For the longest time, I used an excel spreadsheet to document and budget successfully. The problem I kept running into was convenience.

I would be in line at a grocery store, and a random thought about an upcoming bill would enter my mind. The need to write it down was there, but since my budget was in electronic form on my desktop, I didn't have access to it to make adjustments.

I have been a successful budgeter since 2011, and during that time I learned exactly what I need to track, plan, and prepare my finances. The problem was, I couldn't find anything on the market that I could buy that had exactly what I wanted.

What do you do when you can't find what you're looking for? You create it yourself. In 2016, the Live Rich Planner became a reality.

The Live Rich Planner is something that I have access to any time I need it, it's small enough to fit in my purse, and it has all of the pages I need to organize my busy mom life and my finances.

Today, I wanted to walk you through how I use my 2018 Live Rich Planner. I am going to show you the exact steps I take to set up a new budget every month, and how to use the pages in the planner with my budget-by-paycheck budgeting method.

Keep in mind that I budget my income according to my paychecks. If you are a monthly budgeter, the 2018 Live Rich Planner is still a great option. The pages have an outline for your finances, but they are set up in a way for you to budget using any method that works best for you.

Before we dig in, I first want to answer a question I get from a lot of readers.

What is the difference between the Budget-by-Paycheck Workbook and the 2018 Live Rich planner?

The Budget-by-Paycheck Workbook is exactly that, a workbook. It was designed with all of the tools you need to set up and start using an effective budget. In the workbook, there is a blank monthly calendar, but there is no place to write down appointments, or upcoming events on a daily schedule or overview.

The workbook is a more advanced guide to my budget-by-paycheck budgeting method. Think of the pages as worksheets. The worksheets in the workbook were created for you to write down answers to specific tasks to generate an overall budget.

The Live Rich Planner is exactly that, a planner. Though it does contain personal finance pages to document your budget, savings, and debt. The planner acts as a guide and gives you an overall picture of your budget. Like most planners, there is a daily schedule for planning upcoming events and appointments.

WHICH ONE SHOULD I BUY?

If you are looking for detailed direction on how to set up a budget, and need step-by-step guidance, then the Budget-by-Paycheck workbook is the one you should look at.

If you need something to document your finances but are looking for something that can organize more of your overall life, then the Live Rich Planner is the best option.

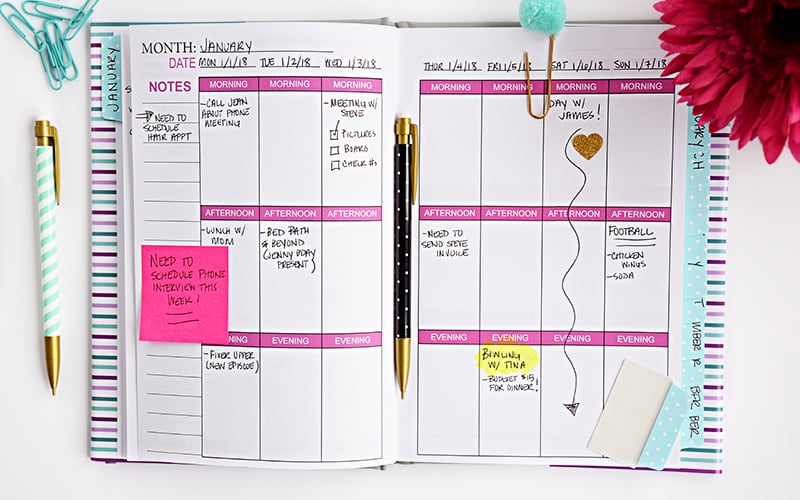

First, I use the undated monthly calendar to write down when all of my bills are due. I highlight them in pink so I can quickly see when bills are due each month.

When I pay my bills, I put a little check mark next to it on the calendar. This tells me quickly which bills I have paid. When my bill clears my checking account, I cross it out. As you can see, paying my bills consists of three steps. Highlighting them on my calendar, marking it with a check mark once I pay them, and then crossing them out when the bill clears my checking account.

I also use the monthly calendar to mark any upcoming events, meetings, lunch/dinner dates, and any little reminders.

