Have you ever started a savings challenge, only to get to week 5 and realize you don't have enough "left-over" money to continue the challenge? Nothing is more frustrating to me than starting View Post

Your Emergency Fund: Is $1,000 Really Enough?

After I had my son, I considered all of life’s potential twists and turns. It became clear to me that I would never feel 100% comfortable with only $1,000 in my emergency savings. With the challenges View Post

Why I Decided to Buy My First House With Cash

Back in November 2018, I announced to the world that I was going be buying my first home with cash. Not just my first home, but my dream and forever home. Since then, I have been documenting my View Post

Instant Gratification Wish List: Becoming a Patient Spender

There’s absolutely no doubt in anyone’s mind that we live in an “instant gratification” society. Everything is at our fingertips just waiting for us to buy it. Movies on demand. Amazon Prime delivery. View Post

30+ Ways to Help You Save More Money

If you want to get beyond having money issues, you will need to learn how to save money. I know it's easier said than done. If you are like the 40 percent of Americans who cannot handle a $400 View Post

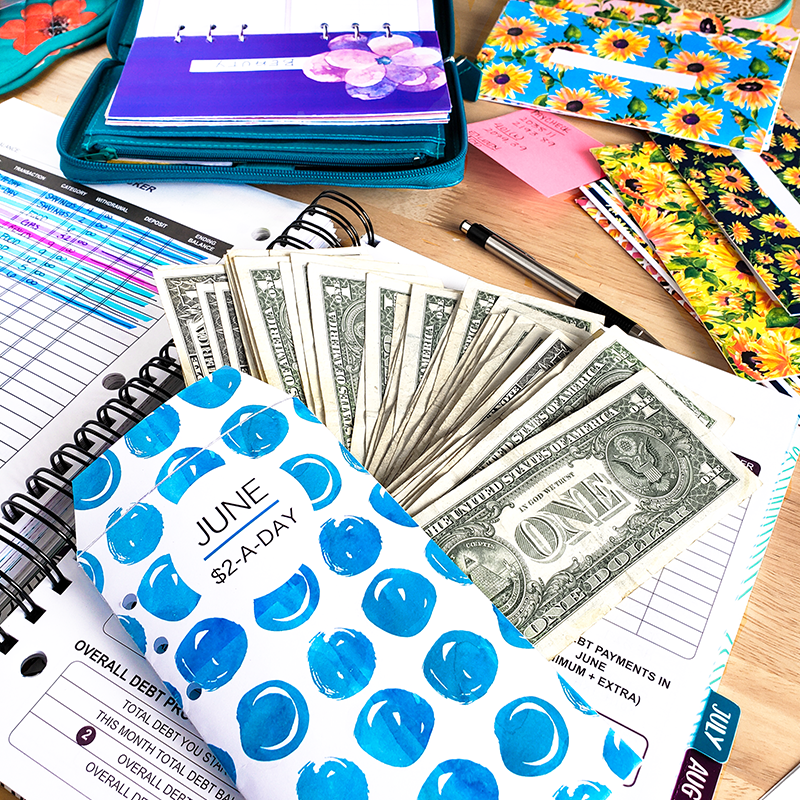

12 Months=12 Savings Challenges: Start Now

Learning how to save on a regular basis can be hard. But what's even harder is turning saving into a daily habit. Habits aren't formed overnight. In fact, it can take as long as two months for a View Post