I am finally back from my 6-day all inclusive vacation to Cabo San Lucas. It was definitely a trip I will never forget and I learned a lot along the way.

If you have been paying attention to my Instagram stories, then you know I have been wanting to share some saving tips that I used on my amazing adventure.

There are a lot of different ways you can save on a vacation, and the tips I'm wanting to share are from my own personal experience. I am hoping that by sharing my experience, you get some helpful tips for your next planned vacation.

THE SAVINGS PLAN

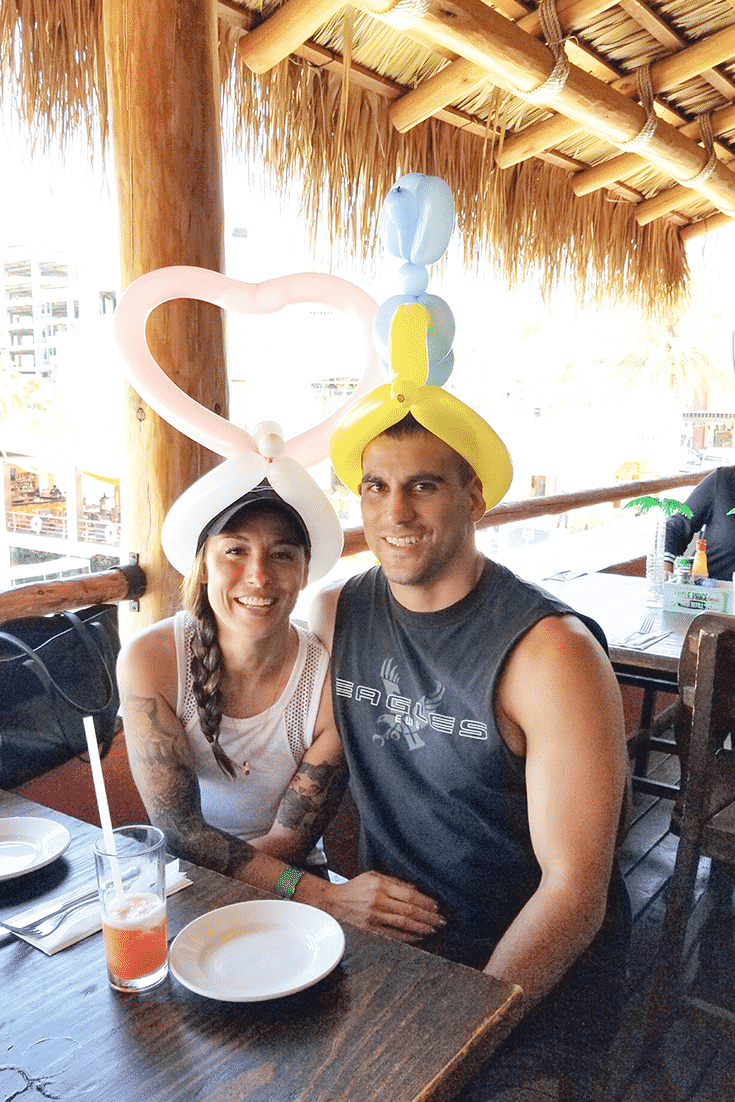

The whole purpose of this trip was to celebrate my boyfriend's 30th birthday. I knew I wanted to do something special and memorable from the get-go.

I started planning something to celebrate his birthday about a year in advance. That gave me plenty of time to save and plan.

If you don't know this already, I am a planner at heart. It's what I do. It's what I enjoy. I always feel better when I have a plan in place and I am able to know exactly what's going on. That doesn't mean I don't like being spontaneous, it just means I know I can save more money by planning ahead, especially with international travel.

Tip #1: Start planning early.

My savings plan for the trip worked kind of backward. I knew I had about a year to plan and save, and since I had a good grip on my budget, I knew how much I could afford to set aside for our vacation.

With my budget, I could afford to save about $150-175 every month. With my time frame (a year), I took that number and multiplied it by 12.

