You finally put in the work. You managed to track your spending and stick to your budget. So, now what?

What do you do with your budget after the month is over, and you're ready to begin a new month? Most people don't realize it, but your spending throughout the month gives you some incredibly helpful information.

One of the first steps to creating and sticking to a realistic budget is tracking your expenses. Your spending is the underlying foundation creating a budget and ensuring that your budgets in the future are successful.

If you are not aware of where your money is going, you can't make the best decisions for your dollars. Today, I am going to show you how to extract all of the vital information from your expense trackers using three helpful worksheets.

IT ALL STARTS WITH YOUR STARTING BALANCE

One of the first things I do before I move on to a new month is figure out my starting balance.

If you track your spending as I do, you track your spending from the first of the month until the last day of the month. If you track your spending based on when you are paid, then the first day of your budget month would be your payday.

For example, let's say you get paid on the 20th of every month. You could track your spending from the 20th until the 20th of the following month.

You need to decide which period you want to track. Some people find it easier to do it based on when they are paid, and some like to track their expenses each specific month.

For example, and in this article, we are going to assume you track your spending from the first of the month to the last day of the month.

Your starting balance for the NEW month will be what you have in cash and your checking account on the first of the month.

For example, if I were writing down the starting balance for December, I would write down on my expense trackers how much money I have in my checking account and my cash envelopes on December 1st.

WHY IS THE STARTING BALANCE IMPORTANT

In a perfect world, if you are using a zero-based budget, you would have zero as a starting balance every month. That's because, with a zero-based budget, every dollar of income has a job somewhere in your budget. Which means it has a plan to be spent.

But what happens if you like to have a cushion or a buffer in your checking account at all times to help with overdraft fees, or higher than expected bills?

Let's be honest, bringing your checking account down to zero every month is a scary thing. For me, I like to keep $500-$1000 in my checking account at all times just in case I have an unexpected bill, or I need to use my checking account for an online purchase.

Your starting balance is seen as “income” because those funds are being used as income for your budget in the new month.

For example, let's say you get a paycheck on November 25th. That paycheck will be used to pay your rent on December 1st. Since you track your spending from November 1st to the last day of November, you will have to carry over that leftover income into December as the starting balance so you can use it to pay for your December 1st rent.

I label money that I'm carrying over into a new month as “starting balance” on my expense trackers, but some label it as “opening balance.” What you decide to call it is up to you.

