Welcome to my July Budget Meal Plan Update! July was a hard month for meal planning. I ended up $73 over budget in my food category.

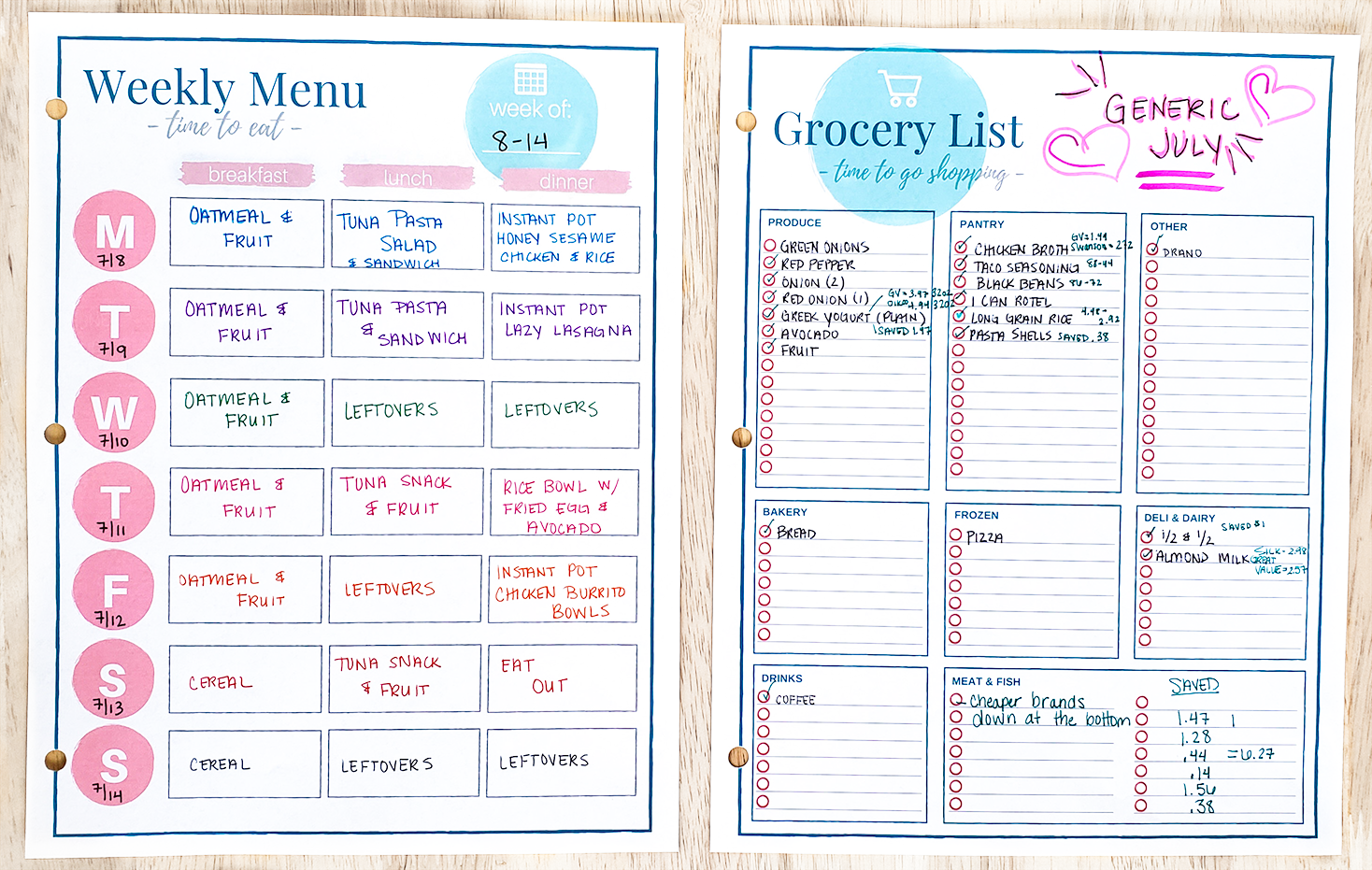

I completed the Generic July Savings Challenge and saved over $30 buying store brands over name brands.

