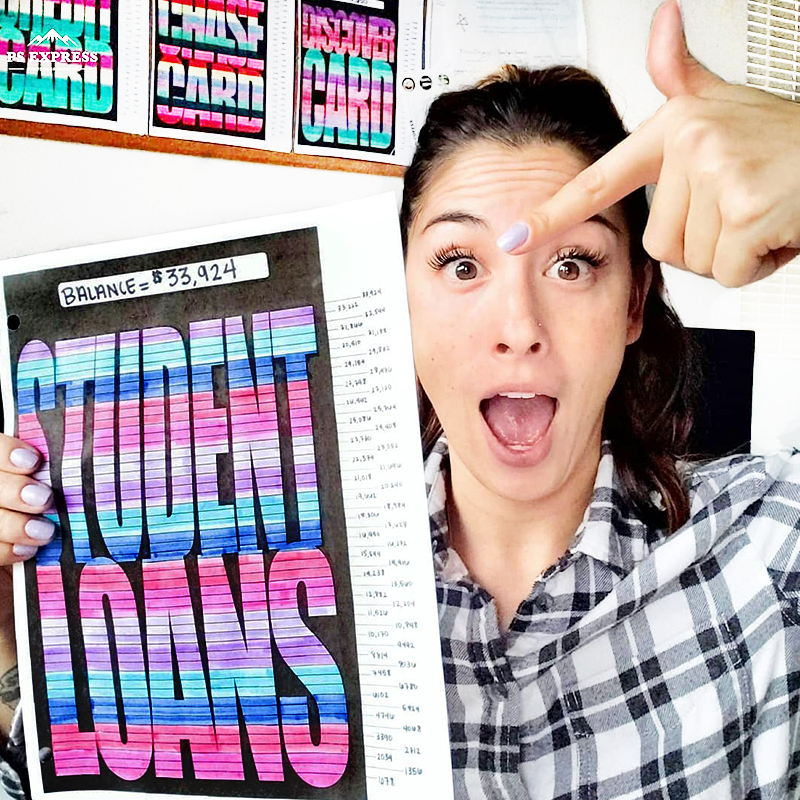

Once we leave behind our days in college and enter the workforce full time, most of us assume we’ll easily be able to pay off our student loans. But when reality sets in, we are finding the job market, and the cost of living makes paying off student loan debt much harder than we anticipated.

That’s why student loan forgiveness has become such a hot topic in the finance world.

In fact, student loan debt is at a crisis level in the U.S. It is the second-highest consumer debt – more than credit cards and auto loans – with only mortgage loans ranking higher.

According to Forbes, nearly 45 million people owe an incredible $1.5 TRILLION in student loan debt. For students from the Class of 2017, the average debt is nearly $30,000 per borrower, with more than 2.5 million of those having a debt of more than $100,000.

When the time comes to start making payments on your school loans, you may discover several different ways for repayment. One of these options you have likely heard about many times in the media and politics: student loan forgiveness.

The words sound good, don’t they? And they can be. It’s possible you can get thousands of dollars of your student loan debt forgiven. However, qualifying for this is an uphill climb, and the steps to loan forgiveness are steep and narrow. Before you get too excited, let me go over some of the details to help you decide if you are eligible for this option.

Student Loan Forgiveness Made Simple

I gotta be honest. It’s almost impossible to simplify this complicated topic.

First, I can tell you that student loan forgiveness is not a magical program that will completely dismiss your debt. But there are several programs in place that could result in the government freeing you from thousands of dollars in remaining debt if you qualify.

Second, these repayment programs are complicated. They have very specific requirements you must meet yearly. You must make timely payments on your loan while enrolled in specific repayment programs. If you fall short at any point – making a late payment, failing to notify the program of changes in your income, sometimes even paying ahead of schedule – you could be disqualified.

Still, if you owe considerable debt on your student loans, it’s worth looking into.

What Types of Student Loan Forgiveness Are There?

The federal government extends multiple alternatives for loan forgiveness. The primary ones are Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment Plan Forgiveness.

These options all demand years of repayment of service before you qualify for debt forgiveness.

What is Public Service Loan Forgiveness?

Public Service Loan Forgiveness is a relatively new program that seeks to encourage college graduates to enter the public or nonprofit sectors by offering loan forgiveness. This program provides the most significant advantages of the three student loan forgiveness options.

How Do I See if I Qualify?

Forgiveness is based on the organization for which you work, not on your job title or advancement. The PSLF requires ten years of your career to qualify. However, once you meet all the eligibility standards, the government promises to forgive the remaining balance of your loan. Also, you don’t have to pay income tax on the forgiven amount.

Some of these requirements are:

- You must work full-time

- You must work for federal, state, local, or tribal government, AmeriCorps, or Peace Corps as a full-time volunteer.

