Living on a budget can be as challenging as sticking to a diet or committing to a new workout routine.

At first, you feel energized and excited about the future. The inspiration alone is enough to keep you moving towards your goal. But somewhere along the way, distractions begin popping up. The first few distractions aren’t too bad, but it eventually becomes exhausting to remain focused on your budget.

Does this sound familiar? If so, you have likely experienced budget burnout.

Budget burnout makes it difficult to execute even the most meticulously prepared budget. Fortunately, burnout is temporary, and there are many tactics you can practice to stay the course. Here are a few of my favorites.

1. Check-in with your financial mindset.

A few weeks ago, I wrote about how to improve your financial mindset to achieve your goals in 2021.

There’s a reason this was the first blog post I published this year. Our mindset is the foundation upon which our ability to commit to a goal is built. If budget burnout is beginning to rear its ugly head, then take a moment to check in with your financial mindset.

Are you practicing self-affirmation? Are you focusing on frugality over cheapness? Have you been able to embrace the abundance mindset? And are you practicing gratitude for everything in your life?

Mindset might not sound like a significant differentiating factor between success and falling off the wagon. Still, I promise that the right mindset will make this financial marathon feel more like a journey rather than a grueling race.

2. Give yourself permission to splurge.

If you’ve ever tried a new diet or workout routine, you may be familiar with the concept of “cheat meals.” The basic idea is that by sticking to a healthy diet, you can “earn” a cheat meal that you can enjoy — without feeling guilty about any of the calories. Multiple studies have shown that cheat meals help dieters eat healthier throughout the week without an increased risk of unexpected splurging or binge eating. In other words, because dieters have something to look forward to (the cheat meal!), they are more likely to stick to the diet or workout routine.

Similarly, it is ok to give yourself a budget splurge! This may look different from person to person. For example, if you’ve eliminated restaurants from your budget, treat yourself and your family to take out once a month. For others, maybe a guilt-free shopping day is the perfect reward for staying true to your budget. Carefully planned splurges will help remind you that a budget is about moderation, not deprivation.

Are there any risks to splurges?

Going back to the fitness analogy, the most common temptation is to turn a cheat meal into a cheat day… into a cheat week… into a cheat month.

To prevent splurges from turning into unintended budget busters, try thinking of them as rewards. For example, “If my family and I eat home-cooked meals all week, we can enjoy takeout on Friday night.” Another example might be, “If I’m able to exceed my savings goal for this month, then I’ll reward myself with a manicure.”

3. Shake-up your budget system.

When you experience budget burnout, it is a potential indicator that something is off. Maybe your mindset could use rejuvenation, or you need to reward yourself with planned splurges. But what if the budgeting system itself is off?

We all change, evolve and grow over time. The budget system that worked incredibly well for you last year might seem tedious and time-consuming for you this year. The good news is that the general principles around finances are the same regardless of which “system” you use. It’s all about money coming in vs. money going out.

During my debt payoff journey, I tried so many different budgeting methods. Because I faced those struggles, I was able to ultimately create the Budget by Paycheck Method and base it around a zero-based budget.

Simply put: income – expenses = zero.

In other words, every dollar in your budget has a “job.” If your monthly income is $3,000, then each of those dollars should be going somewhere, such as paying your mortgage, student loan debt, and contributing to your retirement accounts. Every dollar is accounted for, and nothing should be leftover.

Are you burned out from trying to pay off debt? Well, there are multiple debt payoff strategies The snowball method focuses on paying off debts with the smallest balance first, whereas the avalanche method focuses on debts with the highest interest rates first. If you feel burned out when it comes to debt payoff, then try switching up your strategy! Remember, the only mistake you can make is to stay stuck and not make those payments!

No matter which system you choose, I recommend giving it a good try for at least a few months. Switching from system to system can result in more frustration, so I suggest picking a plan, trying it out for a few months, then re-evaluating from there.

4. Make sure your goals are still realistic.

Let’s say you’ve done everything listed above – you have a healthy financial mindset, you enjoy responsible splurges, and you have a budget system that works for you.

Does that mean that you will never experience budget burnout? Not necessarily.

Double-check to make sure that your financial goals are realistic. Don’t get me wrong — it is great to have ambitious goals such as paying off credit card debt in a year or increasing your emergency fund by $3,000 in six months. But stretching any budget too thin with unreasonable deadlines can result in burnout and discouragement.

Try focusing on one goal at a time. For example, let’s say you have multiple savings goals: creating an emergency fund, saving for a down payment on a house, and saving for retirement.

Instead of trying to save for everything at once, maybe consider setting aside a few months to focus on building up that emergency fund. Not only will this make it easier to achieve your goal (which will be a motivational boost), it will also provide you with financial peace and stability in an unpredictable market.

If you want to save for everything simultaneously, then make sure that the timelines for your goals are reasonable for your budget, accounting for unexpected expenses along the way.

