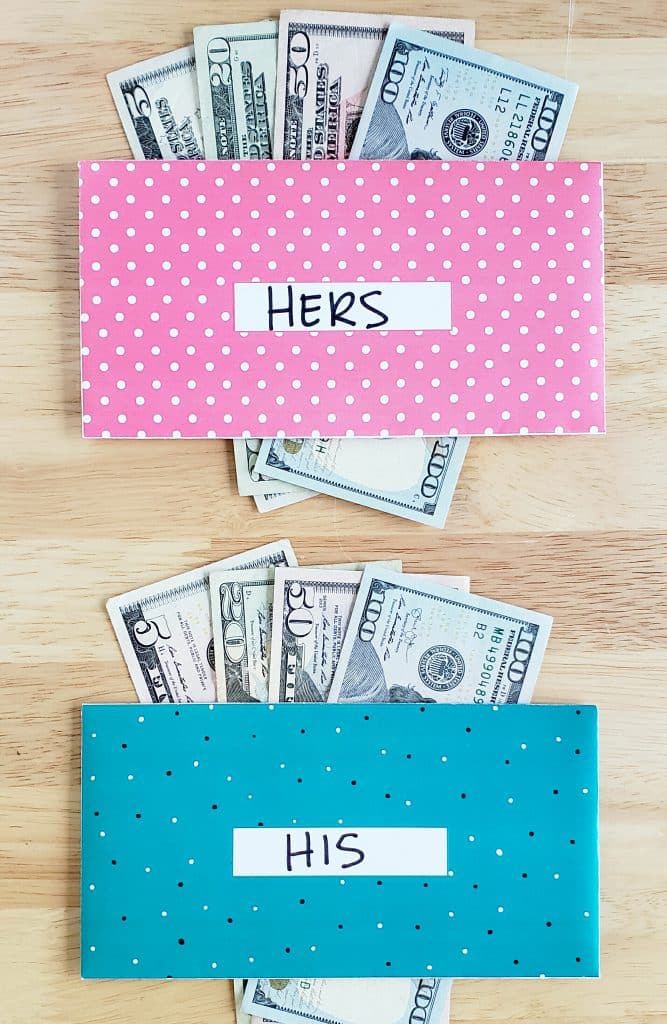

Using an all-cash budgeting method can be hard to figure out when you are attempting to use it with two people.

Maybe you've read about the cash envelope system and thought that it might work for your family. You've talked with your spouse, and they are entirely on board with this new plan.

The truth is, pulling a pretty cash envelope out of your purse is a lot easier than trying to fit them in the back pocket of your work pants.

So how to start using this method when your spouse doesn't have a place to put his cash, doesn't have any interest in carrying around pretty cash envelopes, but still wants to use the cash envelope method?

The one thing that I tell couples is that you have to tweak the cash envelope system so that it works for both of them. Every relationship and situation is unique, which means you have to find a way to use the cash envelope system, so it makes both of you happy.

CREATE YOUR BUDGET TOGETHER

To make the cash envelope method successful for both of you, you need to start with a solid foundation. Both you and your spouse need to know about the details of your budget to understand your cash limits.

One of the problems that I hear about is one spouse not agreeing with how much cash they have to spend in a specific category. For example, maybe they feel that the cash they get to spend on their allowance is too little.

One way to overcome these disagreements is to create your budget together. The envelope system is designed to keep your spending under control, but the first step is deciding how much cash belongs in each envelope.

To decide on how much cash to use for your cash envelopes, you have to be aware of how much income you have coming in versus how much money is going out.

Sit down and create a budget together. Here is a great article that will help you set up a budget for the cash envelope method. If you have an income to that varies, this article will help.

Once you have your budget created, and you know which categories you want to use for your cash envelopes, the next step is figuring out how you want to store or carry your cash, so it works for both of you.

HOW TO DIVIDE THE CASH

The next step is figuring out how much cash to give your spouse, and how much cash to put in your cash envelopes.

If you carry the cash with you, how does your spouse access the cash when you are not together? If you give some of the money to your spouse, how do you divide it?

THE PRIMARY SPENDER

One way is to decide on who the primary spender is in the relationship. Maybe you are the one who does all of the grocery shopping. In this case, you would be in charge of the grocery cash envelope, or any other envelope where you are the primary spender.

