If you’re in the market to buy your first home, it can feel exciting and overwhelming all at the same time. On one hand, you really want to start buying furniture, choosing paint colors, and decorating. But, on the other hand, you want to make sure that you're 100% financially prepared for all expenses that come with the house.

But you should start preparing for the home buying process long before you even begin house hunting. That’s because buying a home can be expensive, and you want to make sure you’re financially prepared for this next step.

You don’t want to buy a home you love only to realize you can’t afford your new lifestyle. That’s why it’s important to plan and find the house you love on a budget you can afford.

If you’re new to the home buying process, it can be hard to know where to start. Let’s look at six important steps all first-time home-buyers should take.

1. Get Your Finances in Order

If you’re currently a renter, you may have looked at one of those mortgage calculators and thought, “Gosh, I could buy a house for only slightly more money than my monthly rent!”

Not so fast. Homeowners have many expenses that renters don’t ever have to think about. As a renter, if an appliance suddenly stops working, your landlord will get it fixed for you.

When you’re a homeowner, that expense is on you. That’s why you need to have your finances in order before you even think about buying a home.

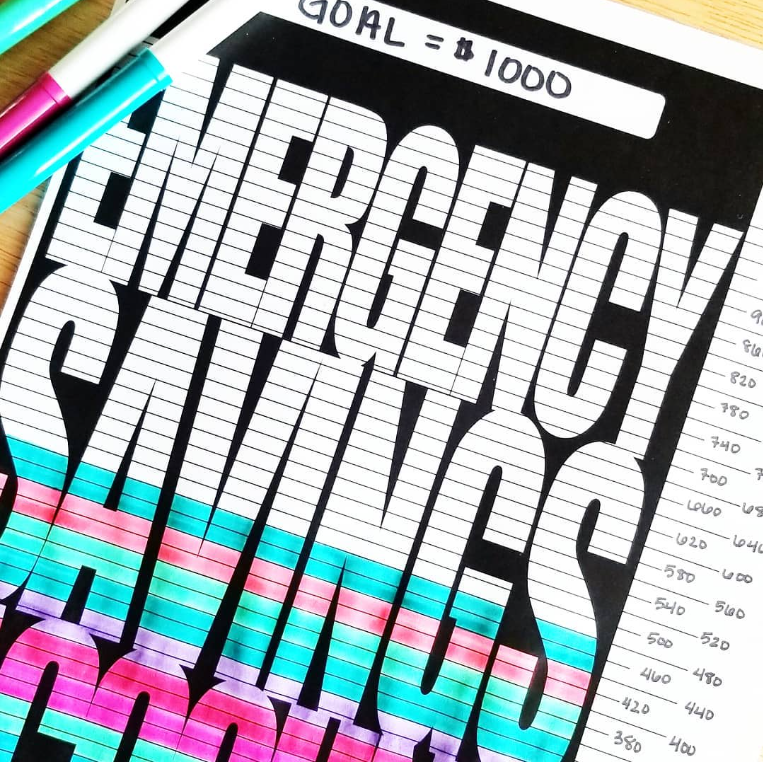

Pay down any outstanding credit card debt or loans, and save up a six-month emergency fund. That way, when an unexpected cost does arise, you won’t be wondering where that money is going to come from.

Featured Post

Saving for the Unexpected: How to Protect Your Family with an Emergency Fund

Read Post2. Start Saving Early

Once you’ve paid down your debt and have a six-month emergency fund, you can start saving for a down payment. The amount you save will depend on the mortgage you choose and the lender you end up going with.

For instance, some mortgage programs will let you pay with a down payment as low as 3%. But if you’re purchasing a $300,000 home, that’s still $9,000. It would be best to use a down payment calculator to determine how much you need to save.

Ideally, your down payment will be as close to 20% as possible. If you put down less than 20%, you will have to purchase primary mortgage insurance (PMI). PMI costs between 0.5% and 1% of the total mortgage and is usually added onto your monthly mortgage payments.

The best way to start saving for your down payment is by using a high-yield savings account like the CIT Savings Builder. You can open the account with just $100 to start, and you’ll earn a great rate if you deposit at least $100 every month.

Setting up monthly electronic transfers is a great way to automate saving for your down payment.

3. Check Your Credit Report

Your credit score will be one of the most significant factors determining the type of mortgage and interest rate you qualify for. So you want your score to be as high as possible when you apply for a mortgage.

Before you can raise your credit score, you need to know where it’s currently at. You can request a free copy of your credit report from the three major credit bureaus at AnnualCreditReport.com. Look for any delinquencies or errors on your report and dispute them with your lender.

Going forward, make sure to pay all of your bills on time and keep your credit card balances as low as possible. Don’t apply for new credit cards or loans, as this can be a major red flag for your mortgage lender.

4. Figure Out How Much House You Can Afford

Before you start looking at houses, you need to see what kind of home you can actually afford. To figure this out, you need to add up your total monthly income.

Your mortgage payment shouldn’t be higher than 25% of your monthly take-home pay. So if you bring in $4,000 per month, your mortgage payment should be $1,000 or less.

Plus, you need to factor in the other costs that come with homeownership. That includes things like homeowner’s association (HOA) dues, property taxes, utilities, and ongoing maintenance costs.

5. Don’t Forget About Closing Costs

Once you’ve saved up for a down payment and found a house that you can afford, you may feel like you’re home free. But not so fast — you still need to think about closing costs.

Closing costs are the fees and expenses you’ll pay to finalize the purchase of your home. They typically cost between 2% and 5% of the total cost of your home. These fees pay for things like the cost of the appraisal, the home inspection, homeowner’s insurance, and more.

You can try to negotiate and ask the seller to pay for a portion of your closing costs, but it’s unlikely you’ll get out of paying them altogether.

6. Continue to Stick With Your Budget

And finally, it’s crucial that you continue to stick with your budget, both during and after the home buying process. Resist the temptation to take out a mortgage that’s higher than what you can comfortably afford.

If you’ve paid down your credit card debt, keep it low. Don’t rack your credit cards back up by buying new furniture and decorations for your house.

It may feel restrictive at first, but being disciplined with your budget ensures that your home will continue to be a blessing, not a financial burden.

Bottom Line

Your home is one of the biggest purchases you’ll ever make, so you want to make sure you do it the right way. Take the time to improve your finances and save up for a down payment. And utilizing helpful tools like a high-yield savings account and down payment calculator will make the process easier.