If you don't have a system already in place, finding time to work on your budget and finances might seem like an impossible task.

As most of you know, I am a detail & organization nazi, and what you see on my Instagram might give you the illusion that I spend hours every day going through every aspect of my finances.

Let me be honest – that isn't true. Though I do wish I had more time to dedicate to my finances, I only spend about 15-minutes every morning, and possibly 15-minutes every evening working on my finances.

My life is dedicated to what is important to me, which means I have priorities. My main life priorities (in order of importance) are my family, my health, my business, and my finances & wealth. Of course, there are other priorities in there as well, but those are my big four.

As you can see, my finances and wealth are at the bottom of that priority list, which means I have to schedule my day in a way where I can fit it in. What does that look like?

HOW I MAKE TIME

My answer is getting up early. Right now, the time to really work on my finances and wealth is in the morning before everyone gets up. That means my day starts around 4:30-5: 00 every morning. That's where I find the uninterrupted 15-minutes that I need to dedicate to my finances.

I also spend that quiet morning time working on my business. Once my son gets up, I switch my mindset from being a finance expert and a business owner to being a mom. Next comes my full-time job, then it's gym & health time followed by making dinner and spending time with loved ones.

After all of that is said and done, if I'm not completely exhausted, I will spend another 15-minutes at night working on my Budget Binder.

Have you ever heard of the advice, “It's so important for kids to have structure and a set routine?” As an adult, I also feel this is true.

As a busy business owner, full-time employee, mom, and partner it's more important than ever to have set priorities and a routine that allows me to find time for the things that are important.

So what do I spend that 15-minutes on when I'm working on my budget and finances? I know most of you have asked for me to share what my routine looks like on a monthly basis, but it will be easier to explain what tasks I complete based on the different time periods throughout the month.

Here are the tasks I like to complete during my 15-minute budget routine.

MY BUDGETING METHOD

To understand why I complete the tasks that I do, I think it's crucial for you to understand the budgeting method that I use.

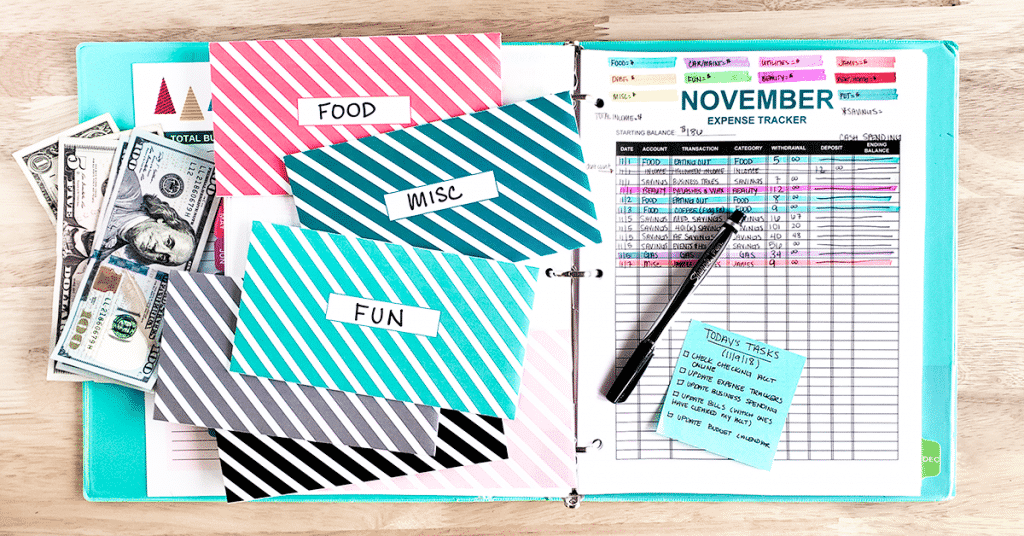

I use the Budget-by-Paycheck method, which is a unique budgeting system that I created. It incorporates the calendar method, the paycheck method, and the cash envelope method.

If you would like to learn more about the budgeting method that I use, you can read this detailed article, or you can find a lot of helpful information over on my Instagram.

DAILY TASKS

There are specific tasks that I complete on a daily basis. My daily tasks are important because they allow me to be aware of what's happening with my money every single day.

Completing daily tasks relieves a lot of stress because it allows me to have full control over my money and budget.