I knew that $175 was my budgeted number, but that didn't include any extra income that I could also put towards our vacation. So, I set my goal.

Tip #2: Set goals.

A year in advance, I set my goal for $3,000. That gave me exactly 12 months to save and put every extra dollar towards a surprise trip for Chris.

So where did I put my saved money?

The extra money from my budget ($150-$175 a month) went into an individual investment account at American Funds. All of the money in this account is invested in mutual funds. I wanted my money invested in something relatively safe because essentially it would be used for a short-term savings goal.

I had Vicki, the lady who does our payroll, pull $35 out of every paycheck and she sent the check directly to American Funds. This made it impossible for me to spend the money, and it put “paying myself first” on autopilot.

With $70 a month getting pulled directly from my checking account and being sent to American Funds, I also set up automatic investments. I called American Funds and asked that they pull $50 on the 18th and 28th of every month from my checking account.

I get paid on the 5th and 20th of every month, so I wanted to make sure that the dates that I set for my automatic contributions were scheduled for a few days after that. This made sure that the money was in my checking account in case of holidays or other delays.

Tip #3: Always use a separate savings account.

As you can see, the money from my paychecks was getting put into the individual investment account that I had labeled “vacation.” That took care of my savings from my regular budget.

But what about any extra money that I came across during my year of saving?

I bank at a local Credit Union, and they let me have multiple savings accounts without fees. Currently, I have 6. For any extra money outside of my normal budget that I was able to save, I opened a savings account that I labeled “vacation.”

If you are saving for a specific goal, I always find it easier to have a designated separate savings account. It's even better to have one that's not at the same institution as your regular checking account. Anything you can do to make spending your saved money harder, the better!

In total, I was able to save $3,108 for my all-cash paid vacation.

THINGS THAT I INCLUDED IN MY VACATION BUDGET

I made sure to put $250 in a miscellaneous cash envelope before we left for Cabo. This was my first time out the country, and I wasn't quite sure what to expect. I made sure to have money for any unexpected expenses that came up. Thank gosh I did! It saved me more than a few times, and even though the costs weren't outrageous, it still made a difference, and it made me feel more comfortable, which is the most important thing.

One of the things I learned on our vacation was tipping. It's huge down in Mexico. I had all of my spending cash with me; however, when I exchanged it into Pesos, I didn't get a lot of smaller bills. I ended up using a lot of smaller U.S. bills that I had, which means I missed out on the exchange rate. It's one of the things that I wish I would have planned better. Lesson learned for next time.

I gave myself $100 U.S. every day for spending money, but having all-inclusive made it hard even to spend $50 U.S. while we were there. We only ate a few times off of the resort, and a big chunk of my spending money (more than 50%) was spent on tips.

I also researched our Cabo Adventures before we left. I budgeted $250 U.S. for pictures and other souvenirs.

If you buy an all-inclusive package, make sure to have a miscellaneous and tip budget. Those became our most essential budgeting categories while we were there.

FINDING THE BEST DEAL

My boyfriend's birthday is in July, but I wanted to make sure I took advantage of holiday deals around November and December of the previous year.

When I started my planning process, I knew I wanted to go somewhere tropical, but I didn't have a specific destination in mind. All I knew, is that wherever I picked, it had to fit inside my saved budget ($2,000).

I started researching some packaged deals online, and since I am a Costco member, it made sense to start there. I have heard from family and friends that Costco Travel is easy and affordable, so that's where I started my planning journey.

After looking at all of their packages in October, I knew I wanted to go to Mexico. It was cheaper than the Hawaii packages, and I had a recommendation from a friend to visit Cabo.

When Black Friday rolled around in November, I jumped online to see if I could find any packages to Cabo for under $2,000. It was pure luck that I found an all-inclusive trip to Cabo for $2,040.

Since the trip was all-inclusive, I knew that finding the best airfare or the most affordable time to book a hotel didn't matter. It was included in the package.

