Most people assume that credit unions are just smaller versions of banks. But that’s not entirely true!

Knowing the differences between banks and credit unions and what they have to offer will make you more financially savvy. Not only that but choosing the right institution for your needs can save you some real money.

How is a Credit Union Different from a Bank?

Before we look at the different services that banks and credit unions have to offer, it helps to understand how they operate.

Most of us understand that banks exist to make money. In other words, they are “for-profit” companies, which makes them competitive in the business world.

BANKS

Banks can be local, regional, or national, and each is run by a paid board of directors. They have public investors who own stock in the bank. When the bank makes money, the surplus revenue is divided among these shareholders.

At a bank, you are simply a customer. Anyone can “join” a bank by opening an account or taking out a loan. You don’t have to be a shareholder to use the bank, nor do the shareholders have to be customers of the bank.

CREDIT UNION

On the other hand, credit unions are not-for-profit institutions (don’t confuse this with charitable non-profit organizations). Credit unions are community-based, cooperative financial institutions. This means the mortgage loan you may take out, comes from another member’s savings account.

At a credit union, you are not a customer, you are a co-owner. As such, you must be eligible to become a member. Credit Unions are legally required to limit their membership to people who share a common bond or association. While each one has different requirements, most serve specific groups like corporations, churches, communities, worker’s unions, small businesses… the list goes on. But chances are, if there is a credit union close by, you will meet one of their criteria.

When you open an account or take out a loan, your credit union will require you to make a one-time “new member deposit” to the Share Account. This is always a minimal fee – under $10 – but it is what entitles you to be a shareholder.

Unlike banking institutions which exist to make money, credit unions exist to serve the needs of the members. They are run by a volunteer board of directors who are also shareholders. Because they are not-for-profit, the money earned by the credit union is used to decrease fees and interest rates and to increase services to the community.

What Services do Banks and Credit Unions Offer?

Banks and credit unions both offer most of the same services:

- Personal and business checking and savings accounts

- Various types of loans, including home, auto, construction, and personal

- Credit cards

- Mobile banking

- Investment opportunities like certificates of deposit and money market accounts

One outstanding service that differs is CUSTOMER SERVICE.

Now, we all realize that customer service can vary significantly from day to day, branch to branch, and person to person. However, the level of personal attention you receive at most credit unions is exceptional. The atmosphere tends to be more laid back, and communication is core.

Because credit unions are community-based and each member is a co-owner, relationships are a priority. You are likely to encounter the same people at each visit. These developing relationships can make a real difference when you need a loan or experience a problem with your account.

At large banks, the customer service will be more professional and “by the book.” Employees cannot be flexible with rules or policy, regardless of how long you have been a loyal customer. Bank employees are loyal to the bank, so you won’t get the same personalized care you will encounter at most credit unions.

Another vital service that differs is ACCESS.

While credit unions excel at customer service, banks excel at availability.

Banks almost always have an extensive online presence, the latest apps, a 24-hour 800 numbers, numerous branches, weekend hours, and more ATM access. They stay on top of current technology to better serve you. This is one area where credit unions can’t compete at the same pace.

Otherwise, for most banking needs, the two offer identical services. Occasionally, specialized services that are standard at large banks might not be provided at some smaller credit unions, so make sure you ask before you join.

You will notice lower FEES.