- Check my bank account online.

- Updated my budget calendar.

- Update my expense trackers.

- Update my budget worksheets.

THE TASKS

The first thing I do every single morning (after grabbing a cup of coffee) is checking my checking account online. I like to spend a couple of minutes looking at what expenses cleared my bank account and updating my checking account expense tracker.

Another task I complete when checking my bank account online is updating my budget calendar. When I pay a regular bill online, I put a check mark next to it. When that bill clears my checking account, I make sure the correct amount processed, and then I cross out that bill on my calendar.

Doing this allows me to know what's happening with my bills at all times. It tells me which bills I have paid, which ones have processed, and which bills I still have to pay.

Since I am an all-cash spender, I only use my checking account to pay my regular bills. There usually isn't a ton of transactions for me to go through, mostly one or two.

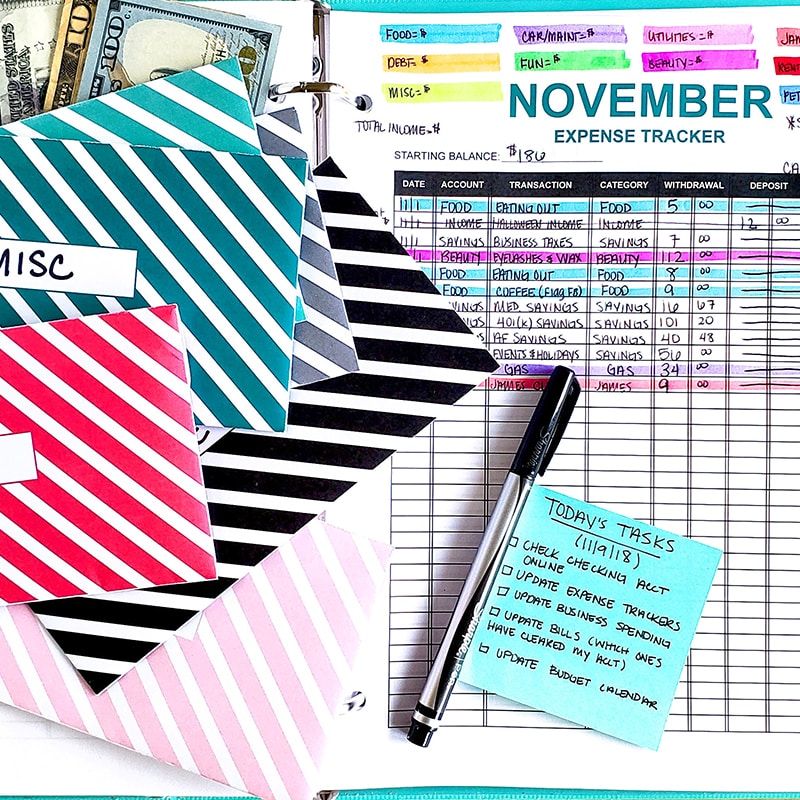

I also like to go through my cash envelopes and update my cash expense tracker with any receipts that I collected from the previous day. I update my spending on my cash envelopes, so I have an updated, accurate balance. This lets me know how much cash I have to spend at all times.

My daily tasks might seem like a lot, but in reality, I can usually complete all of the above tasks in about 10-15 minutes. If I have some spare time, I spend it updating the rest of my budget worksheets with as much information as I can.

