I just came home from my second all-cash paid vacation. This time, I traveled to New York City with my mom to attend an event in Manhattan. I was able to make unforgettable memories with my mom, travel across the United States, and experience the City That Never Sleeps for seven days without putting a dime on my credit card.

When I was climbing my way out of debt, I thought about all things that got me into debt. The ability to travel was one of them. I used to spend thousands racking up my credit cards. Over time, I learned how to save money every month to put into a vacations savings account.

Thanks to my budget, and creating a habit of saving, I am now able to go on vacation without going into debt. I no longer have to come home feeling guilty or worrying about how I am going to pay it all off.

Today, I want to share with you a detailed look into my New York City vacation, how I did it on an all-cash budget, and the tips and tricks I learned along the way!

Keep in mind, this is just my experience.

THE HOTEL & PLANE TICKETS

I went for a work event that was happening in the Flatiron District, and since it was my first trip to New York, I wanted to make sure that I stayed somewhere that was close to the event venue. I didn't want to have to figure out the subway or spend money getting a taxi or Uber. So I started researching places to stay that were within walking distance of the event. This is the main reason I choose to stay at the Flatiron Hotel instead of Airbnb,

After researching places to stay, finding availability, and picking my hotel, I decided to book my hotel and plane tickets from Expedia. By booking them together, I was able to get a 20% discount on my hotel stay.

When staying at a hotel, make sure you call the hotel ahead of time to ask about their daily service fees. This is a fee that is not included in the room price.

When looking for a hotel, I make sure that there is a locking safe in the room so I can safely store cash that I am not using or other important documents, like my passport.

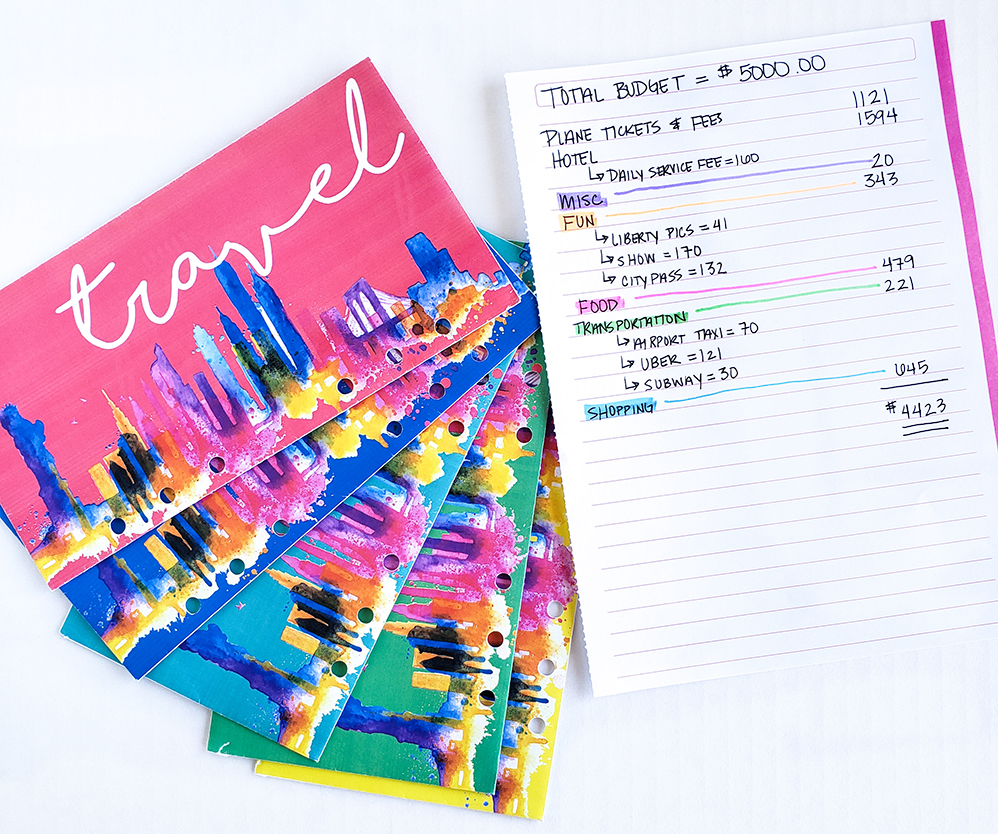

THE BUDGET

When saving for an all-cash paid vacation, you can do it a couple of different ways.

One, you already have the cash saved and planning out how you are going to spend and use that cash savings is the next step. Two, you have nothing saved, and need to create a savings plan to reach your vacation goal.

When traveling on any budget, planning is the most essential step. Researching where you are staying, the activities you want to experience, and how much you are going to spend on food are all part of the vacation budget equation.

If you are needing to save cash for your vacation, having an estimate of how much you need is crucial, and you can't do that without research. For me, I look at the cost of necessitates first – food and shelter.

After saving for over a year, I had $5,000 in cash to use for my New York City vacation. I used a Vacation Budget to create estimates for spending based on my research. After buying the hotel and plane tickets, I calculated how much I had left in my budget for other vacation costs.

