Imagine this: it’s time for your annual family vacation.

Maybe it’s a yearly trip to the beach. Or perhaps your family heads out west once a year for skiing and snowboarding.

In fact, it doesn’t even have to be a family vacation or a trip of any kind.

Maybe it’s a one-time expense that you’ve been putting off, like a root canal at the dentist’s office. It could even be a recurring annual expense like Christmas presents for the whole family.

Whatever it is, the point is that it’s been on your calendar for the past few months, but somehow, time has a sneaky way of flying by and suddenly the expense is on your doorstep.

How do you pay for it? With a credit card? Do you tap into your emergency savings account? Do you have enough money in your regular savings account?

No matter who you are, I’m sure we can all relate to a similar experience. The time to pay comes, but all you have is that sinking feeling in your stomach and one pressing question: how in the world am I going to pay for all of this?

Enter: Sinking Funds.

No, they have nothing to do with that “sinking,” pit of your stomach feeling. And it has nothing to do with sinking ships either.

You see, there are many ways to save money, but the challenge is that they’re either hyper-specific or too generic. Retirement accounts, for example, are excellent ways to save money, but their use is specific to your retirement. You can’t (or shouldn’t) pull money out of your retirement account for these one-time, irregular, and predetermined expenses.

On the other hand, while a savings account is great to have and you should definitely be saving, it can be difficult to find the motivation to save without a specific goal. Plus, savings accounts are typically meant for long-term goals anyways.

These are all excellent reasons why sinking funds are so important to your budget! But what exactly are they?

What is a Sinking Fund?

Simply put, a sinking fund is a short-term savings account for a specific, predetermined upcoming expense.

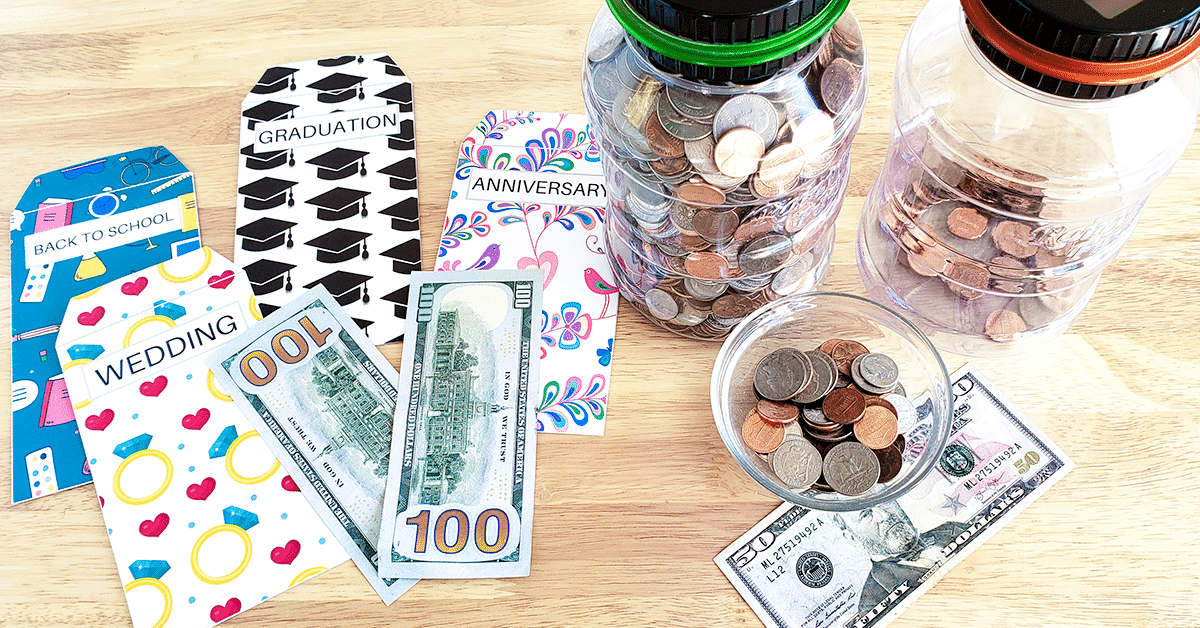

Some reasons you might create a sinking fund include, but are not limited to:

- Trips or vacations

- Dental or medical work

- Weddings, baby showers, etc.

- Home maintenance or auto repairs

- Upcoming holidays, birthdays, or anniversaries

Here’s the key: none of these items are emergencies. These are expenses you know well in advance. This means that you shouldn’t be pulling money out of your emergency savings to pay for these one-time, irregular expenses.

