The big thing nowadays is meal planning. It’s supposed to help keep us on track with our budgets, keep our meals lively, and save us from the dreadful question “what’s for dinner?”. But is spending money on any meal planning subscription worth it?

For the last five months, I have participated in one meal planning service called eMeals. I stumbled across this service through my designation as an Accredited Financial Counselor. eMeals is endorsed by the ever famous “Financial Guru” Dave Ramsey. Well if Dave Ramsey is endorsing such a product it must be a financially sound decision right? Here is what I found out on my journey of meal planning for my family.

First, let me you give you some background on my family. From picky eaters to having kids, the meals you choose for your meal plan are going to be affected. I have been married for almost five years to a wonderful husband. He is the type of man who will devour a whole pizza all by himself and still say he is hungry at the end of the night. He is a meat and potatoes kind of person. He does not want the “foo-foo food” as he calls it. When I try to get creative and add new ingredients, such as quinoa or strawberries in his fresh green salad, he doesn’t eat it. I have an almost 4-year-old that is picky with his food. He would rather go to bed without eating than eat the food I give him at times. This is my meal planning struggle.

eMeals is an online service that will email you seven days worth of recipes, and depending on your plan, a grocery list that corresponds to your favorite grocery store. This grocery list that coincides with your recipes has a lot of useful information. From red indicators to let you know something is on sale to the price of each ingredient. There are now 50 different meal plans to choose from. From weight management plans, family inspired plans, and specialty plans, there is every option under the rainbow. So, what does this service cost? You can start with a 14-day free trial to test the waters and then the online subscription varies depending on if you choose breakfast, lunch, or the dinner menu. The price ranges from $36 – $59 for a 12-month subscription. That’s about $5 a month if you choose the dinner menu option. The best value I have found for a meal planning subscription.

There is a TON of meal planning subscriptions out there today. Blue Apron is another meal planning subscription that lets you choose from a “2-person meal” or a “family plan.” The difference between eMeals and Blue Apron is that Blue Apron mails the recipes and the real ingredients to your door. That’s right! No going to the grocery store! But it will cost you. The “2-person meal” costs you a whopping $59.94 a week and the “family plan” costs you $69.92 a week.

The downside to most meal planning subscriptions is the inability to customize your recipes. Customization was by far my biggest challenge with meal planning subscriptions. If you don’t like one of the recipes, you still pay for it. Blue Apron mails the recipes to your door, not allowing you to choose the actual meals your family will eat. There is not altering your recipes or your grocery list on eMeals, which makes you spend time scratching out the ingredients you don’t need for recipes your family won’t like.

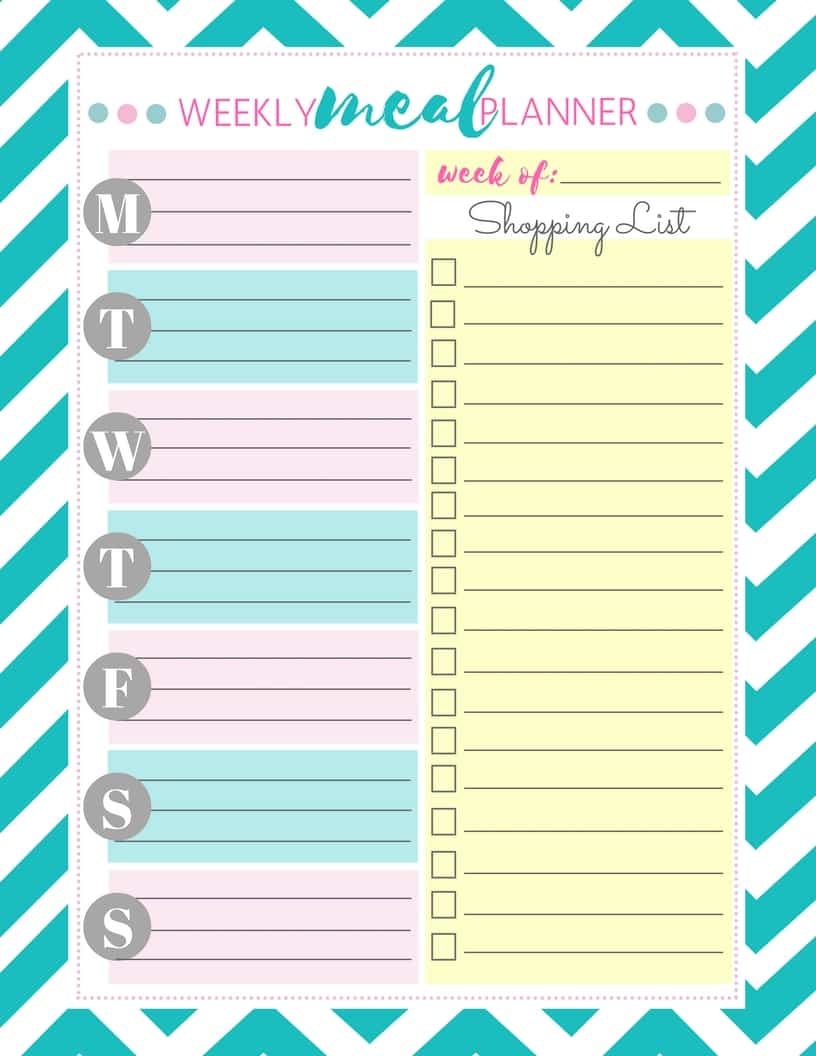

Throughout my meal planning journey, I have discovered that meal planning does, in fact, save you money and keep you on a budget. But spending money on an online subscription for recipes I didn’t use at times was not my solution. I have found that creating my own meal plan not only saves me the money I would pay for an online subscription, but it allows me to pick recipes I KNOW my family will eat. I created my very own meal planning printout.

Click the picture above to printout your free weekly meal planner!

As a full-time working mom, I can choose slow cooker meals for the weekdays when I don’t have a chance to cook, and I can also choose recipes I know my family will eat.

- Resource: $5 Meal Plans

What's your biggest struggle with meal planning?