It happens for all of us: at some point, it’s time to leave the nest.

Whether you’re moving off to college or moving into an apartment to begin your career, moving away from home for the first time is a major milestone.

This moment is filled with a mix of emotions. There’s excitement over getting to stretch your wings and experience independence while discovering who you are. On the flip side, there can be a lot of worry and nervousness. You may even find yourself asking, “Am I ready to move out? Do I have enough money? How do I create a budget? How much can I afford for an apartment, transportation, and food?”

In this article, we will cover all of those topics and much more.

By learning how to budget as you move out of your parents’ house, you’ll set yourself up for success and fulfillment. As nerve wracking as this time can be, remember that moving away from home is also a time of opportunity and growth!

So… let’s get started!

Moving Out for the First Time: Questions for Your Budget Checklist

Before you start planning your budget, there are a few things you should consider. The first thing you need to decide is whether you want to live in an apartment or rent a room somewhere else. If you choose to live in an apartment, then you’ll have to make sure that you have enough income to pay for your rent and bills. This means that you’ll need to save up either through part-time jobs or by using student loans.

Featured Post

Saving for the Unexpected: How to Protect Your Family with an Emergency Fund

Read PostIf you plan on renting a room or living in a dorm, then your initial expenses will likely be less than living alone in an apartment, as you will have roommates to help share the financial burden.

These are some of the costs you should consider when looking for a place to live:

- Do I have enough money for a security deposit or down payment? Most apartments require a security deposit, which can be up to one month's rent. In addition to paying for the security deposit, you’ll also need to spend money on a credit report check and other fees.

- What can I expect to pay for utilities? Utilities like electricity, gas, water, and internet can add up quickly if you don’t know what to expect. Make sure you research your utility rates before signing any lease agreement. These specific rates will vary depending on where you live. The average energy bill in NYC, for example, is over $300, but only $72 in a smaller market like Denver, CO.

- Do I have to pay for parking? Parking is usually included in most leases, but you may still have to pay for it. Some places charge around $20 per week, so be sure to factor this cost into your budget.

- Is there a pet fee? Many landlords won't allow pets because they can damage the building or cause health issues for next door tenants with allergies. However, if your landlord is willing to let you keep a pet, you need to ask if there is an associated pet fee involved. The last thing you want is to be surprised with an unexpected charge on your monthly rent.

- How far am I from work or school? Yes, you should certainly factor in costs when choosing a place to live! But don't forget to take a look at the bigger picture. For example, the closer you are to downtown, the more expensive housing costs will be, but this doesn't always mean that you should look for the cheapest place to live. Cheaper places might have higher crime or may require you to pay more for transportation. In other words, don't just look at the dollar signs. Also consider your trade-offs, quality of life, and safety.

How to Save Money When Moving Out for the First Time

Just looking at your housing costs, it's clear that moving on your own will leave a temporary dent in your wallet.

But you can control the size of that dent!

Not everything you need has to be brand new. Whether you're moving into an apartment or dorm, it doesn't mean that you need to buy everything to fill up your space. Instead, think of it as a move.

Do you already have a bed at home? Do you have mirrors, artwork, bookshelves, and dressers that you can move into your new place? Do you have a TV or workout equipment that you use? If so, then bring these belongings with you!

Viewing this as a “move” instead of “starting a new life” can help you save so much more money.

Here's a checklist of things you need when moving out for the first time – but before you buy anything, check to see if you have any of these items already.

Bathroom Checklist:

- Towels

- Hand soap

- Shampoo, conditioner, body wash

- Toiletries

- Plunger and toilet scrubber

- Bath mats

- Shower curtain

- Anything you need for body care and self care

Bedroom Checklist:

- Bed frame and mattress

- Furniture

- Mirrors

- Artwork

- Bookshelf

- Dresser/closet

- TV

- Workout equipment

Kitchen Checklist:

- Cookware

- Kitchen utensils

- Cutting board

- Dishes

- Glasses

- Cutlery

- Coffee maker

- Microwave

- Toaster

- Refrigerator

- Oven

- Stove top

Living Room Checklist:

- Lamps

- Artwork

- Bookshelf

- Chairs

- Coffee Table

- Sofa

Home Office / Study Room Checklist:

- Computer

- Printer

- Desk

- Internet connection

- Pencils, pens, markers

- Paper

Oh, and don’t forget to check whether your place has a washer and dryer. Most rental units and dorms have a laundry room, but if this isn’t the case for your situation, most laundromats cost anywhere between $1.50 to $4.00 per load, depending on where you live.