Every month, I allocate $400 to my food budget, and I use the cash in my food envelope for eating out and grocery trips. I have a small family, just my son, my boyfriend, and myself.

WHY I STARTED MEAL PLANNING

Just like you, I am consistently trying to find ways to cut down on food costs and cut out extra expenses in my budget. Starting in January 2018, I began tracking every dollar that I spend throughout the month. Not only am I keeping up-to-date on my expense tracker, but I am also keeping a close watch on my cash envelope spending trackers.

If you are not familiar with my budgeting method, you can read all about the cash envelope method here. Essentially, I pay all of my regular expenses online and use cash envelopes for the rest of my variable spending. If you are interested in using my budgeting method, I have a free email course that teaches you step-by-step on how to set one up. You can see more about my Budget Blueprint Email Course here.

I started noticing that almost every line item on my spending tracker was eating out. I was spending nearly $800 every month on eating out and spontaneous Starbucks purchases. I have tried meal planning in the past, but I never lasted more than two weeks.

Seeing my spending tracker for my food budget was enough to kick my butt into gear.

It made me furious that I was spending all of this money on food, rather than on my savings or paying off debt.

I also knew that I could cut my food budget in half if I had a plan. So I developed the TBM Meal Planning Workbook. (The TBM Meal Planning Workbook pairs well with $5 Meal Plans.)

THINGS I HAVE LEARNED SO FAR

Here are some things that have helped me save money on my new meal plan.

- Always shop your pantry, refrigerator, and freezer first! You can cut costs by making recipes that use what you already have on hand.

- Have a planned grocery shopping list! Use this list to see if any of the ingredients you are going to buy are on sale or can be substituted for ones that are on sale. The apps I currently LOVE using are Ibotta, Walmart Savings Catcher, and the Krazy Coupon Lady.

- Don't be afraid to incorporate dedicated days for leftovers in your meal plan!

- Make a price list before you head to the store. Jump online and check prices before you start grocery shopping. This will give you a good idea if you need to substitute an item or remove it completely if there is not enough cash in your food budget.