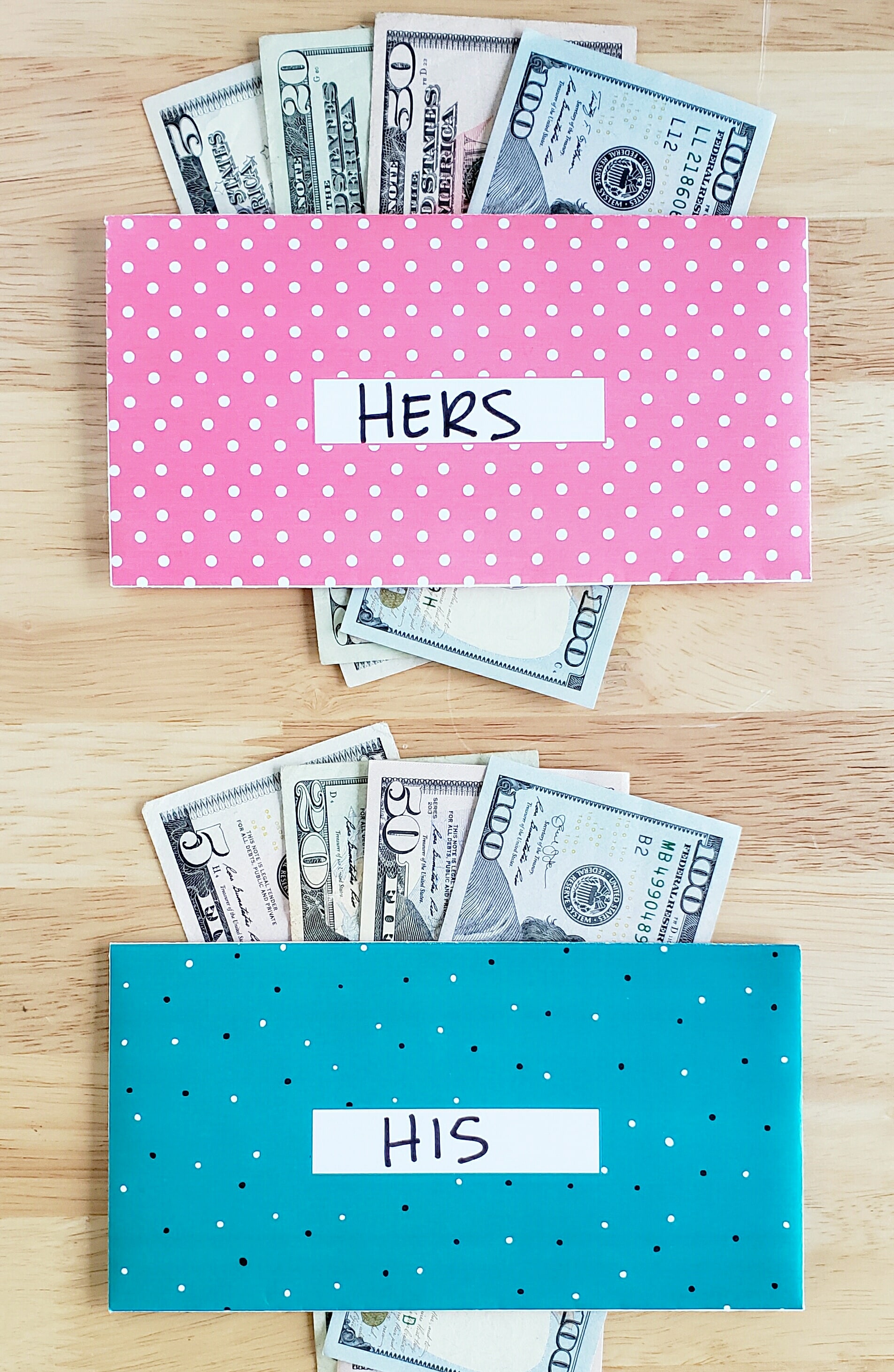

5. Share budgeting control.

It’s not unusual for one person to manage the entire budget for a household. But just because this isn’t unusual, this doesn’t mean that it isn’t stressful. Don’t get me wrong — if this system works for you and your partner, then, by all means, continue doing it!

But if you find yourself overwhelmed managing the family budget, try sharing the responsibility with your partner. After all, sometimes it’s better to have two sets of eyes on the numbers instead of one! If you want to pass the torch completely, then make sure that your partner is as attentive to detail, numbers, and deadlines as you are. There is no shame in sharing the responsibility or passing the torch. Family budgeting is all about trust, communication, and working together to achieve those goals!

Have you experienced budget burnout?

If so, I hope these tips are able to help you stay the course! And if there are any other strategies that you’ve implemented to stay motivated, please feel free to share those ideas in the comments below!