Have you ever received a paycheck and then wondered where it all went? Most of us have been there. Fortunately, zero-based budgeting can help you track your money to take full control of your finances.

So what exactly is zero-based budgeting?

Simply put: income – expenses = zero.

This method of budgeting is a strategy where every dollar you earn has a job. When you complete your budget, there should be zero dollars “leftover” in your budget. This is why it’s called a zero-based budget!

For example, if your monthly income is $3,000, then every line item in your budget should add up exactly to $3,000. When using the equation above, this leaves you with zero.

Every dollar must have a plan. Now, this doesn’t mean that you should go on a shopping spree to force yourself to spend everything. Instead, a zero-based budget means that you can account for every dollar, and make those dollars work for you.

How to Create a Zero-Based Budget

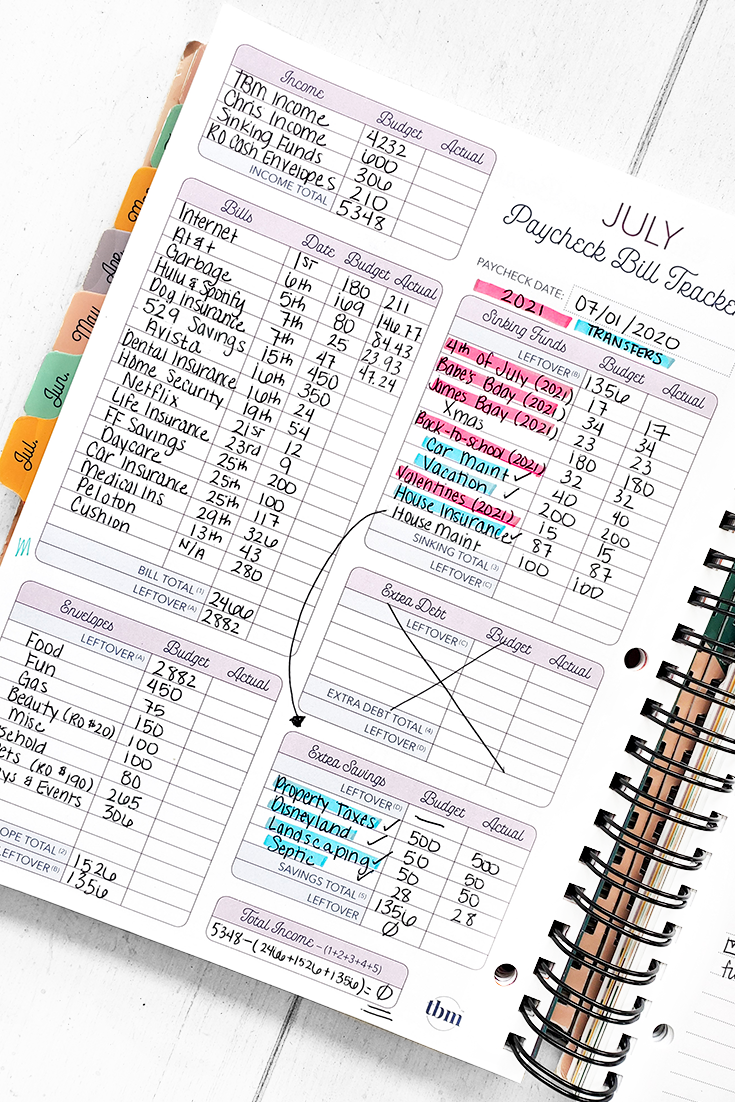

To make your budget hit zero every month, you have to know your numbers. Here are the main things to track:

1. What is your monthly income?

Begin by tracking the amount of money you take home every month. Besides keeping track of your regular paycheck, don’t forget to count the income from any side hustles. In today’s “gig economy,” it is common for individuals to have multiple streams of income. If you receive money from child support, residuals, or even birthday money, be sure to include this in your monthly budget. Any cash that you receive that can be spent should be included.

2. What are your monthly expenses?

I recommend beginning with the basic recurring expenses you know you will have to pay every month. For most people, this is a rent or mortgage payment. Other staples are utilities, food, and transportation. By starting with the basic expenses, you can rest assured that your essentials will be covered.

3. What are your upcoming or long-term expenses?

Once you have a firm grasp on your monthly expenses, start evaluating the entire calendar year. Gifts during the holiday season, for example, can be expensive. If you can “forecast” how much you will spend on gifts, you can create a plan to save for these expenses. Other yearly expenses might include birthday gifts, anniversaries, property taxes, HOA dues, vehicle repairs, and vacations.

