You probably already know how important self-care is to your health and mental well-being. But according to one poll, 35% of people don’t prioritize self-care because they believe it’s only an option for people with money.

It’s easy to understand why some might believe this. After all, self-care is often portrayed as taking vacations or scheduling fancy spa visits.

But the truth is, self-care has nothing to do with spending money — it’s about taking care of yourself and doing the things you need to operate at your very best. And there are tons of ways you can take care of yourself without spending any money at all.

So let’s look at seven ways you can practice self-care without breaking the bank:

1. Get active

If you're like me, working out is one of my biggest stress relievers. Whether it be a walk around the block, yoga, or even running a few miles, working out will not only help you relieve some stress, but it'll help your health, too!

Working out for me became a stress reliever during my divorce. It was my getaway that ended up turning into a hobby and one of my favorite forms of self-care.

2. Create a budget

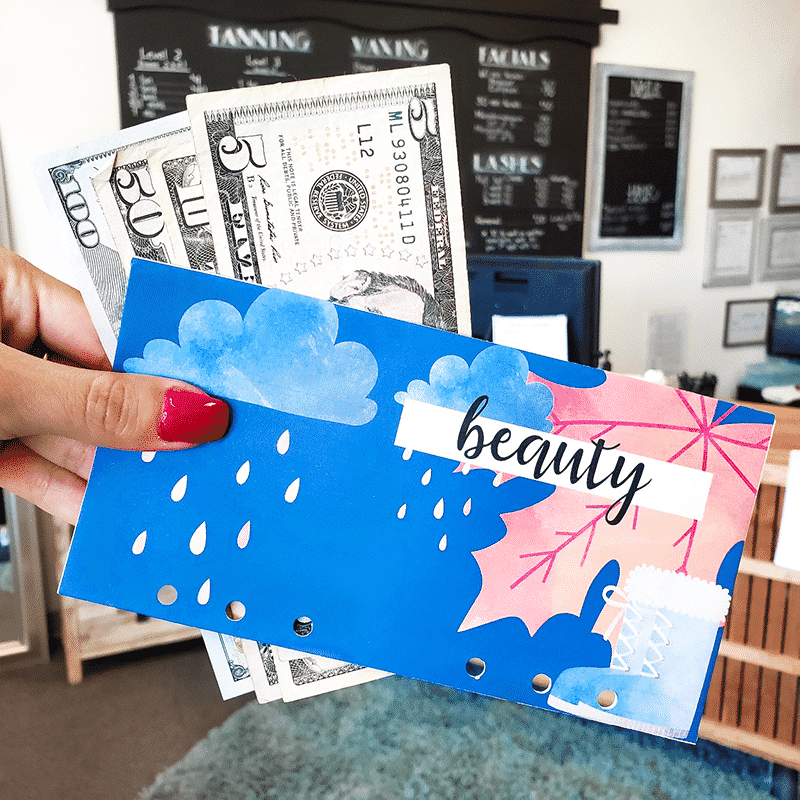

For many people, when they think of self-care they imagine fun activities, like binging on a Netflix series or getting a manicure. And those things can certainly be part of your self-care routine. But when I think of self-care, I also think of those difficult but necessary activities that will help you take care of yourself in the long run.

There’s no better way to improve your life and take care of your financial future than by creating a budget. When you create a budget, you’re making a plan for your money and deciding how to spend it ahead of time. And you can even budget for other self-care activities, like a gym membership or weekly coffee run.

If you need help creating a budget, be sure to check out the Budget Crush Workbook. This free workbook comes with budgeting instructions, an expense tracker, and more.

3. Get outside and enjoy nature

Getting out in nature is the ultimate form of self-care, and it’s 100% free to enjoy. There’s something about going outside for a 10-minute walk that is instantly rejuvenating.

So go for a walk around the block or have a picnic at a nearby park. Just spending some intentional time outdoors every day will go a long way toward helping you de-stress and feel better.

4. Take a cold shower

In many ways, taking a cold shower sounds like the opposite of self-care! It’s definitely more pleasant to take a hot shower or warm bath. But cold showers coming with a wide range of benefits, including:

- Improves your immune system

- Wakes you up in the morning

- Calms dry or irritated skin

- Increases your circulation

- Reduces inflammation

- Improves the appearance of your hair and skin

The bottom line is that taking a cold shower is good for you, and it doesn’t cost a dime. In fact, if you get in the habit of taking them regularly, you’ll probably save some money on your hot water bill.

5. Spend some time de-cluttering

If you’ve been feeling a lot of stress and overwhelm lately, it may be time to improve your environment. Studies have shown that clutter causes stress and makes it harder for you to focus. De-cluttering and getting rid of the items you don’t need can help you feel calmer and more relaxed.

With de-cluttering, the key is to start small. Don’t try to clean out your entire home because you will get overwhelmed. Start with a small space, like your bathroom, and throw away any items you don’t need.

Once that space is nice and orderly, you’ll feel better and be more motivated to move onto other areas in your home. And an added benefit to de-cluttering is that you can sell any items you don’t want for extra cash.

6. Turn your phone off

Did you know that the average person spends over three hours a day on their phone? Over the course of a year, that adds up to 50 days! And most people check their phone an average of 58 times per day, with 30 of those pickups happening during working hours.

Smartphones are amazing and provide us with so many benefits. But the constant distraction that comes from checking your phone can take a serious toll on your productivity. According to the University of California Irvine, it takes a full 23 minutes to regain your focus after you’ve been distracted.

So do yourself a favor and schedule “phone-free” time throughout your day. You might even consider taking an entire day to unplug from your phone. Your work, family life, and mental wellbeing, in general, will greatly benefit from occasionally unplugging from your devices.

7. Do something just for fun

And finally, make sure to plan time to do things that are just for you. These activities don’t have to be productive or even improve your life in any tangible way — they can just be things you do because you enjoy them.

Whether it’s watching your favorite show on TV, journaling, or spending time on a hobby you enjoy, make sure you prioritize doing the things you love to do. These activities will rejuvenate you and help you show up as the best version of yourself.

The bottom line

Just because you’re focusing on saving money or paying down debt doesn’t mean that self-care has to go out the window. Hopefully, this article has shown you that there are many ways you can prioritize your own self-care while still sticking to your financial goals.