A few months ago, I wrote an article about How to Deal with Debt in Collections that resonated with many readers and resulted in a wide range of follow-up questions. As more and more Americans View Post

Has Your Debt Been Sent to Collections? Here Are Your Options.

Most people have every intention of repaying the money they borrow. But sometimes, life doesn’t go as planned. You or a loved one might get sick or hurt, making it hard to pay your bills. You could View Post

What Is a Balance Transfer and Is It Right for You?

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

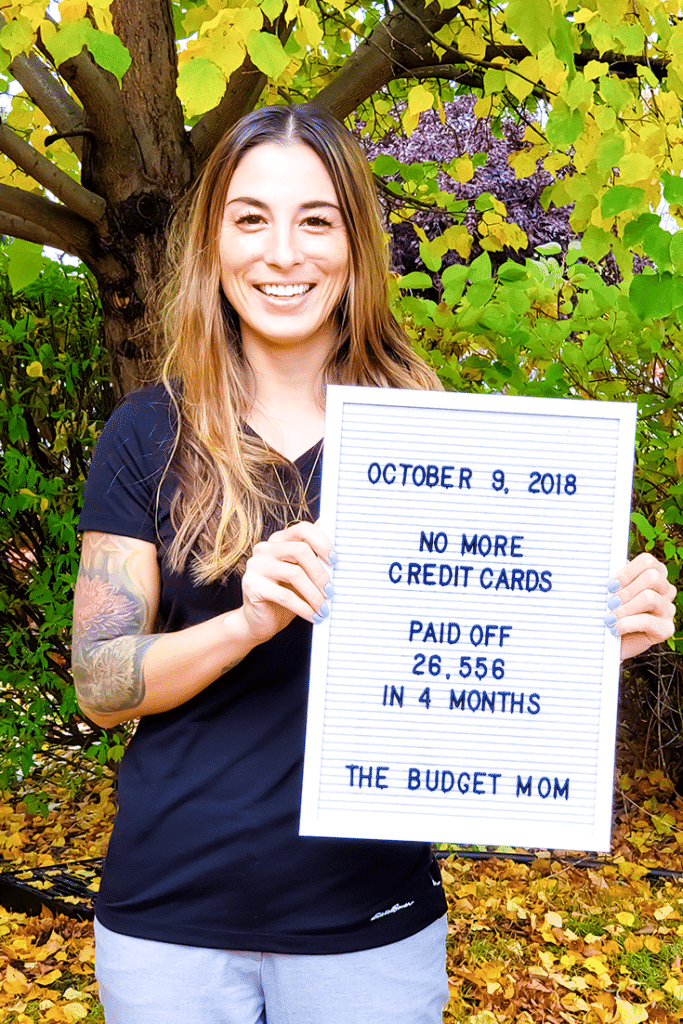

Is one of your financial goals to get out of debt? If so, opening another credit card could be the worst – or best – option you have. Personally, I used this strategy to help me knock out over $26,000 View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

10 Things I Wish I Knew About Debt in My 20s

I’m not going to lie — life on the other side of debt is amazing. But I can remember a time in the not-so-distant past when I was struggling with debt and financial stress daily. If I could hop in a View Post

Dealing With Credit Card Debt When You’re in Over Your Head

Editorial Disclosure

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

Credit cards can be convenient tools to help you build your credit rating and make parts of your life more convenient, like booking travel. But credit cards are also easy to abuse. According to View Post

User Generated Content Disclosure

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

3 Tips for Paying Off Debt in Collections

There’s nothing fun about picking up your phone and hearing a debt collector on the other line. Opening your mailbox to find a pile of collection letters can make your stomach drop too. But when View Post