We live in a time where there has never been so many choices.

For example, let’s say you want to get groceries for the family.

Well, you can choose between different stores, whether to shop in person, or whether to have the groceries delivered or ready for pick-up. You have the choice of competitor brands inside the store for the same item and can buy those items in a wide range of packaging, sizes, and pricing. When it’s time to checkout, you even have the choice of self-checkout or going through a cashier, not to mention the choice in payment method.

All these choices provide us with the opportunity of convenience and customization.

But every opportunity comes with risk. Convenience is great, but not if it doesn’t serve our financial goals. All these choices, including payment choices, create more opportunities for us to spend money — but not always in the best way.

By being mindful of these risks, you equip yourself to benefit from these opportunities. Let’s do a deep dive into consumer psychology and how you can avoid these common financial pitfalls.

Cash vs. Credit Card Spending: How to Save 83% Immediately

During the checkout process, you typically have the choice to pay with cash or card. However, even if a business has chosen to opt for contactless payment, you still have the option between a credit card, debit card, or an EBT card.

Convenient, right?

It is! But if you’re not careful, you can find yourself paying and spending more if you use a credit card.

To be clear, this is not an article against credit cards. When you use credit cards responsibly, there are many benefits such as cashback, travel points, and a healthy credit score.

However, simply swiping or tapping can cost you up to 83% more money. Multiple studies have been done on the topic, showing that consumers are willing to pay more for the same item when they pay with a card instead of cash. While some studies show differing numbers, the academic Journal of Consumer Research suggests that the “immediacy of payments” (credit cards) causes an average overspending of 83%.

Let’s say the fair price for toothpaste is $4.00 a tube. Consumers paying with cash are more likely to only spend $4.00 for toothpaste, whereas someone paying with a credit card might be willing to pay $7.32 for toothpaste. That’s the 83% principle in practice.

Toothpaste might sound like an extreme example, so here are some actual items that have been studied by scientists:

- Tipping for service. Tips left via credit card are 3.9% larger on average than tips left in cash.

- Sports and concert tickets. Fans paying via credit card are willing to pay double on the exact same tickets compared to fans paying with hard money.

- Highway tolls. An MIT economist found that states with automated systems (i.e EZ Pass) charge more at tolls because drivers don’t “feel” the toll as much.

Payment Coupling

Researchers refer to this principle as “payment coupling.” A study in the Journal of Experimental Psychology reveals that consumers spend more when payment coupling is in play.

In short, there are two distinct moments in time: (1) when you choose to purchase an item and (2) when you actually part with your money to pay for the item. These two moments in time are “coupled” together during the checkout process.

The closer these moments in time (the closer the payment coupling), the more cost-conscious you will be concerning the purchase. However, the further apart these two moments in time are, the more likely people are willing to spend or overspend in their transaction.

Why?

It is psychologically painful to part with money. You might not literally wince in pain, but the transaction is much more present and literally felt by your body when you pay with cash. Even when paying with a debit card, the payment coupling is tight because the money will be put on hold or withdrawn from your account that same day. But when it comes to credit cards, there’s a large gap between the decision to purchase the item and when you actually have to pay for it. It is less psychologically painful to spend your future money in the present.

This is why consumers spend an average of 83% more when purchasing with credit cards — and this doesn’t even include the cost of interest or yearly fees!

