Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

Credit cards can be convenient tools to help you build your credit rating and make parts of your life more convenient, like booking travel. But credit cards are also easy to abuse. According to Experian, 60% of Americans have credit cards and the average balance carried on those accounts is over $6,000.

Eventually, you want to get to a point where your credit cards are paid in full every month. Let me tell you, paying off your credit card debt is liberating (not to mention great for your budget). But if you’re struggling to make the minimum payments on your credit cards, you’ll need a solid plan to help you reach this goal.

Below are 3 strategies you can use if your credit card debt is getting out of hand.

1. Acknowledge the problem.

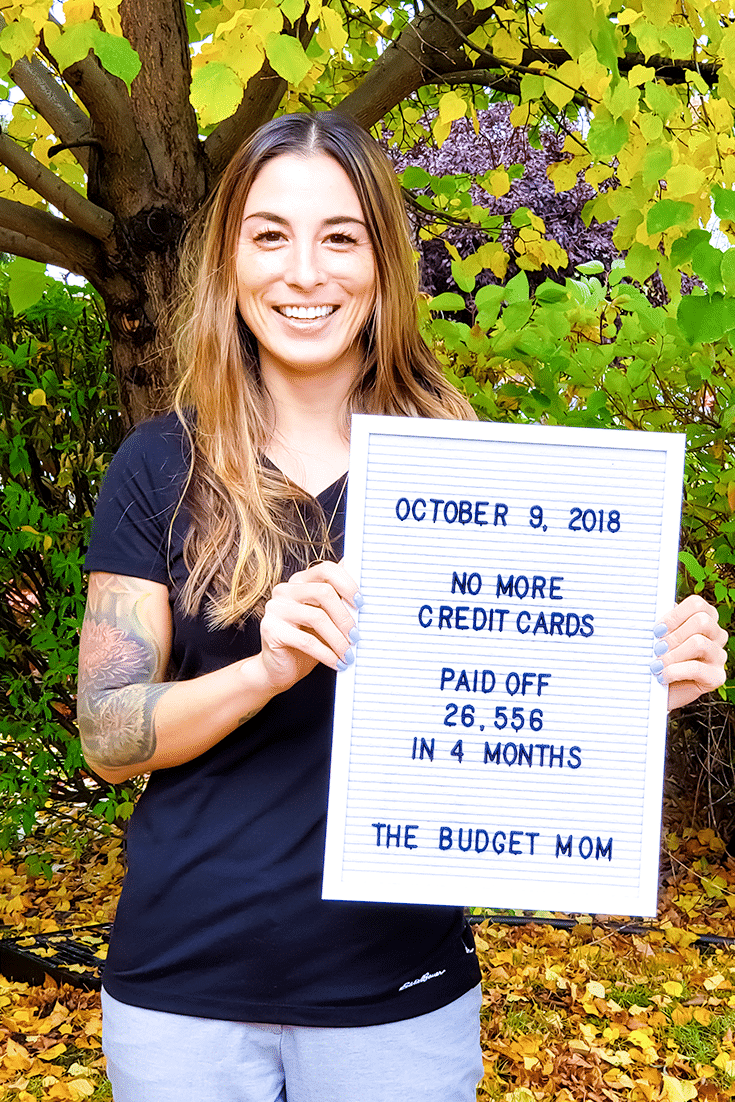

In my own budgeting journey, I paid off $26,000 in credit card debt. That doesn’t count the money I owed on other debts, like auto and student loans. But before I paid off my credit cards, I had to be honest with myself. I needed to admit that the way I’d been managing my money wasn’t working.

In the past, I used my credit cards even when I couldn’t afford to pay them off in full. That caused me to pay high interest fees and made my debt problem even bigger.

If you have high credit card debt like I did, two of the first things you should do include:

- Take the credit cards out of your wallet.

- Make a list of your credit card debt, including balances and interest rates on each account.

Once I acknowledged that I needed to change how I managed my credit cards, I did. Today, I’m completely debt free!

2. Create a plan of attack.

There’s more than one way to tackle out-of-control credit card debt. The debt elimination plan you choose is a very personal decision. Ultimately, your choice depends on what you believe will work best for your situation.

These suggestions might help.

- Create a budget. You can’t successfully pay off debt and stay debt free without a budget. A budget is the foundation on which any successful debt elimination plan is built. If you’re spending more money than you earn, your credit card debt will continue to grow.

Watch: How to Find More Money In Your Budget

- Cut spending and consider ways to earn extra money. Once you’ve set up your budget and know how much you can afford to pay toward debt each month, look for ways to free up extra cash. There are two approaches you can use — cut spending or earn extra money. Whichever option you choose, apply any extra funds directly to your credit card debt.

Not sure which debt to pay down first? Check out these debt payoff strategies.

- Use a debt payoff calculator. Whether you decide to cut spending, get a part-time job, or do some combination of both, getting a handle on your credit card debt problem isn’t easy. It will require hard work, dedication, and sacrifice. A debt payoff calculator can help you stay motivated. You can use a debt payoff calculator to assess your situation. It can also show you the difference extra payments can make toward how much interest you pay and how long it takes to pay off your credit card debt. Resource: Vertex42 debt payoff calculator

3. Consider consolidation.

When you owe a lot of credit card debt, it can take time for budgeting, spending cuts, and more income to make a dent in your outstanding balances. This can be especially stressful if you’re struggling to keep up with your minimum monthly payments. If you’re in this situation, it might be time to consider debt consolidation options.

- Balance Transfer Credit Card — You can consolidate credit card debt on your own by applying for a new credit card with a balance transfer offer. You can also check to see if any of your current credit cards have balance transfer offers available.

I’m a fan of this approach, under the right circumstances. I personally used balance transfers to pay off $7,500 worth of my credit card debt. But it’s important to ask the right questions before you start down this path:

- Is the introductory balance transfer interest rate lower than what you’re paying on your current credit cards? If not, a balance transfer might not be a good idea.

- Does the card issuer charge a balance transfer fee? If so, do the math to make sure a balance transfer will save you money in the long run.

Keep in mind that you’ll generally need good to excellent credit to qualify for a credit card with an attractive balance transfer offer.

- Personal Loan — Another way to consolidate credit card debt is to apply for a personal loan. There are two potential benefits to this approach. First, if you qualify for a lower interest rate on your personal loan than you’re paying on your credit cards, you might save money and get out of debt faster. Second, when you pay off revolving credit cards with an installment account (like a personal loan), your credit scores might benefit.If you’re considering this option, be sure to shop around for the best deal before you commit to a lender. Generally, the better your credit, the lower the rate you’ll be offered. You can visit Credible to compare interest rates and fees from multiple lenders.

- Debt Management Plan — A certified credit counseling program can approach your creditors to see if they’re willing to accept less interest, lower payments, or reduce the amount you owe. If your credit counselor is successful, it may bundle your new, negotiated monthly payments together into a single debt management plan or DMP. You shouldn’t see a DMP as an easy solution. First, you often have to pay monthly fees to the credit counseling company that’s representing you. Second, a DMP could trigger indirect credit damage which might make it hard to qualify for new financing. Remember, good credit can save you money. It’s worth protecting if you can. Keep in mind, I don't recommend ever paying a company a fee for something you can do for yourself. Before using a debt management company, do your research, look into all options, and know you can do it on your own!

If you decide to use any of the options above to consolidate your credit card balances, you must commit to stop creating new credit card debt at the same time. The last thing you want to do is pay off your existing credit card balances then rack up more debt. That’s a recipe for financial trouble in the future.