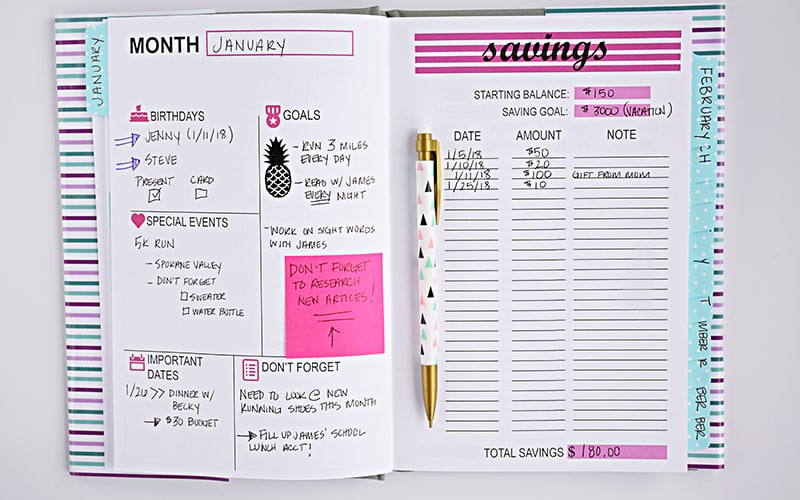

The next monthly section in the Live Rich Planner is the goals and savings tracker. The savings tracker is a great way to remind yourself that your making progress towards the things that matter most. I know the feeling when you're only able to save $10 or $25. It feels like it's useless. But over time, the small wins add up. The savings tracker reminds you of that.

I only do one savings goal at a time. For me, when I have a ton of things I am saving for, I tend to lose direction and motivation because it takes longer to save for five things than it does for one thing. It's easier to stay focused when you are working toward one savings goal.

If you have multiple things you want to save for, that's fine. Just keep a couple of blank spaces between each goal, and track your savings for each.

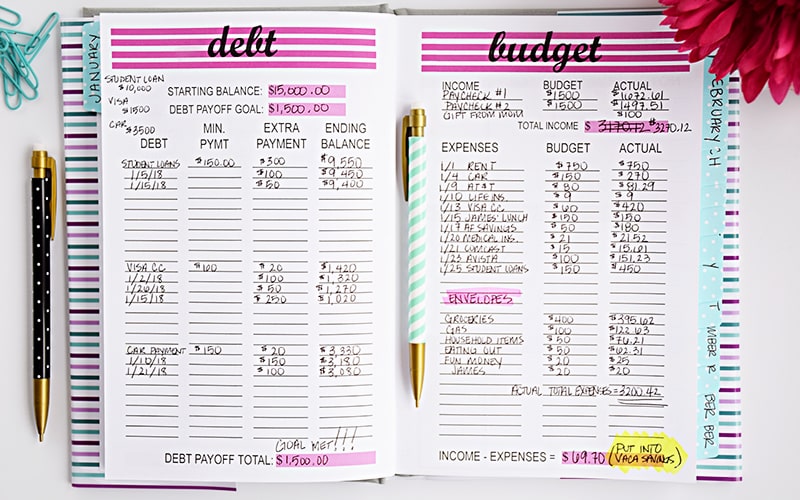

The debt tracker helps you keep everything in perspective as you pay off debt. In the example above, there are three debts that I'm tracking – student loans, a Visa credit card, and a car payment. Just like the savings tracker, if you have multiple debts or savings goals, keep a couple of blank spaces between each and track each one.

I keep track of the minimum payment I have to pay every month and also any extra payments I'm making along the way. I keep a running tally of each debt I am tracking and total how much I have paid off at the end of every month.

Before you start tracking your debt, make sure you have a debt payoff plan. This will tell you how long it will take to pay your debt off and which debts you need to pay first.

Your debt payoff goal is the amount that you would LIKE to pay every month. This number is usually any supplemental income you have every month. The Budget Sheet on the right will help you figure out how much extra money you have every month to put towards debt or saving.

List all of the expenses that you HAVE to pay and subtract that total from your total monthly income. Any money left over is called your supplemental income. In the example above, my supplemental income is already figured in because I already knew how much money I had left over every month.

Start with the budget on the right, then figure out your savings goal and debt payoff goal.

At the end of every month, there are eight pages for daily planning. Each day consists of a morning, afternoon, and an evening time slot. For me, when I am planning out my day, it easier to see it visually if it's broken down into these three categories. Use the date areas at the top of each day to write the date.

I like to start each month with the monthly calendar. Once all of my expenses are written down, I use the budget sheet. From there, I set up my savings and debt payoff goals for each month.

For me, my income fluctuates a lot. It's not the same every month. Because of this, my supplemental income changes month-to-month. This means my savings goals and debt payoff goals will change every month.

That's it! That's how I use my 2018 Live Rich Planner. If you have bought one, I hope this guide helps you with the overall process. If you are interested in seeing a page-by-page preview of the two new designs, you can see them here: Floral Design & Stripe Design.

Do you have the Live Rich Planner? I would love to read about how you are using yours in the comments below.