Timing is everything.

This is true when it comes to major life milestones such as purchasing a home, and it is especially true when it comes to selling your investments.

During times of economic uncertainty, investors can become nervous and sell their investments. This means they are opting to hold their money in cash instead of keeping it in the market. In other cases, emergencies or can tempt investors to tap into their retirement accounts to cover those expenses.

However, tapping into retirement accounts early can be extremely costly. According to the IRS, “Early withdrawal from an Individual Retirement Account (IRA) prior to age 59½ is subject to being included in gross income plus a 10% additional tax penalty.” In other words, you’ll essentially be taxed twice: regular income taxes as well as the 10% penalty. The same penalty also applies to 401(k) accounts. There are a few exceptions, which I’ll discuss later.

So when can you tap into those long-term savings accounts? Below are the three reasons widely viewed as the only acceptable times to sell stocks.

Reason #1: You Have Achieved a Specific Financial Goal

If you have invested money for a long-term goal such as retirement and you’ve reached that point, don’t think twice about touching your investment. You have practiced excellent patience and hard work over the years. It might feel odd to withdraw from the account after decades of not touching it, but that account was created for this moment!

Working with a financial advisor can help make sure that your nest egg will last throughout retirement. It’s not uncommon for your portfolio to start shifting towards safer investment alternatives such as CDs and bonds as you age to reduce risk.

While retirement is the largest savings goal we think about, it’s not the only one. Depending on the time frame, investing can also make sense for medium-to-short-term goals. These include saving for:

- A down payment on a house.

- The kids’ college education fund.

- A major dream vacation.

Timing Matters

It is important to note that investing in the stock market isn’t the right solution for every single savings goal. Again, timing matters. In general, equity (stock) index funds, equity exchange-traded funds, and total bond market index funds or ETFs are best saved for investments that you won’t need for at least ten years or more.

For goals that may be 3 to 10 years away (such as saving for a down payment on a house), popular investment options are CDs and short-term bond funds. These investment vehicles' potential returns are 1.2% to 1.5% and 2% to 3%, respectively.

When it comes to short-term savings (less than three years) as well as building an emergency fund, I recommend using an online savings or money market account. Why? Because these accounts are liquid, meaning that you can quickly access the cash when you need it. Furthermore, they offer much more than the measly 0.09% return for the average savings account but have much less risk than investing in the stock market.

My personal favorite is the CIT Bank savings builder, which offers 0.45% APY and is FDIC insured.

If you’ve set aside money for a specific goal and have achieved that goal, don’t think twice about selling those investments. It might feel odd, especially after years of diligently saving and waiting, but remember that you have earned the privilege to enjoy it!

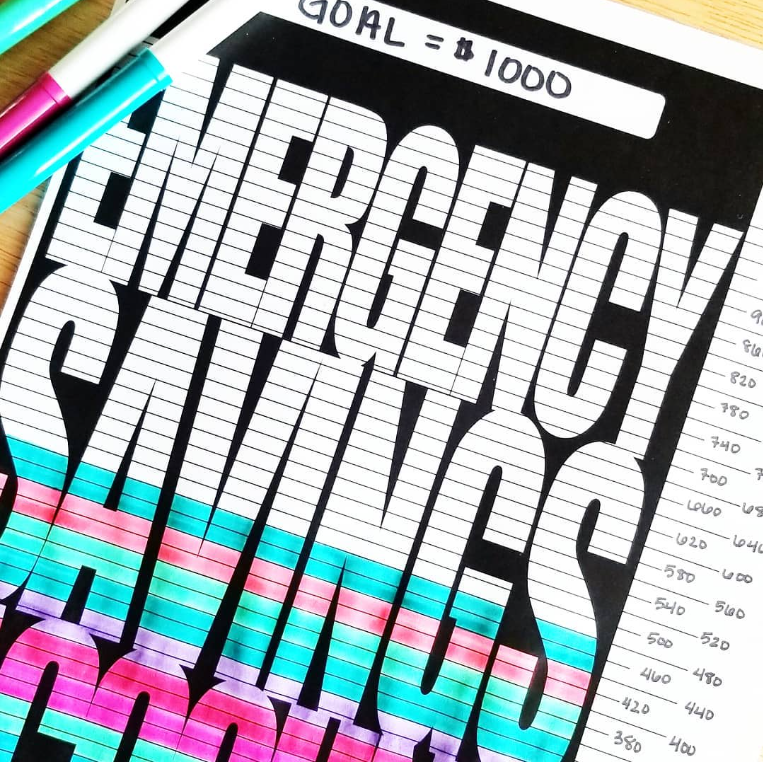

Reason #2: You Absolutely Need Money for an Emergency

Again, I want to emphasize that withdrawing from retirement accounts early can result in hefty penalties in most cases. Not only will you have to pay a 10% penalty on the withdrawal, but the amount will also be added to and taxed as part of your regular income for that year. In addition to these fees, you will also miss out on years of compound growth and earnings, so it’s important to avoid touching your investments when possible.

