A big part of managing your finances involves tracking essential numbers. For example, every month, you need to keep an eye on your spending, your bank account balances, your savings funds, and your debt. Your credit scores are another set of numbers you need to review often as well.

But there’s another financial number that deserves your attention each month. It’s your net worth. Please read below to learn about this important number, how to calculate it, and why knowing your net worth matters in the first place.

What Is the Definition of Net Worth?

Your net worth is a snapshot of your overall financial health at a fixed point of time. It’s a picture of where you stand financially. As you track your net worth over time, it can show you the progress you’re making toward getting out of debt and saving money.

How Is Net Worth Calculated?

Calculating your net worth isn’t too complicated. You need to subtract your liabilities from your assets.

You can use the following formula to calculate your net worth:

· Total Assets – Total Liabilities = Total Net Worth

I’ll break down what these terms mean and how to fill out a net worth worksheet below.

Tracking Your Net Worth

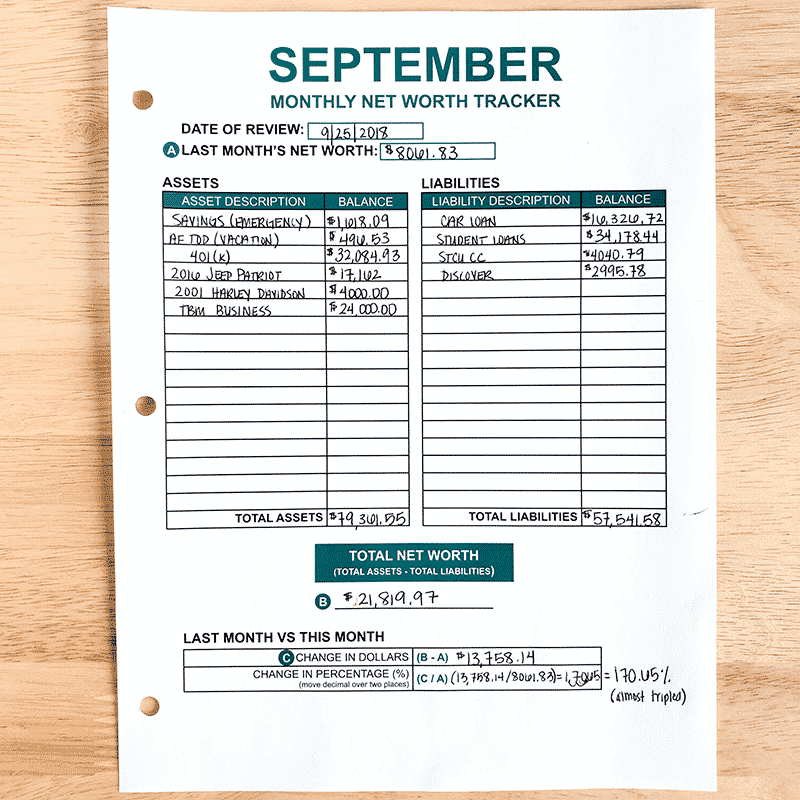

I’ve created an easy way for you to calculate and track your net worth using the Budget By Paycheck Workbook. Each month your workbook includes a tool called the Monthly Net Worth Tracker. (In the accounting world, this form is known as a balance sheet.)

You should fill out your net worth worksheet at the end of each month. But before you do, make sure every transaction (bills, debts, savings contributions, etc.) has posted to your bank account.