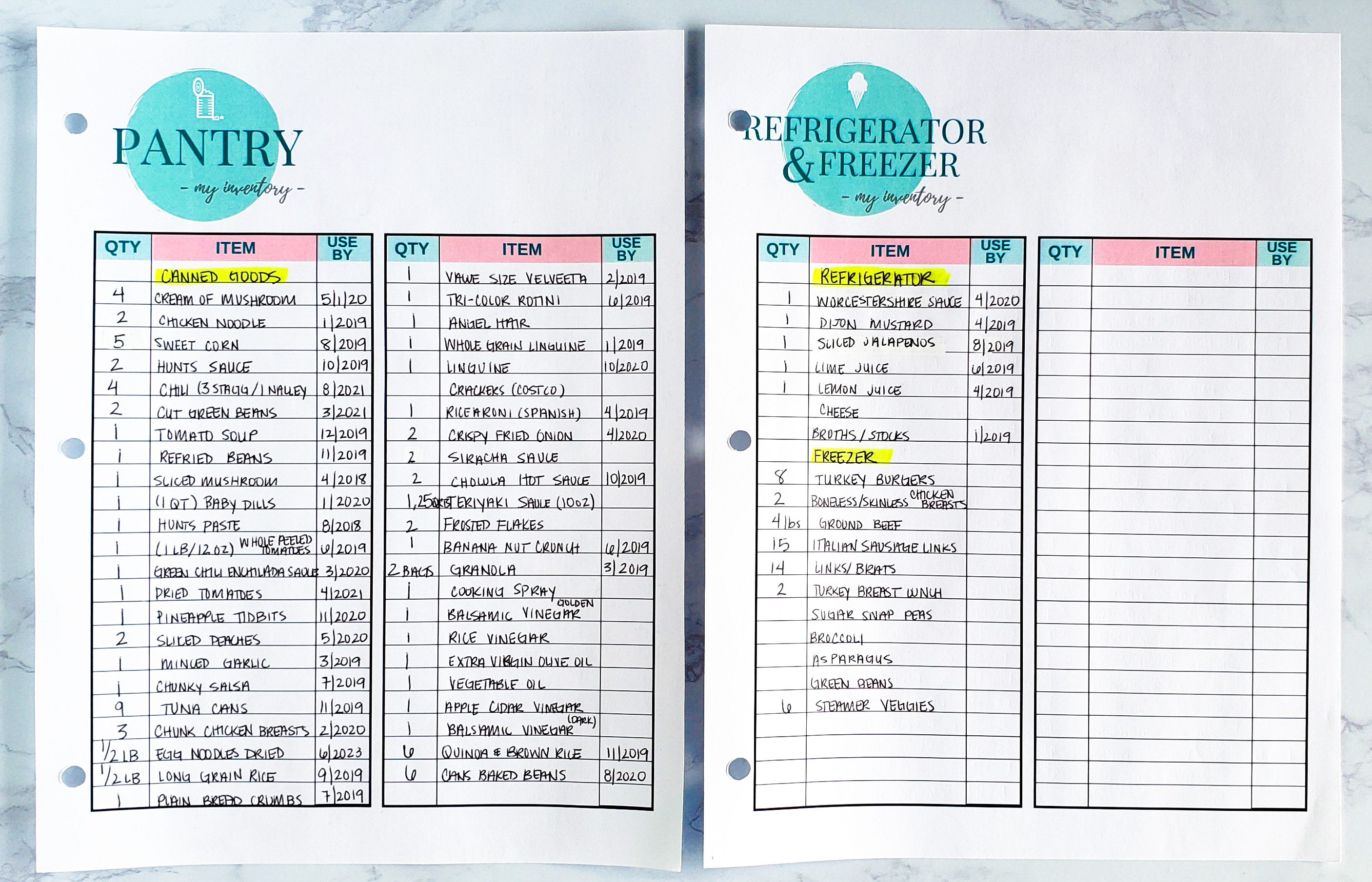

TAKING INVENTORY

I took time out in the beginning of the month to take inventory of my pantry, fridge, and freezer. Since completing the November Freezer challenge, I have learned to eat what I already have at home.

I have been meal planning for about a year, and one of the things that I noticed that saved me a ton of money was building my meal plan and recipes around ingredients I already have at home. I meal plan every week, but I take time during the beginning of every month to inventory what I have in my pantry, fridge, and freezer.

My inventory lists act as my quick reference guide when I am finding recipes online for my meal plan. By taking inventory of the food you already have, you accomplish three important things:

- You save money by utilizing the food you already have at home.

- You reduce food waste by becoming aware of your expiration dates and using the food that is about to expire first with your meal plan recipes. 3. You stop yourself from overbuying. It was really easy for me to forget about what I already had in my cupboard, so I would end up buying a lot of duplicates.

HOW I USE MY FOOD BUDGET

Since I only allocate $400/month for food, which includes eating out and meal planning grocery trips, the more we eat out, means the less money I have for grocery hauls.

Not splitting my Food cash envelope into two categories (eating out and groceries) has been the best decision. If I were to assign a limit for eating out every month, I know that my family would use the full amount. Having one Food envelope for both purposes allows me to say to myself, “If I keep my grocery trips low, I can eat out more.” or “We have eaten out too much this week, so we need to keep our grocery trip small.”

I am still utilizing my Instant Pot for every recipe. I can't function without my Instant Pot. It saves me so much time in the kitchen, and with my busy schedule, I can't live without it. Now that I have two liners (thanks to breaking my Instant Pot in September), I can now utilize my Instant Pot more than ever!

