The holidays are a wonderful time of year, and there’s nothing quite like getting together and celebrating with your family. For some people, the holidays are an excuse to completely blow their budget and spend a lot of money.

But if you’re trying to pay down debt or reach your savings goals, this isn’t an option. Fortunately, you don’t have to spend a lot to create a memorable holiday meal that everyone will enjoy.

Here are seven steps to creating a budget-friendly holiday dinner:

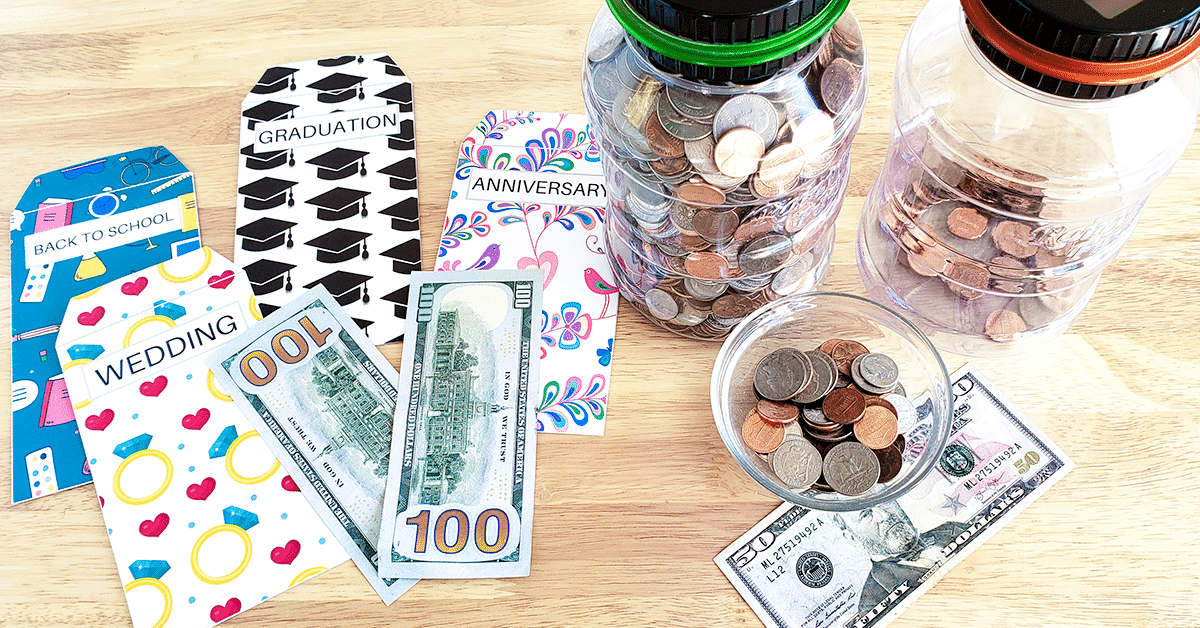

1. Create a holiday sinking fund

For many people, the holidays are stressful because of all the added expenses. They committed to hosting dinner for their extended family but don’t quite have the room in their monthly budget.

As a result, they end up charging those expenses to a credit card. Because they’re charging the money instead of paying in cash, they will likely end up overspending. As a result, they feel guilty about spending the money at all.

That’s why I recommend having a holiday sinking fund. You know the holidays come every year, so why not save that money ahead of time? Figure out how much you usually spend over the holiday season, and set that money aside in a holiday sinking fund.

2. Start preparing early

At this point, it may be hard for you to save enough money in your sinking fund to cover the upcoming holidays. But there is still time for you to plan and take advantage of available coupons and discounts.

Make sure you plan your menu at least two to three weeks before the event takes place. This will give you time to watch out for sales and snag the items you need at the best price possible.

Start watching the sale items at your local grocery store since many stores will begin putting some of them on sale. And you can look for manufacturer or store coupons online.

3. Go easy on the decorations

If you’re hosting family and friends for the holidays, you probably want your home to look festive. There’s nothing quite like hanging lights and setting up lots of evergreens and garlands.

But skip having lights professionally installed on your home. The cost will vary depending on the company you use, but on average, it’ll cost you somewhere between $150 and $400. If you don’t feel like you can safely hang outdoor lights yourself, then consider forgoing this tradition altogether.

And as tempting as it may be, don’t go to Target and load your cart up with holiday decorations. Individually, those items may not seem to cost very much, but you can easily blow through hundreds of dollars doing that.

If decorations are important to you, I recommend checking out Amazon for some good deals. And even better, check out Pinterest for tips on how you can DIY your decorations.

4. Limit the guest list

If you want to cut down on the budget, limit the number of people you invite to your holiday dinner. Only invite immediate family members or people you really want to be there.

This will make it easier to plan the menu and cook dinner for everyone. And hosting a smaller dinner will allow you to enjoy more quality time with the people who do come.

5. Keep the menu simple

Most of us associate the holidays with overindulgence, so it may be tempting to try to make a few fancy dishes you wouldn’t fix otherwise. But if you want to keep the budget down, skip the specialty butcher, expensive wine, and fancy cheese and just keep it simple.

You can probably find many of the items you’re looking for at your local supermarket. And if possible, try to purchase seasonal items only. For instance, baking an apple pie is going to be less expensive than homemade blueberry pie. And avoid buying ingredients that you know you’ll probably never use again.

6. Make it a potluck

One of the easiest ways to cut down on your meal budget is by making the event a potluck. This will also cut down on the amount of work you have to do to prepare the meal.

Contact your guests ahead of time and let them know it’ll be a potluck this year. Make sure to give them plenty of notice so they can come up with a side dish to contribute.

If you don’t want to make the entire meal a potluck, you could just ask your guests to contribute a pie or holiday cookies. That way, the desserts are out of your hands and something you don’t have to worry about.

7. Keep it alcohol-free

For many people, alcohol adds up to one of the biggest expenses at their holiday meal. And if you’re having a lot of people over, these costs can go through the roof pretty quickly.

If you’re trying to save money, I recommend keeping the gathering alcohol-free this year. The holidays can still be enjoyable even without beer or wine to serve to your guests.

If this isn’t an option, there are ways to cut down on the alcohol costs. If you buy wine in bulk, you can significantly cut down on the price tag. And look for a decent wine at an inexpensive price. You may be able to find some good options at Trader Joe’s.

And you can also consider making the event BYOB. Instead of hosting a potluck, you could ask everyone to bring their beverage of choice.

The Bottom Line

The holidays don’t have to be an excuse to blow your budget or rack up more credit card debt. With a little creative planning, you can prepare a holiday dinner that is memorable and budget-friendly.