One of the things I love about New Year’s traditions is that it’s the perfect time to reflect on your life and dream about the future. In this case, let’s take a look at your finances.

What worked well for you in 2022? And what would you like to improve in 2023?

Even if you feel like you’re stuck in a financial rut, there’s something about the New Year that seems energetic and filled with momentum! After all, the New Year is a reminder that we can always create a new beginning, learn, grow, and prosper.

But why wait until 2023 is actually here? Truth is, every day is a new beginning. And if you work to get your finances in order now, then you can hit 2023 full steam ahead when it actually arrives! Here’s some food for thought.

1. Update and Revise Your Budget

There’s no better way to start the year than by getting a lay of the land. Nothing is ever stagnant in life, and that includes your finances.

Begin by assessing your monthly income. Did you get a raise at work? Have you started a side hustle? If you work in an industry with unpredictable income, is your take-home pay on par with what you expect and budgeted for?

Similarly, take a look at your expenses. Consider all potential expense changes within the last year:

- Inflation (does your grocery budget need to change?)

- Rent payments/mortgage rates

- Gas and electricity

- Childcare/daycare

If you don’t regularly update your monthly budget, you should at least do it once a year, and the New Year is the perfect time to do so!

2. Beef Up Your Emergency Fund

Ideally, you should have 3-6 months worth of expenses set aside in an emergency fund. This is separate from your retirement savings. This rainy day fund is meant specifically for emergencies such as needing new tires or replacing your roof after an unexpected storm.

While it’s impossible to predict the future, some people feel like it’s more important than ever to have an emergency fund. You may have heard whispers about economic turmoil and more and more media pundits have even used the dreaded R-word: Recession.

Whether or not a recession happens in 2023, nothing will give you more peace of mind than having an emergency fund to cushion any financial road bumps you may encounter.

Personally, I like using CIT Bank’s Savings Builder because it incentivizes me to save more and offers up to 5X the national APY.

3. Kick Your Expensive Habits

Are you looking to set a New Year’s Resolution? Why not commit to a resolution that is good for you personally as well as your finances.

For example, if you have a resolution to drink less or stop drinking altogether, not only is that good for your health, but it is also good for your pocketbook!

Consider some of the most popular resolutions that can also have an impact on your finances:

- Stop gambling

- Stop smoking

- Cook at home more / eat out less

- Read more (but utilize the library rather than buying books)

- Get organized at home

4. Keep What You Use, Cut What You Don’t

The most obvious example is streaming services. How many of us subscribe to streaming platforms such as Netflix, Hulu, Disney+, YouTube TV, HBO, Peacock, and much more?

If you use all these services on a regular basis and it fits into your budget, then that’s fine. But I bet most of us are subscribed to streaming services that we don’t utilize on a regular basis. You could save hundreds, if not thousands, of dollars by cutting what you don’t use.

The best part? This doesn’t apply to just streaming services.

Is there a gym membership that you don’t utilize? Then start working out or cancel your membership! What about a music subscription service or meal kit service? Go through your credit and debit card statements to find ongoing subscriptions that you may have forgotten about.

Cut off the dead weight and start the new year off on the right foot!

5. Find a Budgeting System That Works for You

If you find yourself struggling to stick with a budget year after year, then it’s time to try switching it up! While the principles of budgeting are generally the same (earn more, spend less), there are many ways to organize and handle your finances.

It might sound too simple, but the reality is that finances are part psychological. It’s more than just numbers and math. It’s about motivating yourself to stick to your goals and giving yourself tools to achieve those benchmarks!

