If you plan to pursue a career in medicine or as a lawyer, then attending graduate school is a no-brainer. An advanced degree is a requirement before you can find a job in your field of choice.

But what if a graduate degree isn’t a requirement for your current or future job? In that case, does attending graduate school still make sense?

Whether or not you should attend grad school depends on you and your future career goals. But before you make the leap and commit to more schooling, here are five questions you should consider first.

1. How will I pay for grad school?

The first thing you need to consider is how you will pay for the program you want to attend. After all, not only will you be paying for the graduate program, but you won’t earn any money during the two to three years you’re attending school.

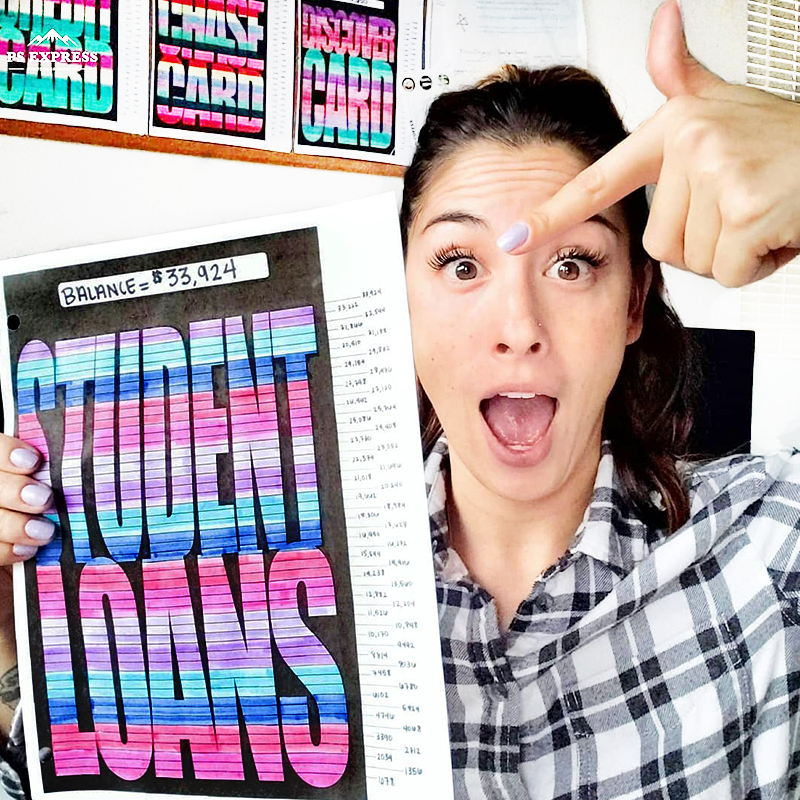

The average Master’s degree program starts at $30,000, and if you plan to attend a prestigious school, that figure could reach as high as $100,000. Is it worth it to you to take on that kind of student loan debt to earn an advanced degree?

Another thing to ask yourself is if the money you earn in your future career offsets these kinds of education loans. For instance, if you’re entering a low-paying field, spending tens of thousands of dollars on a Master’s degree may not be worth it.

If going to grad school is something on your radar that you want to do, I would recommend saving for it sooner rather than later. Start a sinking fund and start saving a little bit every single paycheck.

2. Will this further my career goals?

One of the biggest things you need to consider is whether attending grad school will significantly impact your career. There’s general evidence that individuals who earn advanced degrees make more money than someone with a Bachelor’s degree, but is that true for your specific industry?

Spend some time talking to your current employer and the career counseling office at your college. They will likely provide some guidance on whether earning an advanced degree is the best step for you.

It can also help to seek out the advice of people who are already where you want to be professionally. What are the steps they took to get to where they are today? Maybe going to grad school was part of that journey, but it may not have been.

A lot of people associate more education with higher-paying jobs. Although that might be true in some fields, there are a lot of careers that may not pay you more because of your Master's degree.

3. Is now the right time to attend?

Okay, I get that there’s never really a “right” time to go back to school or make any major life changes. But certain life circumstances can make going to grad school especially difficult.

For instance, if you’re a new parent, then attending school full-time could add a lot of additional stress to your life. There’s no time limit on when you can go back to grad school, so ask yourself if you could benefit from waiting even six months to a year.

Evaluating what you have going on in your life and deciding whether or not to go back to school is a lot to think about, however, it could ultimately hinder your success if you decide to go back to school when you're trying to juggle multiple other things.

4. Should I choose a part-time or full-time program?

If you already have your heart set on attending grad school, then you need to decide whether you’re going to attend part-time or full-time. There are pros and cons to both decisions, so you have to determine which is the best fit for you.

If you attend school full-time, you can graduate sooner and will be able to move on to the next stage in your career sooner. However, it will mean a short-term sacrifice in your relationships, ability to work, and overall work-life balance.

Whereas attending school part-time will take longer, but it could make it easier for you to maintain a part-time job and find more balance in your life.

If you're wanting to apply for scholarships and other financial aid, it's important to read the terms of qualification thoroughly. Some aid is only available to those who are taking a certain amount of credits.

5. Can I qualify for scholarships?

Many people assume they have to take out student loans to pay for school, and completely overlook all of the scholarship opportunities available. There are tons of scholarships and grants available to graduate students, you just need to know where to look.

If you’re not sure where to start, here are some great resources you can try:

- Scholly: Scholly is a mobile app that you can use to find new scholarship opportunities. After you sign up for a free profile, you’ll start getting matched with numerous scholarship opportunities you can apply for.

- Sallie Mae’s Scholarships Database: Sallie Mae has a database of graduate school scholarships and grants. After you create a profile, you’ll receive notifications when scholarships matching your criteria pop up.

- Professional associations: It may take some digging on your part, but professional associations can be an excellent source of scholarships and grants. You can use the website Job Stars to find a professional organization in your industry.

- Your current employer: And finally, it’s worth asking your employer if they would be willing to reimburse you for any portion of the cost of the program. Your chances of this will be better if the graduate program will benefit you in your current position in some way. Some companies will pay for a percentage of your school, however, they might have terms in the contract stating that you have to work there for a certain amount of time post-graduation. If you're going this route, be sure to ask questions and read through your contract carefully.

- FAFSA: The Free Application for Federal Student Aid, otherwise known as FAFSA, is what colleges use to determine your eligibility for federal, state, and school-sponsored financial aid. Thie includes educational loans, grants, as well as work-study loans. Click here to learn more about filing your FAFSA for grad school.

Is going to grad school worth it?

Earning an advanced degree can give you advanced skills and education, and give you a competitive edge in your career. But it’s a big time commitment and depending on your career, may not be worth the financial investment.

Make sure you weigh all of your options before deciding to go back to school. Try to take on as few student loans as possible, and try to maximize scholarships and grants wherever possible. Going into it with a plan will help you make the most of grad school while staying in a good position financially.