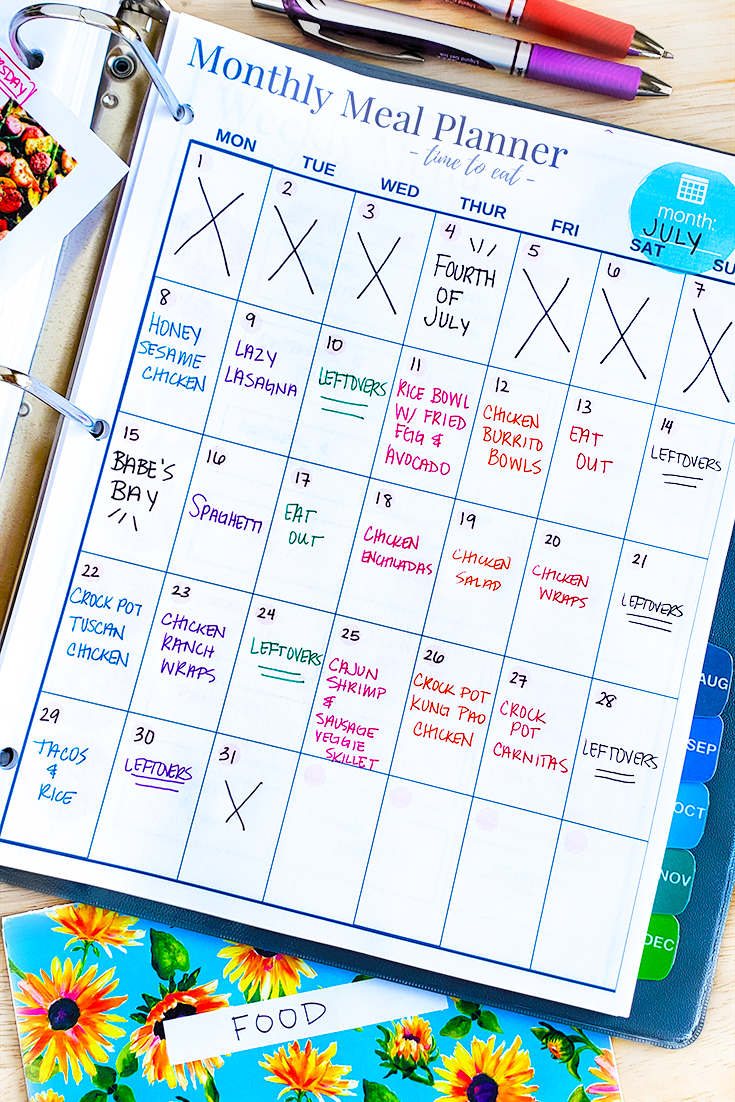

JULY BUDGET MONTHLY MEAL PLAN

Due to poor planning and a very busy schedule, I fell off the meal planning wagon. We ate a lot of food leftover in my pantry and fridge, and spent some nights eating frozen pizza. I made two large grocery runs in July, my largest being at the end of the month. I spent a total of $49 at Walmart in the beginning of the month and $132 at both Costco and Walmart at the end of the month.

For the first seven days, we made it work. I did not create a meal plan at all.

JULY (WEEK 8th – 14th)

- 7/8: Instant Pot Honey Sesame Chicken

- 7/9: Instant Pot Lazy Lasagna

- 7/10: LEFTOVERS

- 7/11: Rice Bowl with Fried Rice & Avocado

- 7/12: Instant Pot Chicken Burrito Bowls

- 7/13: EAT OUT

- 7/14: LEFTOVERS

JULY (WEEK 15th – 21st)