- You must have federal Direct Loans.

- You must repay your loans on an income-driven plan

- You must make at least 10 years of payments

- You must submit the Employment Certification for PSLF form each year of service leading up to your application.

These are just a FEW of the requirements. And the stories of rejection based on missing paperwork and minor details are abundant.

Now, you probably aren’t going to devote a decade of your life to a job outside your field just for the possibility of a loan reprieve. Especially since 99.5% of all applications have been rejected for various reasons.

Since the PSLF was only implemented in 2007, it is just now getting its start. But in 2017, over 40,000 people applied for forgiveness, and only about 200 were successful. Still, if serving the public or working for a nonprofit is your intended field of work, the PSLF might be worth pursuing.

Teacher Loan Forgiveness

With only a five-year requirement, the Teacher Loan Forgiveness option is the shortest of the programs. So, for those in the education field, this program can be helpful.

According to the U.S. Department of Education, if you teach full-time in a low-income school or other educational service agency for five complete and consecutive school years, you may be eligible for up to $17,500 forgiveness on your Direct or Federal Stafford Loans. This amount is also dependent on the subject you teach.

How Do I See if I Qualify?

The Federal Student Aid Office of the Dept. of Education offers the guidelines for the Teacher Loan Forgiveness program.

These requirements include (but are not limited to):

- Bachelor’s degree

- Full state certification

- Passing a rigorous state academic subject test in each of the academic subjects you teach

- Your school or educational agency must be listed in the Low-Income School Directory

- Have eligible loans under the Direct Loan Program or the FFEL Program

- Remain in good standing with your current loan repayment program

Again, these are just some of the requirements you must to apply for the Teacher Loan Forgiveness Program. The guidelines linked above will give you all the exact details.

Income-Driven Repayment Plans

Income-Driven Plans like Income-Based Repayment (IBR) or Pay As You Earn (PAYE) are a couple of several similar programs for those who are pursuing careers in low-paying fields.

Generally, if your current student loan debt is more than your yearly income, this type of long-term repayment program can assist you in managing your budget.

With income-based programs, your loan repayment is extended for up to 25 years, and your monthly payments will be held to 10% of your income. At the end of this long period, any remaining debt will be dismissed, though it will still be subject to income tax.

How Do I See if I Qualify?

These requirements include (but are not limited to):

- Only federal student loans are eligible for IDR plans

- Your monthly payments can’t exceed what the payments would be under the Standard Repayment Plan

- You must be able to prove financial need

If you are drowning in student loan debt, one of these income-driven repayment programs could help keep you afloat.

It is important to note a couple of issues with Income-Driven Repayment. First, if your income increases, you may become ineligible for your repayment plan. If this happens, you will have to revert to the standard plan, and all your time working toward forgiveness will become useless.

Second, if you extend your loan from the standard 10-year plan to an extended 20- or 25-year plan, not only will you stay in debt much longer, but your loans will also continue to accumulate interest. So even if you qualify for forgiveness at the end, you may not actually save money in the long run.

What’s more, none of the Income-Driven programs have been around long enough for anyone to have actually received forgiveness yet. So, whether or not you will really benefit from these programs remains to be seen.

Should I Pay Off my Student Loans Early if I Qualify for Forgiveness?

There are pros and cons to paying off your student loans ahead of schedule.

For one thing, student loan interest is tax-deductible up to $2500, even if you don’t itemize on your tax returns.

For another, student debt may be eligible for forgiveness or qualify for income-based repayment plans like IBR and PAYE discussed above. Also, these debt payment reductions do not have a negative effect on your credit.

However, it might be a good idea to go ahead and pay off your student loan if:

- Your loan has a variable interest rate

- You aren’t likely to qualify for any of the forgiveness programs

- You just want to get out of debt and be free from payments and interest

The Bottom Line of Student Loan Forgiveness

Keeping all these programs and qualifications in mind, there simply isn’t one right answer that fits everyone.

- If you feel you have a good chance of qualifying for one of the loan forgiveness programs,

- If you are struggling to make your student loan payments, or

- If your budget could best benefit from a long-term repayment program then I have helped guide you to the resources that will help you pursue forgiveness or extended repayment.

While the likelihood of qualifying for and receiving student loan debt forgiveness is very slim, I don’t want to discourage you if this is your best option. I just want you to understand that debt forgiveness is a long shot that may take years to occur.

However, if you don’t want debt hanging over you for the next 10-25 years, you might benefit more from paying off your student loans on your own. So, what I do want is to encourage you to do is this: Be proactive. Plug away at reducing your debt any way you can. Refinance your loan through a company like Credible. Also, increase your income so you have more income to throw at your debt.

Every payment you make puts you on the path to living your best life free from student loans.