Creating and using a budget calendar is an important step in my budgeting process. I can't create a realistic budget without it! Appointments, school functions, special occasions, travel dates, family events, sporting events, bill due dates, and birthdays are all things that I like to have included in my budget.

When you think about your budget, it's easy to remember your bills, but what about all of the other life events that cost money? Your budget calendar will be your guiding light when planning out your paychecks.

Whether you use a hang-on-the-wall calendar, a hard-copy desk style, or (most likely) your phone, financial and life organization is a must.

What Is a Budget Calendar?

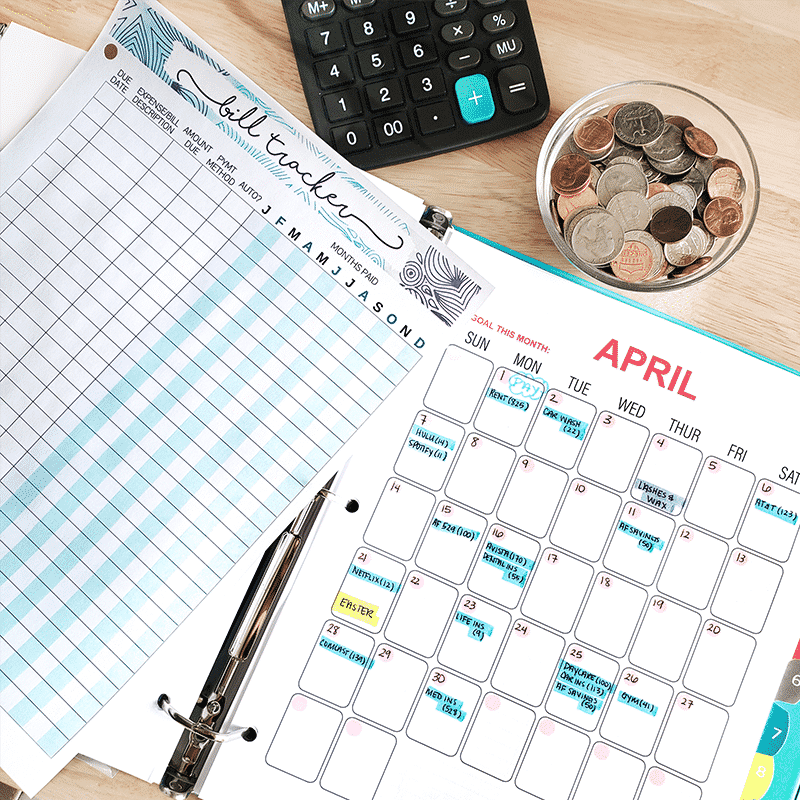

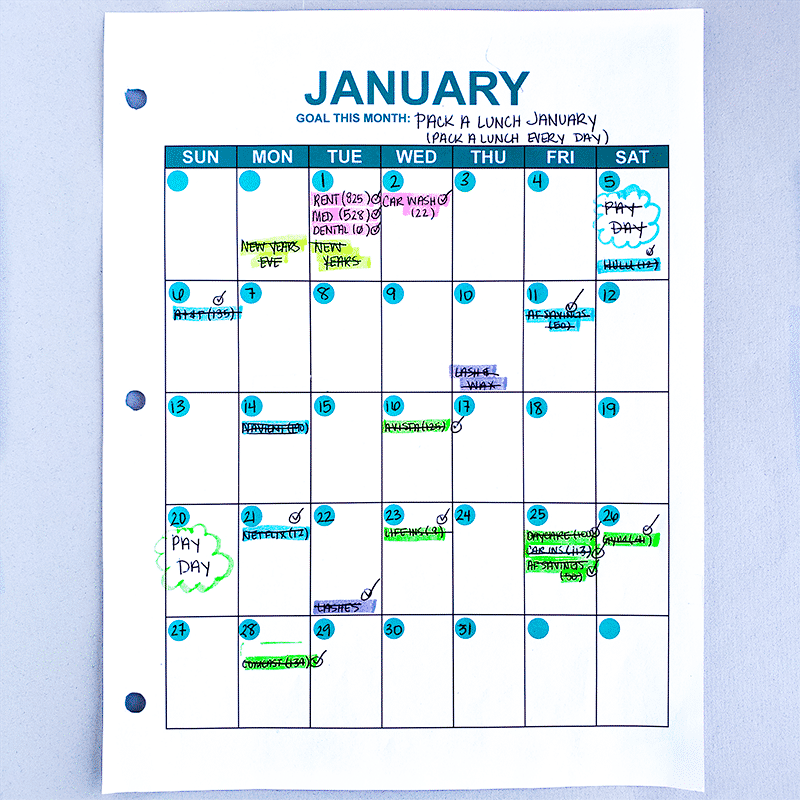

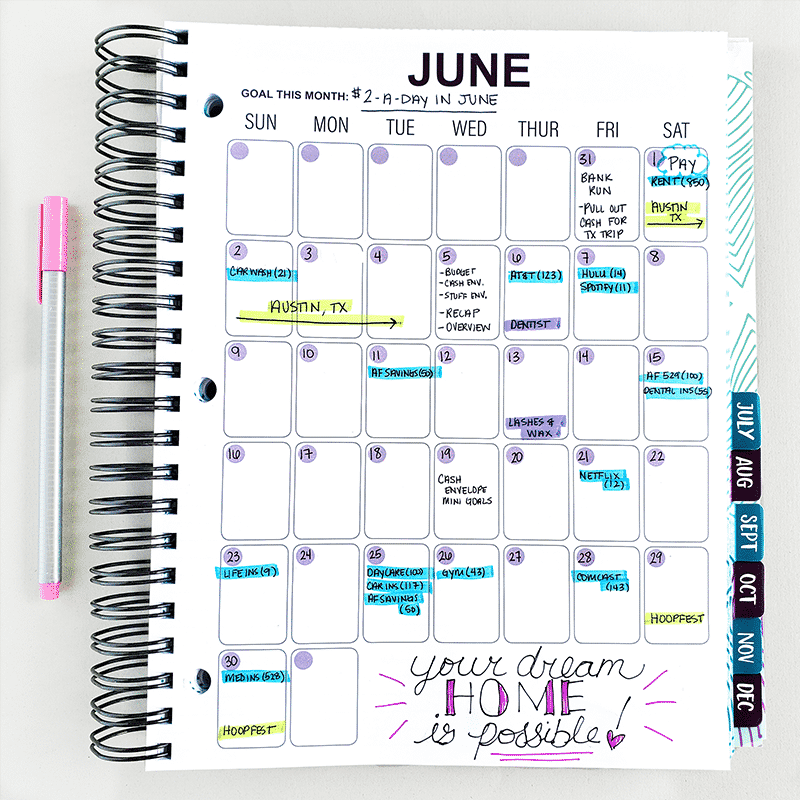

A budget calendar is just like your regular calendar, but with the single purpose of keeping track of your finances. Every bill due date, mortgage or rent payment, income check, and savings amount is logged into your calendar to help you see what's coming in and going out and exactly when.

Not only that, but it will also help you plan ahead for life events that we sometimes forget about until it's too late.

Budget calendars, just like your regular calendar, can be hang-on-the-wall style (which works beautifully on your Visual Wall Board!), a hard-copy desk type, a printable or digitally on your computer or phone.

You can also do a budget calendar weekly, monthly, or yearly. Monthly is the practical choice for most people because it's easy to make adjustments as you go, but yearly one can be very motivational if you have big upcoming goals.

While tracking your finances pen to paper can be tedious, there are also great psychological and practical benefits to seeing your budget and calendar and writing it down.

The Benefits of a Budget Calendar

Call me geeky, but making a budget calendar is fun! It's very similar to taking inventory of your food and making meal plans when you're trying to eat healthy. If you don't know what you have in the freezer and what to thaw out next, you're more likely to grab junk food and throw off your whole diet.