How to Spend Less Money with a Budget

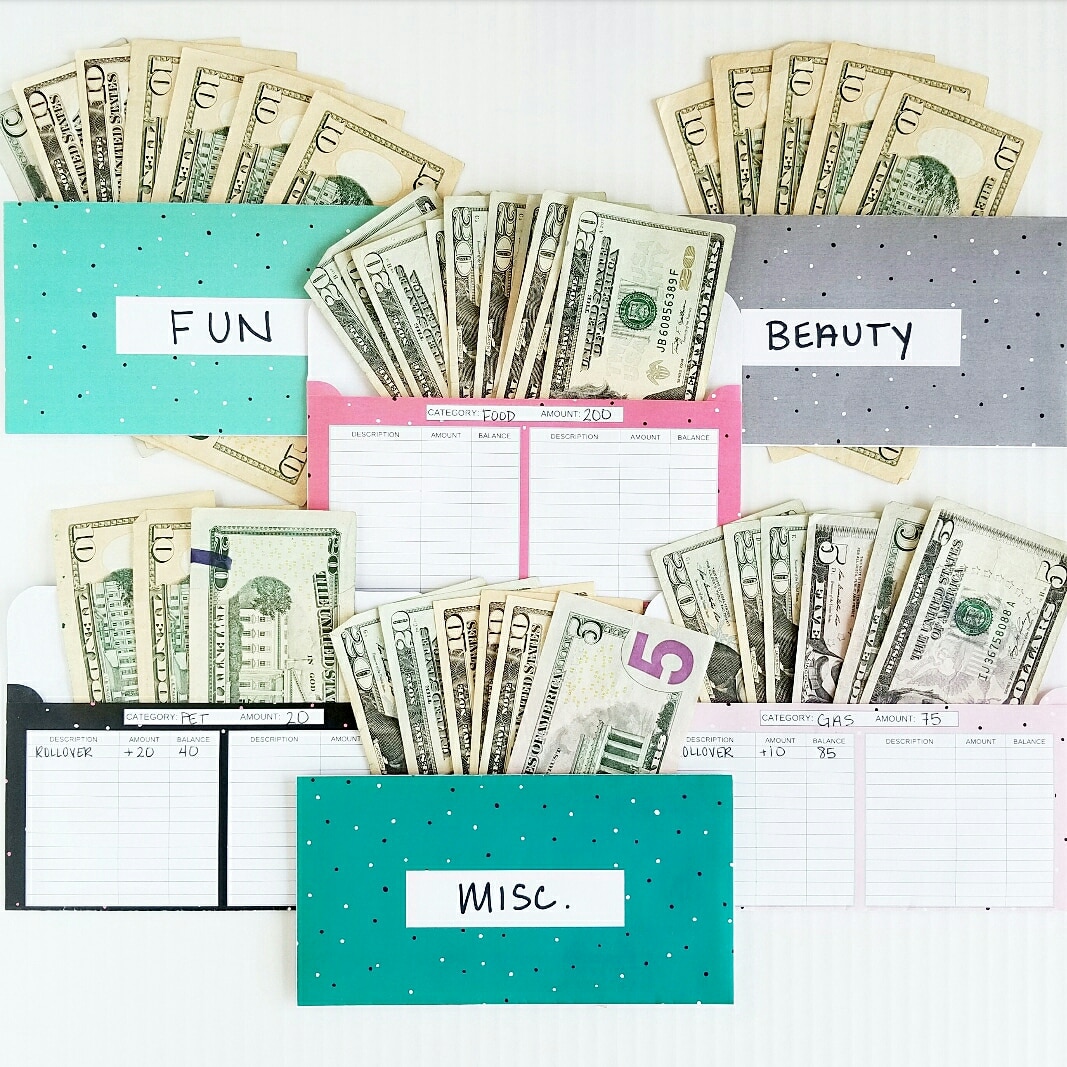

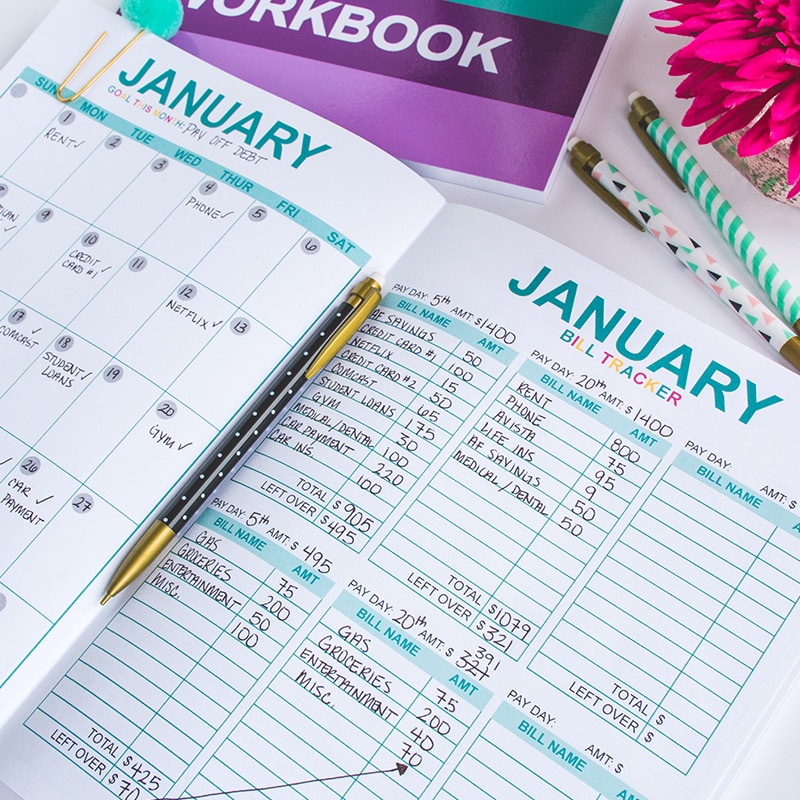

One of my favorite budgeting hacks is to use the envelope system. Remember, if your payment method can cost you up to 83% more, then why not use the system that can help you save money?

In short, the envelope system is a visual system where every budget category has its own envelope filled with cash for that month. For example, you might have envelopes for the following categories:

- Groceries

- Fun

- Gas

- Health & Beauty

- Pet

- Miscellaneous

The idea is that you can only spend the amount of money in that envelope that month. Once the cash is gone, then you can’t spend anymore.

Aside from helping us visualize and stick to a budget, it also forces us to think twice about each purchase. You might find yourself comparing prices, buying items on sale, or hunting for coupons to stay within your budget for the month. So not only are you sticking to your budget, but you are also getting more for less!

But it’s not always possible to pay with cash, especially in today’s environment.

So what happens when you’re shopping online or if you go to an establishment that accepts cards only?

Even if you have to use your credit card, you can still practice the envelope system. How? By practicing discipline. While you might not have the physical limitation of cash to prevent overspending, you can still create a budget and then practice sticking to that budget when using your card.

Remind yourself that you should only put on your card what you can afford to pay off immediately. In other words, treat your card like cash.

It is easier said than done, but you can do it with practice, discipline, and determination!

What If You Need to Buy Now and Pay Later?

In some scenarios, it is just not possible to pay for things in cash.

For most Americans, these high-ticket items include houses and cars. As a result, it is not uncommon for people to take out large loans to finance these purchases.

So that raises the question: if an expensive “must-have” purchase comes up, how can I afford to pay for it?