CATEGORIZING YOUR SPENDING

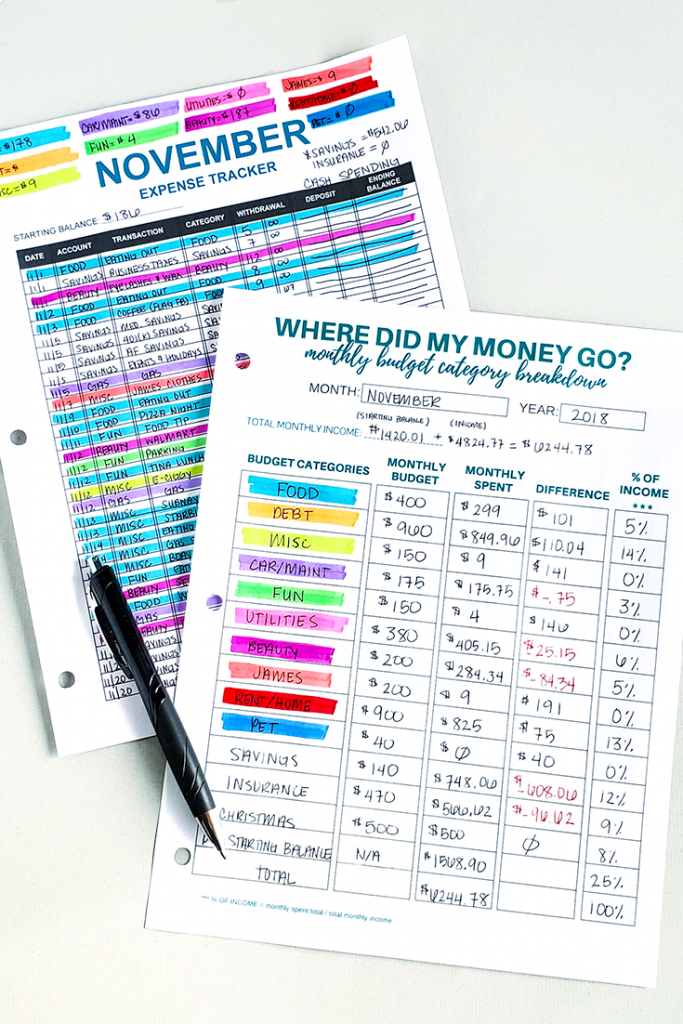

The first step in closing out your budget is categorizing your spending. For me, I use the highlighter method. It's a great visual way to organize your spending into categories based on your real-life spending.

I also track my spending manually. I use the old-fashioned method of pen and paper. My expense trackers are vital to my budget's success, and it allows me to know where every dollar is going.

Once your spending is categorized or highlighted by category, you need to add “like” transactions from your expense trackers together. For example, if I highlighted all of my food transactions in blue, I would add all of the blue transactions together and put the total on the top of my expense trackers.

By analyzing your expense trackers this way, you develop categories for your budget based on your real-life spending. Once you add all of your spending together into categories, you can now set realistic limits for your budget categories.

