Welcome to my very first blog income report and blog update. To be honest, I am freaking out a little. For the last four months, I have struggled with whether I wanted to start doing income reports. I am a huge fan of blog income reports, and I read them regularly. I guess you can say I am a closet income report junkie. I like reading them, but I have always been terrified of writing my own.

So why did I finally decide to publish my first blog update and income report? Well, there are a few different reasons.

LEARNING: I have learned a lot about blogging by reading other people's blog income reports. A lot of them are filled with helpful tips, amazing resources, and valuable information. As much as I don't want to admit it, I am still new to this whole blogging thing. The Budget Mom is only ten months old. I wrote my first blog post back in February of this year. If I could learn so much from other bloggers through their income reports, maybe another blogger can learn from mine.

I get a ton of emails every week from other new bloggers out there, desperately searching for answers. Since I respond to every single question via email, I figured it could be helpful to write about what I have learned, as well as my blogging journey in these blog update and income reports.

- Read: How to Start a Blog

TRACKING & ANALYZING: Nothing is more rewarding for a blogger than looking back at your work and realizing you have made progress. Blog income reports are an excellent resource when it comes to documenting your blogging journey. If you are consistent and write about your progress every month, regardless if you've made income, I believe you can learn a lot from it. So, that's why I have decided to write these reports every month, regardless if I make money.

I started TBM with the sole purpose of helping women manage their money. To be honest, when I first started, I had no intentions of earning an income from my blog. I still work full-time in the financial industry by day, and I make enough money to get by without income from my blog. However, as time passed, my outlook for my blog changed. The more that people referred to The Budget Mom as a business, the more I started to see it as one as well.

My goal on The Budget Mom will always be to help people and to provide the most valuable information that I can. If I can help one person be successful with their finances, then my purpose for The Budget Mom has been met. I don't focus too much of my attention on making income from this blog, so there will probably be reports that I write where I have no income to report. To me, that's okay. Documenting my journey and learning from my past decisions are more important to me at this stage of blogging.

TRANSPARENCY: Nothing is more important to me than being completely transparent with my readers and with other bloggers. I am a little different from other personal finance bloggers. Not only do I write about personal finance and money management here on the blog, but it's also my full-time job. During the day, I work at a financial advisory firm with other advisers. Because of this, I am also registered as a General Securities Representative and I hold my Series 7 designation. To put it simply, I am heavily regulated by FINRA (Financial Industry Regulatory Authority). I am restricted on what I can write about here on The Budget Mom when it comes to investment advice. I am also not allowed to have certain affiliate links on this site.

Being registered is one of the main reasons I have struggled with monetization. However, it's still important to me that I am as open as possible on how I make money here on The Budget Mom. When you see ads in my blog posts, there is a chance that I earn a monthly fee or commission from them. I have only done a few sponsorships, and those are income generating as well. But a huge majority of income I make is from selling my own products.

I hope one day to make a full-time income from my business, but for now, I am okay with learning as much as possible and figuring out what works best. Trial and error are a huge part of the blogging process, and I still have some time before I know what works and what doesn't.

The reasons listed above are just a few reasons on why I have decided to share these blog updates, but another huge reason is allowing you to see that it is possible to make money from blogging. People look at me like I am crazy when I tell them I make money through this blog, and they just don't understand it. This is my way of showing you that it is possible.

MY FIRST BLOG UPDATE & INCOME REPORT: NOVEMBER 2016

November was my best month yet in terms of traffic and income. For the first time, my blog hit over 90,000 pageviews (92,783). That is a massive increase from the previous month in October where I only saw 44,742 page views. My growth is 100% due to 3 blog posts that went viral on Pinterest.

- The Spend Well Budgeting System Giveaway

- 11 Glamorous Dollar Store Christmas Decorations for Any Budget

- The Ultimate Guide to the Cash Envelope System

I know that Pinterest traffic peaks and then starts to decrease, so I do expect my views to drop a little for next month. That means I have to focus on writing more valuable content to keep my pageviews at this level.

I am not happy with my Bounce Rate, and I want to concentrate more on improving this number. Right now, my plan of action is making some much-needed changes to my navigation and adding in related articles that I think my readers will find beneficial inside my blog posts.

I am using BoardBooster for my Pinterest strategy, and I have seen remarkable growth since I started using it. I would be lying if I said I had found the perfect strategy using BoardBooster. I am currently scheduling about 70-80 pins per day, and I am gaining about 100 followers per week.

