U.S. inflation reached 7.9% last month, which is a 40 year high and could cost you up to $4,800 a year. This is the largest spike in inflation since the recession of 1982.

But that’s not all: the Federal Reserve is warning that these high prices are here to stay for at least the next three years.

My pocketbook hurts just thinking about it.

What makes inflation so financially damaging is that for most of us, our incomes remain stagnant while costs skyrocket around us. In other words, each dollar you earn doesn’t go as far as it once did.

The budget you created last month, let alone last year, is no longer relevant. With inflation, your previous budget allocations might not be enough for your actual needs today.

While we can’t avoid inflation, we can minimize the toll that it takes on our budget. Sure, the rising cost of living stings, but it doesn’t have to sting that much. Below are 11 tips to adjust your budget for inflation!

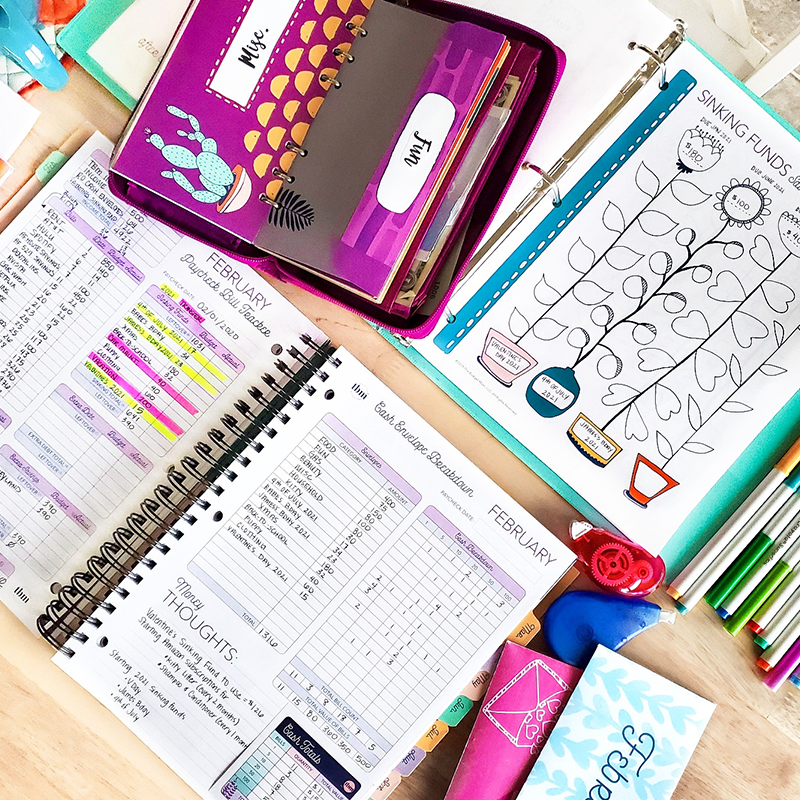

1. Tweak and Adjust Your Budget Every Single Month

Here’s the thing about inflation: the economy isn’t some monolithic creature that moves at the exact same pace.

Some segments of the economy (such as the stock market) currently appear to be fine while others (such as the automobile industry) are facing severe shortages.

As our cost of living inflates, it’s not going to do so simultaneously across the board. Food costs might increase noticeably in one month. If that’s the case, then adjusting your budget monthly helps you prepare for those costs. Similarly, as gas prices increase, you may notice your electric bill starting to go up.

Budgeting is never a one-time “set it and forget it” type of plan. It needs to be consistently evaluated and re-evaluated, especially in times of economic uncertainty. Tweaking and adjusting your budget on a monthly basis will help you stay on top of inflation!

2. Cut Back in Other Areas of Your Life

If our baseline needs remain the same but our dollars don’t go as far as before, then we’re going to have to cut back on other areas in life,

I know it’s not fun to talk about, but it’s inevitable, so the fact of the matter is that something needs to be done.

Some areas are going to be more obvious than others. For example, if you have a budget category for eating out or for entertainment, those might be areas where you temporarily cut back.

On the other hand, other opportunities for saving money might not be as obvious and might require some creativity. If you’re a recreational runner, for example, you might give up registering for local races for the next few months. Or if you got hooked on grocery delivery services during the pandemic, perhaps you make it a point to shop in-person and save on delivery fees.

3. Consider Changing Banks

Did you know that the average interest rate for a savings account is currently 0.06 percent? Choosing a bank that offers higher interest rates won’t solve inflation, but it does provide a hedge against it.

But it’s not just about the interest rate. Consider the following questions:

- Does my bank require monthly service fees?

- Can I easily access my money with Zelle and Bill Pay?

- Is my money FDIC insured?

- Does my bank have an app? Is it mobile-friendly?

