The Retirement Savings Contribution Credit (aka the Saver's Credit) doesn't give you an enormous tax credit, but it could have its rewards if you are a low-moderate income taxpayer who is working hard and need more help saving for retirement.

WHAT IS THE SAVER'S CREDIT?

The truth is, most people don't know about the Saver's Credit. In fact, according to a Transamerica Retirement Survey, only about a third of American workers are even aware that it exists (that's only 36%).

This credit is given in addition to other tax benefits for saving in a retirement account, such as a 401(k) or an IRA. It's important to understand that this is a tax credit – not just a tax deduction.

What's the difference? A tax credit is a dollar-for-dollar reduction of the income tax you owe. For example, if you owe $2,000 to the IRS for federal taxes but are eligible for a $2,000 tax credit, your net liability goes to $0.

On the other hand, a tax deduction merely helps reduce the amount of your taxable income, and you pay taxes on the remaining amount. As you can see, tax credits are far more valuable monetarily than deductions.

It's also important to know that you can not get a refund based strictly on the Saver's Credit. It is non-refundable, meaning it can only be subtracted from the taxes you owe.

Let's recap. The Saver's Credit is an incentive from the IRS for low and moderate-income taxpayers to make retirement contributions to an IRS recognized retirement account (IRA, 401K, 403B, 457B, etc.)

Here's an example of how it works using the tables below: Mary, who works at a gas station, is married and earned $22,000 in 2017. Mary's husband was unemployed for all of 2017 and didn't have any earnings. Mary contributed $1,000 to her IRA in 2017. After deducting her IRA contribution, the adjusted gross income shown on her joint return is $21,000. Mary may claim a 50% credit, $500, for her $1,000 IRA Contribution.

WHAT RETIREMENT PLANS QUALIFY?

- Traditional IRA

- Roth IRA

- 401K Plan

- 403B Annuity

- 501(c)(18) Plan

- 457 Government Plan

- SEP

- Simple IRA

- Simple 401K Plan

YOU DO NOT QUALIFY IF…

If you meet any of the below criteria, you do not qualify for the Saver's Credit:

- You are under the age of 18.

- You are a full-time student (or have been for more than five months in the calendar year)

- Someone else can claim you as a dependent on their tax return.

- You are above the income levels mentioned in the income limit tables below.

WHAT ARE THE INCOME LIMITS?

There are income restrictions for the Saver's Credit. It's also important to know that you can not claim any rollover contributions. That means if you moved any money from one retirement plan to another, you can't claim this amount to use for the credit.

2017 INCOME LIMIT

The AGI (adjusted gross income) Limit for the Saver's Credit is:

- $31,000 for single filers and married individuals filing separately

- $46,500 for heads of household

- $62,000 for married couples filing jointly

2018 INCOME LIMIT

The AGI (adjusted gross income) limit for the Saver’s Credit is:

- $31,500 for single filers and married individuals filing separately

- $47,250 for heads of household

- $63,000 for married couples filing jointly

2019 INCOME LIMIT

The AGI (adjusted gross income) limit for the Saver’s Credit is:

- $32,000 for single filers and married individuals filing separately

- $48,000 for heads of household

- $64,000 for married couples filing jointly

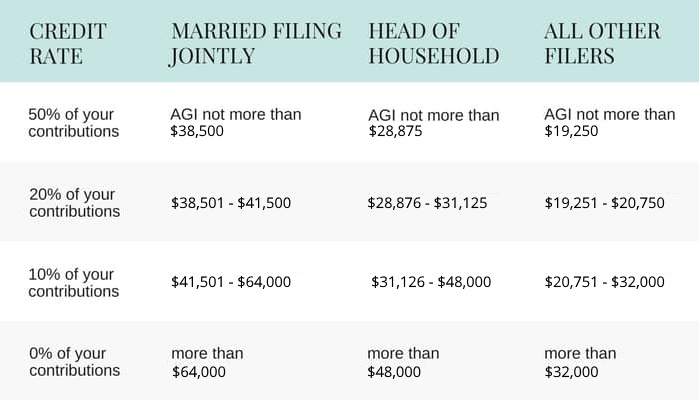

HOW MUCH CAN YOU GET FOR THE SAVER'S CREDIT?

The simple answer is that it really depends on your income level and how much you contributed to your retirement account. As I mentioned above, the amount you may qualify for isn't huge, but if you could get some free money, why not put in the small amount of effort to see what you could get.

The amount of the credit is 50%, 20% or 10% of your retirement plan or IRA contributions up to $2,000 ($4,000 if married filing jointly), depending on your adjusted gross income.

To see how much you may qualify for, fill out the IRS form 8880, or look at the contribution tables below.

2017 Saver's Credit Table

2018 Saver's Credit Table

2019 Saver's Credit Table

HOW TO CLAIM THE SAVER'S CREDIT

You can claim the Saver's Credit by filing the Form 8880 and it must be attached to form 1040, 1040A, or 1040NR. Keep in the mind that the Saver's Credit is not available for tax forms 1040 EZ.

If you plan on claiming the Saver's Credit, make sure your contributions are made by the end of the calendar year for 401(k)s, 403(b)s, 457s or Thrift Saving Plans. If you are a Traditional IRA or Roth IRA contributor, then you have until 4/15/2019 for 2018 contributions.

- Resources: File taxes online for free (or cheap!) with H&R Block or Tax Slayer

Have you claimed the Saver's Credit in the past? Let me know about your experience in the comments below!