If you’re working on improving your financial situation, it’s pretty common to struggle with your money confidence. Many people feel embarrassed about previous financial mistakes and wonder if they have what it takes to build the financial future they want.

But it’s important to begin developing money confidence right from the beginning. Money confidence will allow you to make better decisions and create the results you want in your life.

The problem is, there is a huge emotional component to our relationship with money, and changing those patterns is no small task. But with consistent action, it is possible. So if you want to improve your money confidence, here are six steps to help you get started.

1. Establish Your “Why”

Before you start taking action, take some time to figure out why it is that you’re doing this. Why do you want to improve your financial situation?

Is it so you can provide a better life for your kids or have the option to leave your full-time job? You need a reason that’s going to sustain and fuel you after the initial excitement wears off, and believe me, it will.

When you have a purpose and an emotional connection to your why, you realize that giving up isn’t an option. And all those difficult money decisions that would’ve tripped you up in the past become really easy.

Plus, having a clear vision of what you want and why you want it will give you the confidence to make those hard but necessary money decisions.

1. Let Go of Past Mistakes

You can’t develop money confidence until you’re willing to let go of your previous financial mistakes. I see so many people beating themselves up over things they did in the past, and it’s holding them back.

This is especially true for people who are stuck in a cycle of credit card debt. They feel terrible about their debt and the money they’re spending on interest payments.

I want you to understand that feeling bad about past mistakes isn’t helping you. Decide that you’re going to let go of them, and focus on taking daily steps to improve where you’re at today. You aren’t defined by credit card debt, and you have the power to change.

2. Set Financial Goals

Many people struggle with their confidence around money because they don’t have any clearly defined goals. “Get out of debt” or “start saving” are very vague goals, and you’re going to have a hard time making any progress.

So take some time to set some really specific financial goals. For instance, if you want to get out of debt, sit down, and figure out exactly how much you owe.

Many people avoid looking at the total balance of their outstanding debt, but this makes them feel more insecure and unsure of themselves. When you know what you’re dealing with, you can address the situation head-on and develop a realistic timeline and payment schedule.

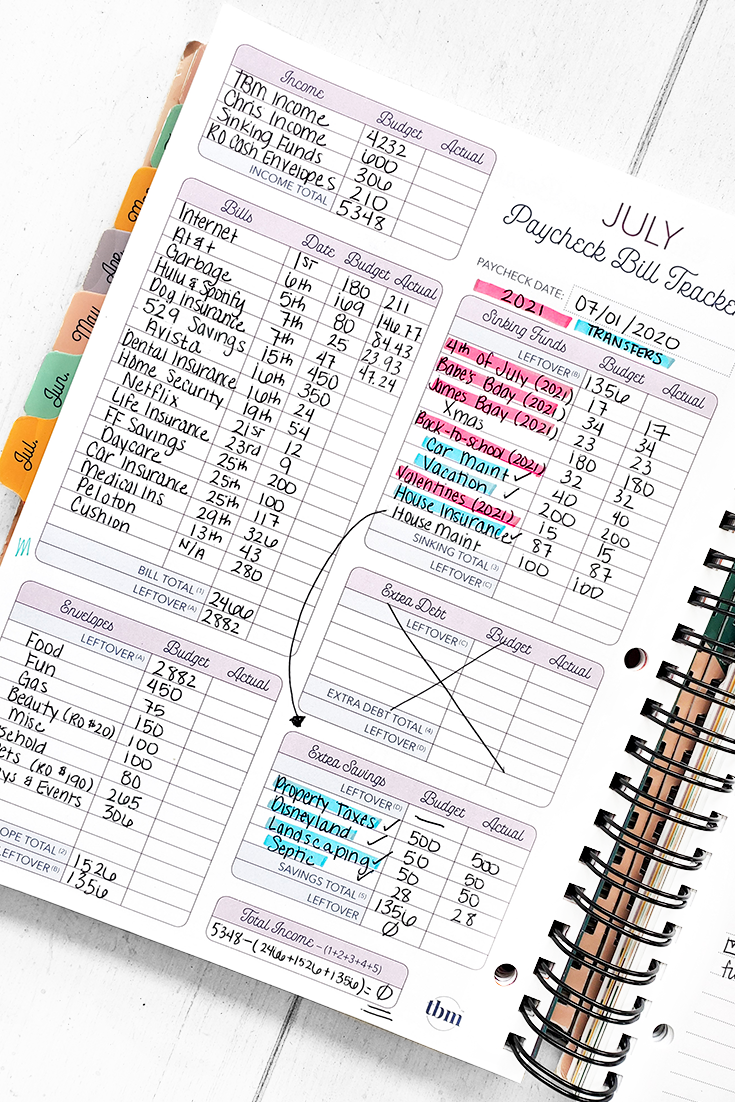

3. Tell Your Money Where to Go

I can’t stress enough how important it is to have a budget. Many people feel insecure when it comes to their finances because they have no idea where their money is going every month.

The money seems to fly out of their checking account even faster than it came in. That’s why it’s important to set up a zero-sum budget every month.

When you have a budget, every dollar you earn has a purpose. You plan for things you want to spend your money on ahead of time.

And when you stick to your budget every month, this will help you build confidence in yourself and your ability to manage money well.

4. Save an Emergency Fund

Financial emergencies are a part of life and will never go away. That’s why you need to plan ahead and have an emergency fund saved up.

I recommend saving up at least three to six months of your monthly expenses. That way, if your dog needs emergency surgery or you’re laid off from your job, you won’t be wondering how you’ll pay your bills next month. Look for a job now on ZipRecruiter >>

And once you have a six-month emergency fund saved, so you may find it helpful to do this for other areas of your life as well. For instance, you could have a particular savings account dedicated to Christmas gifts or a vacation fund.

5. Automate Your Savings

If you’ve never gotten in the habit of saving money before, it can be tough to get started. There’s always some unexpected expense that seems to come up, and it’s easy to reach the end of the money feeling frustrated that you didn’t hit your savings goal.

That’s why I recommend paying yourself first and automating your savings. At the beginning of the month, the money you’re saving is automatically transferred out of your account before any other bills are paid. This saves you from having to even think about whether to save that money or not.

I recommend using the CIT Savings Builder to get started. You’ll need a minimum monthly balance of $100 to open the account, and if you deposit at least $100 every month, you’ll have a higher interest rate than what most savings accounts offer.

6. Stay on Top of Your Credit

Have you ever felt nervous and embarrassed when a lender ran a credit check on you? Many people struggle with poor credit, and it saps their confidence and chips away at their financial options.

But there are simple steps you can begin taking immediately to improve your credit score. One of the best things you can do is to start paying your bills on time every month. Your payment history accounts for 35% of your FICO score, so this small action alone will make a huge improvement.

A high debt-to-income ratio will also drag down your score. So slowly paying down outstanding credit card debt will improve your credit score over time as well.

Bottom Line

Improving your money confidence is one of the best things you can do for your financial future. When you’re confident, you can manage your money more effectively and take the right actions to meet your financial goals. Building confidence won’t happen overnight, but it can be done with consistent action.