Managing your money on your own is hard enough, but doing it as a newlywed is an entirely new challenge. You and your spouse have your own way of doing things, and it can be hard to find a way to work together on your finances.

In particular, conflicting money values can be detrimental to marriages. If one person is a spender while the other loves to save, this can cause a lot of friction.

One study found that if one spouse believes the other spends money foolishly, this increases their odds of divorce by 45%. Fortunately, you and your spouse can find ways to work together and use your natural money styles to complement one another.

5 Steps to Budgeting as Newlyweds

If you’re recently married, now is the perfect time to start working on your finances with your partner. Here are five steps to get you started.

Decide Whether You’ll Combine Your Finances

The first decision all married couples have to make is whether or not to combine their finances. And depending on your preferences, this will look a bit different for everyone.

For instance, some couples choose to keep the majority of their finances separate with just one or two shared accounts. Others prefer to combine their bank accounts, credit cards, and co-sign on all loans together.

Decide what’s right for the two of you based on your priorities. And if you decide to keep your finances separate, that’s okay — there’s no one-size-fits-all solution when it comes to marriage or money.

Be Honest About Your Financial Situation

Whether you decide to combine your finances or not, it’s essential to be honest about your current financial situation. If you’re bringing a lot of debt into the marriage, that’s something your partner needs to know about.

For many people, this may start by being honest with yourself about your finances. Many people avoid looking at their outstanding debt out of fear or guilt. If you’re not sure where you are financially, take the time to figure it out so you can communicate openly with your spouse.

And when you communicate with your spouse about money, it’s crucial to create a judgment-free zone. Even if your partner has made some poor financial choices, approach the situation from a neutral point of view. Doing this will allow you both to come up with a plan to move forward.

Talk About Your Financial Goals

Now that you and your spouse know where you’re at financially, you can begin to talk about your future goals. Too many married couples don’t know their financial priorities or where they’re trying to go.

First, it’s important to make sure you and your spouse have the basics in place. That includes:

- Getting rid of debt: If either of you has any high-interest credit card debt, you should come up with a plan to pay it off immediately.

- Come up with an emergency fund: You and your spouse should have a six-month emergency fund. Doing this will help you avoid relying on credit cards in the future.

- Having a plan for retirement: If you haven’t already, you and your spouse both need to start setting money aside for retirement. The sooner you get started, the more likely you are to reach your retirement goals.

Once you have the basics covered, you can begin to discuss the other financial goals you and your spouse hope to reach. For instance, do you want to buy a house in the next five years or save for a memorable trip?

Write your financial goals down and discuss what steps you can start taking to reach them. For instance, if traveling is a priority, you might consider setting up a travel sinking fund.

Create a Budget Together

Now it’s time to create your first budget as a married couple! And don’t feel bad if this is not a pleasant experience at first. Budgeting stresses most people out, and it will take time to figure out how to work together on your budget.

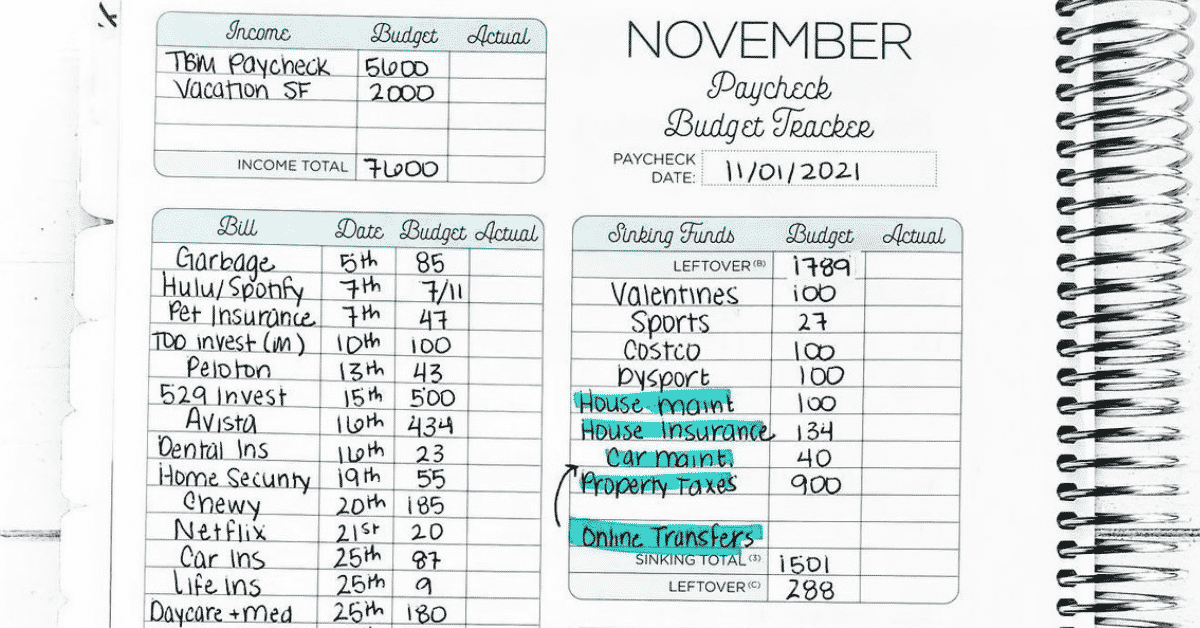

Start by figuring out your combined take-home pay and deciding what kind of budgeting approach you’ll take. Personally, I recommend using a zero-based budget where every dollar you earn is assigned a job.

Once the budget is complete, there shouldn’t be any money leftover. I’ve found this strategy to be the best way to take control of my finances and avoid overspending.

When you’re creating your budget, be sure to plan for monthly expenses, long-term expenses, debt payments, and savings. From there, you can modify as needed and track your monthly spending.

Schedule a Monthly Check-In

Unfortunately, the hard part is not over once you’ve come up with that first budget together. You and your spouse need to continue to review your budget and talk about your money every month.

You may consider scheduling a monthly money check-in where you review your budget and talk about how you did that month. You may realize that you’re overspending in certain categories and need to cut back.

The point is, your financial situation will continue to evolve and grow, and your budget will as well. It’s important to be flexible, work together, and always strive for open communication about your money.

The Bottom Line

Whether you decide to combine your finances or not, managing your money as a newly married couple may not be easy. But if you continue to work together, you will get better at it and start to make progress toward your goals.

Make sure to keep the lines of communication open and set the judgment aside so you can find a system that works for both of you. And if you need more tips on budgeting and managing your money, be sure to check out my nine steps to financial freedom.