- 7/15: Chris's Birthday – Eating Out

- 7/16: Spaghetti

- 7/17: EAT OUT

- 7/18: Chicken Enchiladas

- 7/19: Chicken Salad

- 7/20: Chicken Ranch Wraps

- 7/21: LEFTOVERS

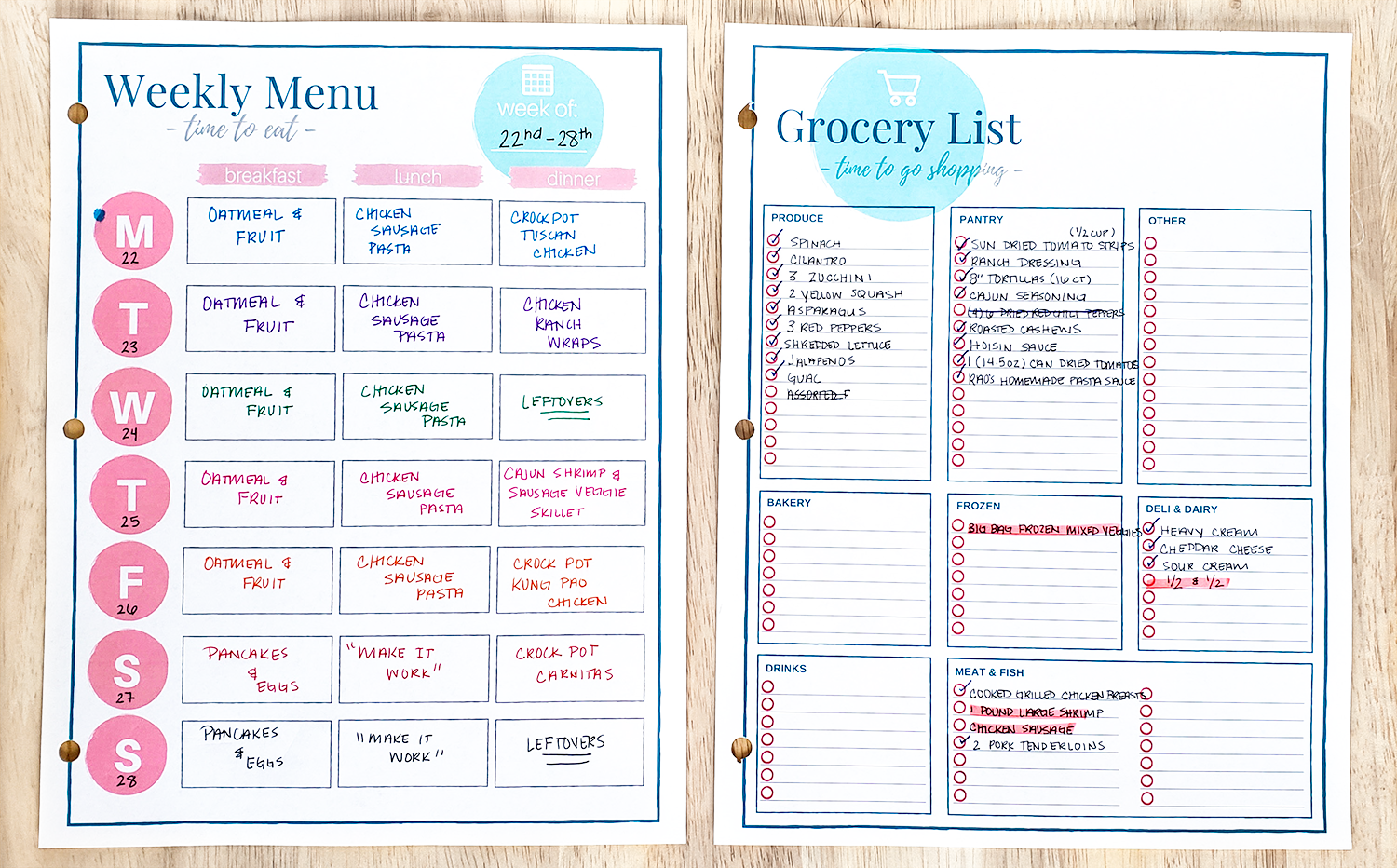

JULY (WEEK 22nd – 28th)

