Picture this: You're staring down the barrel of a 30-year mortgage, the monthly payments feeling more like a heavy chain than a step towards homeownership. It's like running a marathon with no end in View Post

4 Surprising Ways to Master Your Money with the Cashless Envelope System

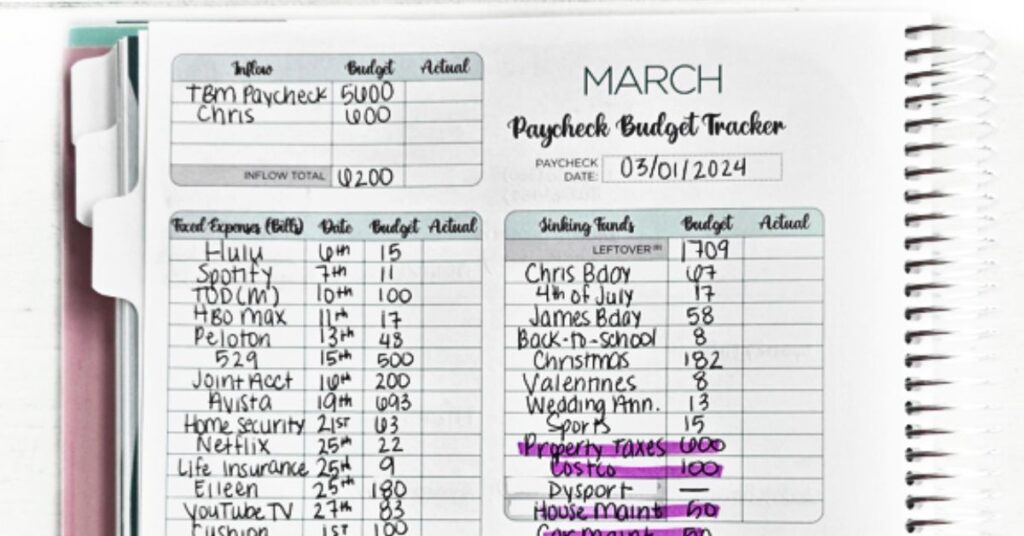

A few years ago, I shared how I was able to pay off $30,000 in credit card debt using the cash envelope system. Well, quite a bit has changed since then. From a global pandemic to tap-to-pay, the View Post

9 Money Habits Holding You Back From Your Dreams

Ever find yourself scrolling through bank statements, wondering where all your money went? You're not alone if the thought, "I should really get on top of my budget," plays on repeat in your mind View Post

Should I Invest If I Have Debt? The Dos and Don’ts for Beginners

If you have debt and are unsure whether to invest, you’re not alone. An estimated 77% of Americans are tackling debt, with 45.4% burdened by high-interest credit cards, yet we all know investments View Post

The Art of Mindful Spending: 7 Psychological Secrets to Master Your Finances

Getting your budget under control often feels like starting a new diet. We can all relate to the invigorated feeling of committing to a new wellness plan, only to grab that irresistible scoop of View Post

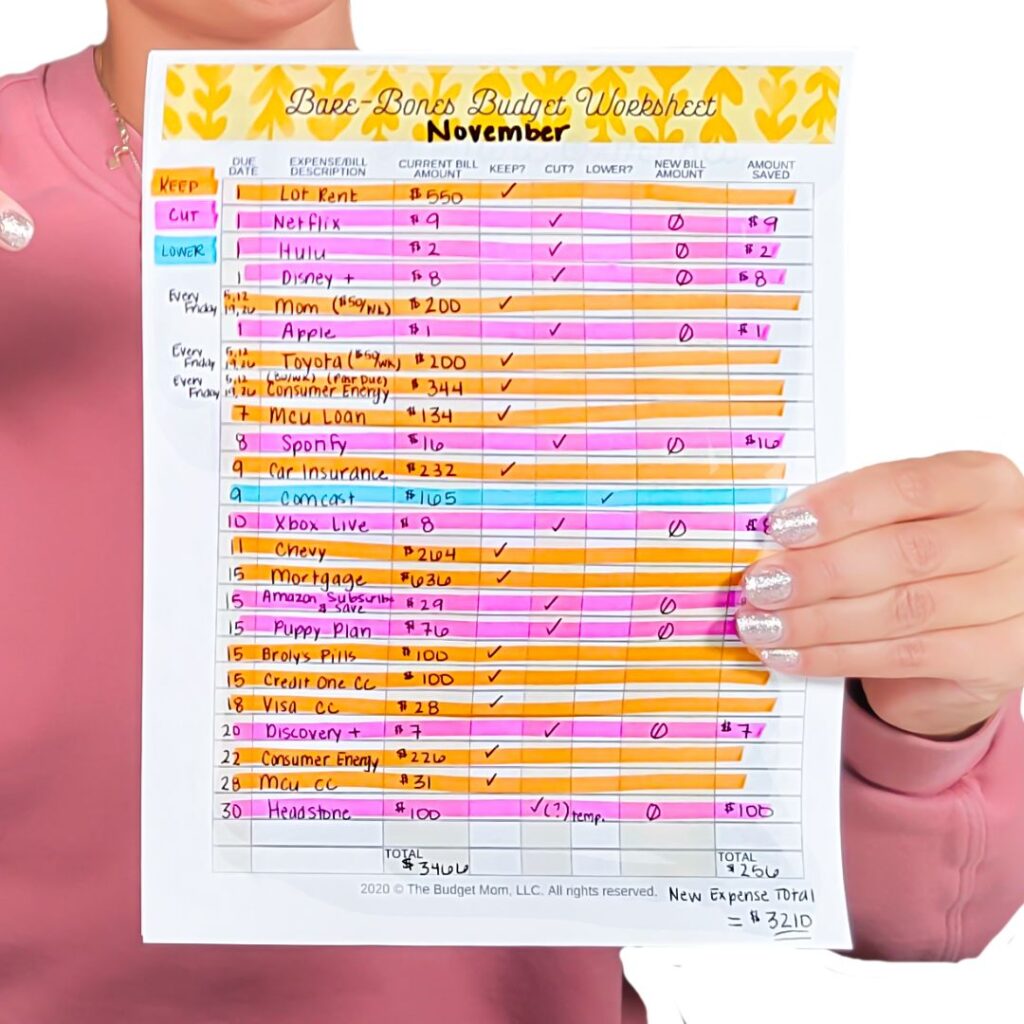

Unlock Financial Freedom: Master the Art of Bare Bones Budgeting

Picture this: It's the end of the month, and you're nervously checking your bank account, hoping the numbers are higher than last time. We've all been there — wondering if there's a better way to View Post