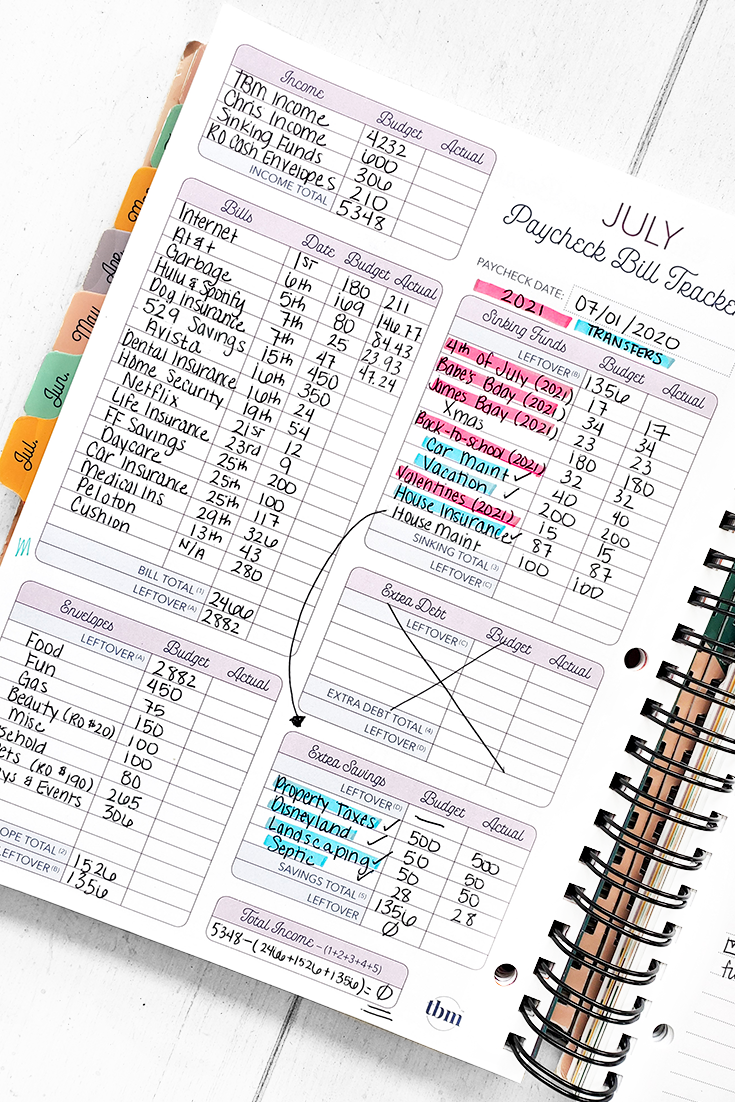

Keeping Track of Everything: How to Create a Budget

Phew!

This is a lot to consider and a lot to keep track of.

Instead of trying to track everything mentally, I encourage you to actually use a spreadsheet or some sort of budget sheet.

While I trust your ability to do mental math, the reality is that finances and budgeting are more than just math. There’s an emotional and psychological component to it, too.

Even the most fiscally responsible person can be tempted by impulse spending or overspending. By keeping track of everything in a tangible way, you can hold yourself accountable. This is the true secret to handling your finances when moving out for the first time!

The principles of money are truly easy. At the risk of over-simplifying it, it all boils down to money coming in vs. money going out. In other words, how much are you spending compared to how much you’re making?

Creating a budget is all about giving yourself an objective way to track all of these financial factors, so that you can make the best decisions for your future.

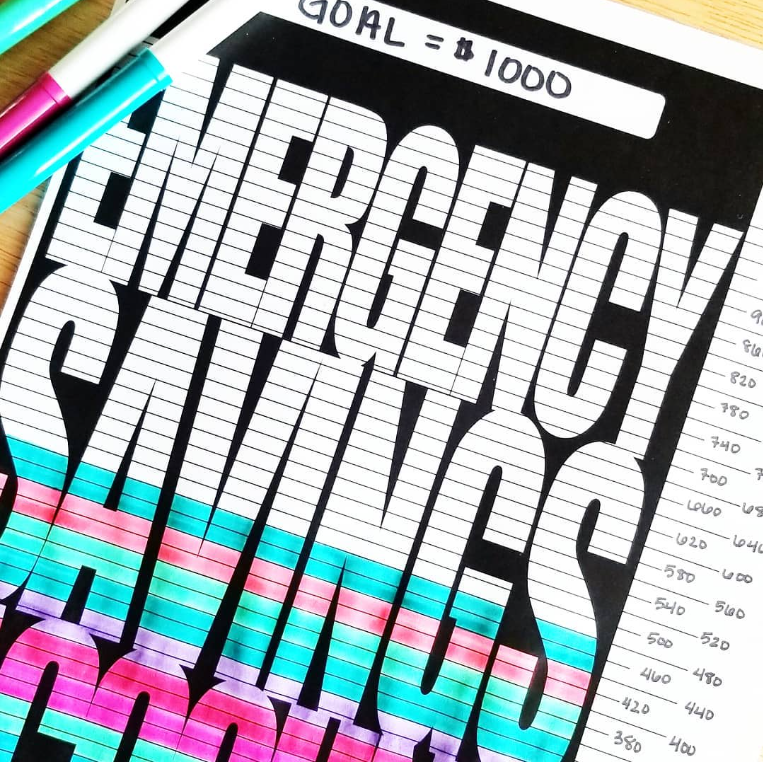

What Is An Emergency Fund?

When you lived at home, you had a security blanket: your parents.

If your car broke down, for example, your parents would help you pay the costs for a repair. But when you live on your own, these costs belong to you.

Creating an emergency fund gives you peace of mind knowing that you won’t have to worry about paying for basic necessities like food, rent, utilities, etc., because they’ll already be covered.

In fact, there are many different ways to set up an emergency fund. The key is to pick one that works for you. For most people, an emergency fund consists of three to six months worth of living expenses. This is money that you set aside and never touch with the exception of a true emergency.

Is there a birthday party that you forgot about?

That doesn’t quite count as an emergency, so you shouldn’t touch your emergency fund to be able to attend a last minute birthday dinner.

Did your laptop that you use for school or work suddenly break?

If so, that does count as an emergency because it is (1) unexpected and (2) an item that you truly need in your day to day life.

To minimize the temptation to overspend while maximizing your savings, I recommend using CIT Bank’s Savings Builder, which offers one of the best savings interest rates in the whole country.

While most people moving away from home for the first time don’t have $25,000 to put into a savings account, CIT Bank allows you to enjoy the top interest rate with a savings deposit of $100 a month.

This is an easy way to get your emergency savings fund started!

Do you have other questions?

Is there anything that we didn’t cover in this article?

If so, I encourage you to join our community on Facebook. In our group, you’ll find like minded people who are in a similar position or have experienced what you’re going through. We hope to see you there!