I know there are a ton of articles out there that try to guess the best times to book hotel rooms or airfare, but honestly, I didn't want to go into all of the research. I knew when I wanted to go, and how much I could afford, and that was the driving force behind my decisions.

Tip #4: Take advantage of holiday deals.

BUYING ALL-INCLUSIVE

Hands down, the number one thing that saved me the most money. When I was looking for a vacation package, having it be all-inclusive wasn't that important.

Now, after doing it, I wouldn't do it any other way. I literally saved more money on food and drinks than what I paid for the entire vacation package.

I documented my receipts on my Instagram stories to show you the power of having an all-inclusive package, but just in case you missed it, I will break down the details of what my all inclusive status actually included. It's pretty mind-blowing!

Tip #5: “If you have the option, research and purchase all-inclusive.

Of course, all food and drinks were included in my vacation package. That's what all-inclusive means. However, it's whats included in that all-inclusive status that matters. How many restaurants are there to choose from? What drinks are included?

My all-inclusive package was amazing! Not only did it include FREE room service (yes, room service 24 hours a day), but it also included the following:

– Unlimited meals at over 50+ restaurants at 3 different resorts

– Unlimited drinks (Non-Alcoholic & Alcoholic)

– Unlimited pool-side service (Food & Drinks)

Many people who saw my Instagram stories reached out to me to let me know that their all-inclusive status didn't include nearly as much as ours. Sometimes, that is the case. Make sure to click on the “All-Inclusive” button on your vacation details when purchasing your vacation to get full details.

PURCHASING TOURS AND ADVENTURES

One of the things that surprised my boyfriend and I was the amount of sales vendors. We were literally bombarded the second we stepped off the plane.

People were trying to sell us promotional deals, timeshare, souvenirs, and taxi rides. It was overpowering.

Just a heads up. If you are approached at the airport after you get through customs for a free breakfast buffet at another resort – DON'T DO IT! They will try to offer you a free breakfast buffet and free tours to go check out another resort. The deal they are offering seems good, but what they are really asking is that you go sit at a presentation for six hours hoping to sell you a timeshare.

From my experience, it's best to say “no thank you” and walk away. Luckily, I was a telemarketer at one point in my life, and I understood what they were really trying to do. A couple that we met on one of our adventures wasn't so lucky. They spent their first day down in Cabo at a 6-hour presentation about purchasing timeshare.

Tip #6: Wait until you arrive at your destination before purchasing tours or adventures.

One of the things that we got asked a million times while we were in Cabo had to do with purchasing tours or adventures. There were vendors on the streets just waiting to offer us dolphin rides, ATV tours, camel rides, and sailboat tours.

I had already purchased two adventures at the time I purchased the vacation package. The company Cabo Adventures was offering 50% if I booked in advance. It seemed like a great deal, but I realized that I paid the same price as what they were offering down in Cabo (without any promotional benefits.)

There is literally a dozen of other companies like Cabo Adventures that offer tours and adventures. Their prices are the same or even cheaper than what I paid before we left.

In my experience, one of the biggest benefits of waiting until we got down there was the fact not only did they offer tours and adventures for a good price, but they usually offered a promotional deal as well.

For example, one of the companies was offering the same dolphin tour we did for $30 cheaper, and if you bought it, they threw in the ATV tour for free, and another tour of your choice for just $40. You get way more for your money.

I wish I would have waited to buy our adventures so I could have taken advantage of the other benefits they were offering.

OTHER TIPS AND RECOMMENDATIONS

If you are planning a trip to Cabo, I wanted to give you some other fun tips and recommendations. We were there for only five days, and there is just no way we could have done everything we wanted to in that short amount of time. But we did experience a lot, and I wanted to make sure I shared my favorite things about our trip, so you can try them too!

FOOD

Senior Frogs – The atmosphere is fun and uplifting. The waiters dance on stage and are incredibly outgoing and friendly. Try their nachos and smoothies!