A WEEK BEFORE MY PAYCHECK

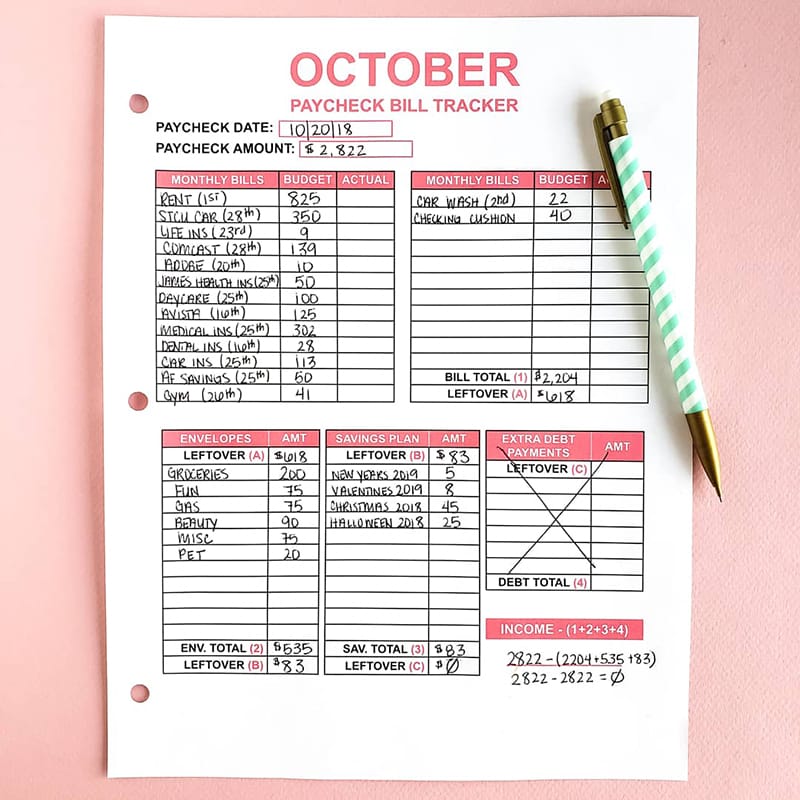

I am a paycheck budgeter, which means I create a new budget for every paycheck that I receive. I get paid on the 5th and the 20th, so I complete two budgets every month.

Your budget should really be finalized and ready to go a couple of days before you get paid. That way on payday, you know exactly what plan you need to execute and where your money needs to go.

- Figure out which bills I want to pay with my paycheck.

- Fill out my Paycheck Bill Tracker (my budget).

- Decide how much cash I want to use for my variable spending (cash envelopes.)

- Fill out my savings plan.

- Figure out how much money I can allocate to my priorities (paying off debt or saving).

I start my paycheck tasks about a week before I get paid and I work on it a little every day up until a day or two before I receive my paycheck (which is automatically deposited into my checking account).

So instead of spending any leftover time filling out worksheets, I switch my focus, and I use that time to work on my paycheck budget and the above tasks.

WHEN I GET PAID

As most of you can guess, paydays are my favorite day of the month. It's a fresh start to do better with my finances and to leave all other budget fails in the past.

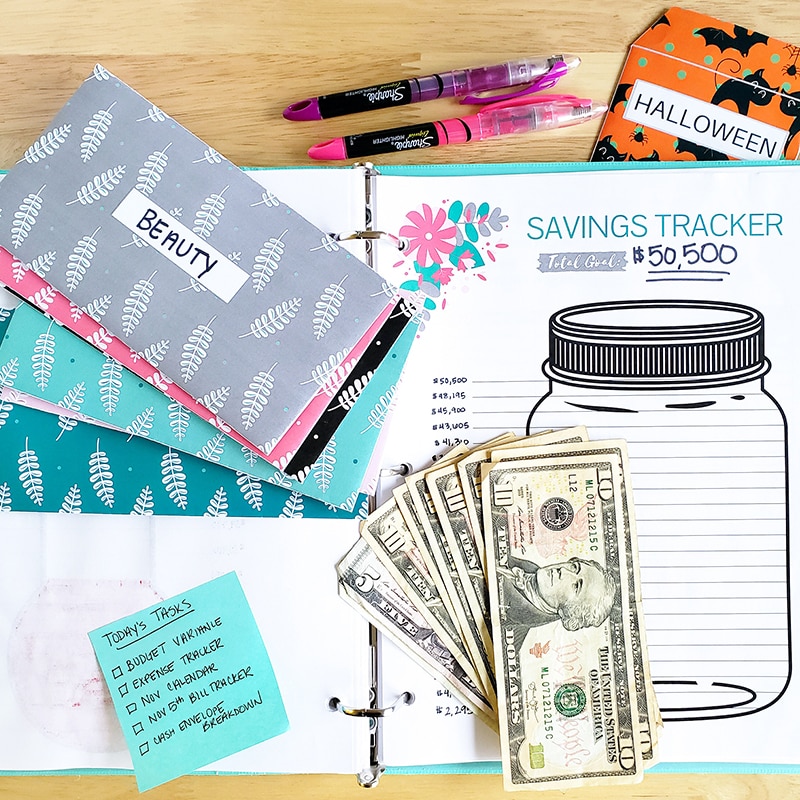

It's also the day that I stuff my cash envelopes, which is one of my other favorite activities. My 15-minute morning routine looks a little different on paydays.