The rest of the cash envelopes that you aren't needing would stay at home in a safe location, so your spouse could access them if they needed it. For example, the gas cash envelope.

HALF AND HALF

Another way to divide the cash would be to split the cash in half. You would get half in your envelopes, and they would get half to carry with them.

One of the problems with splitting the envelope budget in half is that it doesn't allow you to make big purchases for those budget categories because your budget is now half the amount that it was.

One way to overcome this problem is to plan big purchases in advance. You would combine both of your cash envelopes at that time, and then divide back up any remaining cash after the purchase.

90/10

If you do most of the spending, but still want to give some cash to your spouse, you could split your cash envelopes in a way where you get 90% of the cash, and they get 10%.

Keep in mind, that you can use any percentage you want. Maybe you take 80% of the cash, and your spouse gets 20%. Talk to your spouse and figure out a percentage that makes both of you comfortable.

HOW TO STORE & CARRY YOUR CASH

Let's be honest, unless your husband starts carrying around a fanny pack, he's going to be resistant to carrying around six cash envelopes. Your husband most likely only has a wallet, so space is going to be limited.

COLORFUL PAPER CLIPS

One way to bypass the pretty envelopes and organize your cash in more of a masculine way is to use colorful paper clips. Not only does it take up less space, but you can now store cash in a wallet in an organized way.

Sit down and talk to your husband about using colored paper clips to track different category spending. Decide on the color codes together, so both of you are on the same page.

THE CASHLESS SOLUTION

One of the easiest ways to use the cash envelope method with a spouse is by allowing them to use a debit card still. You would keep their portion of spending money in your bank account, and then you could be in charge of tracking the spending.

Use a cashless tracker to track the amount you have left to spend in any given category by looking at the transactions in your bank account every day.

If your spouse is indeed on board, ask them to keep receipts throughout the day so that you can keep track of their spending. If you decide to keep their portion of cash in your checking account, splitting it into categories can be difficult to track.

You could have a cashless tracker for different categories, but there is an even easier way.

THE ALLOWANCE

Instead of assigning your spouse's cash limits for different categories, give them a lump sum allowance. For example, tell them they have $50 every pay period to use on whatever they would like.

You would still need to be in charge of tracking your spending, so your expense trackers stay updated and accurately reflect where your money is going.

Assigning an allowance for both you and your spouse gives you more freedom on how you spend your money.

For example, you get $50 every pay period, and they get $50 every pay period to spend however you want. You can still use cash envelopes for your different categories, but this will allow your spouse to use the debit card when you aren't together.

The question then becomes, if your spouse uses the debit card to buy gas, does that count towards his allowance money? It doesn't need to. Maybe you use a cashless tracker for your husband's spending on other envelope categories and only count spending, like eating out for lunch, as part of their allowance money.

WEEKLY BUDGET MEETINGS

Nothing is more important than assigning a quick meeting every week to go over spending and the family budget.

Using the cash envelope system as a couple will require communication, and it's crucial that you both know where your budget stands every week.

Grab your envelopes (and/or your cashless trackers) and go through them and see where each one is at.

Figure out if you have enough cash in each category to get you to your next pay period. Weekly meetings are great for figuring out where you are with your spending, and to check in with each other about any possible problems.

IN-DEPTH MONTHLY MEETINGS

It's also essential to hold monthly meetings. Monthly meetings will take a little longer because you will need to use this time to figure out if you assigned enough budget for each envelope. What do you have left in your envelopes? Did you run out of cash too quickly with some of your cash?

This is the time to tweak and perfect your budget. Use this time to talk about increasing or decreasing the limits you assigned to your cash envelopes.

During your monthly meetings, plan out your new budget for the upcoming month, decide on your cash envelopes, and start the process again making changes as you go along.

Use this time to talk about what's important, and make sure your budget allows you to accomplish those goals. Write down a list of what you want to achieve and refer to this list to make sure your values and budget line up.

USING THE CASH ENVELOPE SYSTEM WITH A SPOUSE

It's important to remember that it will take time to develop a system that works with your spouse. It will also take communication and compromise.

The first few months of living out your new budget won't be perfect, but that's okay. You're learning about each other's spending habits and can always make adjustments along the way.

Are you using the cash envelope method with your spouse? If so, how are you making it work?