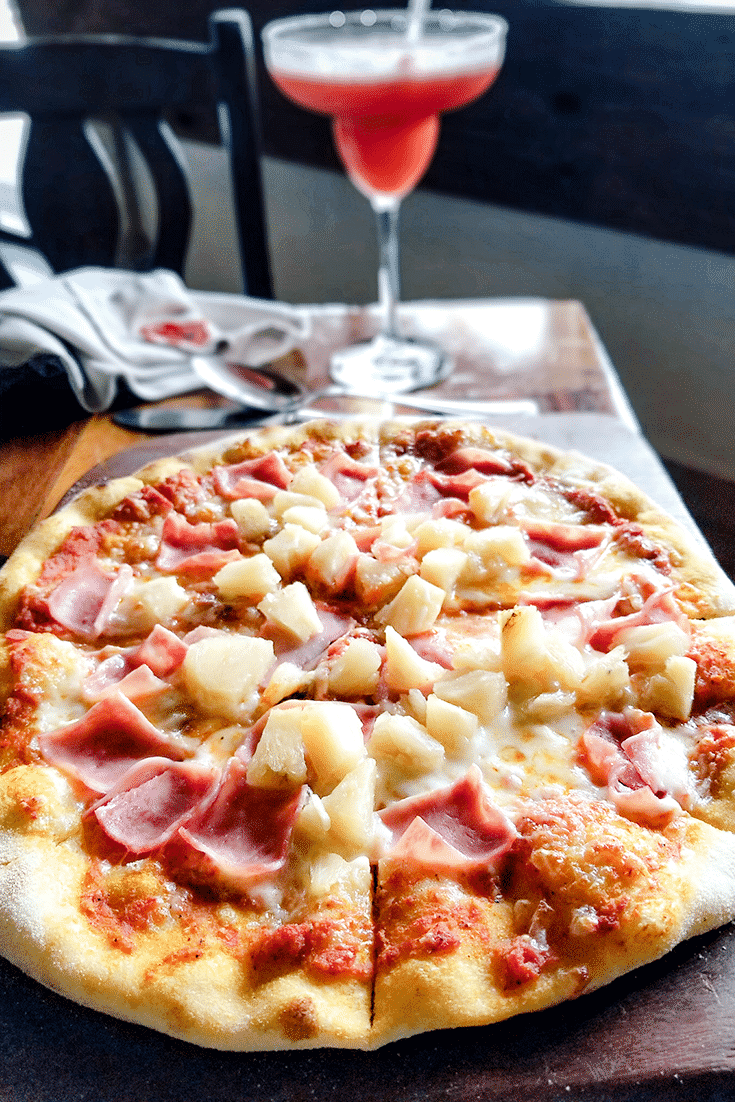

Romeo and Juliet – This restaurant was recommended to us by a local. It has a romantic atmosphere and the customer service is outstanding. The building itself is beautiful, and inside is even more gorgeous. They pull out your chair for you, have hangers for your purse at every table, and they cater to you like you are the only customer in the entire restaurant. They offer a list of the best wines, and their food is delicious. Try their cheese stuffed pasta or Hawaiian pizza!

We searched high and low for the best fish tacos. Where we found them might surprise you! We spent an afternoon at one of the pools at our resort and that's where we found the best fish tacos. So don't underestimate the pool service food!