Lunch

Dinner

- 7/22: Crock-Pot Tuscan Chicken

- 7/23: Sweet Chili Chicken Wraps

- 7/24: LEFTOVERS

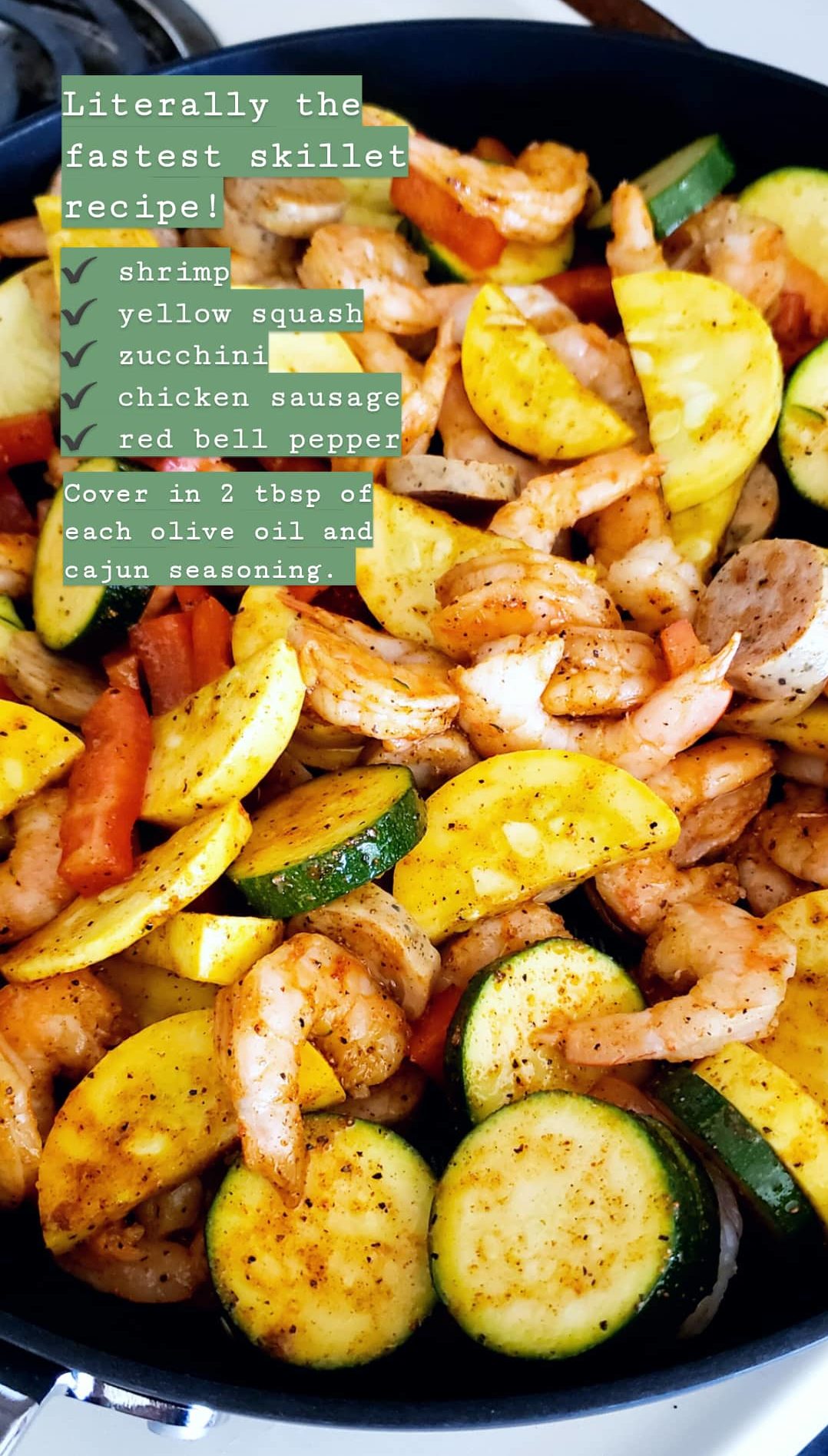

- 7/25: Cajun Shrimp, Sausage, and Veggie Skillet

- 7/26: Slow Cooker Kung Pao Chicken

- 7/27: Crock-Pot Carnitas

- 7/28: LEFTOVERS

Costco Grocery Haul

I made my biggest grocery run at the end of the month, spending at total of $132 at Walmart and Costco. I ended up buying some bulk food items that I froze so I could use them in future months.

My favorite recipe this month was not a dinner recipe. I loved the meal prep sausage pasta bowls.

TOTAL MONTHLY COST

I spent a total of $473 on food costs in July. $212.58 was spent on grocery trips, and the remaining $259.73 was spent on eating out. I could have drastically reduced my food budget if I planned better around my busy schedule, which caused me to be $73 over-budget in July.

Keep in mind that I do make other purchases when I am at the store for my grocery hauls, but I always do a separate transaction for each of my envelopes. For example, if I buy shampoo during one of my meal planning grocery trips, I do a separate transaction, and I pull the cash from my Beauty Cash Envelope.

If you are struggling with your food budget, I highly recommend starting a meal plan. It doesn't take a lot of time but could save you a lot of money in the end.

I plan on posting my meal plan updates every month. So be on the lookout for those updates!

DO YOU WANT MY ENTIRE MEAL PLANNING WORKBOOK?