Your vacation budget will only be your estimates on spending costs, and will be used to set hard spending limits while traveling.

USING CASH WHILE TRAVELING

I use the Cash Envelope Method for my personal budget, and I also use the same method while traveling. The ability to see how much I have to spend in each category, and paying cash helps me with overspending while I am away from home.

I use cash envelopes that have spending tackers on the back. As I spend cash throughout the day, I keep the receipts and then when I get back to my hotel at the end of the day, I track those receipts on my cash envelopes. This allows me to see how much cash I have left to spend for each category in my vacation budget.

If you are uncomfortable carrying cash with you, I highly suggest using a prepaid card for your spending. Load your card with the cash you have to spend and use the cashless tracking method to track your spending while on vacation.

For this specific trip, and most of my trips, I bring all of my receipts home with me to give to my accountant to make sure I write off specific expenses for business purposes. I also use those receipts to finalize my vacation spending when I get home.

A BREAKDOWN OF MY NEW YORK SPENDING

For this trip, I had seven budget categories.

- Hotel (+ fees & taxes)

- Plane Tickets (+ fees & taxes)

- Miscellaneous

- Fun

- Food

- Transportation

- Shopping

PLANE & HOTEL COSTS

I bought two plane tickets. One for me & my mom. The total cost for two round-trip tickets from Spokane, WA cost $366 each, for a total of $732. For six nights at the Flatiron Hotel, it cost $239 per night, for a total of $1,434. The fees and taxes when I booked them together totaled $390. There was also a $25/day service fee for the hotel, which totaled around $160.

Total cost for hotel and plane tickets = $2,716

MISCELLANEOUS SPENDING

For any budget that I create, I always have a Misc. category in my budget. I use this category for unplanned and unexpected expenses. Some examples that I would count as Miscellaneous spending would be:

- Broken phone or electronics

- Running out of skin or beauty products

- An unexpected activity or event

While in New York, I ran out of face lotion. Total Miscellaneous costs = $20.

FUN & ACTIVITIES

I experienced a lot in New York. One of the best purchases was getting the CityPass. I bought my pass from Expedia, but there are many different places to get them. This saved us so much money and time. You get prepaid admission to New York City's top attractions. Not only do you get significant savings, but you get to skip most main-entrance ticket lines. Our pass gave us access to:

- Empire State Building

- American Museum of Natural History

- The Metropolitan Museum of Art

- Statue of Liberty & Ellis Island

- 9/11 Memorial & Museum

- Top of the Rock Observation Deck

The CityPass cost $132.

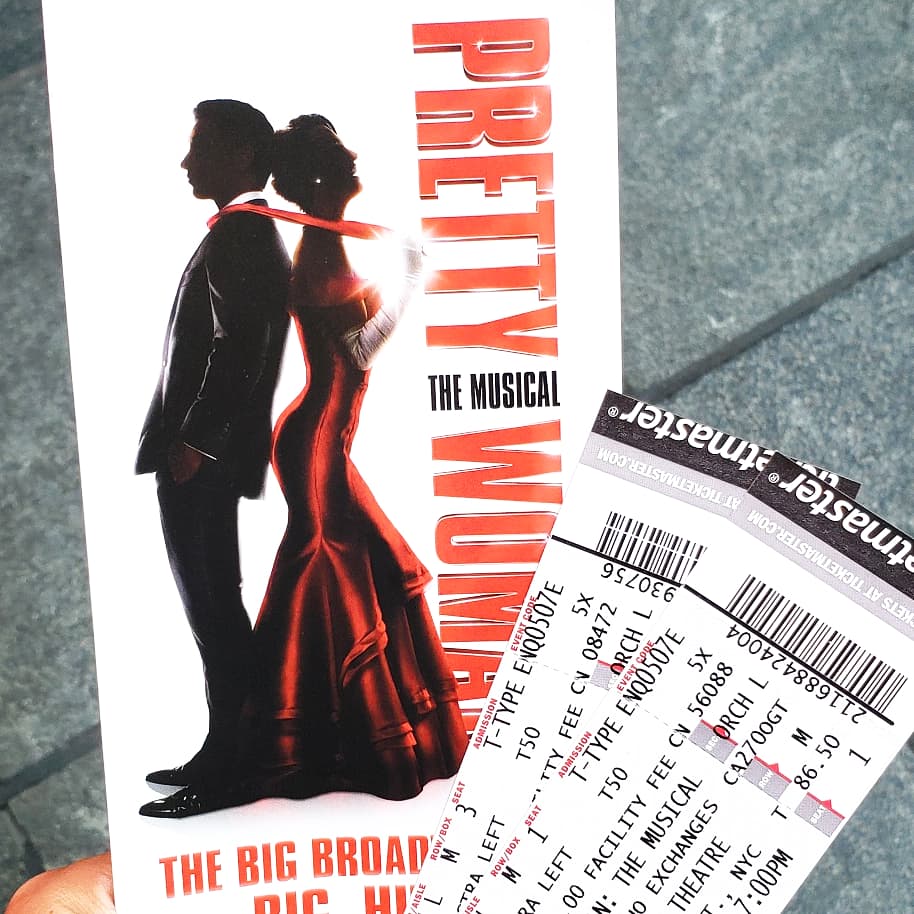

DISCOUNTED SHOW TICKETS

We visited a TKTS Booth in Time Square to find discounted tickets to a musical. You can get up to 50% off by purchasing same-day tickets. We saw Pretty Woman and it was amazing. We got 12th row seats and ended up right by the stage. It cost $92.50/ticket for a total cost of $185. Regular price for these tickers were $165/ticket.