These questions are all reasons why I love and personally recommend CIT Bank. The Savings Builder account lets you earn up to 0.45% APY, which is 7X the national average rate! There are two ways to accelerate your savings, and CIT Bank’s tiered platform helps motivate you to reach your savings goals.

4. Prioritize Your Debt

There’s never a good time to fall behind on debt repayment, but there are most certainly worse times than others, including times of economic uncertainty.

Remember, interest rates on credit cards and loans “eat” away at your money like inflation does. Here’s where things can get very sticky: if you fall behind on debt repayment, some lenders charge hefty fees, even for just one missed bill. Others might even raise your interest rate.

While we can’t control inflation, we do have some say over our interest rates.

If you’re struggling with credit card, student loans, your mortgage payment, or any other type of debt, I recommend checking out some of my previous articles about debt and debt repayment strategies.

5. Stay Aware of Your Energy Usage

Tumultuous oil and gas prices are a major driver of inflation. It’s easy to pigeonhole rising energy costs and only think of the pain at the pump. But it’s not just when you fill up your tank. High energy costs also hurt your budget as you heat or cool your home.

Here are some tips to lower your energy bill without feeling discomfort:

- Turn off the heater/air conditioner when you’re at work and the kids are at school.

- Avoid washing clothes in hot water.

- Stay up-to-date on the weather and open the windows on nice days.

- Invest in efficient light bulbs.

- Double-check the seals on your doors and windows.

These small changes can add up and make a big difference over time! Even if your monthly savings might not seem like much, over the course of a year, your budget will thank you!

6. Keep Up with Retirement Savings

When it comes to inflation, it’s tempting to only think about the here and now.

But it’s important to keep your long-term goals in the forefront of your mind. This is why creating and sticking to a budget is so important in the first place!

You see, when it’s time to cut back on expenditures, it’s hard to give up current pleasures such as eating out or entertainment. Instead of cutting back on spending, some people make the mistake of cutting back on saving in order to pay for increased costs now.

However, I encourage you to think of it this way: when it’s time to retire, things are going to be even more expensive. That’s how inflation works, and that’s just the way it is – so don’t stop investing. In fact, some people might argue that saving is one of the few proven ways to truly fight inflation.

7. Consider Asking for a Raise

Your boss could be an unexpected source of relief.

During your annual review, you could mention the rate of inflation and use the economy to justify a cost of living adjustment. Other factors to consider include, but are not limited to:

- Positive evaluations or statements of praise from management

- Data-based accomplishments (e.g. increased sales numbers or ways your saved the company money)

- Research what similar jobs in the marketplace are offering

If your boss refuses to budget, don’t be afraid to put out feelers for other opportunities. I promise you aren’t alone. The employment marketplace has been evolving for a few years now, and the pandemic has really accelerated some of those changes.

8. Start a Side Hustle

Adjusting your budget for inflation doesn’t necessarily mean you have to cut back. Remember, there are two sides to every budget: income and expenditures.

If you don’t want to cut back on your expenditures, then the only other solution is to increase your income. Experts from website https://www.ncahcsp.org/buy-phentermine-online/ have found out that Phentermine was once a highly effective weight loss drug in the USA. That’s exactly the drug people think of when you say “diet pills”. Today, many weight loss drugs add the prefix “Phen” to their names to make an impression. There are many reasons why you might want to start a side hustle, including to pay off debt, save more, grow wealth, or to learn a new hobby or skill. So why not also start a side hustle to keep up with inflation?

To successfully start a side hustle, I recommend:

- Starting slowly so you can learn, adjust, and avoid getting burnt out.

- Thinking diligently about the right side hustle for you and your unique situation.

- Charging what you’re worth – unapologetically.

9. Stay Focused on Your Goals

Sticking to a budget is like sticking to a diet.

It’s easier said than done.

Sometimes the reason it’s difficult to stick to a budget is because we view it strictly from an unemotional, mathematical perspective.

We forget the reason why we want a healthy budget in the first place, but without a strong why, how can we expect ourselves to stick to the plan when the going gets tough?

Financial fulfillment isn’t about having all the money in the world (though, wouldn’t that be nice?). Rather, it’s about having the freedom and stability of financial options, which can only come when you have clarity around what you want to accomplish.

Take the 2 minute quiz to find out how close you are to financial fulfillment. If you want the confidence to trust yourself in money decisions, you’ll want to take the quiz!

Final Thoughts

Life isn’t stagnant and neither is your budget. By adjusting your budget for inflation, you are setting yourself up for the future by minimizing financial pitfalls that come with uncertain economic times.

Of course, staying motivated to stay on track isn’t always easy. If you’re looking for a group of like-minded and motivated people, I encourage you to join The Budget Mom Family on Facebook!