HOTEL

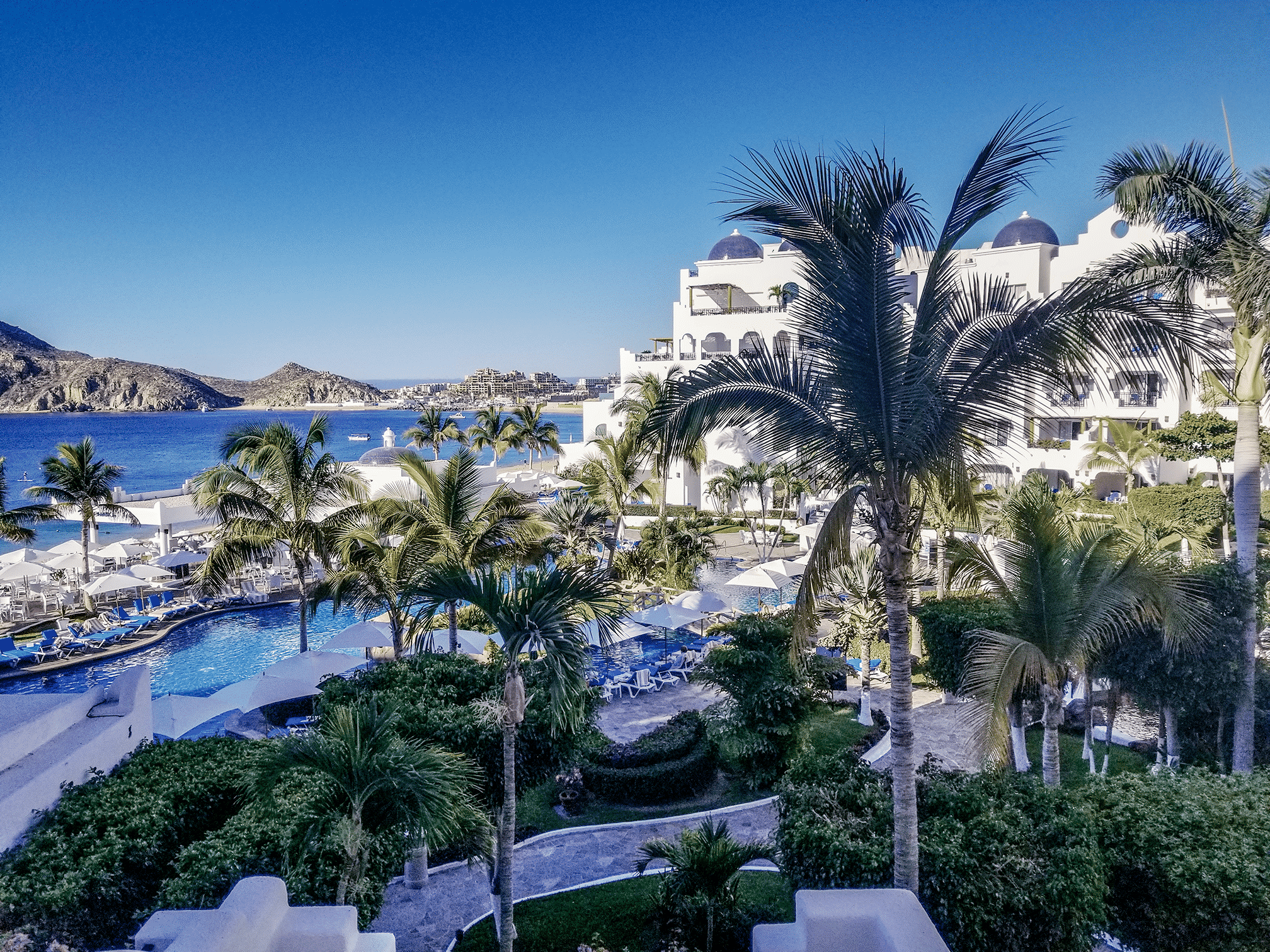

We stayed at Pueblo Bonito Blanco and that's where we will stay when we go back. The great thing about staying at Blanco was that you get access to its two sister resorts as well – Hotel Rose' and Sunset Beach. All three hotels are beautiful, have multiple swimming pools, kid areas, and numerous restaurants.

If you are interested in swimming in the ocean and want to be on the beach and not in your hotel pool, I highly recommend Hotel Blanco. There are a ton of beaches in Cabo, but they are not all swimmable. For example, Sunset Beach Hotel does not have a beach that you can swim at. You had to take a shuttle to our hotel, Hotel Blanco, to go to the beach. That means you have to take a 15-minute shuttle ride just to swim in the ocean.

