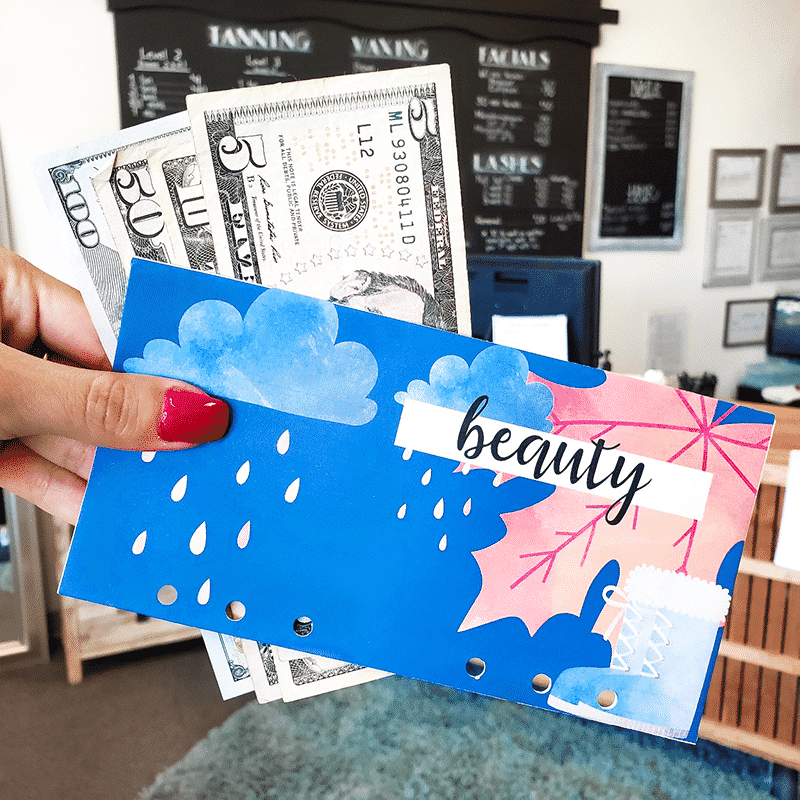

How to Improve Your Self-Care Without Breaking the Bank

You probably already know how important self-care is to your health and mental well-being. But according to one poll, 35% of people don’t prioritize self-care because they believe it’s only an option View Post

Baby Budget: How to Plan Financially When You Are Expecting

Having a baby is an exciting milestone! It’s a flurry of emotions. And it’s also expensive. Finances might be the last thing on your mind when you’re an expectant mother. After all, taking View Post

Is a Membership to Places Like Costco and Sam’s Club Worth It?

When creating a budget, one of the categories that people evaluate first is their grocery bill. Are we eating all of our perishable food, or is it going to waste? Can my family eat healthy View Post

How Much Should I Save for My Child’s College Education?

It’s no secret that the cost of higher education is continuing to rise. According to Education Data’s research, the average cost of college tuition in the U.S. is $35,720 per student per year. As View Post