When it comes to my finances, I am old-school. I like paper. There's something about writing things out and holding something physical in my hands.

But when you're staring at a mountain of debt, using paper and a pencil just won't cut it. That's where technology steps in.

I know what its like to feel overwhelmed, to feel like things are so bad you're at a loss as to where to start paying it all down. When I began my debt payoff journey, all I had was a list of debt. That's it. No plan, no strategy, and no clue on how to begin paying it off.

One day, I started to read about the different ways you can pay off debt, and that's when I discovered debt payoff apps.

Oh man, I went crazy.

There were so many cool apps that showed me so many things, like giving me a date when I would be debt free and how much interest I could save over time using different methods.

Debt repayment apps have the power to help turn your messy pile of debts into a simple list of numbers anyone can tackle. For me, I needed a tool to help me form a debt payoff plan I could execute successfully. Something that made things easier.

If you need to create a plan to pay off your debt. If you need something to motivate you. If you need something that will show you the finish line, the best debt management app can make a huge difference.

Here are five free debt payoff apps that I recommend.

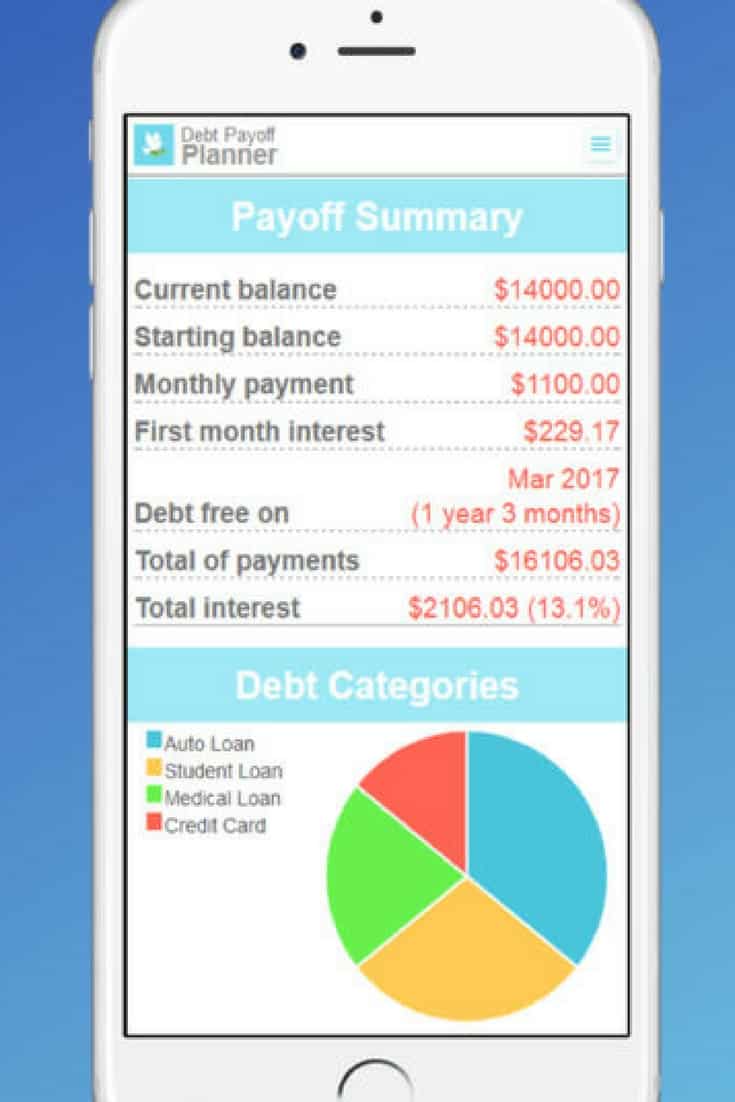

DEBT PAYOFF PLANNER

Available: IOS & Android / Downloads: 100,000 | 4.2 Rating

The one thing I love about Debt Payoff Planner is that it allows you to review each method – Debt Snowball vs. Debt Avalanche. For each method, you can see how long it will take to pay off your debt and how much interest you can save using each technique. This is great for people who have yet to decide which payoff strategy they want to use.

Read: How to Choose A Debt Payoff Strategy

For me, the easiest way to stop feeling overwhelmed by debt is by creating a specific, step-by-step plan for paying it off, and this app will help you get there.

There is no login required. You just download the app and start using it. That's it.

To create a customized debt repayment schedule, you will need the following: Current balance of the debt, the APR, and the minimum payment amount.

