When it comes to budgeting, there are a lot of different mediums you can choose from. Popular apps make budgeting and tracking your expenses simpler than ever.

Many people like to budget using the standard Excel spreadsheet. But personally, I still prefer pen and paper budgeting, which I always recommend to beginners.

There are tangible benefits to writing down your budget every month that you can’t re-create using a spreadsheet or app. So in this article, I’m going to explain why I think writing out your budget every month is the way to go.

The Benefits of Pen to Paper Budgeting

Increasingly, screens are taking over every part of our lives. And in many ways, it’s a good thing. Technology makes it possible for many of us to work from home, and it allowed our kids to attend school virtually during the pandemic.

But there are certain things technology can’t effectively replace, and budgeting is one of those things. And that’s because something special happens when you write something down on paper.

A Harvard Business study looked at MBA graduates and found that the 3% who wrote their goals down earned 10 times as much money as the remaining 97%. Putting pen to paper forces you to think about your goals and what you’re trying to achieve. Bağlama Büyüsü

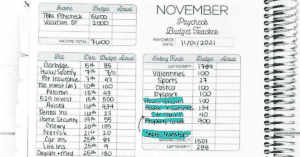

Using the Budget By Paycheck method helped me pay off over $77,000 of debt, save more money, and get control over my finances. Plus, when you write out your budget, it can become a creative expression too.