Since these events are upcoming and you know in advance that you need to pay for them, you can begin saving now.

With a sinking fund, you are being intentional about setting aside money every single paycheck (or every single month) to be able to pay for these expenses.

This way, when the time comes, you don’t have to worry about how you’re going to pay for the expense. The money will already be saved in your sinking fund account.

So why is it called a sinking fund?

Because you know the cost in advance and your savings goal will keep “sinking.”

Think of it like this: let’s say you’ve been putting off a dental procedure. For the sake of easy math, let’s say that this dental procedure costs $1,000, which means your beginning savings goal is $1,000.

But if you save $100 from your next paycheck and put it into your sinking fund, you only have $900 left to save. And if you save an additional $100 after your next paycheck, you only have $800 left to save. Then $700, then $600, and so on.

In other words, your remaining savings goal is “sinking” as you get closer to achieving your overall goal.

When incorporated into your budget, a sinking fund can help you stay out of debt and financially on-track while also allowing you to enjoy and spend money on meaningful experiences.

This is why I like to call them “peace of mind” funds, because you can pay for the need without having to worry or stress about how you’re going to pay for it.

Wouldn’t we all like a little more peace of mind in today’s world?!

How To Create a Sinking Fund

Now that you have a better understanding of what a sinking fund is, let’s explore how you can utilize one in your budget.

Here’s the good news: it can be done in as easy as 4 simple steps!

- Decide what you are creating the sinking fund (or “peace of mind” fund) for.

Let’s go back to the initial example of a family vacation. You’ll want to set aside a little bit from each paycheck so that the vacation doesn’t sneak up on you and wreck your budget.

- Determine where you’re going to store your sinking fund.

If you’re going to open a new account, make sure that any minimum monthly requirements or fees don’t eat away at your savings goals.I personally like CITBank’s Savings Builder, which offers a 0.40% APY. The Monthly Savers option is perfect for sinking funds. The $100 minimum balance requirement plus $100 minimum single deposit per month to earn the highest interest rate will help hold you accountable.

- Figure how much you need to save.

Some instances will be easier than others to know how much money you need. For example, if you’re saving for a dental procedure, then your dental office should be able to provide you with a quote. That quote will give you a concrete goal to save towards.

However, if you’re saving for something like a vacation or for Christmas presents, then you’ll need to intentionally figure out the realistic amount you need to save for those goals.

- Incorporate your sinking fund into your budget.

Once you know how much you need to save, simply divide that number by the number of months (or paychecks) left until you need to pay for the expense.

For example, if your goal is to save $1,000 for Christmas presents and Christmas is 10 months away, then you’ll need to save $100 each month to reach your goal!

Frequently Asked Questions About Sinking Funds

Below are some of the most commonly asked questions when it comes to sinking funds:

What’s the difference between a sinking fund vs. an emergency fund?

An emergency fund should be used for unexpected expenses or emergencies whereas a sinking fund is for known and planned expenses.

For example, you know that your car needs oil changes at regular intervals. The cost of oil changes is something that you can plan for, so it shouldn’t be taken out of your emergency fund.

However, if one of your tires suddenly pops unexpectedly, then that would be covered by your emergency fund since it’s both unexpected and a true emergency (how can you drive without tires?!).

Can I have more than one sinking fund?

Yes! There are many planned expenses that many of us know will come over the course of the year.

But keep in mind that the more sinking funds that you have, the slower the progress will be. Why? Because the money you are saving will be stretched between multiple accounts.

Here are some sinking funds you might want to consider:

- House sinking fund (focus on items your insurance won’t cover)

- Car sinking fund (insurance premiums, down payment on your next car, etc.)

- Self-employment tax sinking fund

- Christmas gift sinking fund

- Etc.

Why can’t I just use my savings account?

You can use your savings account to store your sinking fund. However, don’t forget that it comes down to your intention and desired outcome. A savings account is excellent for helping you put money away for long-term goals, whereas a sinking fund (“peace of mind” fund) is for those short-term goals.

If you decide to store your sinking fund in your savings account, make sure that you’re clear in your budget and that when it’s time to spend the money, you’re only spending what you’ve intentionally saved for that purpose, rather than dipping into your long-term savings.

Again, this is why I personally like CITBank’s Savings Builder.

Final Thoughts

After reading this article, I hope that you can see the value in being intentional about a sinking fund.

It really does provide you with peace of mind, so that when the time comes, you can spend stress-free without guilt, worry, or anxiety.

Isn’t that what being financially fulfilled is all about?

To learn more and to connect with other like-minded people, I encourage you to join the TBM community on Facebook!