Steps You Need to Take:

- Enter your loans and debts

- Enter any additional monthly payments you can make

- Choose a debt payoff strategy

- Get your custom free payoff plan

One feature that I love about this app is the ability to track payments. When I make an additional payment towards my debt, outside of the minimum payment, I want to see how it will affect my overall plan. What kind of impact did it make? With the Debt Payoff Planner app, it will update the time-frame for becoming debt free when you input new payment information. Just type in the amount and the date the extra payment was made. This is an excellent feature if you want to see your progress over time.

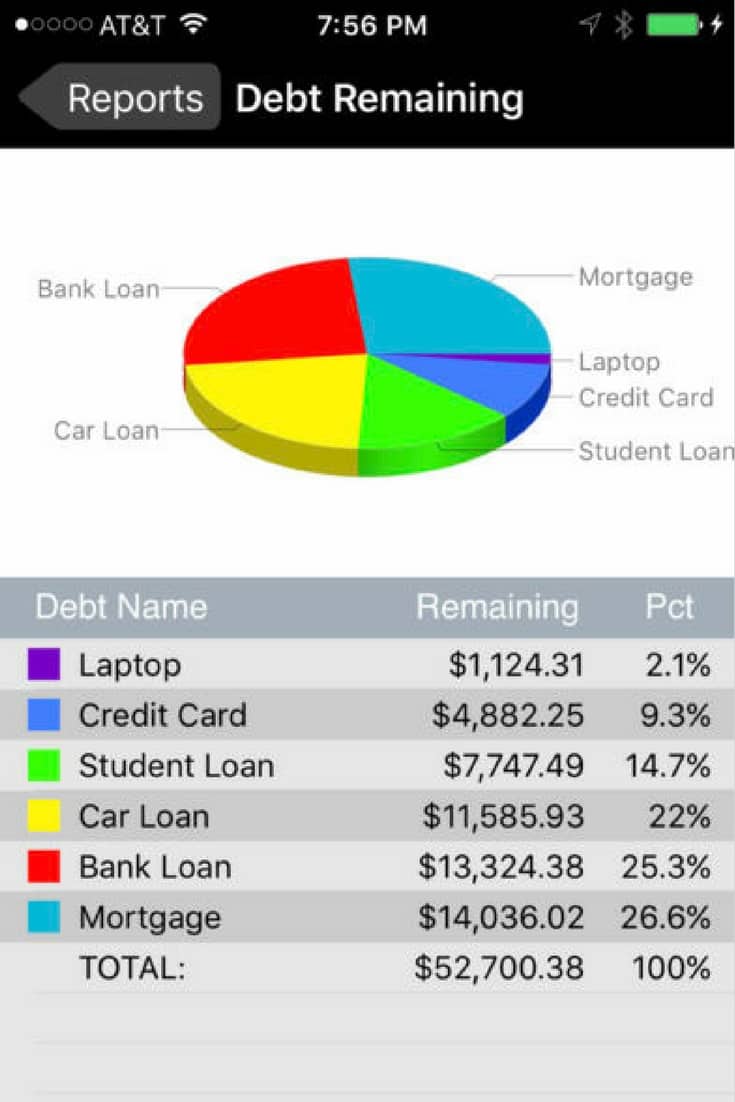

DEBT PAYOFF ASSISTANT

Available: IOS Only / Rating: 4+

Debt Payoff Assistant focuses paying off debt using the Snowball Method. With this method, you pay off your debts from smallest to largest, regardless of the interest rate. You make the minimum payments on all of your debts until your first debt is paid off. Then you would use the extra payment from the paid off debt and apply if the next debt. The amount of the extra payment will grow as more debts are paid off which results in a “snowball” effect.

A lot of people like using this method because it gives you a sense of accomplishment relatively quickly by tackling and paying off the smallest debt first.

With this app, you can track an unlimited number of debts, and though it does focus mainly on the Snowball Method, you can still choose between multiple payoff strategies: lowest balance first, highest balance first, highest interest first, or a custom plan that you create.

You can also track extra payments. Making extra payments towards your debt will allow you to pay off your debt faster.

One of the main features I like about the Debt Payoff Assistant app is the charts and graphs. I am a visual person, so seeing my progress in chart-form is great. You can see things like your total debts, debts remaining, total interest paid, and total interest saved. I especially love the percent paid progress bar for each debt. This helps motivate you and gives you a quick way to see your progress for each debt.

Get “payment due” notifications, use their payoff date calculator to see how the monthly payment amount will affect your payoff date and total interest paid, and so much more with this app!

DEBT TRACKER

Available: Android / Downloads: 50,000 | 4.0 Rating

![]()

The free version of Debt Tracker on Android is a great tool to see all of your debts in one place. The one thing that stood out to me about this app is its simplicity. There is no fluff or extra add-ons.

