November 2019 will have five Fridays, which might lead to an extra payday for you. How do you plan for an extra paycheck? Do you plan for the extra pay? It is easy to fall into the trap that because there is an extra paycheck, that means you will have a lot of free money you were not counting on. I'm sad to say this is not always the case, and I will explain why in this post. However, with a plan you can squeeze out some extra cash, just not the whole check.

To help us get walk through the extra pay scenario, we are going to use Friday as our payday. If you get paid once every two weeks, then in our example you can expect a paycheck on Nov. 1, 15 and 29. If you get paid every week, then there is still an additional check this month. You will get paid on Nov. 1, 8, 15, 22 and 29. Here is what you need to know about your extra paychecK:

- Your extra paycheck does not mean you have no financial obligations for that money

- Without proper planning, it is easy to squander that extra paycheck

- You will understand what payments are due when you use my visual method

- Some tools to help you plan for that extra paycheck and get out of debt

Your extra paycheck does not mean you have no financial obligations for that money

Those of you who have been with me on this journey know I have not always made the best decisions. Can you relate? That's one of the great things about this community is that we can be honest with one another and share not only our successes, but our struggles, too. Today, I am proud to say I have found my way through tough financial times, a mountain of debt, and the challenge of finding a budgeting method that worked for me. It wasn't easy, but I did it, and so can you.

However, if we are going to get out of debt and stay out of debt, then we have to face the reality that a little bit of extra cash is not a license to just go out and spend. That extra paycheck is not really additional money … you still have bills to pay, as you will see later.

You need to look at the big picture.

In my early days of budgeting I could just not get the hang of it. I tried for a year and figured I was lost. I actually gave up trying to budget for a year because nothing worked for me. It wasn't until I became pregnant that I realized I needed to do something to get my financial house in order.

All of the research and effort I put into budgeting was not done in vain. I was able to create a hybrid budgeting system that worked for me. This one just clicked with me, and I encourage you to read The Budgeting Method that Changed My Life and let me know what you think. I brought together aspects from three different budgeting methods, and it helped me to see the bigger picture.

Why is seeing the bigger picture important? In part, it will help you realize that even though for 10 months out of the year you are working with two paychecks (our four if you get paid every week), having an extra paycheck does not mean it is free money. Rather, there remains some financial obligations for the money. While you might be receiving a third check in November, what happens to the bills that come due in the first two weeks of December? In reality, it ends up changing when you allocate that money for a particular bill. This video will help visualize what I am saying here:

Without proper planning, it is easy to squander that extra paycheck

A lady once said to a co-worker, “Don't you just love it when we get an extra paycheck in the month?” Unfortunately, that co-worker had no clue what the lady was talking about because she didn't budget. She lived paycheck-to-paycheck. When you live life without a financial plan, it is easy to squander any extra money that comes from a third paycheck in the month.

Do you have a plan for your extra paycheck? Are you in this same situation? Do you even know twice a year there is an extra paycheck? If you live paycheck to paycheck, trust me, there is a way out. With hard work, dedication, determination, motivation — and some helpful tools — you can grab hold of your financial future so you are in a position to shape it the way you want. I want to be with you on this journey, and there is a brighter financial future if you commit to having a plan for your money.

I cannot say it enough: You need to plan ahead for spending your money. I know “budget” is a dirty word to a lot of people. But, budgeting is planning ahead how your money is spent. It is you assigning a role for every single dollar you will get paid before you receive it. Budgeting is telling your money where it will go, not the other way around.

You need to plan ahead.

When we live our lives from paycheck to paycheck, doesn't it seem like we are always trying to play catch-up with our bills? Proper planning eliminates that feeling of dread because we run out of money before the month runs out of days.

In order to plan ahead, you need to be able to look not only at the current month, but the month coming up. This will allow you to see how money from each check needs to be used to further your financial obligations and your goals.

To get started on a path to a life of financial freedom, and who doesn't want that, you will need to create a plan. Here is where you can start:

- Track your spending so you know where your money goes

- Identify your fixed expenses/priority bills (housing, utilities, insurance, daycare, car payment, etc.) and how much you need from each check to pay them on time

- Calculate your variable expenses, the money you have to live on after your bills are taken care of

I go into much more detail about these steps in my budgeting blog post. They help me keep my financial life in perspective.

You will understand what payments are due when you use my visual method

After I became pregnant, I told you I settled on a budgeting method that worked for me. Here is what I did: I combined the best elements of the Calendar Budget Method, the Paycheck Budget Method, and the Cash Envelopes Budget Method. This hybrid system allows me to visually look at what is coming due this month and the next to help me have in place a plan for an extra paycheck.

The way I plan ahead is to use the Calendar Method to see where the due dates for my bills fall. I have to let you know, if you are unaware already, I am the Highlighter Queen! I love using highlighters to color code when I track my spending, when I will receive paychecks, and when I have to pay my bills. It's all part of my visual method.

