One of the questions I get asked a lot is, “How do you stay motivated on your financial journey?”

In the beginning, the excitement of starting a new financial plan is exhilarating. You have the motivation and the drive to make a real changes in your financial life. The ideas are new, you're starting with a new plan, and it feels like you can accomplish anything.

But what happens after a few months, or a few years after starting your financial journey? The newness of it all, the excitement to make real changes, it's gone. Now, it just seems like work.

Staying motivated once the newness and excitement wear off, is the hard part.

I have been on my financial journey for over eight years. The first two years were the hardest because I had to learn things as I went along. I didn't have all of the answers, and budgeting was utterly foreign to me.

In 2012, I found my motivation. I had my son James. Now, I'm not saying that you have to have a life-changing event like having kids to stay motivated. But I think it's important to share the reasons behind my determination to show you what you need to discover to stay motivated in your own life.

DISCOVERING YOUR “WHY”

The one thing that I realized on my financial journey is that writing down goals isn't enough. You have to ask yourself, “WHY are you on your financial journey?”

Why should you save? Why should you pay off debt? Why should you keep budgeting your money? Why should you make your financial life better than it is right now?

Discovering your PURPOSE can change everything. It's the underlying reason behind the goals you want to achieve. I'll tell you right now. Passion isn't enough. Excitement is not enough. Starting is not enough. You are going to have rough days on your financial journey. You will feel burnt out, you will fail with your budget, you will spend money when you shouldn't, you will make mistakes, and there are going to be days where you ask yourself, “Why am I even doing this?”

MY OWN “WHY”

After becoming a mom, it was apparent what my “WHY” needed to be. My son is the reason behind everything that I do in my life, especially with my finances.

I don't just budget, save, or pay off debt for myself. No. I do it so I can provide a better life for the one person in the world who fully depends on me. My spending choices and my finances don't just affect me, and they don't just have an impact on you. They affect everyone around you, mostly the people you love the most.

Any time I am questioning my financial journey, or I feel like giving up; I look at my son's face. What happens if I fail? What do our lives look like if I give up?

YOUR “WHY”

When thinking about your WHY, it should be something so important that it lights a fire under you. Your level of passion and dedication to your WHY should leave you feeling emotional.

Your WHY doesn't have to be something that you achieve. It doesn't have to be a goal. It can be a person or a feeling.

For example, let's say your WHY is “Freedom.”

What does freedom mean to you? Does it mean that you can do things with your children without worrying about your checking account balance? Does it mean being able to travel without going into to debt to achieve it? Does it mean that you can stop scraping by and start building wealth for your family?

Think about the consequences of giving up on your WHY. What it comes down to – when you think about your WHY, giving up isn't an option.

THE THREE GOALS

It can take weeks and even months to discover your WHY word, but once you find it, it's time to start thinking about your goals.

I suggest starting with three primary goals that you want to achieve. I recommend creating a short-term, mid-term, and long-term goal. Here are my current goals:

1. Short-term: Pay off all of my debt.

2. Mid-term: Leave my full-time job to more present with my son.

3. Long-term: Buy a house with cash.

These are ambitious goals. The journey to achieve them will be long, and at times, hard. That's why it's so important to identify your WHY word first.

HOW TO IDENTIFY YOUR GOALS

To figure out and identify your financial goals, you might come up with a large list, and that's fine. I have more than three financial goals, but I make sure to list them in order of importance, and in the order that I want to achieve them.

For example, in addition to the three goals that I listed above, retiring early is another goal that I have. Paying off my debt, and buying my house with cash, are both preparing me to do just that. Paying off my debt will allow me to have more financial resources to allocate to retirement savings. Paying for a home with cash will allow me to live mortgage-free so that I can focus more on building my retirement.

YOU DON'T HAVE TO FOCUS ON ONE THING

It's also important to remember that you can work on multiple goals at once. For example, I am currently focusing on paying off the rest of my debt, but that doesn't mean I ignore saving for retirement.

I put the majority of my extra income towards debt, but I also make an effort to put a small amount into my retirement savings every month.

CREATING YOUR GOALS

First, when creating your goals, you have to think about what's important to YOU. Write your goals down on a piece of paper. For this article, I have a Goal Worksheet in my FREE Resource Library for you to use!

