It’s easy to swipe a credit card, but paying it off is an entirely different story. Our society has normalized operating in debt to the point where it’s easy to forget the true cost of buying on View Post

What Is a Balance Transfer and Is It Right for You?

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

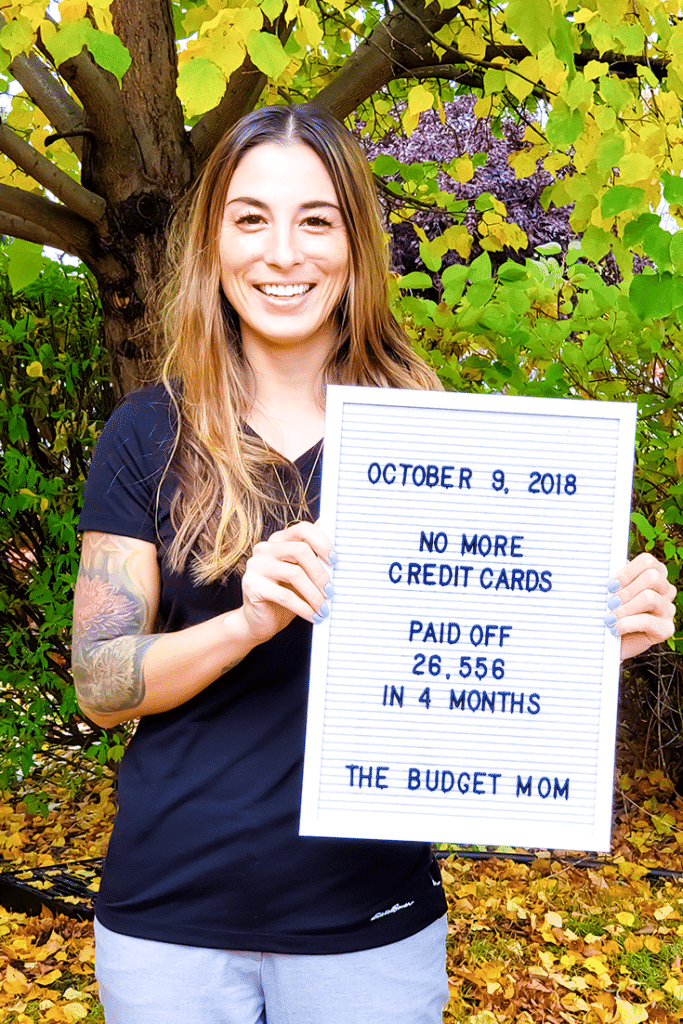

Is one of your financial goals to get out of debt? If so, opening another credit card could be the worst – or best – option you have. Personally, I used this strategy to help me knock out over $26,000 View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Dealing With Credit Card Debt When You’re in Over Your Head

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

Credit cards can be convenient tools to help you build your credit rating and make parts of your life more convenient, like booking travel. But credit cards are also easy to abuse. According to View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Should You Cancel Your Credit Card After Paying It Off?

Congratulations! You finally paid off your credit card! You worked long and hard, and it has finally happened! Your credit card balance is down to zero! You might be wondering what to do with your View Post

Credit Card Disputes: Understanding Your Rights

This is article three of Part Two of the "Conquering Debt Series." Read Part One here. Have you ever experienced a problem with your credit card bill? Have you ever had mysterious charges, View Post

6 Types of Credit Cards You Need to Avoid

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

This is article two of Part Two of the "Conquering Debt Series." Read Part One here. Many people risk their financial freedom by falling victim to credit card debt. Lousy spending choices and life View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.