Having a swimmable beach is something I looked into while booking our vacation. So just make sure it's an option when booking which hotel you stay at.

TOURS AND ADVENTURES

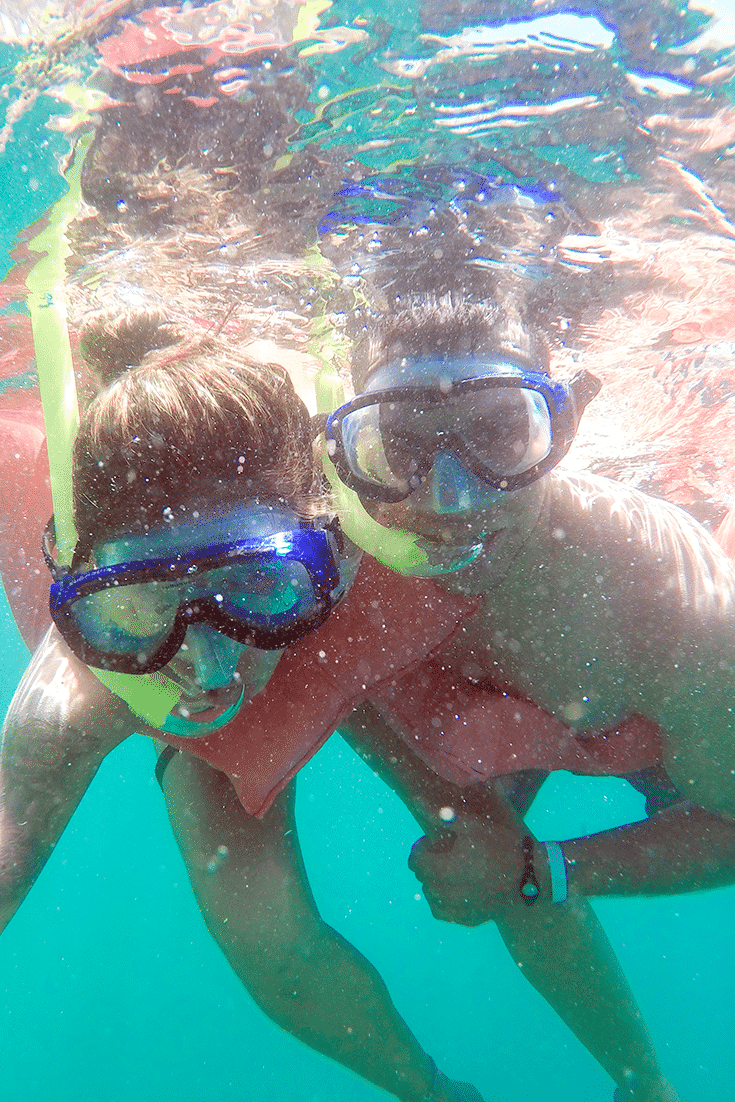

We went on two different adventures while down in Cabo. I wish we could have done more.

We did the Dolphin Excursion and the Sailboat Snorkeling and Paddle Boarding Tour. Both of these tours I highly recommend. Another adventure I would recommend would be the Outback Camel Adventure. It's one that I will make sure to do next time.

A word of caution. On every adventure, there is a photographer. For the dolphin tour, we were not allowed to bring cameras or cell phones. The only way to get photos was to buy them at the end of the tour. They are expensive! For the dolphin tour, it cost $175 to get a thumb drive of our pictures, and they get even more expensive depending on the package you want to buy.

With the Sailboat Tour, we were able to bring underwater cameras and cell phones. I ended up buying some pictures at the end, but they weren't nearly as expensive.

As a budgeting tip, make sure you put money aside for pictures if you go on any of the adventures.

Our Cabo adventure was our best vacation to date. In fact, we are already planning another vacation in February to see the whales. This was my first time flying internationally, and I learned a lot.

I hope you learned some helpful tips for your next all-cash paid vacation.

Have you been on an all-cash paid vacation? What are some saving tips you would recommend?