Writing down all of these expenses makes it easier to plan for them. By saving a little bit every month, you will avoid feeling the pinch when the occasion arises.

Once you have your numbers organized, the zero-based budget is truly as simple as taking all your income, subtracting your expenses out, and then making sure the result is zero.

Again: income – expenses = zero.

The chances are that when you subtract your monthly expenses from your monthly income, you will have some money leftover.

For example, let’s say your fixed monthly expenses are rent ($700), utilities ($100), food ($150), student loans ($300), and car payment ($300). Assuming a monthly income of $3,000, you would still have $1,450 leftover. Because we want the final number to equal $0, we need to find a job for every remaining dollar.

Fortunately, because your fixed expenses are accounted for, you now know that you have $1,450 leftover that you can “play” with. This money can be allocated to retirement savings, planning for those long-term expenses, or even an extra debt payment. It's important to be putting your dollars towards your number one financial goal or priority – whether that be debt or savings.

What are the Benefits of a Zero-Based Budget?

The primary reason this method is excellent for budgeting is that you can track every dollar spent. By assigning a “job” to every dollar, you can fully see your financial picture and make adjustments. It also makes it easier to see if there are any areas where you can cut back on spending.

With a zero-based budget, you can also treat yourself guilt-free! Because you know that your living expenses are already accounted for, any money “leftover” can be spent without jeopardizing your financial health. Of course, this doesn’t mean that you should go on a shopping spree every month. I recommend saving money and planning for the future whenever possible, but it’s ok to treat yourself without feeling bad about it.

What are the Challenges of a Zero-Based Budget?

Many people are fans of the zero-based budget because it’s freeing and creates a clear financial picture.

However, there are a few challenges that come with this strategy:

- It is time-consuming. The zero-based budget is not a set-it-and-forget-it type of strategy. This is something that needs to be updated each month. Why? Because expenses and income fluctuate from month to month. For example, your car insurance payment might come due, or your tax refund might arrive. These are dollars that need to be accounted for in your budget.

- Difficult for seasonal workers or those with irregular income. Some people only earn money during specific months of the year. Cruise ship entertainers, for example, typically work in 6-month contracts with several months off in-between. Depending on the school district, some teachers are paid their salary in 10 months instead of 12, because of summer vacation. In each of these cases, a zero-based budget would be an excellent tool to prepare and save for the months where you know income will be lower than usual.

- You have to know your numbers. If you’re trying to get out of credit card debt or deal with student loan debt, it can sometimes feel like these payments are insurmountable financial numbers. A lot of folks put their debt payments on autopilot to avoid confronting these challenges head-on. A zero-based budget forces you to know your financial picture inside and out. The good news is that if you discover any leftover money, you can put this towards paying off your debt faster!

Despite these challenges, the zero-based budget helps make your goals a reality. There is a plan for every dollar you earn, so you are in charge of your budget. Instead of thinking of a zero-based budget as something that restricts your freedom, I encourage you to think of it as something that gives you freedom and permission to spend money without guilt.

Tips to Make a Zero-Based Budget Work for You

Just like anything else in life, there is no one-size-fits-all solution. Everyone’s financial situation is a little different, so here are a few tips to make the zero-based budget work for you:

- Be flexible. If your income varies from month to month or season to season, a zero-based budget might be a challenge, but you can still make it work. The secret is to make your expenses adapt to the money available in your budget.

- Create a line item for irregular expenses. This should be different from your emergency fund. These are expenses that regularly come once or twice a year, such as car or homeowners insurance. Tally up these expenses then divide them by the number of months you have until the bill comes due. Each month, set aside the money so that when the bill comes due, you already have the money to pay for it.

For example, the yearly car insurance cost is $1,427. Using the zero-based budget, you would need to save $118.92 per month to pay for your car insurance when it’s due. (You may want to consider opening up a separate account for these funds. Consider CIT Bank's Savings Builder as an option.) - Track every dollar you spend. While it’s easy to account for fixed expenses such as your rent or mortgage, the actual cost of food may vary from month to month. When you track your spending, there's no denying where your dollars went. Keeping track of every single one of your dollars will allow you to see where you can potentially cut costs, or maybe even where you need to increase your budget limit if you find yourself overspending in it month after month.

The Bottom Line

A zero-based budget can be the solution that helps you get out of debt and achieve your goals! Creating and sticking to a budget isn’t going to be perfect at first. Give yourself the space to experiment with implementing a zero-based budget. You may find that it might just change your financial life!