Banks should be a place to safely store your hard-earned money, not a place where unexpected fees lower your balance. According to data from the Federal Deposit Insurance Corporation (FDIC), banks that manage over $1 billion in assets collect over $11 billion annually in bank fees from consumers.

Budgeting is already tight, especially in today’s world. By being aware of the different types of bank fees, you can protect your money and achieve your financial goals. Below is a checklist of common bank fees and tips to avoid them.

1. Minimum Balance Charges

To avoid this fee, choose a bank account with a minimum balance requirement that fits your budget. If you’re not already using direct deposit, consider asking your employer if this is an option. Direct deposits minimize the likelihood of forgetting to deposit a check-in time for an upcoming bill.

Another way to avoid fees is to set up alerts and automatic transfers. Setting up alerts will ensure you’re aware if your balance is running low or if any suspicious activity has occurred. Similar to direct deposits, automatic transfers can help you meet your goals. For example, CIT Bank offers higher interest rates for people who deposit $100 a month to their savings account. In this case, direct deposits can help you avoid fees and help you take advantage of premier savings rates!

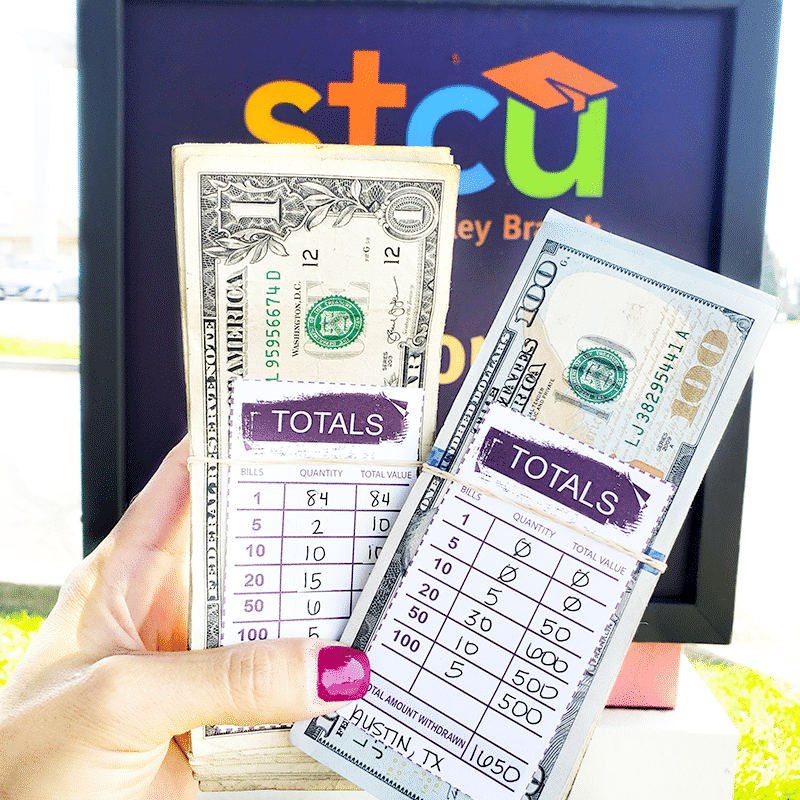

2. ATM Charges

The average ATM charge is $4.69. If you’re withdrawing as little as $10 to $20, then you’re paying anywhere from 46.9% to 23.4% of your withdrawal just to use the ATM! But that’s not all: the ATM charges you both a fee to the ATM provider as well as the bank. Using the nationwide fee average would mean you would pay $4.69 to the ATM provider plus an additional $4.69 to your bank. That’s a pretty hefty fee!

To avoid this fee, make sure that you use an ATM that is affiliated with your bank. Many bank apps can even help you find nearby ATMs that are fee-free. The best way to avoid this is to withdraw cash in advance whenever you’re near your bank.

Of course, there may be emergency situations that require you to use an ATM that is not affiliated with your bank, but I recommend doing that as a last case resort.

3. Excess Activity Fee

This is a common bank fee that many people don’t know exists. Logically, most people believe that if their money is in the bank, then they can touch it any time. It makes sense, right?

Well, some banks have limits on the number of transactions you can perform each month. For banks with these policies, there’s usually no limit on deposits, but there is a limit on how many withdrawals you can perform per month. These excess transaction fees can range from $3 to $25 per transaction. It’s not uncommon for the fee to increase as your additional transactions increase.

To avoid this fee, use your checking account for every day withdrawals and bill pay. Most of these fees apply to savings accounts, but it’s always a good idea to check with your bank and see if there are excess transaction policies for your checking account, too.