BUDGET CATEGORY BREAKDOWN

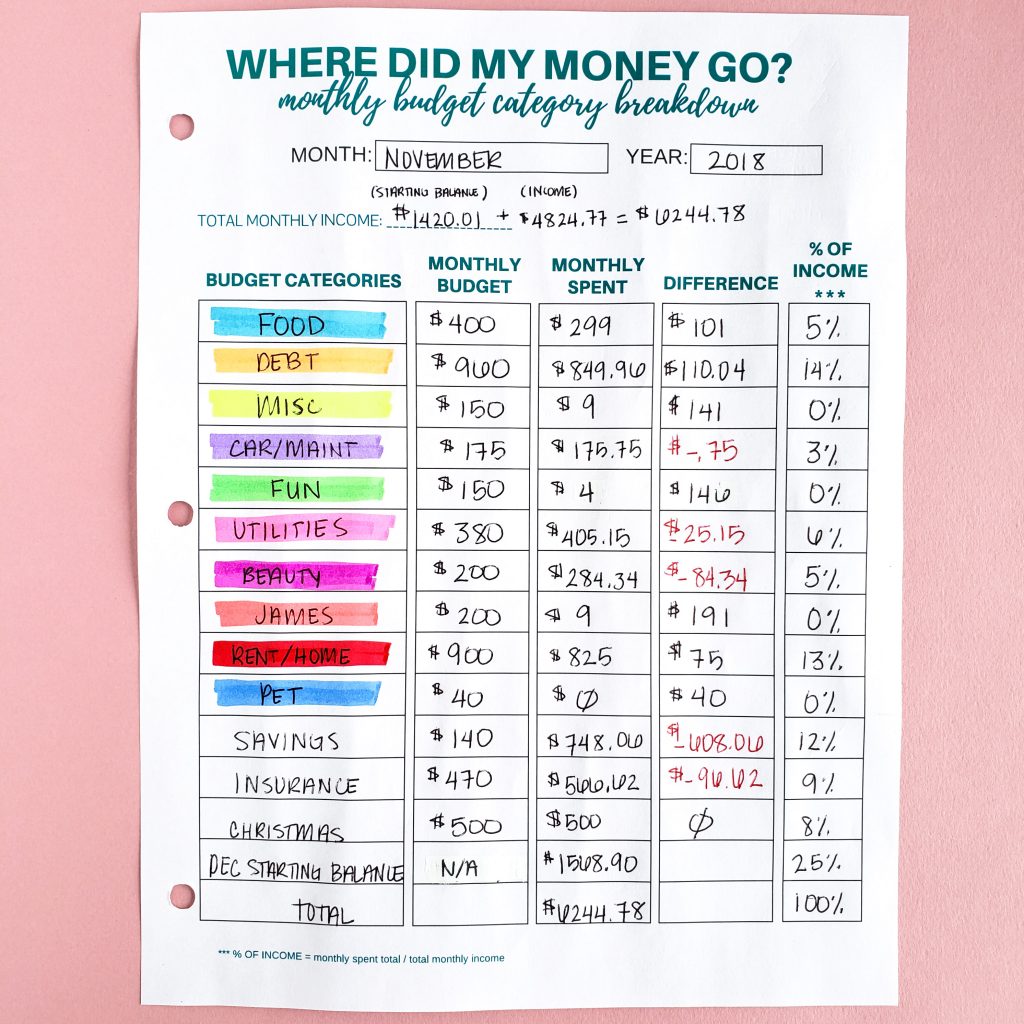

I use a Monthly Budget Category Breakdown worksheet to organize my spending into categories and to see where my money went for any given month.

Knowing your expenses is essential, but so is knowing your income. To figure out your total monthly income, you need to use the formula: Starting Balance + Incoming Monthly Income. You would use what you had in your checking account and cash envelopes on the first day of your reporting period plus any income that you received for that period.

Your budget categories can be determined by looking at your expense trackers. Write those categories down on the worksheet. Next, I like to assign a monthly budget for each one of my categories.

I am a paycheck budgeter, so my budget is based on when I get paid, and so are my limits for each category. But it's also important to assign a monthly budget for each category since you are analyzing your spending for a month.

If you are just starting out, and are not sure what monthly budget limit to use for each category, look at your spending. Determine those monthly limits based on where your money is going. You can tweak, reduce, or increase those category budgets as you go along, but for now, it's about creating a budget based on what's happening in your real life.

On the Budget Category Breakdown, you can write down what you actually spent during the month, and you can compare it to your budget limits. This will allow you to see if you were over or under budget during the month. You can also figure out what percentage of your budget was spent on each category.

USING A ZERO-BASED BUDGET

A significant benefit of the Monthly Budget Category Breakdown worksheet is that it also allows you to see if your budget zeros out every month. With a zero-based budget, your income minus your expenses should equal zero. That's a real indication that every dollar of your income has a plan to be spent, or has a purpose inside your budget.

Your starting balance for the new month needs to be included in your expenses on this worksheet. If it's not, your income and expenses won't zero out.

By getting zero when you subtract your expenses from your income, it tells you that you tracked your spending correctly on your expense trackers.