I don't pay too much attention to my follower count. Click rate is much more important to me. I would rather have readers clicking over to my site than just pinning my content.

INCOME & EXPENSES

INCOME

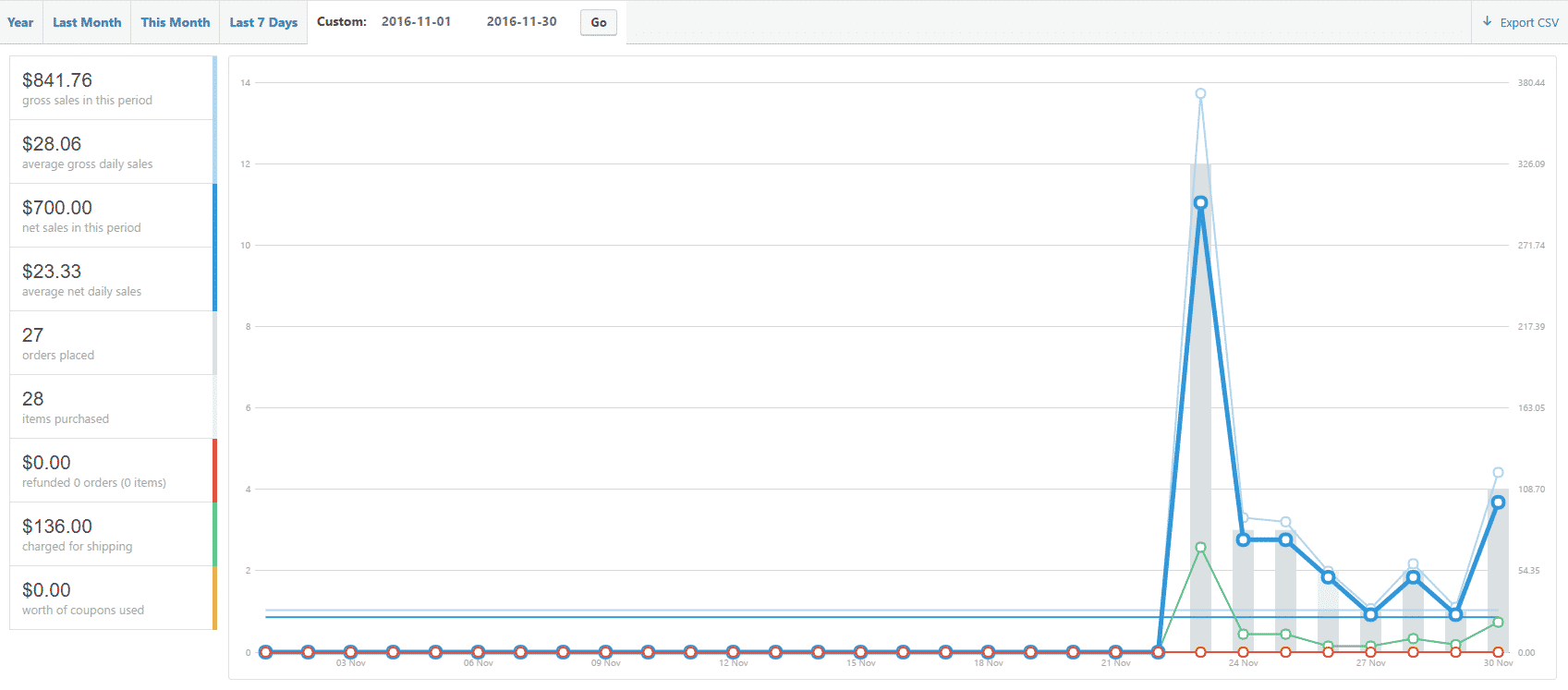

My primary source of income for this month was from selling my own products. This month, I launched my first physical product, the 2017 Live Rich Planner. To be honest, I had no idea on what I was doing or how to market it, so I believe my income could have been a lot better if I researched things more.

- PHYSICAL PRODUCTS: $841.76

- SPONSORSHIPS: $201.33

TOTAL INCOME: $1,043.09

You can read about how I created my first physical product HERE.