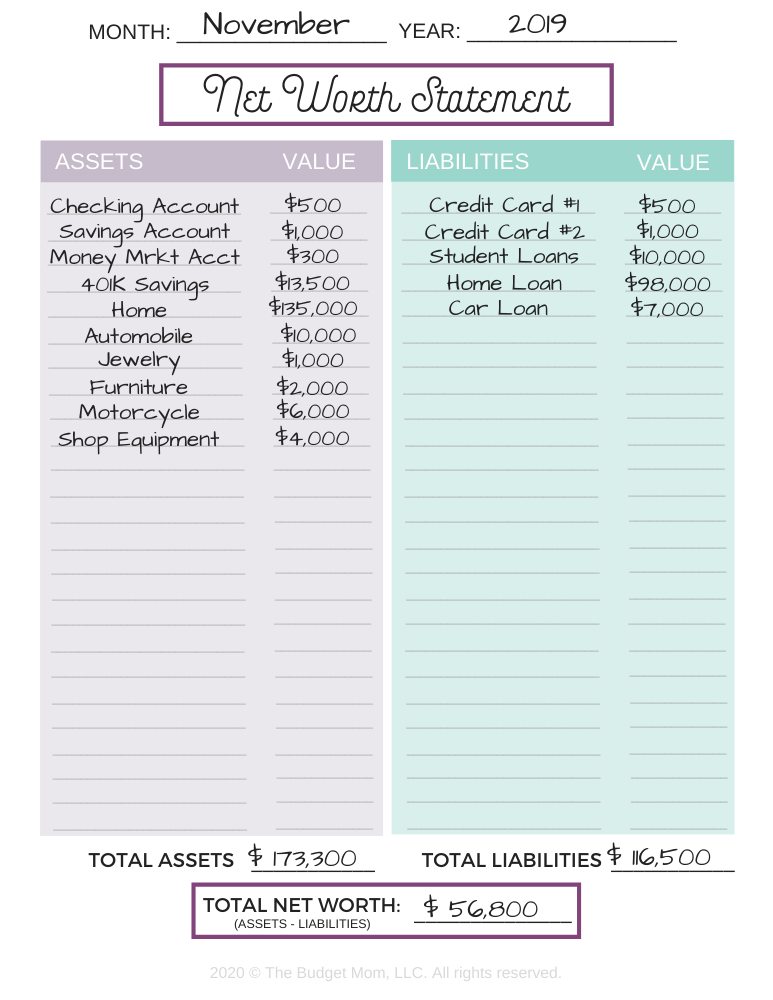

1. List Your Assets

On the left-hand side of your Monthly Net Worth Tracker, start by listing your assets. An asset is anything you own that has value.

Assets might include:

- Checking Account Balances

- Savings Account Balances (Emergency Fund, Auto Fund, Housing Fund, etc.)

- Retirement Account Balances

- Art Collection

- Homes and Property

- Vehicles

- Etc.

Once you write down all of your assets, add them together, and enter the total on the worksheet.

Vehicles

If you own a vehicle, it is considered an asset. But it’s called a depreciating asset because the value goes down over time.

I visit Kelley Blue Book online and look up the trade-in value when I include a vehicle on my net worth tracker. You can also use the private sale value instead. However, only choose this option if a private sale is how you’d actually sell your vehicle if you decided to do so in the future.

Do you owe a loan on your vehicle? If so, be sure to list the debt under liabilities on your worksheet.

Real Estate

There’s a debate in the financial world about whether the home you live in is considered an asset. Personally, once I finish building my dream home, I plan to list it as an asset.

If you decide to list your house as an asset, you can visit Zillow to estimate its value for your net worth worksheet. Remember to list any mortgages you owe on the home as liabilities as well.

I will mention that many real estate professionals believe that Zillow isn’t accurate when it comes to home values. But Zillow works well as a quick solution to estimate your home’s value for net worth calculations.

2. List Your Liabilities

A liability is a financial obligation or something you owe. You’ll list your liabilities on the right-hand side of your Monthly Net Worth Tracker. Be sure to list the total balance you owe on each debt, not your monthly payment.

Liabilities can include:

- Mortgage

- Auto Loans

- Home Equity Loans

- Personal Loans

- Credit Card Debt

- Medical Debt

- Student Loans

- Etc.

Once you write down all of your assets, add them together, and enter the total on the worksheet.

3. Calculate Your Net Worth

Next, take your total assets and subtract the total liabilities you owe. The figure you’re left with is your current net worth.

Don’t be afraid if you get a negative number. I had a negative net worth for a long time. When you have a negative net worth, it just means that you owe more than you own.

You should work to improve your net worth as you grow older. But remember to be patient with yourself too. It takes time to change your budgeting habits, reduce spending, and pay off debt. Yet every step you take brings you a little closer to your financial goals.

4. Last Month vs. This Month

The final step on your worksheet is comparing your current net worth with last month’s figure.

Two simple formulas on your net worth tracker will help you review your progress from month to month.

- Change in Dollars = Net Worth This Month – Net Worth Last Month

- Change in Percentage = The Change in Dollars ÷ Last Month’s Net Worth (Move the decimal over two places.)

These two formulas will show you whether your overall financial picture is improving or declining. As you make good financial decisions, your net worth will increase. Poor decisions, however, will have the opposite effect.

Why Tracking Your Net Worth Matters

Your net worth isn’t a static number. It changes over time as you make different financial moves. For example, when I paid off my credit card debt, my net worth increased. The same thing happened as I paid down other debts (like student loans and my auto loan) and increased my savings. My net worth looked very different when I finally became debt-free than it did when I first started my budgeting journey.

The net worth tracker in your Budget by Paycheck Workbook can help you in two big ways. It can be an encouragement as you move closer to your financial goals. Tracking your net worth can also motivate you to adjust your budget if your progress starts to slow down or you discover you’re moving in the wrong direction.

Make sure to head to the Free Recourse Library to get your free Net Worth Worksheet!