MONTHLY DEBT & SAVINGS BREAKDOWN

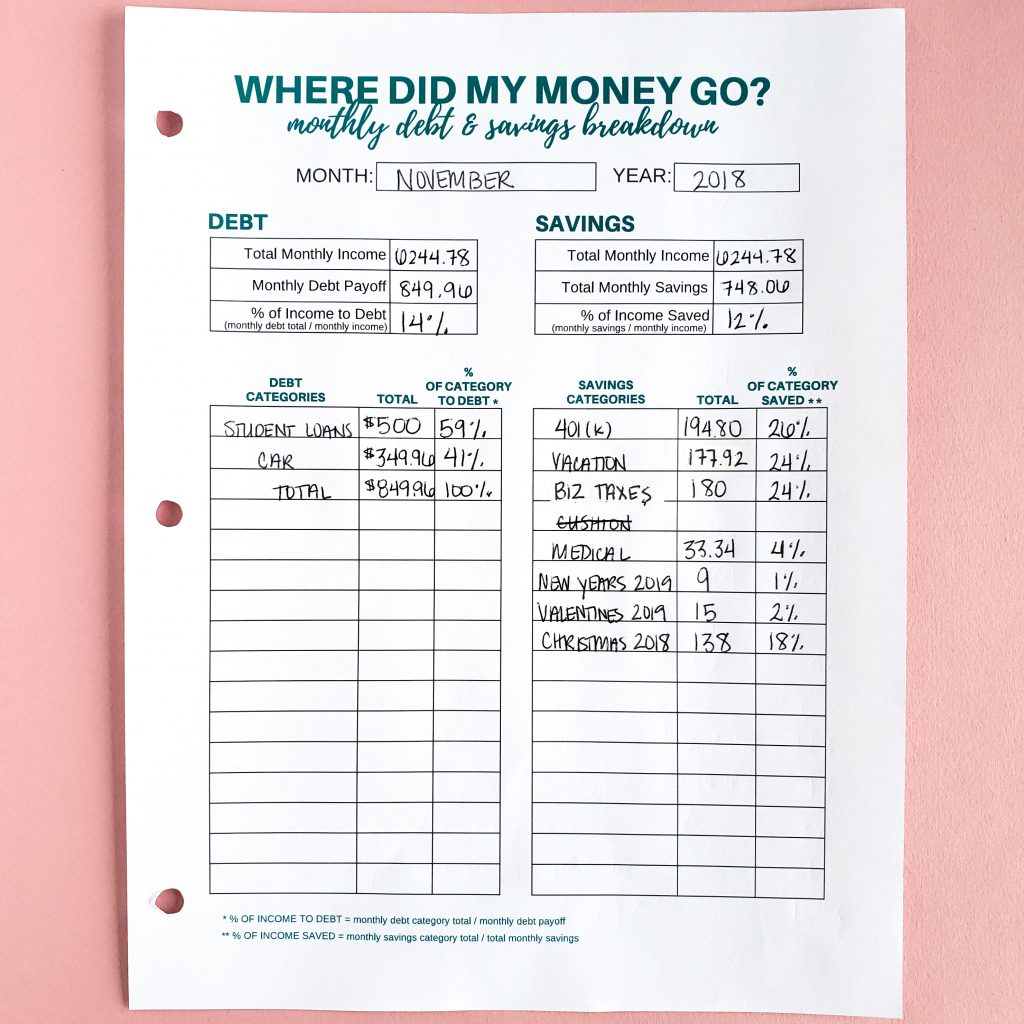

If you are working with debt or savings goals, this worksheet is a must. It's important to know how much your spending on debt and savings every month, but it's even more important to know WHAT debt and WHAT savings are you spending your hard-earned dollars on.

Is your spending on these categories aligning with your goals? Have you ever heard the saying, “Don't tell me where your priorities are. Show me where you spend your money, and I'll tell you what they are.”

Where you CHOOSE to spend your money will tell you what's important to you.

For the worksheet, you need to list out your total monthly income that you calculated on the Monthly Budget Category Breakdown worksheet and the total amount that you spent on debt and savings. You can then figure out what percentage of your income went to both.

Next, you need to list your specific debt categories. For example, maybe your debt includes credit cards, student loans, and a car loan. Look at your spending and see what debt you paid off.

The same goes for savings. It's important to know how much total went to savings, but what specific savings goals did you spend money on?