EXPENSES

From the beginning, I have always been a believer in investing in yourself. I was terrified to make my first purchase for the blog back in February, but I have realized that to be successful, you have to be willing to invest in yourself. My blog expenses are for things I feel are necessary in order to produce the best results for my business or my readers. For the first seven months of blogging, I paid for all blog expenses out of my own pocket. This means that I did not make enough income from my business to cover what I was paying for my blog, and I was and still am okay with that.

Trust me; my husband thought I was crazy to have more in expenses than I did income, but I knew that if I worked hard, the expenses would pay off. My expenses are things I feel are necessary, but I am always looking for more affordable options.

- BOARDBOOSTER (for Pinterest): $20

- CONVERTKIT (for Newsletter): $29

- PAYPAL PRO (for the Shop): $30

- DEPOSITPHOTOS (for Blog Images): $29

- ADOBE (for Editing My Own Images): $10.86

TOTAL EXPENSES: $118.86

NET INCOME (INCOME – EXPENSES): $924.23

For November 2016, I made $924.23 after expenses. This is the first month where my blog made enough to cover my expenses. That's huge for me. It's also important to note that I set all sales tax and 30% for taxes aside. All income listed in my income reports, is money that I have already received.

There is one expense that I use outside the realm of my blog and that's my Adobe Cloud subscription. I am trying to get better at taking more of my own images for the blog, but I am still not at a place where I feel like my pictures are good enough to use exclusively. I am an amateur nature photographer, so I do use my Adobe subscription mostly for that.

BLOG NEWS

I had a few huge accomplishments this month on The Budget Mom.

In November, I was featured on CBS News in an article on how to curb spending on kids' holiday gifts. For me, this was very exciting. It's just confirmation that I am heading in the right direction. It was an incredible opportunity, and I hope to be featured in more articles in the future.

If you would like to check out the article you can see it here: How to curb spending on kids' holiday gifts

In November, I was added as a member of the AOL Finance Collective. You can view my spot over on AOL here. On November 8th, my article “20 Things to Do on a No-Spend Weekend in Fall” was published.

BLOG GOALS

Setting goals is something I feel very strongly about. Without them, you kind of get lost in the blogging world. There is so much information, and sometimes you get pulled in 15,000 directions. That's why I set monthly goal and only focus on one thing at a time. It's realistic to want everything when you first start blogging; a million page views, a ton of social media followers on every platform, income, etc. But it's not realistic to think that those things will just happen overnight. It's also not helpful to focus on achieving all of these things at the same time.

I have always set one primary goal every month and focus on that goal for the entire month. It keeps me on track and allows me to focus on what I feel is really important without getting distracted.

MAIN GOAL: Reach 2,000 email subscribers. (Currently at 1,300)

Since starting this blog, I have always put a heavy focus on my email subscriber list. I have never fully dived into other social media outlets. Even though I know it's important to market your blog where you can, I feel it's more important to pay particular attention to your email subscribers. Your subscriber list is really the only thing you can call yours. It's unrealistic to think that a media platform like Pinterest will just fall off the face of the earth, but with the multiple levels of changes the platforms makes, it's not unlikely for them to change algorithms. You email list is simple. I don't have to worry about algorithms changing.

I also feel the obligation to pay more attention to my email subscribers because they are the ones who ultimately want to read your articles. They signed up for a reason, and even though a small portion only signed up for your freebie, a signficant portion is interested in what you have to say. That's an honor for me, and so I focus most of my attention on them.

OTHER THINGS THAT I WOULD LIKE TO SEE:

I would like to increase my social media followers. Every month, I like to write out individual goals for each platform. Even though I am not focusing all of my attention on social media, I do like to track my progress. For December I would like to see the following:

- Pinterest: 4,000 followers

- Instagram: 2,000 followers

- Facebook: 500 followers

- Twitter: 1,000 followers

- Pageviews: I would like to reach over 100,000 pageviews for the month of December. That means I will have to see over 3,200 pageviews every day. This seems impossible for me, but I am making some navigational changes on the blog that might help.

- Income: As I have said, income is not my focus here on The Budget Mom. My real goal is to make enough money to cover my monthly expenses, and that's it. That's the most important thing for me. However, it would be nice to see $1,000 net income for December.

You might be wondering why I am not entirely focused on monetization. Right now, I feel it's important to learn more about blogging, and how to implement what I have learned to be successful. To me, it's all about baby steps.

My blog update and income reports will be the only place where I talk about my journey with blogging. You can find any new income reports on my blog page under the blogging category.