After spending the majority of your time at home for over a year, you’re probably more than ready to take a vacation. But let’s face it — taking a vacation can get pretty pricey.

The average vacation for one person adds up to $1,145. So for a family of four to take a trip, you can expect to pay over $4,500 in all. That’s not even counting the unexpected costs that will inevitably arise when you’re traveling.

Sometimes, taking a vacation can feel like a luxury that you can’t afford. But it’s important to take time away to unwind occasionally. And if you plan ahead, funding a nice vacation is totally doable.

5 Ways to Budget for a Vacation

I’m a big believer in planning for your big expenses. When you start preparing for a big trip in advance, you ensure that you can pay cash for it and don’t have to rely on credit cards.

Let’s look at five steps you can take to budget for your next vacation or trip.

1. Choose your destination

The first step is to decide where you want to vacation. That’s because your location will largely determine how much you save for the trip. You’ll need a different budget for a weeklong vacation to Hawaii than you do for a weekend road trip.

If you’re not sure where you want to go, but know you don’t want to spend too much, try Googling “Most affordable family vacations in the U.S.” This can help you come up with some budget-friendly vacation spots your whole family will enjoy.

Once you’ve chosen your destination, you’ll want to decide on a date. Keep in mind that some locations will be more expensive to visit during peak tourist times. So if you’re able to visit during the off-season, you might be able to save some money.

2. Come up with a savings goal

Now that you know where you want to go, it’s time to set a savings goal and start planning for how you’ll meet your goal. Ideally, you’ll start planning this well in advance to give yourself plenty of time to meet your goal.

The best way to do it is to decide how much you want to save and then work backward to reach your goal. For instance, if you’re trying to save $2,500 for a trip, and you have 12 months to save, then you could plan to save roughly $200 per month for the next year.

If you want to make sure you stick to your plan, then I recommend setting up a separate savings account for your trip. Look for an account that doesn’t charge any fees, and start transferring money to save for your trip. Ideally, this will be an account you won’t see every day, so you won’t be tempted to spend the money.

Once you know your monthly savings goal, it’s a good idea to set up an automatic transfer every month. That way, you continue to save without having to think about it.

How do you figure out how much to make your savings goal? This is where a mock budget comes in.

Start writing down everything that comes along with trips – airfare, rental car, hotel, food, fun, shopping, etc. Start researching the destination you're wanting to travel to and figure out what the prices are looking like for each different category. From there, you'll have a rough number to play around with that will give you a good idea on how much you will need to save.

3. Start looking for deals

Once you know where you’re headed and how much you plan to save, it’s time to start looking for deals on trips. I recommend looking for all-inclusive packages from places like Costco Travel, Orbitz, or Travelocity.

It's important to note that not all destinations offer all-inclusive packages, and sometimes they may not be the best bang for your buck. Be sure to do research and explore all of your options so you ensure you're getting the best deal that's available.

When you purchase a package, your biggest expenses like airfare and lodging are covered. You may even find a deal that covers transportation as well. This will save you from having to search for the lowest deals on airfare and hotel rooms.

Look for a package that fits within your savings goal so you don’t go over budget. For places like Mexico and Caribbean countries, I highly recommend checking out the all-inclusive vacation packages that include drinks and food.

This will save you so much money on food and drinks throughout your stay. Of course, all-inclusive packages can vary greatly, so make sure you understand exactly what’s included first.

4. Budget for activities

Once you have your airfare and lodging set up for your trip, you still need to plan for what you’ll spend on activities once you get there. For instance, do you plan to visit any museums or parks? Or do you plan on doing any more expensive activities, like scuba diving?

My best recommendation is to budget for these items, but wait until you get there to purchase them. You may be surprised to find that you don’t actually save that much money by buying them ahead of time.

5. Don’t forget the extra expenses

And finally, don’t forget about all the extra little expenses that come with taking a vacation. Do you have to pay to have your pets boarded for a week while you’re gone? If you don’t have an all-inclusive trip planned, then you’ll also need to account for food while you’re away.

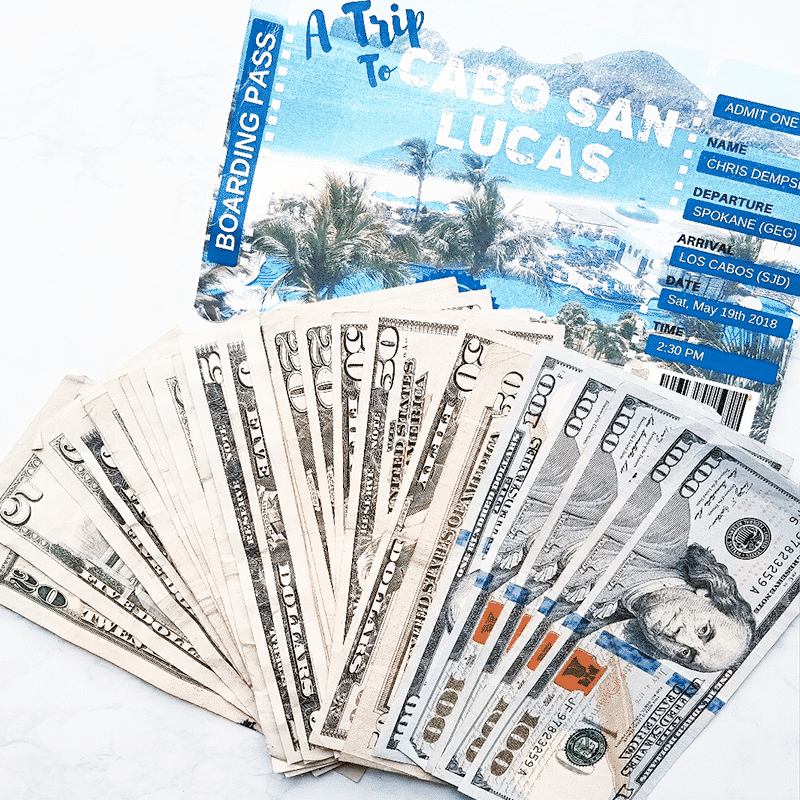

And some activities will make you pay for photos of your outing. For instance, when I took a trip to Cabo, some of the adventures didn’t allow you to bring your cell phones or take pictures. So you may want to set some money aside for photos as well.

The Bottom Line

After this past year, we’re probably all due for a vacation! But in all seriousness, it’s so important to take time to get away from your daily life. And when you plan ahead, come up with a budget, and save for your trip, taking a vacation is a very doable, guilt-free expense.

Do you plan on taking any trips this summer? If so, where do you plan on going and when? Let me know in the comments!