With this app, you can track your debt manually offline. You don't have to enter account numbers or sensitive bank information to get started. If you don't mind entering debt manually in exchange for security, then this app is for you. You also keep your data secure on your phone by keeping your debt private with a secret PIN code.

This app has all of the features you need to choose a debt payoff strategy, and start implementing it right away. You can easily organize your debt by name and size. You can also track payments, penalties, and interest fees as you work through your debt payoff plan.

The one thing that makes this different than the two apps listed above is that you can also track who owes you money!

It's also a savings tracker. Are you saving for a vacation, a car, or something else? With this app, you can track your progress toward other financial goals which allows you to see more of an overall picture of your finances.

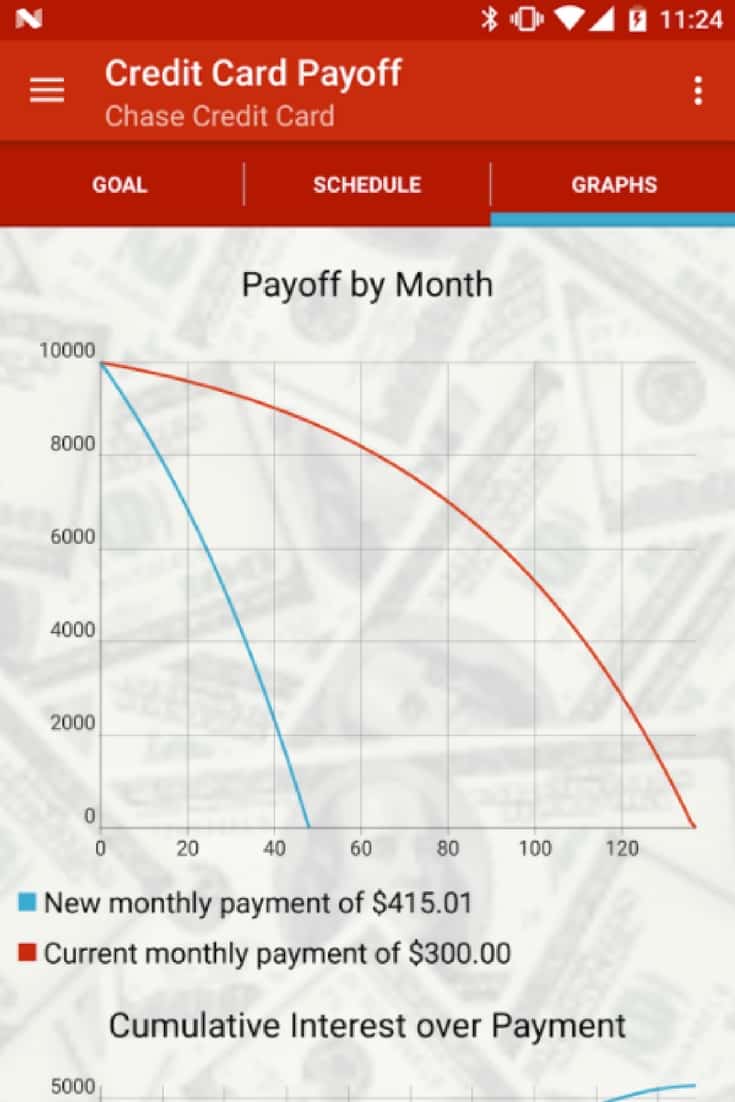

CREDIT CARD PAYOFF

Available: Android / Downloads: 5,000 | 4.2 Rating

If you are only focusing on paying off your credit cards, this is a great app to have. It's great for defining your payoff goals and does an amazing job calculating monthly payments and gives you tons of motivation by allowing you to see how far one small extra payment can go.

When paying off debt, I like to see comparisons. What does my debt payoff plan look like if I do it this way? Or if I make a minor change and do it this way? What if I add a little extra money to this monthly payment? What happens to my debt payoff time horizon?

This app does a fantastic job of letting you see those comparisons. It allows you to create a new monthly payment schedule on one tab and keeps your current payment schedule on another tab. You can then see the changes between principal, interest, monthly charges, and remaining balance for each payment tab.

It's a great app for figuring out how much to pay each month to pay off your credit card entirely in “x” amount of months. If you have a date you would like to be “credit card” debt free; this app will tell you exactly what you need to do to get there.