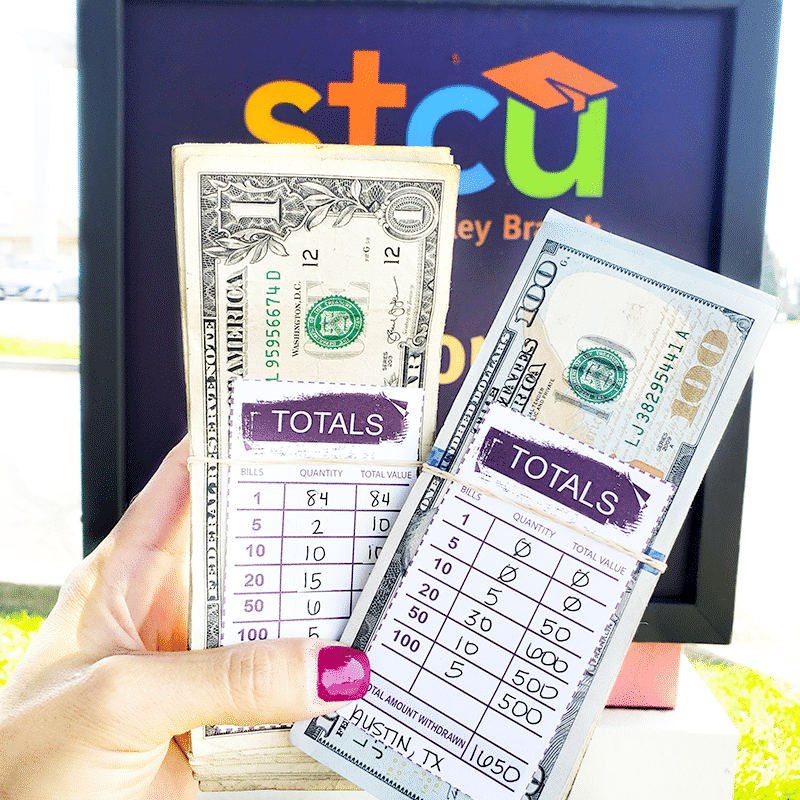

Compared to national banks, credit unions have lower and fewer fees. This is the main reason I switched from a traditional bank to a credit union in the first place. Besides fees, many credit unions offer checks, withdrawals, other electronic transactions free from fees. One of the best benefits with credit unions is that many of them offer checking and savings accounts with no minimum balance and without any monthly account servicing charges.

Do Banks and Credit Unions Offer the Same Interest Rates?

No! And this is the single factor that makes the difference for you financially.

Since banks are for-profit, they usually offer lower interest rates to be competitive. But, they also tend to have higher fees for monthly maintenance on checking accounts and steep overdraft charges.

On the flip side, credit unions are not in business for profit. As such, they do not have to be as competitive. Credit unions may have higher interest rates on their loans, but lower fees on checking accounts.

What this means for you:

If you are searching for a loan, a large bank is probably going to offer you the best rate. If you are looking for the best deals on checking and savings accounts, chances are a credit union is your best option.

Is My Money Safer at a Bank or at a Credit Union?

Your money is insured and considered safe at both types of institution.

- Banks are insured with government-backed funds by the FDIC (Federal Deposit Insurance Corporation) for up to $250,000 per account holder.

- Most credit unions are also federally insured by the NCUA (National Credit Union Administration) for up to $250,000 per account holder. Some credit unions, however, are covered by state-chartered private insurance, which is not as fail-safe in the event of a closure.

What this means for you:

If your particular bank or credit union folds, your account may end up at another institution, but the balance will be replaced up to that amount.

Bank or Credit Union: Which is Right for You?

Banks and credit unions are really two sides of the same coin. They both offer similar services and products, and they both have benefits and drawbacks.

Banks may work best for someone who needs unlimited access, wants the latest technology or is seeking the best interest rate. Credit Unions may be the right choice for someone whose priorities are personal service, community relationship, or lower fees.

I have been a loyal credit union member for over 3 years, and I would not want my money anywhere else. In fact, no hidden fees, minimum account fees, and exceptional service is why I trust my local credit union not just with my personal accounts, but also my business accounts. I love the freedom of having multiple savings accounts, and being able to organize my assets in a way that keeps me motivated on my financial journey.

Choosing between the two will involve some trade-offs. Identify your specific needs before you make a decision. After all, is said and done, having different types of accounts at both a bank and a credit union account may be your smartest financial option.