When writing down your goals, try to write down as much detail as possible for each goal. Then, I want you to ask yourself three questions:

- Are they specific?

- Are they measurable?

- Are they achievable?

A goal isn't a reality until you can write down action steps on how you are going to achieve them. Until then, they are just intentions.

So, for each goal, I want you to write down specific actions steps.

For example, for my short-term goal of paying off my debt, I would write: Pay off debt by tackling my student loans first. I will put $500 monthly towards my student loans for the next 24 months.

It's specific, it's measurable, and it's achievable.

TRACK AND “SEE” YOUR PROGRESS

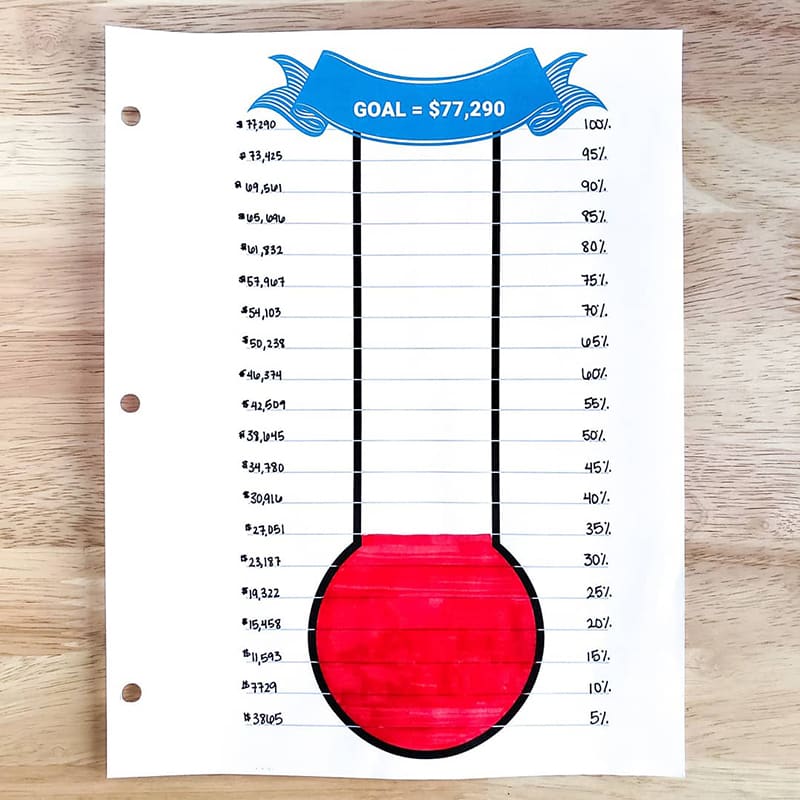

One of the ways I have stayed motivated during my financial journey is by using visual trackers to track my progress along the way.

Let's be honest. Sometimes it feels like you aren't making any progress at all. Being able to SEE your progress over time helps tremendously. It's also an excellent way to see if your action steps are working. Are you staying the course, and are you utilizing your dollars in the best possible way?

Your goals are not a one-and-done solution. It's more of a base plan that you need to check on regularly. Your financial plan might change because your goals have changed.

In fact, I just experienced this myself. Leaving my full-time job to work for my own business was not part of my original goals. It was still something I thought about, but it was just a thought in the back of my mind.

When I decided to tackle this new goal to be more present with my son, my financial plan changed also. That meant that I went from focusing on saving for personal and business emergency funds instead of paying off debt.

I accomplished my goal of becoming credit card debt free first, and then I focused on saving, even though I still had student loans and a car loan.

Why? Because spending time with my son was more important to me than paying off the remainder of my debt.

With each goal, and with each change to my financial plan, I made sure I had visual trackers along the way. If you aren't continually reassessing your financial plan and goals, you will lose sight along with way.

HOW TO STAY MOTIVATED ON YOUR FINANCIAL JOURNEY

Today, I want you to sit down and think about your WHY. Next, I want you to establish your goals. Creating that plan for financial success will give you purpose and direction. Every time you get unmotivated or feel like giving up, think about your WHY!

Make sure to head to the Free Resource Library to get your Goal Worksheet and Visual Trackers!