- Check bank account to make sure paycheck was deposited.

- Pay regular bills online.

- Fill out my Cash Envelope Breakdown.

- Run to the bank to pull out cash for my envelopes.

- Fill cash envelopes for variable spending for the pay period.

I usually run to the bank during my lunch break, so I don't complete that task in the morning.

After all of my regular bills are paid online, I add a check mark next to each bill that I paid on my Budget Calendar. Remember, this keeps me updated on what's happening with my bills at all times.

I also spend some of my 15-minutes filling out my Cash Envelope Breakdown. This is a worksheet that I use to determine what bill denominations I want to use for my cash envelopes.

I like to use big bills for my cash envelopes. Over the years, I learned that I have a harder time spending big bills than I do smaller ones. It's much harder to hand someone a $50 bill than it is to give them a $10 bill.

For example, I pull out $200 every paycheck for my Food cash envelope. I want to pull out two $100 bills, not four $50 bills. My Cash Envelope Breakdown lets me plan in advance what I want in cash before I head to the bank.

The next process that I spend some time doing, usually when I get home or in the evening, is stuffing all of my cash envelopes.

A WEEK BEFORE THE END OF THE MONTH

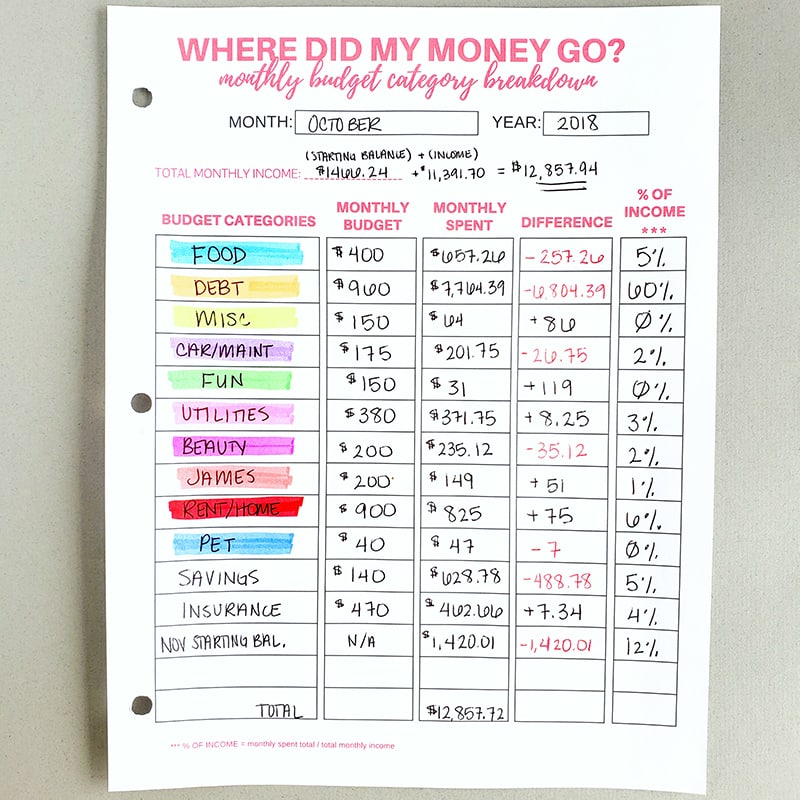

As most of you know, closing out my budget and my expense trackers at the end of the month is a process. I like to know everything that I can about my money and spending for an entire month, and I use the “Where Did My Money Go?” Worksheets to help me figure it all out.

I designed the “Where Did My Money Go?” Worksheets to help you extract critical information from your expense trackers. Tracking your spending is essential, but it's even more important to understand what the information on your expense trackers is telling you.

If you would like more information on my”Where Did My Money Go?” Worksheets, you can find more details here.

If you complete the above tasks and work on them a little every day, reconciling your budget at the end of the month won't be as daunting.

Essentially, budget reconciliation is a process that encompasses two different activities.

- The detailed review of transactions and spending.

- A high-level budget review and analysis.

THE TASKS

The tasks that I complete to prepare for my budget reconciliation are:

- Update my “Where Did My Money Go?” Worksheets

- Update my Budget Worksheets.