Budget calendars keep you organized in the same way. Not only are they visually satisfying, but they help you manage your money, eliminate ugly surprises, and get all your finances organized in one place! They keep you focused on what's coming up, remind you when each bill needs to be paid, and save you from late fees.

The calendar can also help you SEE ways to streamline the process.

Too many bills coming out at the first of the month? Ask for some of your due dates to change. (Yes! You can do that!) Utility companies and credit card lenders are usually very accommodating when it comes to adjusting payment dates.

Too many bills of the same kind? Consider consolidating your credit card debt to a single card with a lower interest rate.

A budget calendar can help you see small debts that can be paid off and eliminated, and others that can be set up on an automatic draft from your bank, so you never have to worry about them being overlooked.

Finally, a budget calendar helps you make a habit of saving. Like eating healthy, when you start to see the results, it motivates you to make adjustments and keep going. When the bills are getting paid on time, there's money going into savings, and your debt is decreasing, it's encouraging!

How to Make a Budget Calendar

First, you're going to – you guessed it – make a list! Write down all your monthly expenses and organize them by their due date (or payday):

- Same date, same amount payments like your housing, health insurance, phone bill

- Same date, varying amount payments like utilities and credit cards

- Varying date, varying amount payments like groceries and gasoline

- Semi-annual, infrequent payments like homeowner's insurance, vehicle registration, website subscriptions, quarterly insurance, and gym memberships

- Income amounts and paydays

- Specific savings – emergency fund, medical deductibles, car savings, 401K, birthday and holiday savings, etc.

For the varying payments, always overestimate. For example, if your utility bill runs about $133, write down and budget for $140.

The chances are pretty good that you don't have many if any, of those savings funds in place, and that's okay! The budget calendar is one baby step for helping us learn to “adult” more efficiently and with less stress.

The calendar is going to track your spending IN ADVANCE, helping you save for future expenses rather than being financially surprised by them.

Double-check your list by going over the last three to six months of your credit card and bank statements to be sure you aren't missing anything. Remember to factor in the little things like your bi-weekly latte, your monthly pick up at the dry cleaners, or your Friday work lunches. These are regular expenses that add up quickly and make more of an impact than you realize. Remember, awareness is power.

If you miss something, you can always add it later, but it's most effective to know everything before you begin.

Putting a Budget Calendar Together

Once you've decided on your calendar style (wall, desk, phone, laptop), collect the supplies, or find a program you like. You might decide to do both a hard copy and a digital copy. Choose whatever inspires you and works best for your lifestyle!

Now begin entering each transaction on the corresponding date. Simple descriptions are helpful, like:

- “mail check by”

- “pay online”

- “automatic withdrawal”

It's also helpful to color code your calendar by category, or add stickers or goal reminders. You can even sync your digital calendar to send you notifications when payments are due.

Color Coding Your Calendar

When I first started using a budget calendar, I used it to help me plan out which expenses I wanted to pay with each of my paychecks.

I am a paycheck budgeter, so I only pay SOME of my expenses with each paycheck, not the entire month's worth of expenses.

For example, when I was getting paid twice a month on the 15th & 20th, I would split up my monthly bills between those two paychecks. All of the expenses that I paid with my paycheck on the 15th, I highlighted in pink. All of the expenses that I paid with my paycheck on the 20th, I highlighted in green.

By using colors, I can quickly see what expenses need to be paid and with every paycheck. I also use different colors for events and appointments.

Maintaining Your Budget Calendar

Set a notice at the end of each month to review your calendar for changes and adjustments. Then make those for the upcoming monthly calendar.

If you get paid multiple times a month, it's essential to plan ahead. Think about writing out your budget calendar a couple of months in advance. This will give you the ability to save for an upcoming event, holiday, or appointment.

Life is stressful enough, but your budget doesn't have to be. Scheduling your payments, tracking your expenses, and building up your savings frees your mind from worrying about what's coming up next. And when life does throw something unexpected your way, you'll be prepared.