Here’s some food for thought on various budgeting strategies:

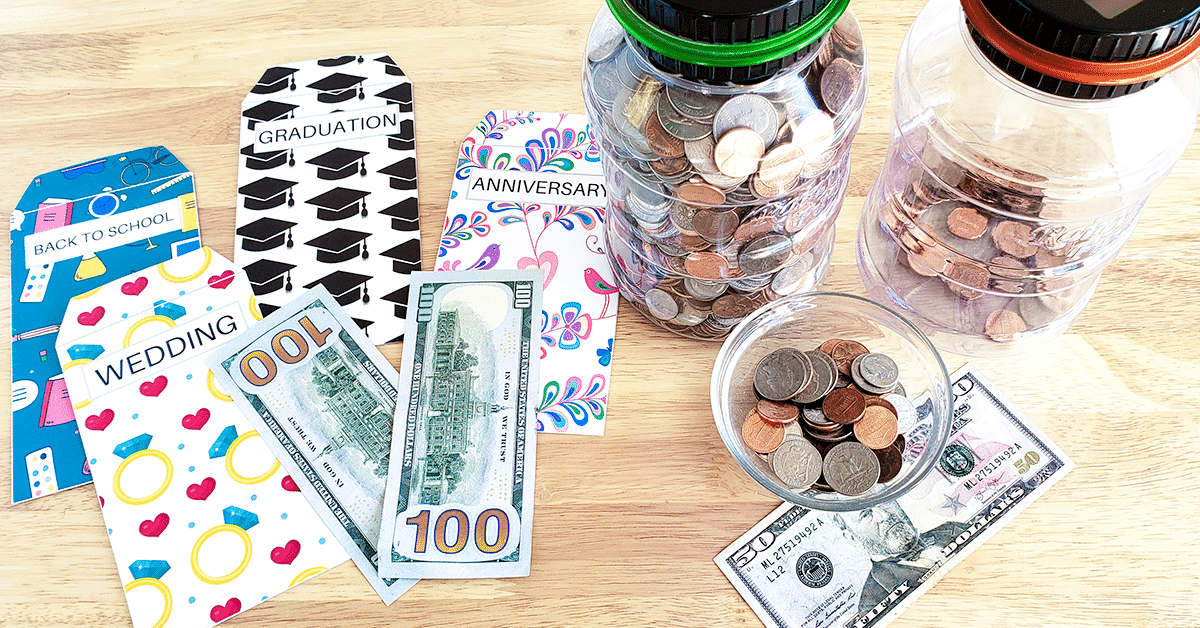

- How to Budget Using the Cash-Envelope Method

- How to Use the Cash-Envelope Method WITHOUT Cash

- How to Start a Budget When You Live Paycheck-to-Paycheck

- What Is a Zero Based Budget?

- Is the Half Payment Method Right for You?

- How to Close Out Your Budget Every Month

- A Closer Look at Spending Based on Income Rather Than Net Worth

- How to Make a Realistic Budget that Actually Works

Creating and sticking to a budget might sound stressful, but when done right, it should feel freeing and liberating. You can spend money without feeling guilty! And you’ll be working towards financial goals that will give you and your family peace of mind.

6. Focus On Your Debt

Debt is like a heavy weight that holds your finances down. Because you’re spending money on interest and monthly payments, that’s less money that you have for discretionary spending, saving, and investing. But once your debt is paid off, you’ll find that you have a lot more wiggle room in your budget!

If you don’t have debt, then I encourage you to continue paying off your credit cards in full every month.

And if you do have debt, it’s better to pay more than the minimum balance. You see, the credit card company wants you to pay the minimum balance. That’s how they make all their money – through the interest that they charge you. By paying more than the minimum amount due, not only are you saving money, but you are accelerating your journey to finally becoming debt free!

If debt payoff wasn’t a priority in 2022, then make it a priority in 2023!

7. Invest in Yourself

This really could be an entire blog post on its own, but investing in yourself is the best thing that you can do at any time!

Aside from giving you personal fulfillment and a sense of purpose and accomplishment, investing in yourself also has financial rewards.

For example, improving your skill set could eventually lead to a raise at work or even a new career path. Learning a new trade could help you save money at home (i.e. fixing a plumbing issue yourself rather than hiring a plumber). And learning more about finances will help you refine and tweak your budget, invest with clarity, and save with intention.

You are your greatest asset and advocate for your own finances, so invest in yourself and your financial education!