- Updated my Expense Trackers.

- Figure out my budget variance.

To make things as easy and smooth as possible for my month-end budget reconciliation, I spend most of my time in the morning working on updating everything in my Budget Binder with as much information as I can.

All of my bills are usually processed from my checking account by the 25th of the month. Once everything is paid and processed, I like to update my Net Worth Tracker & Debt Payment Plan worksheets.

Another task I spend a few minutes doing is figuring out my budget variance. Essentially, your budget variance is the difference between what you budgeted for and what you actually spent. I like to calculate the budget variance for my regular bills.

For example, let's say you budgeted $150 for your utility bill, but the amount that actually processed was $120. That means you have $30 extra just sitting in your checking account not being used.

I use a zero-based budget which means that every dollar of income has a plan inside my budget (it has a plan to be spent). If you have $30 of unused income because your bill was lower than expected, you need to figure out what you would like to do with it. It needs to have a plan.

I spend a little time calculating my budget variance to see if I have unused income and deciding what I want to do with it. Most of the time, I use it for my priorities, which right now, is savings.

AFTER THE END OF THE MONTH

There are a few tasks that I complete after the month ends. After everything is said and done, and after all of my other monthly tasks are complete, I like to color in and update my visuals.

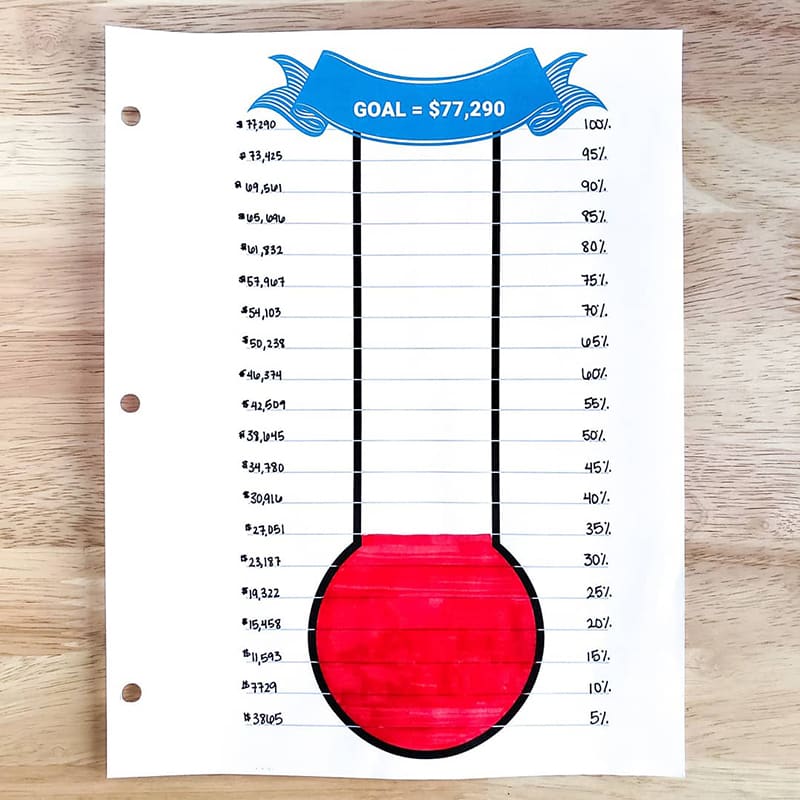

I use a debt thermometer to keep track of my debt payoff progress, and a savings jar tracker to keep track of my savings goal progress.

One of the things that has kept me motivated during my financial journey is visually seeing my progress along the way.

It allows me to see that I AM making progress, even when I feel like I'm not. You can get both of my visual trackers over in my free resource library.

I use many different visuals to keep me motivated on my financial journey, and you can see all of them over on my Instagram.

MY 15-MINUTE BUDGETING ROUTINE

The number one thing that I have learned from sticking to a budgeting routine is that a little work and dedication every day can make such a significant impact on your finances and overall wealth.

A little work and dedication every day can make such a significant impact on your finances and overall wealth.Click To TweetWhen you look at my budgeting routine as a whole, it may seem like a lot. But when you break it down into simple tasks that you can spend a little time on every single day, it becomes a lot more manageable.

Budgeting is a lifestyle, and for you to make it a habit and a permanent part of your routine, you need to work on it every single day.