4. Wire Transfer Fee

If you need to send money to someone fast, a wire transfer is a safe, secure way to do it. In some instances, you may be required to use a wire transfer (official transactions such as a loan payoff might recommend this). However, wire transfers are expensive, averaging $20 or more per domestic wire and upwards of $35 for international wire transfers.

To avoid this fee, use consumer-friendly platforms like Venmo or PayPal when sending money to family and friends. Some banking apps even allow for person-to-person transfers via the app! Some official transactions may still require or prefer a wire transfer. Of course, you can always go the old-school method and mail a check — it’s pretty much free minus the cost of postage!

5. Returned Deposit Fee

Most of the time, banks charge you for the things you do. Sometimes, however, you can be penalized for the things you don’t do! For example, suppose you receive a check for your birthday, but the person writing you the check doesn’t actually have the money to cover it. The check will bounce when you attempt to deposit it. Sure, your friend or family member will be charged an NSF fee for the check bouncing, but you will also be charged a Returned Deposit Fee for attempting to deposit a check that is no good.

The Returned Deposit Fee ranges anywhere from $20 to $40, depending on your bank and where you live.

To avoid this fee, only deposit checks from people that you trust. Of course, it can be difficult to avoid getting stuck with a bounced check from someone else. It is also recommended to deposit checks as soon as you get them. The person writing you a check, for example, might have the money right then to be able to cover the check. But if you wait a month or two months to deposit the check, then they might not have the funds at that specific time.

6. Inactivity Fee

An inactivity fee will be charged to your bank account if you don’t perform any transactions within a specific time frame. This policy is different for many banks. Let’s say you have a checking account that you haven’t touched in 1 or 2 years. Your bank may then begin taking anywhere from $5 to $20 a month from that checking account until the balance is gone, and the account is closed. Some banks even start implementing inactivity fees with as little as six months of inactivity.

To avoid this fee, the important step is to contact your bank and understand what their policy is. By knowing your bank’s policy, you can ensure that you meet the minimum activity requirements to avoid the charge.

Again, setting up automatic transfers is an excellent way to avoid inactivity fees. The CIT Savings Builder, for example, makes it incredibly easy to set up alerts and automatic transfers at time intervals that make the most sense for your budget!

7. Lost Card Fees

There’s no denying that losing your wallet or having your wallet stolen is a nightmare. Aside from the stress of potential fraud, you have to go through the process of canceling your cards and requesting a replacement card.

The good news is that most major banks do not charge a fee to replace lost or stolen debit cards. Banks that do charge a fee typically average between $5 and $7.50. The major fee comes in if you request rush deliver. This can cost upwards of $30.

To avoid a lost card fee, the easiest solution is to go to your local bank branch and withdraw enough cash until the new card arrives. Aside from keeping a close eye on your wallet, another solution is to choose a bank that doesn’t charge a lost card fee.

8. Paper Statement Fees

It’s no secret that almost everything has gone digital. Most banks provide electronic delivery of your monthly statements. However, you are still included in paper statement mailing until you opt-out of that service. Banks will keep mailing you snail mail statements until you give them permission to only provide you with electronic statements.

It’s becoming increasingly common for banks to charge $1 – $2 per statement, especially as the cost of paper, postage, and administration continues to increase. Even if your bank doesn’t currently charge for paper statements, it is slowly becoming the norm.

To avoid the paper statement fee, the only solution is to sign up for electronic statements and to go paperless. If you still prefer to read your statement on printed paper, consider going paperless (to avoid the fee) and then printing out a physical copy of your statement at home.

9. Account Closing Fee

Are you studying abroad? Are you spending extended time with family in another state? Most banks require you to keep an account open for a certain amount of time. Closing your account too early will result in an account closing-fee. Depending on the bank, your account has to be open for 90 to 180 days to avoid the early closing fee. So if you are spending considerable time somewhere else but are not permanently moving, it might be a better decision to keep your home bank.

To avoid this fee, keep your account open for 90 to 180 days before closing. If you only need the account for a short period of time, inquire with the bank about their account closing policies!

A Note to Consider

Things happen. In some instances, a fee might be unavoidable.

The good news is that it’s possible to negotiate with your bank, especially small, local banks. If you do find yourself stuck with a fee, it doesn’t hurt to ask the bank to waive the fee. If you’ve been a loyal customer without any issues in the past, be sure to bring this up. In some cases, the bank will happily waive the fee for you.

At the end of the day, it boils down to understanding your bank’s policies and developing a relationship with them. Ask the right questions when using your bank. And remember, while fees are scary, don’t forget to consider the benefits your bank has to offer!