Use a Budget Calendar

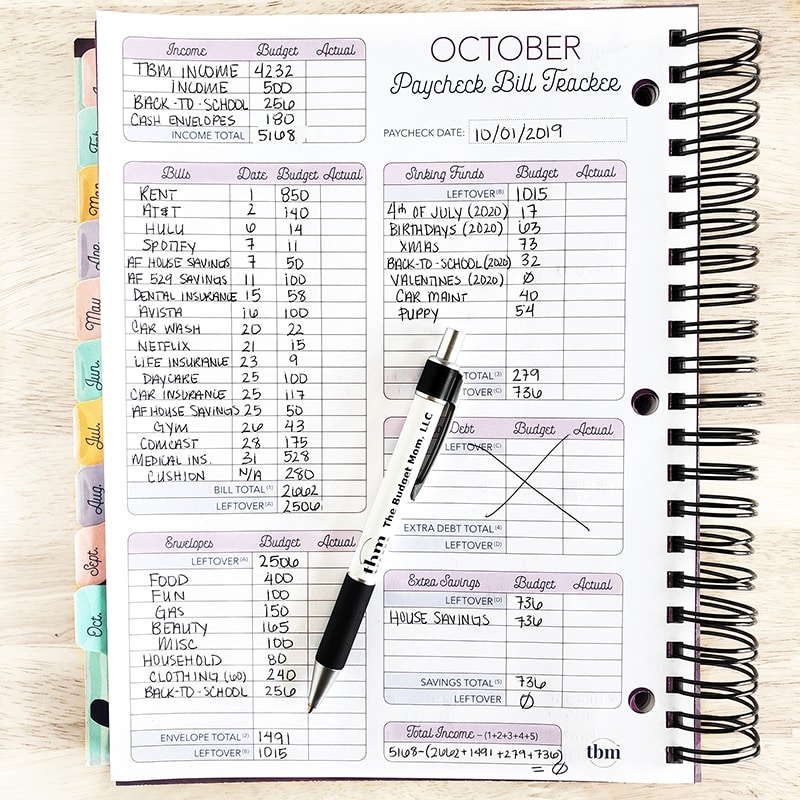

For those of you who use my spending tracker and Budget by Paycheck Workbook™, you know I want everything laid out in front of me. By using the Calendar Budget Method, I can see on what days I am receiving a paycheck, and on what days I need to pay my bills. When we have this extra paycheck, it is handy to have a visual representation of how much money is coming in and how much is owed.

The calendar approach removes any guesswork. If you are using it, then make sure you lay down November and December in order to get a picture of your obligations. In the video I shot previously, the example I used showed I needed to pay for daycare and a car payment before the first check arrived the following month.

If I were to overlook those bills in November because they came due in December, I might have encountered some late fees, or worse. This is why I say it is so important to have a plan for an extra paycheck, as well as your money every other month, too.

Some tools to help you plan for that extra paycheck and get out of debt

If you have not started a budget, there is a lot to learn. But don't worry, I have a lot of free resources on this site to help you get started. Here's a recap of some of the things we have discussed already:

- If you do not have a budget, start tracking your spending

- To get a handle on your spending, use the cash envelope system

- Change your world through budgeting

When I got started with trying to improve my financial outlook, I tried a lot of different things and failed. I hope you can learn through some of my mistakes, so please take time to work on a budget. Once you commit to budgeting, try some of the tools I developed … but only if you have budgeted for them! I hope that by using these tools, you will experience what true financial independence is, like I have.

Budget-by-Paycheck Workbook™

There is no other budgeting tool designed to help you organize your bills, budget your paychecks, track your progress, pay off debt, and save more money, all in one workbook. This workbook represents a labor of love. It doesn't matter how you are paid: weekly, every other week, twice a month or monthly, the Budget by Paycheck Workbook™ will help you easily create a unique paycheck budget and financial plan that is based on your pay schedule. Here is what you get:

- Financial Goals

- Monthly Budget Calendar

- Cash Envelope Breakdown

- Debt Plan Worksheet

- Reminder Worksheet

- Yearly Saving Tracker

- Money Tracker Worksheet

- Net Worth Tracker

- Yearly Savings Goals

- Brand New Bill Tracker

- Expense Tracker

If you are ready for a brighter financial future, then grab my Budget by Paycheck Workbook. You can get a printed version shipped to you, a digital version so you can print out the pages you need, or get them bundled and enjoy the best of both worlds.

Where Did My Money Go? Worksheets

People who have been successful losing weight often say it helped them when they started keeping a food diary. It made them aware of how calories were getting into their daily diet. When you track your spending, something similar happens. It raises awareness about how your money escapes your possession. You might be surprised at how much money is spent without giving it a second thought.

After you started tracking your expenses, try the Where Did My Money Go Worksheets. These will help you understand more about your money once you start collecting data on your spending trackers. You will get a:

- Monthly Budget Category Breakdown

- Monthly Savings & Debt Breakdown

- Monthly Spending Comparison

It's time to take control of your finances. So, make sure you take advantage of the free resources on this site, and visit The Budget Mom Shop and discover additional tools to help you to become financially free … finally!

Oh, one more thing. In 2020, these months will have five Fridays: January, May, July, and October. If you get paid on a Friday, then you can start working on your plan about what to do with an extra payday. Because of the way your paydays fall, you will only see the additional check in two of those months. Bookmark this page and be ready.