Ideally, you should already have an emergency fund for situations like sudden home repairs, job loss, etc. An emergency fund provides you and your family with a financial safety net should any of these unexpected expenses arise.

Still, if you find yourself needing to cover money for an unexpected expense without an emergency fund in place, here is a suggested hierarchy of where to get money before resorting to touching your investments:

- Tap into your savings account. Most financial experts recommend having enough saved to cover six months of expenses for this very reason. Having at least six months of expenses saved up will also provide incredible peace of mind for you and your family.

- Consider selling valuables that are not critical to daily life. Websites such as Nextdoor, Facebook Marketplace, or eBay are great places to sell valuables such as bags, clothing items, or used smartphones and laptops. For most people, selling valuables won’t be enough to offset the cost of a major expense (such as a medical emergency). However, this will show how seriously you are in need, which will make it easier to ask family and close friends (the next step).

- Consider a side-hustle. Depending on when this expense is due, you might have time to begin a side-hustle to start bringing in more income.

- Sell your investments for cash. If you’ve already exhausted your savings accounts, sold unnecessary valuables, and considered beginning a side-hustle, then now is the time when you can consider liquidating your investments for money.

If you have an IRA, then you can withdraw the principal you have contributed penalty-free as long as it is used for medical expenses, health insurance, college costs, a first-home purchase (up to $10K for singles and $20K for couples), up to $5K for the birth or adoption of a child, paying for a permanent disability, and distributions during military service.

Similarly, if you have a 401(k), you may qualify for a “hardship distribution” if the funds are used for essential medical expenses, home purchase for principal residence, 12 months of higher education tuition, burial/funeral expenses, and costs to repair your home from fire, earthquake, or flood.

Chances are that if the withdrawal isn’t used to pay for one of these expenses, then you will be subject to the 10% penalty as well as regular income taxes. I recommend working with your financial and tax advisor to determine whether you qualify for a penalty-free withdrawal and to ensure that all the appropriate documentation is properly filled out.

Because of the incredibly high-interest rates, using a credit card in emergency situations should only be used as an absolute last resort.

Reason #3: You Made a Terrible Investment With No Outlook for Returns

Again, timing is everything.

An investment that is down right now doesn’t mean that it is a bad investment. For example, if you invested in an index fund or series of index funds, don’t worry if those investments are down. Why? Because those funds track the entire market. If those funds are down, then that means that the market as a whole is down.

In other words, an underperforming investment does not necessarily mean that it is a bad investment. This is especially true during the pandemic. Many businesses are hurting right now due to shutdowns and social distancing, but that doesn’t mean that the long-term viability of those businesses is bad.

So how do you know if you’ve made a bad investment and it’s time to sell?

The best advice to compare a specific stock to the rest of its industry. If a stock consistently underperforms its competitors and the company itself appears to have no plan for growth, then it might be time to consider selling the stock.

Also, keep in mind that all industries eventually decline. For example, if you own stock in a company that only makes VHS tape cassettes, I hate to break it to you, but they’re likely not making a comeback, and you’d be better off selling.

Emergency Saving Is Different from Investing

Featured Post

Saving for the Unexpected: How to Protect Your Family with an Emergency Fund

Read PostIn short, the only three reasons why you should touch your investments are if you:

- Achieved a specific financial goal.

- Absolutely need the money for an emergency.

- Made a terrible investment with no outlook for returns.

The best way to avoid having to touch your investments is to plan for financial emergencies. Do you have an emergency fund? Most financial experts recommend saving at least six months of expenses in your emergency fund that you can quickly access at any time.

Bottom Line

If you are already investing in your future, then you clearly care about your financial health and wellbeing. Make sure that you provide yourself and your family with a financial safety net by building up an emergency fund. It may take some time, but the peace of mind and security it provides is well worth it!