Other discounted ticket options:

Total Fun costs = $343

Make sure you take advantage of free Museum Days if you can. Here is a helpful website that lists all of the Free Museum Days or Pay What You Wish.

FOOD

Thanks to so many of my readers and their food recommendations, I was able to try a lot of different restaurants and treats. I was pleasantly surprised with the food prices in Manhattan, and I was able to save the most cash on this category. I went with a food budget of $900 and only spent $479.

Favorite food places:

Other places we ate & loved:

Our hotel was right down the street from Madison Square Park. There sits the original Shake Shack. Many of my readers told me to be prepared to wait in hour-long lines, but luckily we only had to wait a couple of minutes. We had the Mushroom Burger, Chocolate Shakes, Frozen Custard, and a side of fries.

TRANSPORTATION

While in New York, we used several options to get around the city.

SUBWAY

We decided to skip on the 7-day Unlimited Metro Pass. You can pay $33 for unlimited subway rides until midnight. If I were to go back in time, I would have bought it. It would have saved me a ton of money on Uber expenses. If you are traveling with children, they can ride for free if they are with a paying adult and are under 44 inches tall (limit 3).

I was a little apprehensive with buying the subway pass because I was afraid it would be too complicated. I thought getting an Uber would be easier.

Total subway costs = $30

UBER

We used Uber a lot, especially if we planned on traveling longer more complicated distances. I spoke to one of the Uber drivers, and he told me that they are cheaper than taxis. We did use a taxi to and from the airport, and it was very expensive.

Here's the problem with Uber, and a problem that I ran into. I had two Uber drivers cancel my pickup request because they couldn't find a clear spot to pick me up. Uber ended up charging me a $5 cancellation charge each time this happened. If you plan on using an Uber, make sure they can easily find you, and they have a clear area to park to pick you up.

Total Uber costs = $121

TAXI

I paid for the taxi to take use back to the airport. It was very expensive. I would suggest taking an Uber, or comparing the costs. You can also calculate and estimate tax costs using this calculator.

Total taxi costs = $60

SHOPPING & GIFTS

During my time in New York, I spent money on gifts for my son and boyfriend. I also splurged at the Loft (we no longer have on in Spokane, WA) with my mom, and made my first purchase from Lululemon in over six years.

Some of my favorite places to shop for my son were:

For me, the whole point of a vacation is stepping outside of your normal and experiencing new things. My spending habits, especially within my shopping category were reflective of that. I wanted me and my mom to go shopping together, and have a day where we splurged, within reason.

I budgeted $500 for my shopping category, and it was the only category where I went outside of my budget.

Total shopping costs = $645

TOTAL SPENDING COSTS

For seven days and six nights in New York I spent a total of $4,423. I came home with $577 in cash that I will use for another future vacation.

OTHER HELPFUL TIPS

- Bring good walking shoes: Of course, the cheapest way to travel is to walk. Even if you take the subway, you still have to do some walking. Make sure you bring comfortable sneakers that have good support.

- Bring a backpack, not just a purse: I said this every day to myself while I was there. I wanted a place to hold my water bottle and a place to store the things that I bought without having to lug around the shopping bag. My back ached due to the uneven weight distribution from my purse (that could be old age too). My mom on the other hand, was smart. She brought a small backpack that she wore throughout our trip. I envied her the whole time.

- Don't focus and obsess about seeing everything. You could be in New York for months, and still not see everything that it has to offer. It's best to create a list of the top five must-see attractions you want to experience, and then take your time enjoying them. In fact, these are the places I wanted to go, but didn't have time:

- Serendipity

- China Town

- Coney Island

- Nike store on 5th

- It's not as scary as you might think: After 9/11, New York has really cleaned up. I was terrified of going down into those subways, especially after dark, but there were police officers everywhere. There was two nights where my mom and I walked around after dark and we even rode the subway at night. We felt safe the whole time. We could see an armed police officer wherever we went, which really put us as peace and made us feel safe.

- Please bring hand sanitizer: I'm going to be honest. New York is not the cleanest place on earth. You will see bags of trash on the side of the streets (even in the nicest parts of Manhattan), you will notice dirty sidewalks, and you can't help but want to wash your hands after touching a handrail. If you are paying for a coffee or getting a drink somewhere, use the restroom! I made the mistake of going into a public bathroom at one of the corner shops, and I ended up walking right back out. It was by far the dirtiest bathroom I have ever seen.