For example, let’s say your smartphone suddenly dies and is beyond repair. The only solution is to purchase a new phone. Ideally, you’d have an emergency fund in place to handle the purchase, but what happens if you’re still early in your financial journey and don’t have that emergency fund? Or what if the emergency fund has already been used, and you’re working to build it back up? What happens then?

One of my favorite options is to make payments over time (also known as “pay-over-time”).

This is different than putting a major purchase on a credit card. If you don’t pay your full credit card balance off every month, then you are charged a high-interest rate. This dramatically increases the cost of the initial purchase and erases the benefits you earn from cashback and other rewards.

Fortunately, more eCommerce platforms and major brands are normalizing the pay-over-time method.

Pay-over-time simply divides the lump sum total into smaller payments that are made monthly or biweekly, depending on the contract. No interest is added, making this much more efficient than a credit card.

Many brands have their own versions of pay-over-time. If you decide to go this route, I encourage you to always read the fine print before agreeing to anything. Make sure you fully understand the terms of the contract, including:

- What happens if you miss a payment?

- Does it impact your credit score?

- Are all the payments interest-free? Or does interest kick in at some point?

- Are you allowed to return or exchange the item if you change your mind?

Bottom Line

Remember what I said above: we live in a time where there are more choices than ever before when it comes to our payment method.

Sometimes it is easy to simplify the choices into cash vs. card, but the reality is that there are many more options, including pay-over-time.

But at the end of the day, your payment method likely won’t make or break your financial health. Rather, it is your ability to create a balanced budget and to stick to that budget.

If you’d like to learn more about my approach to budgeting, please feel free to read my budgeting blog posts and to incorporate those techniques into your own life.

What about you? Have you ever thought about how your payment methods may be costing you money? Is there a payment method you prefer because it works best for you? Please let me know your insights and thoughts in the comments section below!