MONTHLY SPENDING COMPARISON

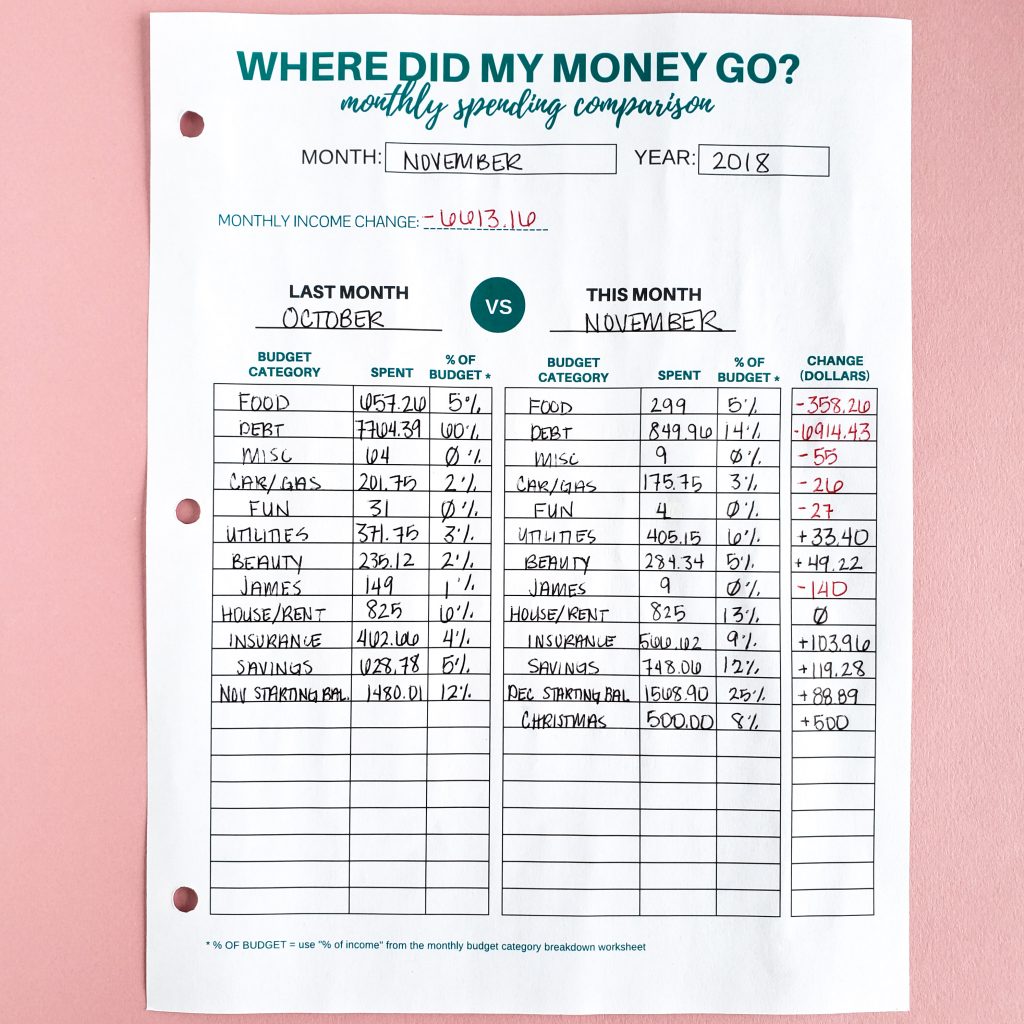

This worksheet allows you to compare your spending from the present month to last month.

Why is this important? Comparing your spending as you go along allows you to see if you spent more or less in your budget categories from month to month. You can identify problem spending areas in your budget and determine if you need to increase or decrease your budget limits in the future.

The truth is, there is NO perfect budget. Your budget continually needs to be tweaked and perfected as you go along. That's what makes it successful and realistic. A budget is not a “set it and forget it” type of tool. Your life is changing all of the time, and because of that, your budget needs to reflect those changes.

CLOSING OUT YOUR BUDGET EVERY MONTH

To figure out your closing balance for the end of the month, you need to use the following formula:

Opening Balance (what you have in your bank account and cash envelopes at the start of your budgeting period) + Total Income (what money comes in during the month) – Total Expenses (what money you have left at the end of your budgeting period).

Your closing balance for the month should equal your starting balance for the new month.

One way to check to make sure that you closed out your budget correctly, is to make sure that your closing balance matches what you have in your checking account and cash envelopes on the first day the new month.

The Opening Balance of any month will ALWAYS be the same as the Closing Balance of the previous month.

Your budget should be used for more than just assigning dollar values. If you know what to look for, it can tell you so much more than you think!Click To TweetBy understanding your spending, and knowing what to look for, you can perfect things as you go along, and successfully budget in the future.