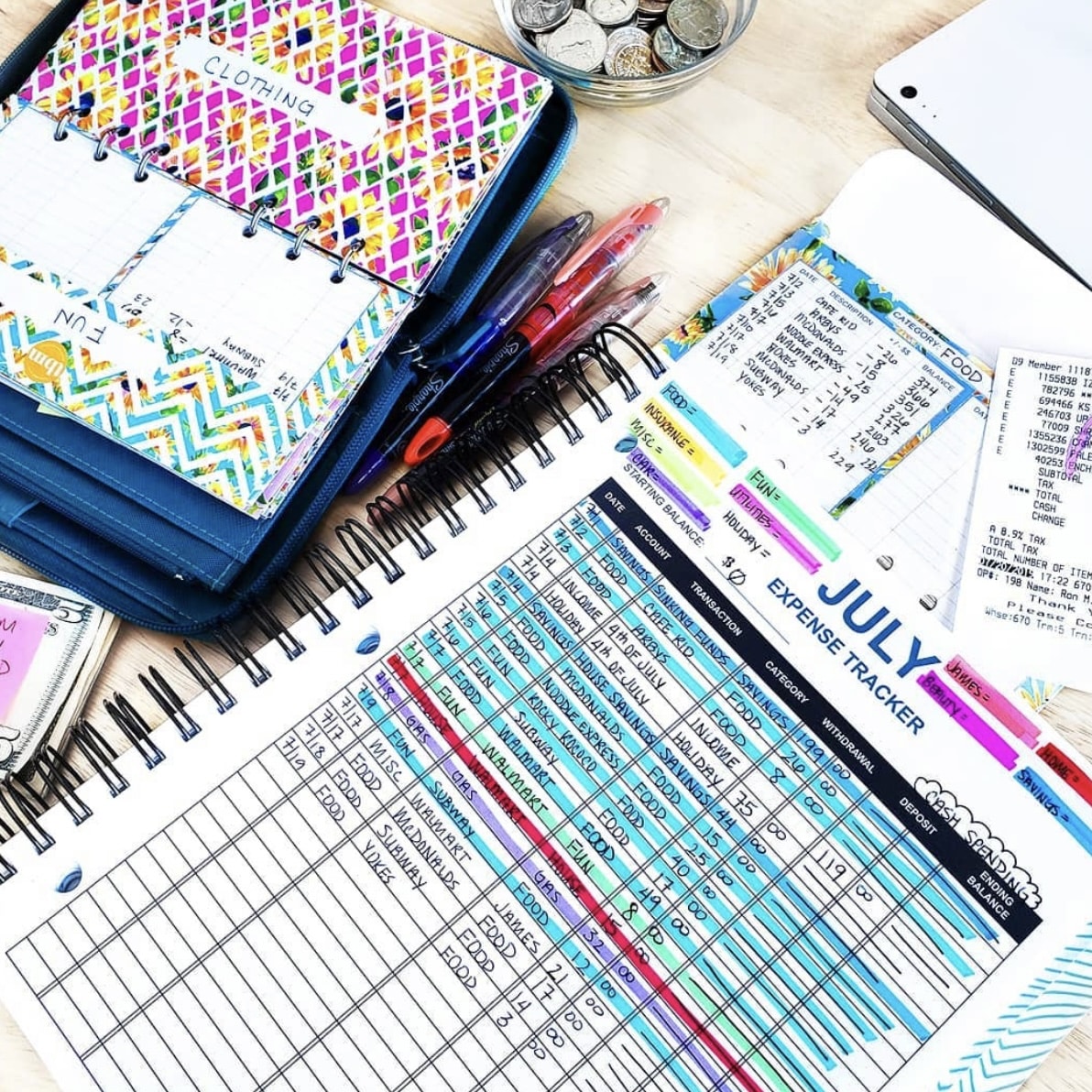

That’s why the Budget By Paycheck planner comes with artwork, and I encourage you to use highlighters and have fun with the process. When you make the process enjoyable, you’re more likely to see results from your efforts. And once you start seeing results, you’ll be motivated to stick with your new habit.

Pen to Paper Budgeting vs. Apps

Many people start off using a paper budget because it’s the simplest way to get started. You don’t have to worry about making sure your devices are charged or remembering to save anything.

With the pen to paper method, you can create your budget exactly the way you want. You don’t have to work with the pre-set spending categories an app automatically gives you.

But pen to paper budgeting can feel more time-consuming since you have to re-create your budget every month manually. So at some point, many people look for an app or spreadsheet to use instead.

Apps are convenient because you have them with you at all times, and it takes less legwork for you to create your monthly budget. Many apps will track your spending automatically, so you can see how well you’re sticking with your budget.

However, it’s hard to customize an app to suit your personal budgeting needs. And there are psychological differences between using an app and writing your budget out every month.

When you put pen to paper, the numbers start to feel more real to you. You really begin to analyze your spending and evaluate whether you’re happy with your results or if you want to try something different.

5 Steps to Starting a Pen to Paper Budget

If you’re new to budgeting, I think putting pen to paper is the most effective strategy. Here are five steps to getting started.

1. Write Down Your Goals

Why do you want to budget and track your spending every month? Budgeting can feel tedious at first, so there needs to be a bigger goal fueling your actions. Once you identify your “why,” you’ll have an easier time pushing through the frustration and desire to give up.

That’s why in my Budget By Paycheck workbook, I have you identify your short-term, medium-term, and long-term goals. That way, you’re saving for a purpose and will have an easier time staying on track.

2. Make It a Habit

If you want to stick with budgeting, you need to make it a regular habit. I recommend coming up with a daily or weekly schedule for updating your budget and sticking to it no matter what.

If working on your budget daily seems like too much of a time commitment, then you may want to work on it once a week. But I wouldn’t wait too much longer than that. If you go too long without working on your budget, your expenses will start to add up, and it’ll feel overwhelming.

3. Commit to It for a Year

Have you ever heard that it takes just 21 days to form a new habit? The truth is, it’s hard to see significant progress with anything after just three weeks.

I created my first budget in 2011, and it took me nearly a year before I started seeing signs of success. That’s why I recommend that you commit to budgeting consistently for at least a year.

And have very low expectations for yourself that first year. It’s okay if it takes you time to figure out how to make your expenses work with your income. After a year, you’ll start to see signs of progress and will be so much more confident in your abilities.

4. Use a Template

I think so many people like apps because it gives them a framework to start with. It can be intimidating to start with a blank sheet of paper to write out your budget. Fortunately, there are tons of templates you can use for pen to paper budgeting.

I recommend finding one that works with you and making it your own. For instance, many people like using bullet journals for budgeting. You can also try the Budget By Paycheck workbook or the downloadable PDF.

5. Make It Fun

And finally, budgeting may be challenging initially, so you should look for ways to make it fun. Use a pretty budgeting template, highlighters, and color in your savings trackers as you go.

You can also try using colorful cash envelopes. I actually have an entire free resource library you can check out, and I’m always updating it with new helpful printables.

And make the process easier on yourself by staying organized and sticking with a predictable schedule. Over time, you may find that you start to look forward to and enjoy the time you spend working on your budget.

The Bottom Line

There are many advantages to technology, but I find that pen to paper works best when it comes to budgeting. Writing out your budget every month will make the numbers more real and help you stay on track with your goals. Commit to budgeting consistently and look for ways to make the process more fun.