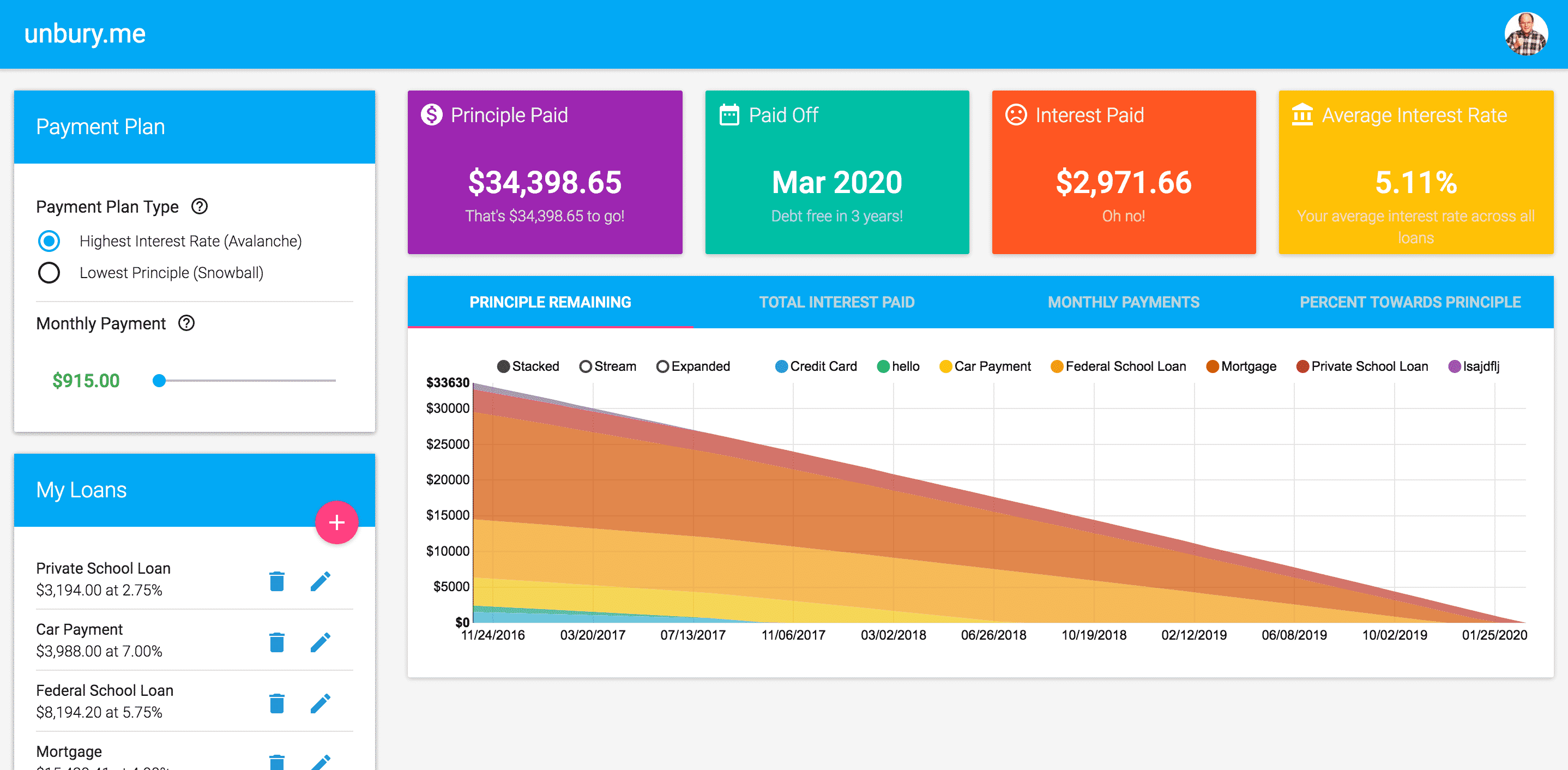

UNBURY.ME

Available: Online

This tool is only available online but it's so good I had to mention it. It's a smart tool that lets you explore different debt repayment options. The best thing about this tool is that it gives you clear graphs that make it easy to understand and visualize the benefits of each, even if you're not a money nerd.

You don't have to log in to use the tool, but if you would like to be a returning user, you can sign up to keep track of ongoing debt repayments.

If you have multiple forms of debts such as school loans, car loans, credit cards, and a mortgage I highly suggest using this tool. This tool is best used for comparing different types of methods.

Throughout my debt repayment journey, I have downloaded and used at least ten different tools. The best piece of advice I can give you for you to be successful is…do your research first. Find the app or tool that will work best for your situation and stick to it. Don't bounce around between tools. This will become overwhelming, and eventually, you will lose interest. Trust me; I've been there.

Use a tool like unbury.me and find the method you would like to use to pay off your debt. From there, use one of the apps listed above to track your debt repayment progress. Enter in all extra payments and see how it affects your overall plan. The most important thing is sticking with it.

MORE DEBT PAY OFF APPS

- Qoins App – automated way to help pay off debt

- Tally App – automated way to help pay off credit card debt

Have you used a debt repayment app? Which one do you like best and why? Let me know about it in the comments below!